Prosthetics Market Size and Trends, 2031

The global prosthetics market was valued at $1.6 billion in 2021, and is projected to reach $2.5 billion by 2031, growing at a CAGR of 4.5% from 2022 to 2031. The growth of the prosthetics market is expected to be driven by high potential in adoption of the technology in developing countries due to increase in the incidences of accidents, increase in practice of amputation, and surge in demand for prosthetics devices.

Prosthetics is a device designed to replace a missing body part or to make a part of the bodywork better. Missing limbs and joints are commonly replaced by prosthetic devices. These devices are worn by people who have lost limbs or those born with congenital limb differences. There are many types of prosthetic devices to help people regain mobility. Each serves a different function depending on what body part is missing. Artificial limbs attach to the amputee's residual limb (stump) by belts, cuffs, or suction. Either the residual limb fits directly into a socket on the prosthetic, or a liner is used that’s fixed to the socket by vacuum or a pin lock. The current prosthesis options improve quality of life by providing mobility needed to manage daily activities. Lower extremity prosthetics allow people to walk, run, and play sports. With increased movement, people gain greater independence and confidence and live fuller lives without feeling socially anxious or burdened by physical challenges.

Historical Overview

The market has been analyzed qualitatively and quantitatively from 2021 to 2031. The prosthetics market witnessed growth at a CAGR of around 4.5% from 2022 to 2031. Most of the growth during this period was from North America owing to the increase in the adoptions of prosthetics, rise in incidences of injuries and trauma, as well as well-established presence of domestic market players in the region.

Market Dynamics

Growth & innovations in the medical devices industry for the adoption of prosthetics device technology is driven by the massive pool of chronic diseases like bone and joint cancer. The rise in the number of injuries due to accidents or sports that lead to the procedure of amputation creates an opportunity for the Prosthetics Industry. Moreover, the rise in the number of strategies adopted like agreements by various key players across the globe is set to affect Prosthetics Market Growth positively. For instance, in November 2019, Össur and Alfred Mann Foundation (AMF) signed a milestone agreement that allowed Össur to further develop and license AMF’s implanted myoelectric sensor (IMES) system as both organizations continue exploring the potential of mind-controlled prosthetic technologies.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced medical technologies, significant investments by government to develop prosthetics, and strong foothold of medical device industries in emerging countries. In addition, the cost effectiveness of the prosthetic devices may also decide the demand for adoption of the devices. It's because the high cost of the devices makes it unaffordable for the facilities or hospitals that generate low revenues for the adoption of healthcare devices. Hence, the cost effectiveness factor for the prosthetics is attributed to further support the market growth.

The demand for prosthetics is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in the number amputation procedures performed and increase in awareness toward benefits of prosthetics further drive the growth of the market. Furthermore, rise in consumer awareness related to advanced healthcare options boosts the adoption of prosthetics. In addition, an increase in research activities by manufacturers for developing innovative solutions in prosthetics technology is expected to fuel their adoption in the near future. However, the high cost associated with the prosthetics & greater maintenance associated with the prosthetics are hampering the Prosthetics Market Size growth.

Segmental Overview

The prosthetics market is segmented on the basis of product, design, end user, and region. On the basis of product, the market is classified into upper extremity prosthetics, lower extremity prosthetics and others. On the basis of design, the market is bifurcated into exoskeletal design and endoskeletal design. On the basis of end user, the market is categorized into prosthetics clinics, hospitals, and others. Region wise, the market is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

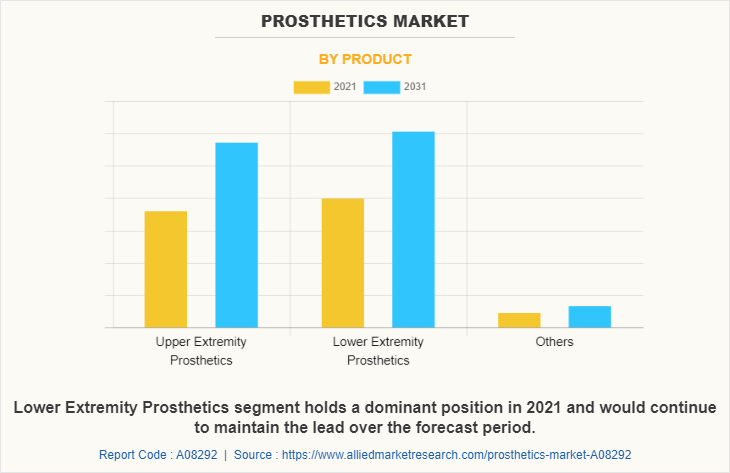

By Product

The lower extremity prosthetics segment dominated the global Prosthetics Market Size in 2021 and is expected to remain dominant throughout the Prosthetics Market Forecast period, owing to an increase in the adoption of lower extremity prosthetics for implantation and the availability of several types of devices that are developed by various key players in the market. Moreover, the rise in the practice of amputation also boosts the demand for prosthetics devices.

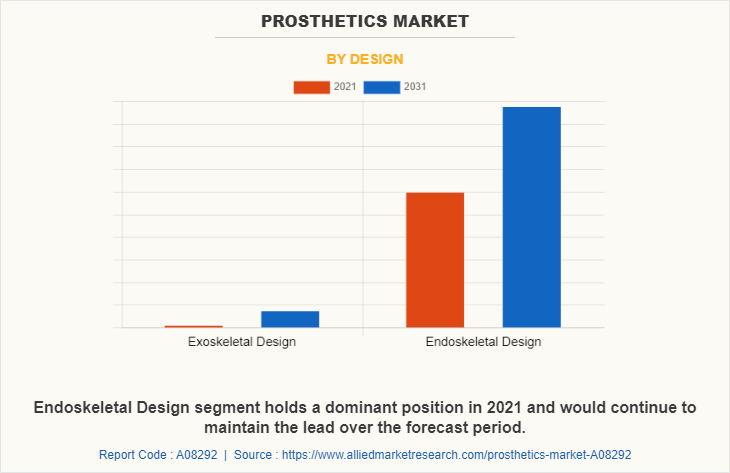

By Design

The endoskeletal design segment dominated the global Prosthetics Market Share in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to the increase in prevalence of chronic bone disorders among the population like osteoporosis and osteopenia. In addition, growth in awareness regarding the prosthetics benefits and rise in adoption of advanced prosthetics drives the growth of market.

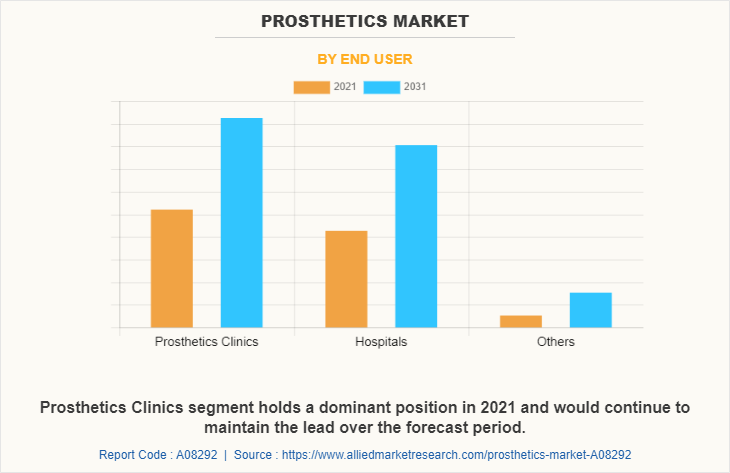

By End User

The prosthetics clinics segment held the largest market share in 2021 and is expected to remain dominant throughout the forecast period, owing to the preference of population for the intrapartum monitoring in hospitals and the ease of accessibility of the patients to the hospitals and clinics post-COVID-19 pandemic situation.

By Region

The prosthetics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America was the dominant region and is expected to remain dominant throughout the forecast period, owing to high prevalence rate of bone disorders like osteosarcoma, an increase in the number of market players, and a surge in the number of devices available in the region. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the presence of high populace countries such as India and China, which in turn increases the number of chances of suffering from accidents and trauma conditions and the increasing number of strategies and trends adopted by the market players.

Competition Analysis

Competitive analysis and profiles of the major players in the prosthetics, such as Aesthetic Prosthetics Inc., Aether Biomedical, B. Braun Melsungen AG, Blatchford Limited, Integra Lifesciences Holdings, Mobius Bionics LLC, Ossur, Ottobock SE and Co. KGaA, Steeper Group, Stryker Corporation, are provided in this report. There are some important players in the market such as B. Braun Melsungen AG, Blatchford Limited, Mobius Bionics LLC, Ossur, Ottobock SE and Co. KGaA. Various players have adopted strategies like product launch and acquisition as key developmental strategies to improve the product portfolio of the prosthetics market.

Recent Developments in the Prosthetics Market

- In June 2020, Unlimited Tomorrow, Inc., announced the launch of TrueLimb, a next-generation prosthetic arm that is available through a completely remote process that amputees can initiate online, broadening access to customized devices like this for the first time.

- In September 2019, PSYONIC, announced the launch of its first product, the Ability Hand, at the American Orthotic & Prosthetic Association (AOPA) National Assembly.

- In June 2020, Steeper Group, completed the acquisition of the Espire ElbowTM prostheses range from the U.S. based College Park Industries. Steeper Group intended to continue growth in the UK and the U.S. to provide more manufacturing and technical support for the Espire range.

- In June 2020, Ossur had announced the completion of acquisition of College Park Industries. College Park is a global provider of prosthetic devices and supporting services headquartered in Michigan, U.S.

- In February 2019, Össur acquired the technology related to the development of a powered ankle prosthesis from SpringActive, Inc., a privately held engineering firm that specializes in computer controlled prosthetic devices and industrial exo-systems. This acquisition concludes a multi-year collaboration where the teams from Össur and SpringActive explored the technology’s potential to spread across multiple product platforms within Össur.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the prosthetics market analysis from 2021 to 2031 to identify the prevailing Prosthetics Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the prosthetics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global prosthetics market trends, key players, market segments, application areas, and market growth strategies.

Prosthetics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.5 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Product |

|

| By Design |

|

| By End User |

|

| By Region |

|

| Key Market Players | Blatchford Limited, Ottobock SE & Co. KGaA (suit X), Stryker Corporation, Össur, Integra LifeSciences Holdings, Steeper Group, Aesthetic Prosthetics Inc., Aether Biomedical , B. Braun Melsungen AG, Mobius Bionics LLC |

Analyst Review

In accordance with several interviews conducted, a prosthetic device or prosthesis plays a significant role in rehabilitation when an arm or other extremity is amputated or lost. For many people, an artificial limb improves mobility and the ability to manage daily activities, as well as provides the means to stay independent. A number of factors that are involved in choosing a prosthesis include the location and level of the amputation, the condition of the remaining limb, and the activity level, particularly for a prosthetic leg or foot.

Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the increase in the research and development expenditure for the development of innovative and advanced products that increases the demand for the advanced prosthetic devices packed with enhanced benefits, increase in awareness about the prosthetic amputation procedures and increase in government support for amputation procedures among the amputees and other related trends adopted by the market players.

The total market value of the prosthetics Market is $1604.69 million in 2021.

The forecast period in the report is from 2022 to 2031.

North America is the largest regional market for Prosthetics.

The market value of the prosthetics Market in 2022 was $1670.48 million.

The top companies that hold the market share in the prosthetics Market are Aesthetic Prosthetics Inc., Aether Biomedical, B. Braun Melsungen AG, Blatchford Limited, Integra Lifesciences Holdings, Mobius Bionics LLC, Ossur, Ottobock SE and Co. KGaA, Steeper Group, Stryker Corporation.

The base year for the report is 2021.

Yes, prosthetics companies are profiled in the report.

The key trends in the prosthetics Market are increasing adoption of advanced prosthetics, rising incidence of accidents, and a surge in technological advancement in prosthetics.

Loading Table Of Content...