Property Insurance Market Research, 2031

The Global Property Insurance Market was valued at $15897.8 billion in 2021, and is projected to reach $38708.5 billion by 2031, growing at a CAGR of 9.5% from 2022 to 2031.

Property insurance industry provides insurance for renting and coverage that protects against loss from theft, fire, and other perils for tangible assets and equipment of businesses or residences. It includes all-risk coverage insurance that offers protection from all risks. In addition, property insurance policies normally exclude damage that results from a variety of events, including tsunamis, floods, drain and sewer backups, seeping groundwater, standing water, and a number of other sources of water.

Increase in digital transformation among industries and the rise in penetration of internet & mobile devices across the world boost the growth of the global property insurance market size. In addition, growing need for finance among businesses and individuals to house insurance positively impacts the property insurance market growth. However, enforcement of strong rules by banks and financial institutions for providing housing finance is hampering the P&C insurance software market growth.

The report focuses on growth prospects, restraints, and trends of the global property insurance market analysis. The study provides Porter’s five forces analysis to understand impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global property insurance market share.

The property insurance market is segmented into Coverage, End User and Application.

Segment Review

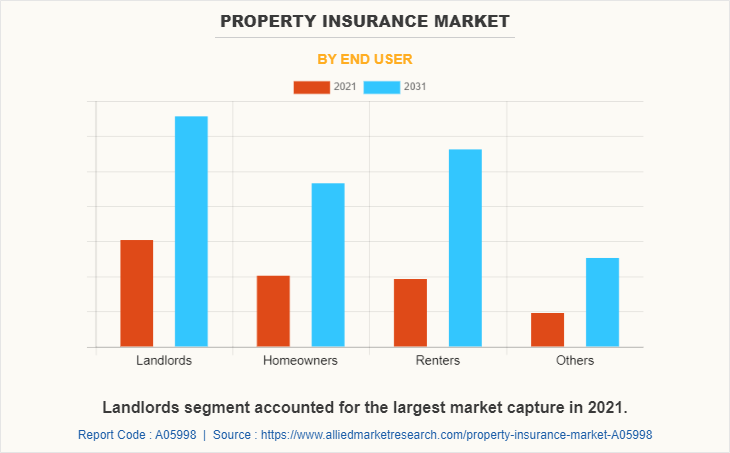

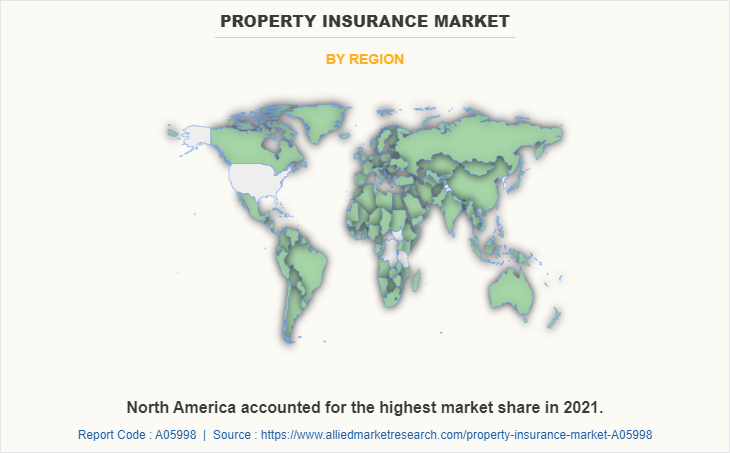

The global property insurance market is segmented based on coverage, end user, application and region. By coverage, the market is bifurcated into fire and theft, house damage, floods and earthquake, personal property, and others. By end user, the market is bifurcated into landlords, homeowners, renters, and others. By application, it is categorized into personal and enterprise. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of end user, the landlords segment holds the largest share of the property insurance market, owing to the fact that landlord property insurance helps to provide insurance for renting which cover the loss of rental income, which is expected to drive the market. However, the renters segment is expected to grow at the highest rate during the forecast period, as property insurance coverage insurance for renting is for certain amount in the event that gets sued for an injury or other damages incurred at home by other people.

Region-wise, the property insurance industry was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to a rise in awareness among SMEs and large businesses toward property insurance services. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the rise in awareness and additional savings by individuals to purchase their own real estate properties.

The key players profiled in the property insurance market analysis are Admiral Group Plc., Allianz, Allstate Insurance Company, American International Group, Inc., AXA, Chubb, Liberty Mutual Insurance, PICC, State Farm Mutual Automobile Insurance Company, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Report Coverage & Deliverables

The property insurance market report covers essential aspects, including policy types, technological advancements, and key application areas. Deliverables focus on the market’s growth potential, risk assessment trends, and innovation in service offerings. The report highlights property insurance challenge faced by property insurance companies, such as rising claims due to natural disasters, regulatory changes, and evolving customer expectations. Additionally, the analysis includes forecasts, competitive strategies, and emerging trends in digital transformation within the property insurance domain. These deliverables help stakeholders assess future opportunities and make informed decisions on risk management, customer service improvement, and technology integration.

Type Insights

Property insurance policy primarily cover residential, commercial, and industrial properties against damages caused by fire, theft, natural disasters, and vandalism. The market is witnessing growing demand for customized policies tailored to specific industries, such as real estate and manufacturing. Homeowners and business owners increasingly rely on comprehensive insurance solutions that address property damage and liability, ensuring financial protection against a wide range of risks. Specialized coverage, such as flood or earthquake insurance, is also gaining popularity in regions prone to such events.

Technology Insights

Technology is reshaping the property insurance growth, particularly in the areas of risk assessment and claims processing. Advanced technologies like AI, big data, and IoT are enabling property insurance companies to assess risks more accurately, leading to improved pricing models and faster claims handling. Insurers are adopting automation tools to streamline customer service, reduce paperwork, and provide real-time policy updates. The rise of insurtech startups is further accelerating the digital transformation of the property insurance domain, driving innovation in underwriting, fraud detection, and customer interaction.

Application Insights

The application of property insurance shares spans various sectors, including residential, commercial, and industrial properties. Residential insurance remains the dominant application, accounting for the largest market share due to the widespread need for homeowners' coverage against damages. Commercial property insurance is seeing increased adoption as businesses seek protection from financial losses caused by fire, theft, and other risks. Industrial properties, particularly in sectors like manufacturing and logistics, are increasingly opting for property insurance policies that cover complex risks associated with machinery breakdowns and operational disruptions.

Regional Insights

Regionally, North America and Europe dominate the property insurance domain due to strong regulatory frameworks and high awareness among property owners. In North America, the U.S. leads in property insurance adoption, driven by frequent natural disasters such as hurricanes and wildfires, necessitating comprehensive insurance solutions. Europe, particularly countries like the UK, France, and Germany, benefits from stringent insurance laws and high urbanization rates. Meanwhile, Asia-Pacific is experiencing rapid market growth, with rising industrialization, urbanization, and increased awareness of property risks driving demand for property insurance value in countries like China and India.

Key Companies & Market Share Insights

The Property Insurance companies include Allianz SE, State Farm, Zurich Insurance Group, AXA Group, and Chubb Limited. These companies lead the market by offering comprehensive property insurance service that cater to both individuals and businesses. Their dominance is attributed to strong global presence, innovative policy offerings, and technology-driven customer service enhancements.

Top Impacting Factors

Increase in Digital Transforming Among Industries

Cloud computing solutions have aided in the transformation of digital banking, benefiting both front-end and back-end operational models. Since the pandemic has stuck, many enterprises across different domains are actively transforming their businesses online. Additionally, property insurance companies in becoming more future-proof while also laying the foundation for increased customer value and revenue. According to the article published by Max Life, in June 2022, the business value of cloud computing for insurance is fast becoming evident. Furthermore, cloud solutions enable open banking, broadening the range of options available for finding insurance to consumers across traditional and non-traditional financial services. Moreover, to meet their capacity and speed requirements, insurance providers and financial institutions are increasingly turning to digital technologies to store data and support applied analytics. Therefore, the increase in digital transformation among insurance industries is expected to drive the growth of the property insurance market during the forecast period.

Rising Penetration of Internet & Mobile Devices Across the World

The spread of internet access to every corner of the globe has resulted in a surge in the online segment which has facilitated a rapid growth prospect for property insurance. In the twenty-first century, increasing use of devices such as smartphones and tablets, as well as access to the internet via 4G, 5G, and other technologies, has accelerated the adoption of digital technology. Moreover, to streamline daily operations and gain access to data from anywhere, insurance providers and financial institutions are turning to cloud-oriented software, as the software keeps businesses up to date on transactions automatically. According to the article published by InsurTech, in January 2022, there are many different ways insurers can use the cloud to improve their business, which is platform hosting, data storage, backup, marketing campaign, and ERP. Therefore, the rising penetration of the internet and mobile devices across the world is expected to drive the growth of the market forecast period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global property insurance market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & property insurance market opportunity and their impact analysis on global property insurance market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry and property insurance market outlook.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Property Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 38708.5 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Coverage |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | State Farm Mutual Automobile Insurance Company, AXA, Allstate Insurance Company, Zurich, Admiral Group Plc, Liberty Mutual Insurance, American International Group, Inc., PICC, Allianz, Chubb |

Analyst Review

Property insurance provides protection against most risks to property, such as fire, theft, and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Moreover, property is insured in two main ways, which are open perils and named perils. Open perils cover all causes of loss not specifically excluded in the policy. Some common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Whereas, named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include damage-causing events such as fire, lightning, explosion, and theft.

Key providers of the property insurance market such as PICC, AXA, and Zurich account for a significant share in the market. With larger requirements from corporate culture, various brands are expanding business outlets to automate and simplify data management. For instance, in July 2022, AXA Partners and DOA Underwriting enter into a partnership, which intends to enable more customers to access travel insurance via approximately 1,500 brokers and insurance intermediaries in niche market sectors.

In addition, with increase in demand for getting instant solutions to a problem with all resourceful insights, companies such as AXA have performed strategic collaboration to help end users. For instance, in May 2021, AXA one of the largest and most diversified P&C insurers, and Akur8, an AI-driven insurance pricing technology company, are delighted to announce their collaboration to further enhance AXA Tianping’s pricing process with Akur8’s high-performing AI technologies. This collaboration helps to enhance business transformation expertise to automate marketing workflows with AI.

Furthermore, in December 2022, the People’s Insurance Company of China (PICC) announced an International Warranty Service (IWS) strategic cooperation with vape brand GEEKVAPE. The agreement involves a product safety liability insurance policy with a coverage of up to 1 billion yuan.

The property insurance market is estimated to grow at a CAGR of 9.5% from 2022 to 2031.

The property insurance market is projected to reach $38,708.53 billion by 2031.

Increase in digital transformation among industries, rising penetration of internet & mobile devices across the world, and growing need for finance among businesses and individuals to insuring property contribute toward the growth of the market.

The key players profiled in the report include Admiral Group Plc., Allianz, Allstate Insurance Company, American International Group, Inc., AXA, Chubb, Liberty Mutual Insurance, PICC, State Farm Mutual Automobile Insurance Company, and Zurich.

The key growth strategies of property insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...