Professional Liability Insurance Market Research, 2032

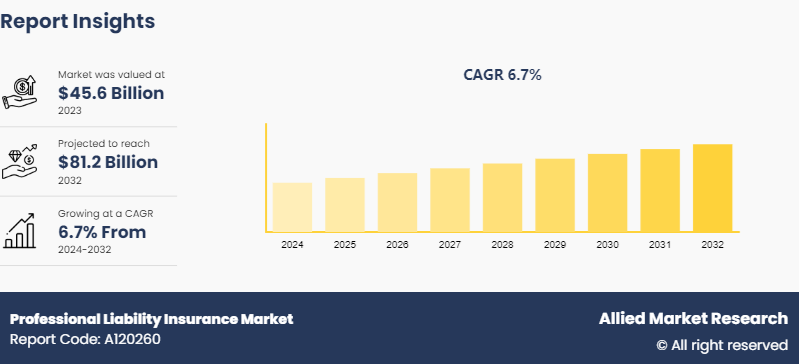

The global professional liability insurance market was valued at $45.6 billion in 2023, and is projected to reach $81.2 billion by 2032, growing at a CAGR of 6.7% from 2024 to 2032. Professional liability insurance plays a vital role in safeguarding the reputation and financial stability of professionals and their businesses by providing financial protection against potential claims and lawsuits. Moreover, policies can be customized to meet the specific needs of different professions, addressing unique risks and regulatory requirements associated with each field.

Professional liability insurance, often referred to as errors and omissions (E&O) insurance, is a specialized type of coverage designed to protect professionals and their businesses from claims of negligence, errors, omissions, or inadequate work. It is particularly crucial for professionals who provide specialized services or advice to clients, such as doctors, lawyers, accountants, architects, consultants, and other service providers. This insurance provides coverage for legal costs associated with defending against claims, including attorney fees, court costs, and settlement expenses, regardless of whether the professional is found liable. In addition, it protects against claims arising from mistakes, oversights, or failures to perform a service that results in financial loss or harm to a client.

Key Takeaways

The professional liability insurance market outlook covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major professional liability insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global professional liability insurance market forecast and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The market dynamics of professional liability insurance market are influenced by various factors, including regulatory changes, industry trends, claims experience, and economic conditions. One key driver of market dynamics is the evolving regulatory landscape governing professional services. Changes in laws and regulations impact the scope of liability faced by professionals and the types of coverage required, leading to shifts in demand for insurance products. In addition, industry trends and emerging risks, such as advancements in technology or changes in client expectations, can shape the demand for specific coverage features and drive innovation in insurance products. Claims experience also plays a significant role, as insurers adjust pricing and underwriting strategies based on historical loss data and trends in claim frequency and severity. Economic conditions, including interest rates and overall market volatility, can influence insurers' investment income and profitability, affecting pricing and capacity in the professional liability insurance market.

Public Policies of Professional Liability Insurance Market

Public policies regarding professional liability insurance typically revolve around ensuring the protection of consumers, promoting accountability among professionals, and maintaining the integrity of the insurance market. One key aspect of public policy is the regulation of insurance providers to ensure they meet solvency requirements and operate in a financially sound manner, safeguarding policyholders against the risk of insurer insolvency. In addition, policymakers may establish minimum coverage requirements or mandate certain professions to carry professional liability insurance to protect consumers from financial losses resulting from professional errors or negligence. Public policies also aim to promote transparency and fairness in insurance practices, requiring insurers to provide clear and accurate information about coverage terms, pricing, and claims processes. Furthermore, policymakers may enact laws or regulations to address emerging issues and risks in professional liability insurance, such as cyber liability or environmental liability, ensuring that insurance products remain relevant and effective in protecting consumers and professionals alike.

Market Segmentation

The professional liability insurance market is segmented into type, application, and region. On the basis of type, the market is divided into medical liability, lawyer liability, CPA liability, construction liability, and others. On the basis of application, the market is divided into up to $1 million, $1 million to $5 million, $5 million to $20 million, and over $20 million. The professional liability insurance market region-wise, is analyzed across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Regional/Country Market Outlook

The regional outlook of professional liability insurance market varies depending on factors such as regulatory environments, economic conditions, and cultural attitudes towards risk and insurance. In regions with well-established legal systems and robust regulatory oversight, such as North America and Europe, professional liability insurance is widely adopted and regulated to protect consumers and ensure accountability among professionals. These regions often have stringent licensing requirements for professionals and may mandate certain professions to carry professional liability insurance as a condition of practice. In addition, there may be industry-specific regulations governing coverage terms, pricing, and claims handling practices to ensure fairness and transparency in the professional liability insurance market.

In emerging markets like parts of Asia-Pacific, Latin America, and Africa, the outlook for professional liability insurance market is influenced by factors such as economic development, regulatory capacity, and cultural norms. While demand for professional liability insurance is growing in these regions as professionals seek to mitigate risks and protect their businesses, there may be challenges related to regulatory compliance, insurance affordability, and consumer awareness. Policymakers in these regions are working to strengthen regulatory frameworks, improve insurance market transparency, and enhance consumer protection measures to support the growth of professional liability insurance market.

Industry Trends

In June 2022, U.S.-based company Anaqua, the intellectual property (IP) management technology provider acquired Practice Insight Pty Ltd, and its intelligent time capture software WiseTime, from IPH Limited. This acquisition provides intellectual property management solutions that offer advanced reporting and analytics, integrated document management, secure cloud hosting, collaborative client portals, intuitive user experience and integrated time and billing.

In Europe, the largest demand growth is likely to come from the younger generations in Europe and from online and offline sales channels. Therefore, consumption of used and refurbished mobile phones has increased significantly in Europe in the past years.

In January 2021, France-based intellectual property solutions provider, Questel acquired Equinox, a UK-based technology company known for its IP management system. The Equinox IPMS solution strengthens Questel’s position in the IPMS market by adding a dedicated solution for law firm clients.

Competitive Landscape

The major players operating in the professional liability insurance market include Chubb Group of Insurance Companies, American International Group, Inc., Hiscox Inc., Allianz SE, Tokio Marine Holdings, Inc., AXA SA, The Travelers Indemnity Company, Assicurazioni Generali S.p.A., The Doctors Company, and CNA Financial Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the professional liability insurance industry.

Recent Key Strategies and Developments

In April 2024, Boost Insurance, the leading insurance infrastructure platform, announced partnership with Amwins Program Underwriters, part of Amwins Underwriting Division, to launch an enhanced, technology-enabled version of two long-standing Lawyers Professional Liability (LPL) programs: LawGold and Firemark, and re-launch its Attorneys’ Select program.

In October 2023, Indigo launched its new medical professional liability insurance platform, utilizing artificial intelligence to revolutionize this once conventional industry. Indigo's platform disrupts the traditional market by leveraging new data and advanced technology to offer customized pricing for physicians and a streamlined experience for brokers. Indigo policies will carry an A- (Excellent) rating by AM Best by qualifying as a member of Concert Insurance Group's rating unit and will provide robust coverage, including physician-centric defense.

In January 2024, Coalition announced that it will now offer miscellaneous professional liability (MPL) insurance. MPL coverage protects against a claim that a business committed errors and omissions in the performance of a professional service.

Key Sources Referred

Boost Insurance USA, Inc.

Questel SAS

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the professional liability insurance market growth, current trends, estimations, and dynamics of the professional liability insurance market analysis from 2024 to 2032 to identify the prevailing professional liability insurance market opportunity.

- The professional liability insurance market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the professional liability insurance market share to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global professional liability insurance market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the professional liability insurance market players.

- The report includes the analysis of the regional as well as global professional liability insurance market trends, key players, market segments, application areas, and market growth strategies.

Professional Liability Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 81.2 Billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 219 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | American International Group, Inc., Assicurazioni Generali S.p.A., The Doctors Company, The Travelers Indemnity Company, Allianz SE, Chubb Group of Insurance Companies, CNA Financial Corporation, AXA SA, Tokio Marine Holdings, Inc., Hiscox Inc. |

The professional liability insurance market was valued at $45.6 billion in 2023, and is estimated to reach $81.2 billion by 2032, growing at a CAGR of 6.7% from 2024 to 2032.

The major players operating in the professional liability insurance market include Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA, Travelers, Assicurazioni Generali, and Doctors Company.

North America is the largest regional market for Professional Liability Insurance

Growth of professional services across various industries is the leading application of Professional Liability Insurance Market.

Urbanization and transformation towards service-sector economy and increase in awareness of the professional liability insurance plan are the upcoming trends of Professional Liability Insurance Market in the globe.

Loading Table Of Content...