Procurement Outsourcing Market Research, 2032

The global procurement outsourcing market size was valued at $6.4 billion in 2023, and is projected to reach $16.1 billion by 2032, growing at a CAGR of 11% from 2024 to 2032.

Market Introduction and Definition

Procurement outsourcing industry is the transfer of specialized procurement functions, such as sourcing, category management, and transaction management, to a procurement BPO provider. It is the process of selecting an external third-party partner to manage and provide procurement service.

Moreover, while procurement outsourcing industry was traditionally restricted to the transactional purchase-to-pay process, businesses could outsource comprehensive category management of non-core expenditure areas to a third party. Procurement outsourcing is a way to reduce headcount without heavily impacting business operations. However, in other areas, such as data security, adhering to internal standards is crucial. Defining expectations early, particularly for high-risk business processes, is crucial to balance the outsourcing operations.

Key Takeaways

The procurement outsourcing market size study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major procurement outsourcing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The procurement outsourcing market analysis study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global procurement outsourcing market trends and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Industry Trends:

In February 2024, the UK government launched two tenders for cloud services valued at $9.5 billion that were spent under framework agreements. In a separate procurement initiative, the UK government sought the help of a tech firm to help public bodies ’transition to cloud software or hosting services.’ This framework could be valued over $1 billion.

In April 2023, U.S. public sector invested in procurement outsourcing and platforms, as it emerged from years of delayed digital modernization.

Key market dynamics

The global procurement outsourcing market growth has grown due to several factors such as technological advancements and rise in need for advanced efficiency & productivity. However, loss of control & visibility and data security & privacy act as restraints for the procurement outsourcing market. In addition, the surge in demand for strategic sourcing and category management are expected to provide ample opportunities for market growth during the forecast period.

In addition, strategic sourcing and category management are crucial for organizations to optimize their procurement processes and achieve cost saving solutions. Procurement outsourcing providers offer specialized expertise in these areas, helping companies to develop strategic sourcing strategies. In addition, the growth of the procurement outsourcing market is driven by several factors, including the need to adopt new IT solutions aligned with consumer trends, the demand for simplified procurement processes by enterprises, and the management of compliance policies and agreements.

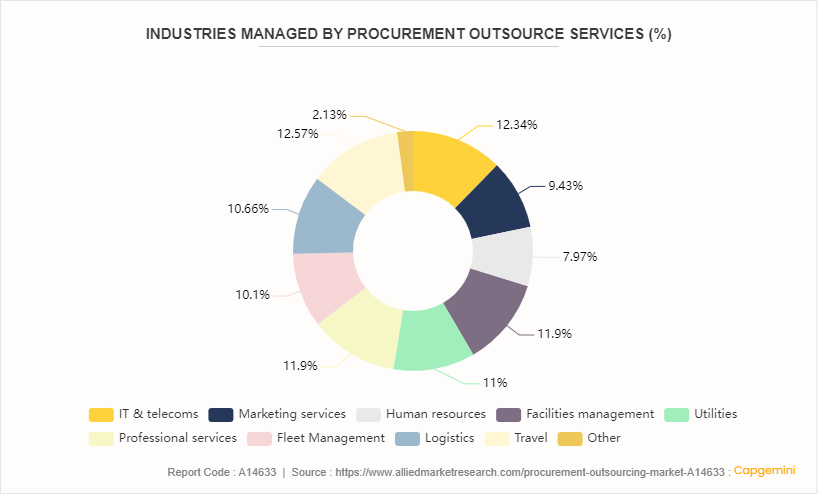

Outsourcing Adoption in Different Industries

Outsourcing services are widely adopted by various industries to eliminate the workload and enhance product efficiency. Of those companies already engaged in some procurement outsourcing activity, eProcurement systems management turned out to be the most common.

Outsourced procurement function, where 51% currently outsource their business operations. According to the article published by Capgemini, IT management & infrastructure is the most outsourced business function (49%) , followed by payroll (39%) and logistics (32%) . Finance & accounting (18%) and legal (13%) joined procurement (12%) as the three least outsourced business areas.

Market Segmentation

The procurement outsourcing market share is segmented into component, deployment, organization size, industry vertical, and region. On the basis of component, the market is divided into solution and services. On the basis of deployment, the market is segregated into on-premise and cloud. On the basis of organization size, the market is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of industry vertical, the market is bifurcated into BFSI, healthcare, IT & telecommunication, and manufacturing. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

Procurement outsourcing market forecast to grow rapidly in the U.S. Companies might save money by outsourcing their procurement activities. Businesses reduce procurement costs, negotiate better deals with suppliers, and optimize their procurement processes by leveraging the expertise and economies of scale of outsourcing providers. Moreover, Latin America offers several advantages beyond cost arbitrage, especially for companies based in the U.S. and Canada, or even European companies looking to outsource or nearshore their procurement operations.

In July 2023, the UK government developed a new ‘contract management playbook’. The suite of existing playbooks provides a well-balanced view on best practice in procurement in the areas.

In October 2023, the UK government is planning for a new $6.09 billion investment framework for public sector organizations to purchase outsourced contact center and business process services over the next four years.

In January 2023, the Japanese government is to introduce an additional scheme for IT procurement by government organizations and make online procurement of IT-software possible in 2024.

Competitive Landscape

The major players operating in the procurement outsourcing market include Accenture, IBM Corporation, Infosys, Capgemini, Genpact, Wipro Limited, WNS, Corbus LLC, HCL Technologies Limited, and Tata Consultancy Services.

Recent Key Strategies and Developments

In February 2024, Accenture acquired Insight Sourcing, a provider of strategic sourcing and procurement services. Insight Sourcing is expected to broaden Accenture’s sourcing and procurement services for private equity companies and the consumer goods, retail, technology, and industrial industries.

In February 2024, Genpact collaborated with Tropicana Brands Group, to transform its global business services and supply chain operations. Genpact is projected to leverage its domain expertise and digital business platform to implement standardized processes, data analytics, and innovative digital solutions to transform Tropicana Brand Group's finance and accounting (F&A) operations.

In December 2022, WNS Limited (WNS) acquired the Smart Cube, a leader in platform-driven research and analytics (R&A) focused on procurement and supply chain, and OptiBuy, a leading European provider of procurement platform consulting and implementation solutions. These assets are complementary to WNS’ existing offerings and strengthen the company’s capabilities in both high-end procurement and advanced analytics.

Key Sources Referred

GEP

Asian Development

Sourcing Industry Group

Harvard Business Review

World Bank Group

IMF

Key Benefits for Stakeholders

This report provides a quantitative analysis of the procurement outsourcing Market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the procurement outsourcing market forecast segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global procurement outsourcing market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Procurement Outsourcing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.9 Billion |

| Growth Rate | CAGR of 10.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 303 |

| By Component |

|

| By Deployment |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Wipro Limited, HCL Technologies Limited, Capgemini, Accenture, Infosys, IBM Corporation, Tata Consultancy Services, Genpact, WNS, GEP |

Loading Table Of Content...