Private Equity Market Research, 2032

The global private equity market was valued at $445.4 billion in 2022, and is projected to reach $1.1 trillion by 2032, growing at a CAGR of 9.7% from 2023 to 2032.

Private equity refers to a form of investment where funds are pooled from various sources, such as institutional investors, high-net-worth individuals, or pension funds, to acquire ownership stakes in private companies. Contrary to publicly traded companies, these investments are not listed on stock exchanges. Private equity firms deploy these funds to purchase a significant portion or the entirety of a company, aiming to enhance its value over time through active management strategies. They work closely with management of the acquired company, implementing operational improvements, strategic changes, and growth initiatives to maximize its performance and ultimately generate returns for investors. Private equity market spans various stages of businesses, from startups to established companies, and often involves restructuring expansion, or turnaround efforts to unlock full potential of the company before exiting the investment through avenues such as IPOs or sales.

The potential of private equity for higher returns stems from its proactive involvement in company management, actively implementing changes that drive operational efficiencies and enhance the overall value of invested companies. The access to specialized expertise and extensive networks enables private equity firms to guide and support portfolio companies, fostering growth, innovation, and streamlined operations. This flexibility within the private equity market allows firms to deploy diverse investment strategies across industries and company stages, optimizing risk while leveraging various opportunities.

However, regulatory complexities pose a significant challenge, demanding stringent compliance across multiple jurisdictions, thereby increasing operational overheads. Limited liquidity further impedes the rapid monetization of investments due to longer investment horizons. Nonetheless, an opportunity arises through ESG integration, where private equity can adopt sustainable practices, ethics, and governance principles, not only attracting investors but also differentiating themselves, fostering positive societal and environmental impacts, and ensuring sustained financial performance in the long run.

The report analyzes the profiles of key players operating in the private equity market such as Apollo Global Management, Inc., Bain Capital, LP., Blackstone Inc., EQT AB, HELLMAN & FRIEDMAN LLC, Insight Partners, KOHLBERG KRAVIS ROBERTS & CO. L.P., Tarrant Capital IP, LLC, The Carlyle Group, and Thoma Bravo. These players have adopted various strategies to increase their market penetration and strengthen their position in the private equity market size

Private Equity Market Segment Review

The private equity market outlook is segmented on the basis of fund type, sector, and region. On the basis of fund type, it is segmented into buyout, venture capital, real estate, infrastructure, and others. On the basis of sector, it is divided into technology, financial services, real estate and services, healthcare, energy & power, industrial, and others. On the basis of region, the private equity market it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

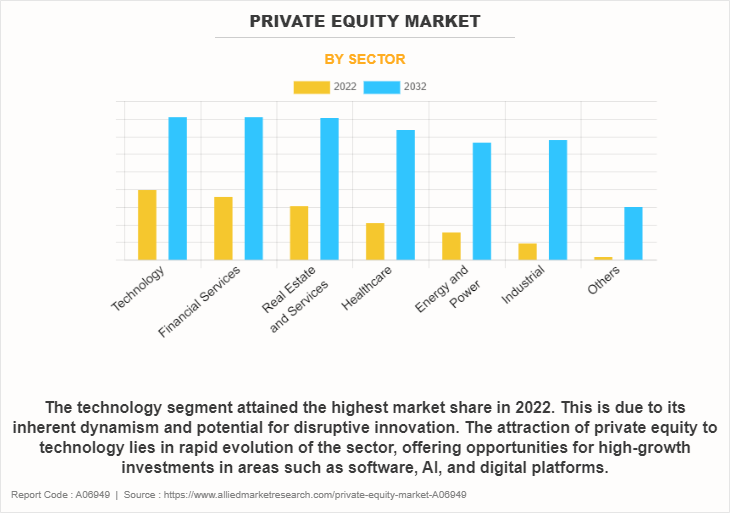

On the basis of sector, the technology segment attained the highest market share in the private equity industry. This is due to its inherent dynamism and potential for disruptive innovation private equity industry. The attraction of private equity to technology lies in rapid evolution of the sector, offering opportunities for high-growth investments in areas such as software, AI, and digital platforms. The technology sector continuously presents novel solutions, reshaping industries and catering to evolving consumer needs, making it a preferred choice for private equity investments. On the other hand, the industrial segment is attributed to be the fastest-growing segment during the forecast period in the private equity market share. This is primarily due to the renewed focus on manufacturing advancements, automation, and Industry 4.0 initiatives. The interest of private equity in the industrial sector has surged due to opportunities in modernizing manufacturing processes, embracing technological advancements, and pursuing efficiency gains in the private equity sector. The forecasted growth of the sector reflects increased investments in advanced manufacturing technologies, sustainable practices, and infrastructure development, aligning with global demands for innovation and efficiency in industrial operations.

On the basis of region, North America attained the highest share in the private equity market growth in 2022, as the region has a well-established ecosystem for equity private, boasting a mature financial infrastructure, access to a vast pool of capital from institutional investors, and a robust regulatory environment conducive to investment activities by the private equity companies in this region. Moreover, North America is home to a thriving tech and innovation landscape, attracting substantial private equity funds interest in tech-driven companies and startups. The presence of a diverse range of industries, along with a culture that encourages entrepreneurial ventures, further fuels private equity activity in the region. In addition, historically strong economic performance and a relatively stable political environment contribute to investor confidence, making North America an attractive hub for private equity investments. On the other hand, Asia-Pacific is expected to be the fastest-growing segment during the forecast period in the private equity market.

One key factor is the economic expansion and burgeoning middle class of this region, leading to increased consumer spending and business opportunities. As economies in Asia-Pacific continue to evolve and mature, there is a surge in entrepreneurial activity and innovation across various sectors, attracting investor interest. In addition, favorable demographic trends, technological advancements, and government initiatives supporting economic development and infrastructure investments create an environment conducive to private equity growth. The relatively untapped potential in many industries, coupled with increase in globalization and interconnectedness, positions the Asia-Pacific region as a hotspot for private equity investors seeking higher returns and diversified portfolios amid evolving global private equity market dynamics.

The report focuses on growth prospects, restraints, and trends of the private equity market analysis. The study provides Porter five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the private equity market.

Competition Analysis

Recent Product Launches in the Private Equity Market

On July 27, 2023, Verity, a leading provider of investment research and management software, announced the launch of VerityRMS for Private Equity, a deal intelligence platform that streamlines due diligence and dealmaking processes for private equity firms. For over a decade, Verity has empowered the world's leading fund managers to centralize their research, boost collaboration, and accelerate decision-making.

On November 27, 2023, Private equity firm True North entered the private credit market with the launch of 'True North Private Credit'. The company said it recognized the need to expand its product offering beyond private equity (PE) to leverage its capabilities and fully deliver value to all stakeholders. The private credit sector in India is fast evolving into a robust segment, driven by the favorable risk-reward equation and the presence of a good regulatory framework. Hence, True North has decided to foray into private credit (PC) to offer agile capital solutions to well-governed and profitable enterprises and deliver superior, risk-adjusted returns to its investors

Top Impacting Factors

Potential for Higher Returns

Private equity investments often offer the potential for higher returns compared to public markets. This is primarily due to the active involvement of private equity firms in the management of the companies they invest in. These firms typically aim to enhance operational efficiency, implement strategic changes, and drive growth, which can significantly increase the value of the invested companies over time. The ability to directly influence the operations and strategy of these companies allows private equity investors to capitalize on opportunities that might not be readily available in the public markets. Moreover, the longer investment horizon of private equity market allows for patient capital to nurture businesses and realize value over several years.

Regulatory and Compliance Challenges

One of the significant restraints in the private equity market involves regulatory and compliance complexities and a lack of private equity awareness. As private equity firms engage in complex transactions and have considerable control over the companies they invest in, regulatory scrutiny regarding antitrust issues, disclosure requirements, and potential conflicts of interest can be stringent. Adhering to diverse regulations across multiple jurisdictions adds a layer of complexity, requiring substantial legal and compliance expertise, which can increase operational costs and pose challenges for some firms.

Opportunity for ESG Integration

An emerging opportunity within the private equity market lies in integrating Environmental, Social, and Governance (ESG) principles into investment strategies. Increasingly, investors are prioritizing sustainability, ethical practices, and corporate responsibility. Private equity firms have the opportunity to incorporate ESG considerations into their investment decisions, driving positive social and environmental impact while potentially enhancing long-term financial performance. Firms that effectively integrate ESG factors into their investment processes may attract a broader investor base, differentiate themselves in the private equity market, and contribute positively to the companies they invest in by promoting sustainable practices and responsible business conduct.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the private equity market segments, current trends, estimations, and dynamics of the private equity market forecast from 2023 to 2032 to identify the prevailing private equity market opportunity.

- Private equity market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the private equity market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global private equity market.

- Private equity market player positioning facilitates benchmarking and provides a clear understanding of the present position of the private equity market players.

- The report includes an analysis of the regional as well as global private equity market trends, key players, market segments, application areas, and market growth strategies.

Private Equity Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.1 trillion |

| Growth Rate | CAGR of 9.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 351 |

| By Fund Type |

|

| By Sector |

|

| By Region |

|

| Key Market Players | Bain Capital, LP., EQT AB, HELLMAN & FRIEDMAN LLC, Insight Partners, Apollo Global Management, Inc., The Carlyle Group Inc., Thoma Bravo, KOHLBERG KRAVIS ROBERTS & CO. L.P., Blackstone Inc., Tarrant Capital IP, LLC |

Analyst Review

The growth of the private equity market is majorly due to the continual search for higher returns in a low-interest-rate environment drives investors toward alternative assets such as private equity, seeking potentially higher yields. In addition, the increase in globalization of businesses creates a wealth of investment opportunities globally, allowing private equity firms to diversify portfolios across various regions and industries. Furthermore, the evolution of technology and innovation presents compelling prospects, with firms leveraging tech advancements to enhance operational efficiencies and unlock value within their portfolio companies. The growth in acceptance and integration of ESG (Environmental, Social, and Governance) principles in investment strategies also fuel growth, attracting socially responsible investors and aligning with sustainable business practices. Furthermore, favorable regulatory environments in various regions, facilitating easier capital flows and investment activities, play a pivotal role in fostering the global expansion of the private equity market.

Investors are drawn to the private equity market by several compelling factors. Foremost is the potential for higher returns compared to traditional investment avenues. Private equity offers the promise of superior yields through active management and value creation within invested companies. In addition, investors are enticed by the diversification it offers, allowing access to a wide array of industries and company stages, spreading risk across a varied portfolio. Moreover, the allure of having a stake in unlisted companies that often possess high growth potential and innovative business models drives interest. The longer investment horizon aligns with patient capital strategies, giving investors the opportunity to participate in the growth and success of companies over time. Furthermore, the ability to partner with seasoned private equity firms boasting specialized expertise, networks, and the potential for active involvement in company strategies amplifies the attractiveness of this investment avenue. Moreover, the rise in integration of ESG principles and the alignment of private equity strategies with sustainable and responsible investing also resonate strongly with socially conscious investors, further bolstering the appeal of the private equity market.

Some key players profiled in the report include Apollo Global Management, Inc., Bain Capital, LP., Blackstone Inc., EQT AB, HELLMAN & FRIEDMAN LLC, Insight Partners, KOHLBERG KRAVIS ROBERTS & CO. L.P., Tarrant Capital IP, LLC, The Carlyle Group, and Thoma Bravo. These players have adopted various strategies to increase their market penetration and strengthen their position in the private equity market

The global private equity market was valued at $445.4 billion in 2022 and is projected to reach $1.1 trillion by 2032, growing at a CAGR of 9.7% from 2023 to 2032.

Private equity involves pooling funds from investors to acquire ownership stakes in private companies. These investments are not listed on stock exchanges. Firms aim to enhance company value through active management strategies, including operational improvements and strategic changes, to generate returns for investors.

Key players in the private equity market include Apollo Global Management, Inc., Bain Capital, LP., Blackstone Inc., EQT AB, Hellman & Friedman LLC, Insight Partners, Kohlberg Kravis Roberts & Co. L.P., Tarrant Capital IP, LLC, The Carlyle Group, and Thoma Bravo.

In 2022, North America held the largest share of the private equity market. The region's mature financial infrastructure, access to substantial capital from institutional investors, and a robust regulatory environment contribute to its leading position.

Factors driving the private equity market include the potential for higher returns due to active management and the flexibility to implement diverse investment strategies across various industries and company stages.

Challenges facing the private equity market encompass regulatory complexities that demand stringent compliance across multiple jurisdictions, increasing operational overheads, and limited liquidity, which impedes the rapid monetization of investments due to longer investment horizons.

Loading Table Of Content...

Loading Research Methodology...