Pressure Relief Valves Market Overview, 2031

The Global Pressure relief valves market Size was valued at USD 4.4 billion in 2021, and is projected to reach USD 7 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. Pressure relief valve (PRV) is also called as a relief valve. Pressure vessels and other equipment are protected by pressure relief valve from being subjected to pressures that exceed their design limits. The valve is used to control or limit the pressure built inside the equipment which may cause equipment or instrument failure, or fire. The pressure is relieved by allowing the pressurized fluid to flow from an auxiliary passage out of the system.

Pressure Relief Valves Market Dynamics

Pressure relief valve are used in the oil & gas industry for drilling and workover operations, which, in turn, increase demand for pressure relief valve, and is anticipated to boost growth of the pressure relief valve market. According to a report on North America Midstream Infrastructure through 2035 published in June 2018 by ICF International Inc., total investments in oil & gas infrastructure are projected to range between $685 billion and $895 billion from 2018 to 2035.

In addition, pharmaceuticals and food & beverages industries are largely saturated in developing countries including European Union, such as the U.S. and China. Pressure relief valve have an important role in manufacturing of different types of medical devices and support key players to give opportunity during this pandemic situation. For instance, according to the India Brand Equity Foundation (IBEF), the food & beverage processing industry has emerged as a high-profit and high-growth sector, owing to its immense growth potential.

Moreover, rise in number of industrial infrastructure projects in developing countries is driving the demand of pressure relief valves market. For instance, the government of China spent $10 billion on a new oil & gas refinery project, Guangdong refinery, which is expected to be completed by March 2022. Such instances are expected to drive the growth of the market. There are many domestic manufacturers present in places, which is expected to hamper growth of the pressure relief valve market. Domestic manufacturers provide pressure relief valve ranging from $100 to $200.

However, key players offer pressure relief valve ranging from $100 to $2500. Hence, customer focuses more on adopting pressure relief valve from domestic manufacturers, which, in turn, hinders the pressure relief valves industry growth.

The demand for pressure relief valve decreased in the year 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shut-down production of pressure relief valve for the end-user, mainly owing to prolonged lockdowns in major global countries.

This has hampered the growth of the pressure relief valve market significantly during the pandemic. The major demand for pressure relief valve was previously noticed from giant manufacturing countries including China, U.S., Germany, Italy, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for pressure relief valve. This is expected to lead to re-initiation of manufacturing industry at their full-scale capacities, which is likely to help the pressure relief valve market to recover by end of 2022.

Emerging economies such as the India, China, and Egypt, are investing more in hydrocarbon projects, to produce more oil & gas exploration, which is expected to provide lucrative opportunities for growth of the pressure relief valve market. Rise in demand for oil & other energy and renewable resources is anticipated to drive growth of the pressure relief valve market. The government of Egypt invested around $2.5 billion in construction of a new oil refinery project to process hydrocarbons. All such instances are anticipated to provides lucrative opportunities for the pressure relief valves market growth.

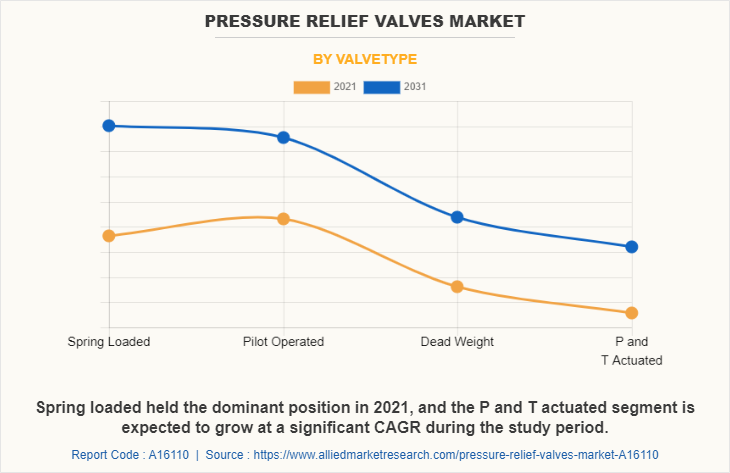

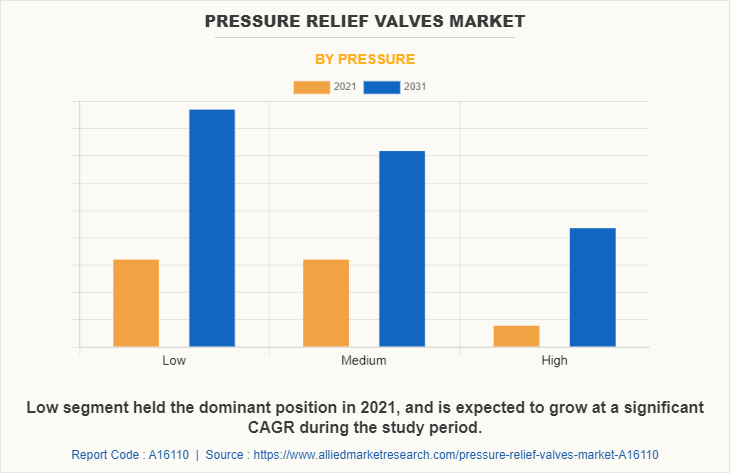

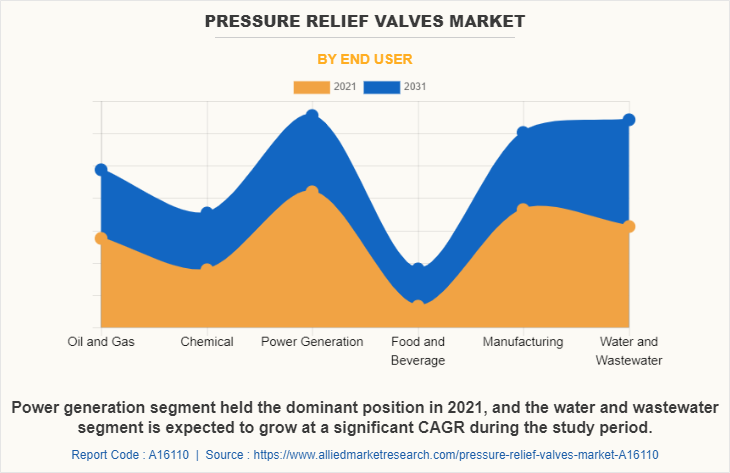

The global pressure relief valve market is segmented on the basis of valve type, pressure, end user, and region. Based on valve type, the market is divided into spring loaded, pilot loaded, dead weight and p and t actuated. Based on pressure, the market is divided into low, medium and high. Based on end user industry, the market is divided into oil & gas, chemical, power generation, food & beverage, manufacturing and water & wastewater.

Region Wise,

The global pressure relief valve market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Valve Type:

The pressure relief valve market is categorized into spring loaded, pilot loaded, dead weight and p&t actuated. There are types of spring loaded valves conventional spring loaded and balanced spring-loaded both are used to minimizes the effects of backpressure on the equipment. pilot loaded relief valve" refers to a form of diaphragm valve in which the opening of the main valve is controlled by a smaller integral spring-operated valve; the main valve is typically kept closed by system pressure, so no external supply is required.

A deadweight safety valve has a valve seat where the weight of the seat is lifted when the pressure in the boiler or pressure vessel exceeds the usual working pressure. Pressure and Temperature relief valves, also known as p&t valves, which are emergency safety limit devices that will stop or release too much heated water and pressure. Pilot operated is expected to exhibit the largest revenue contributor during the forecast period. P&T Actuated is expected to exhibit the highest CAGR share in the valve type segment in during the pressure relief valves market forecast period.

By Pressure:

The pressure relief valve market is classified into low, medium and high. Pressure relief valve up to 300 psig are considered in the low segment. Pressure relief valve from 301-800 psig are considered in the medium segment. Pressure relief valve above 800 psig are considered in the high segment. Low segment is expected to exhibit largest revenue during forecast period, and also expected to exhibit highest CAGR share in pressure segment in pressure relief valve market during forecast period.

By End User Industry:

The pressure relief valve market is divided into oil & gas, chemical, power generation, food & beverage, manufacturing and water & wastewater. Pressure relief valve are used in the oil & gas industry for safety against pressure spikes specifically for downhole and subsea oil equipment. In the chemical industry to protect sensitive analytical equipment from over-pressurization. Electrical power industries adopt pressure relief valve for functions such as steam control, boiler circulation, and condensation systems.

Food & beverages industry includes processing of raw agricultural produce into processed food & beverages. Pressure relief valves in food & beverages processing are used for transportation of raw or processed food during the industrial processes. Pressure relief valve are used in the automotive industry to use automated valves for storing and transporting gas, liquid, or slurry. Pressure relief valve are used in the automotive industry to control the flow of gas in engines. Power Generation is expected to exhibit largest revenue share in the end-user segment in the pressure relief valves market share during forecast period. The water and wastewater segment is expected to exhibit largest CAGR during forecast period.

By Region:

The pressure relief valve market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in pressure relief valve market share. And LAMEA is expected to exhibit highest CAGR during forecast period.

Competition Analysis

The major players profiled in the pressure relief valve market include AGF Manufacturing, Inc., Alfa Laval, Curtis-Wright Corp, Emerson Electric Co., General Electric, Goetze KG Armaturen, IMI PLC, Mercury Manufacturing Company Limited, The Weir Group PLC, and Watts Water Technology, Inc.

Major companies in the market have adopted acquisition and product launch as their key developmental strategies to offer better products and services to customers in the pressure relief valve market.

Some examples of acquisition in the market

In February 2020, Curtiss-Wright Corporation, a leading provider of pressure safety and release valves, has acquired Dyna-Flo, a well-known designer and manufacturer of linear and rotary control valves, isolation valves, actuators, and level and pressure control systems for the chemical, petrochemical, and oil and gas markets, for $62 million. The acquired business will operate within commercial/industrial segment of Curtiss-Wright.

Some examples of product launch in the market

In December 2022, Emerson has launched two new-to-the-world technologies for the Crosby J-Series pressure relief valve (PRV) product line.

In April 2022, Lamot Valve & Arrestor has launched its new product: the Model L11E Weight-Loaded Pressure Relief Valve. The valve includes an option to add calibrated weights in 0.5 using increments, giving the operator the flexibility to adjust the set pressure of this valve from the top of the tank and eliminating the need to remove and retest in the shop on a test stand. It can be used as a stand-alone vent to the atmosphere pressure relief valve or can be used in addition to existing pressure relief valves to add additional flow capacity.

In December 2020, Weir Oil & Gas has launched latch back pressure valve system to increase safety, reliability of drill- thru operations.

In December 2020, Consolidated, a Baker Hughes subsidiary, has launched its new 1900 series dual media (DM) spring-loaded safety relief valve (SRV) with patented trim. The new series is designed to perform on both liquid and gas media and has dual certification (liquid and gas) nameplate capacity stamping in accordance with ASME (American Society of Mechanical Engineers) and BPVC (Boiler and Pressure Vessel) Code Case 2787. The 1900 DM series is the first and only spring-loaded safety relief valve in the industry that is 'dual certified.' Dual certified means the valve is both vapor/gas and liquid flow certified without making any modifications or adjustments to the relief device when switching fluids during the flow testing.

In November 2020, Danfoss has launched its new 65bar safety valve, SFA 10H, that offers reduced capacity, high reliability, and high-pressure for applications with CO2 and synthetic oils. The design and manufacturing of this product focuses on preventing leaks, providing perfect reseating after release, and keeping a stable set pressure over time.

In April 2020, Baker and Hughes has launched the 2900 series gen II pilot pressure relief valve (PRV). This innovative product has a full-nozzle main valve that easily threads in and out to save maintenance expenses while protecting the main valve body from corrosive service under normal operating circumstances.

In May 2019, Weir Oil & Gas has launched SPM SafeEdge ARC for Remote Setting and Digital Control of Relief Valves.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the pressure relief valves market overview, segments, current trends, estimations, and dynamics of the pressure relief valves market analysis from 2021 to 2031 to identify the prevailing pressure relief valves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pressure relief valves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the pressure relief valves market outlook and analysis of the regional as well as global pressure relief valves market trends, key players, market segments, application areas, and market growth strategies.

Pressure Relief valves Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 214 |

| By ValveType |

|

| By Pressure |

|

| By End User |

|

| By Region |

|

| Key Market Players | Alfa Laval, General Electric, Mercury Manufacturing Company Ltd., Watts Water Technologies, Inc., IMI plc, AGF Manufacturing, Inc., Emerson Electric Co., Goetze KG Armaturen, Curtis-Wright Corp, The Weir Group PLC |

Analyst Review

The global pressure relief valves market witnessed a huge demand in Asia-Pacific followed by Europe. The highest share of the Asia-Pacific market is attributed to increasing demand for pressure relief valve in the chemical, oil and gas and food and beverage sector.

Pressure relief valves shield other equipment, such as pressure vessels, from pressures that are too high for them. By enabling the pressured fluid to exit the system through an auxiliary path, the pressure is reduced. Rise in number of industrial infrastructure projects in developing countries is driving the demand of pressure relief valves market. For instance, the government of China spent $10 billion on a new oil & gas refinery project, Guangdong refinery, which is expected to be completed by March 2022. Such instances are expected to drive the growth of the market. Developing nations, notably those in the European Union, the U.S., and China, are also largely saturated in the pharmaceutical and food and beverage industries. Pressure relief valves play a significant part in the production of various medical equipment and assist crucial players by providing opportunities during the forecast period. Adopting pressure relief valve from domestic manufacturers hinders the market’s growth. Key market players offer pressure relief valve ranging from $1000 to $2500. But domestic manufacturers offer it for $100 to $200. This in turns restrain the market growth. Emerging economies such as the India, China, and Egypt, are investing more in hydrocarbon projects, to produce more oil & gas exploration, which is expected to provide lucrative opportunities for growth of the pressure relief valve market.

The major players profiled in the pressure relief valve market include AGF Manufacturing, Inc., Alfa Laval, Curtis-Wright Corp, Emerson Electric Co., General Electric, Goetze KG Armaturen, IMI PLC, Mercury Manufacturing Company Limited, The Weir Group PLC, and Watts Water Technology, Inc.

The global pressure relief valves market was valued at $4,430.5 million in 2021, and is projected to reach $7,038.1 million by 2031, registering a CAGR of 4.6% from 2022 to 2031.

The forecast period considered for the global pressure relief valves market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global pressure relief valves market report can be obtained on demand from the website.

The base year considered in the global pressure relief valves market report is 2021.

The major players profiled in the pressure relief valves market include AGF Manufacturing, Inc., Alfa Laval, Curtis-Wright Corp, Emerson Electric Co., General Electric, Goetze KG Armaturen, IMI PLC, Mercury Manufacturing Company Limited, The Weir Group PLC, and Watts Water Technology, Inc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based type the pilot operated segment was the largest revenue generator in 2021.

Loading Table Of Content...