Protein Alternatives Market Research, 2031

The global protein alternatives market size was valued at $16.6 billion in 2021, and is projected to reach $73.9 billion by 2031, growing at a CAGR of 16.2% from 2022 to 2031.

Protein alternatives are substitutes for animal-based protein. Protein-rich plants like soybeans, peas, and almonds have long been used as substitutes for meat and other animal products. However, the term "protein alternative" can also refer to more contemporary developments that replicate traditionally animal-based foods like eggs, dairy, and various kinds of meat. Consumers and investors alike have been paying increasing attention to the protein alternatives, which ranges from plant-based eggs to cultured meats made from animal cells in culture. Animal exploitation and the environmental effects of food production would be reduced if alternative proteins were used in place of currently produced animal products.

Market Dynamics

The protein alternatives market growth is projected to be fueled by the rise in the consumption of clean proteins as well as by growing awareness of consumers and adoption of proteins from sustainably derived sources. Consumer awareness of the value of clean protein in daily diets for sustaining energy and managing weight is expected to have a beneficial effect on the growth of the protein alternatives market. The protein substitute offers several health advantages, including improving nutritional makeup and boosting the immune system of the body, which should expand the market for protein substitutes in food applications and promote Protein Alternatives Industry.

Moreover, animal nutrition increasing demand for protein alternatives is the major driver which propels the growth of Protein alternatives industry. Protein alternative is crucial to the livestock industry since it is fed to a variety of animals, including cattle, fish, poultry, swine, pets, and horses. There has been a noticeable rise in demand for alternative protein sources for animal feed as a result of greater emphasis on lowering the overall cost of feed, which is predicted to drive the alternative protein market share. Alternative protein is a significant source for animal feed applications because of the rich mix of vitamins and amino acids present in plant-based proteins.

In addition, plant-based proteins supplying nutrition and taste is also a factor which drives the market growth. Plant-based protein sources like soy protein are used commonly in burger patties, mince, and sausages due to their acceptable quality attributes in terms of texture & flavor. The demand for meat analogs is being driven by consumer attention to sustainability, rising health concerns, and the desire for delicious meat substitutes. These reasons are anticipated to boost the protein alternatives market demand.

Due to increasing awareness among consumers regarding the harmful health effects of meat & meat products are creating many opportunities in the protein alternatives market. Eating animals can have a range of nutritional consequences. It has been demonstrated that eating too much meat leads to elevated cholesterol and rise in obesity rates. consumers are becoming more interested in choosing healthier decisions as the connection between animal-based proteins and health issues becomes more widely known.

In addition, with growing R&D in food technology and the regular launch of the new product by key players contributing to the growth of the protein alternatives market. For instance, Nestle introduced a plant-based burger in the U.S. in April 2019 under the name Sweet Earth. In Europe, the identical product was sold under the Garden Gourmet name.

However, stringent regulatory compliances along with the inability to digest protein are expected to obstruct the market growth during the forecast period. There is a lack of regulatory certainty for edible insect applications in the food business. The effects of eating edible insects can vary from person to person, making the clearance process more difficult. In turn, this limits the development of insect-based proteins. The market is also being hampered by allergies related to many protein alternatives, such as those derived from plants and insects.

Market Segmentation

The protein alternatives market forecast is segmented on the basis of source, application, distribution channel, and region. On the basis of source, the market is classified into plant protein, mycoprotein, algal protein, and insect protein. On the basis of application, the market is bifurcated into food & beverage, dietary replacers, animal feed, and others. On the basis of distribution channel, the market is categorized into hypermarket/supermarket, chemist/drugstore, specialty store, and online store. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

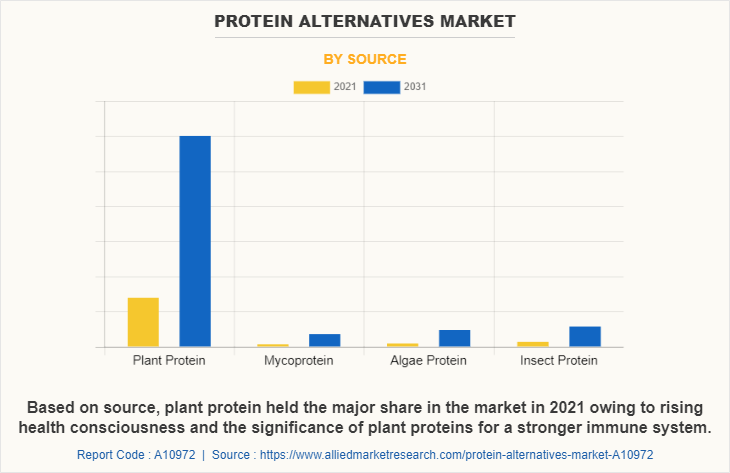

By Source

On the basis of source, the market is segmented into plant protein, mycoprotein, algal protein, and insect protein. The plant protein segment accounted for a major share in the Protein alternatives market share in 2021, and is expected to grow at a significant CAGR during the forecast period. A useful supply of protein that comes from plants is simply known as plant protein. Global demand for plant-based protein is driven by rising health consciousness and the significance of plant proteins for a stronger immune system. Plant-based proteins provide amazing health benefits such as it improves digestion and metabolism.

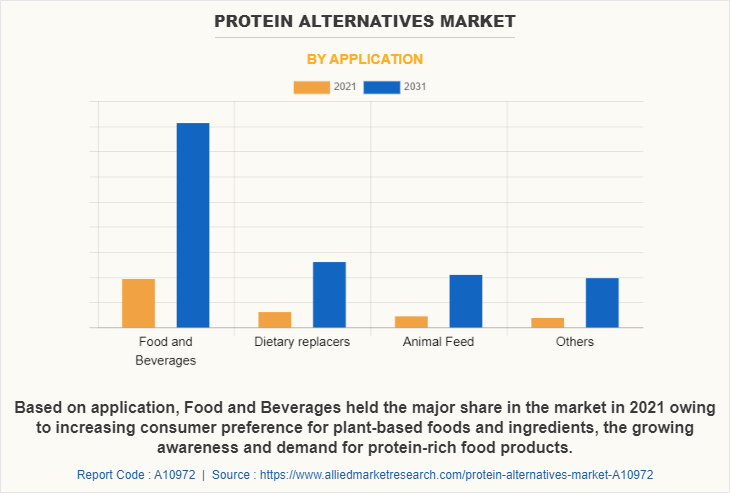

By Application

On the basis of application, the market is segmented into food & beverage, dietary replacers, animal feed, and others. The food & beverage segment accounted for a major share in the protein alternatives market in 2021, and is expected to grow at a significant CAGR during the forecast period. The protein alternatives products, such as insect, plant-based and others, are widely consumed in the food & beverages industry. The large share of this segment is mainly attributed to increasing consumer preference for plant-based foods and ingredients, the growing awareness and demand for protein-rich food products, the versatile functionality and compatibility of plant-based protein with vegetarian and vegan lifestyles, and the rise of clean-label trends.

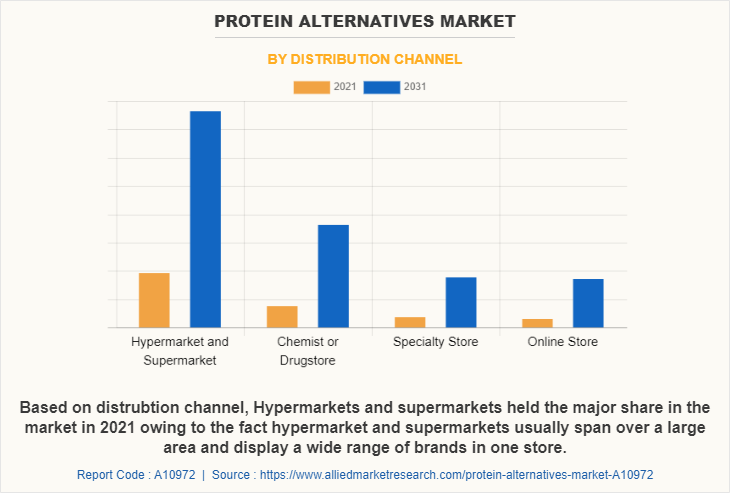

By Distribution Channel

On the basis of distribution channel, the market is segmented into hypermarket and supermarket, chemist or drugstore, specialty store, and online store. The hypermarkets and supermarkets segment accounted for a major share of the market in 2021 and it is expected to grow at a significant CAGR during the forecast period. This is attributed to the fact hypermarket and supermarkets usually span over a large area and display a wide range of brands in one store. In addition, they are especially located near dietary supplements areas for convenience and easy accessibility. Therefore, people majorly prefer to buy white goods from Hypermarket and Supermarkets. A surge in urbanization and population density in metro cities are expected to boost the demand for Hypermarket and Supermarkets.

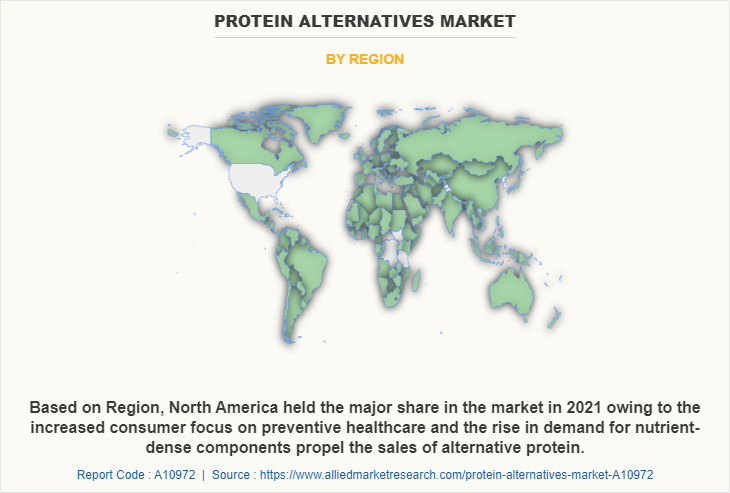

By Region

On the basis of region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA. The North America protein alternatives market is projected to witness the fastest growth during the forecast period. Consumers in North America are worried about the additives used in food products. When choosing protein alternatives, environmental and health considerations are crucial. In addition, the increased consumer focus on preventive healthcare and the rise in demand for nutrient-dense components propel the sales of alternative protein, particularly in the U.S. and Canada.

Competitive Landscape

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the market include Armstrong Cricket Farm Georgia, Aspire Food Group, Axiom Foods Inc, Burcon NutraScience Corporation, Enterra Feed Corporation, Entomo Farms, Glanbia PLC, Now Foods, Pond Technologies Holdings Inc, Protix B.V, Archer Daniels Midland Company. Bluebiotech International GmbH, Calysta, Inc., Cargill, Incorporated, Cellena Inc., JR Unique Foods Ltd., Kerry Group Plc, Plantible Foods, Inc., Roquette Frères, String Bio, MycoTechnology, Inc, Farbest Brands.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the protein alternatives market analysis from 2021 to 2031 to identify the prevailing protein alternatives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the protein alternatives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global protein alternatives market trends, key players, market segments, application areas, and market growth strategies.

Protein Alternatives Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 73.9 billion |

| Growth Rate | CAGR of 16.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 287 |

| By Source |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | MycoTechnology, Inc, Entomo Farms, Armstrong Cricket Georgia, Calysta, Inc., Protix B.V, Plantible Foods, Inc., Archer Daniels Midland Company, JR Unique Foods Ltd., Farbest Brands, Axiom Foods Inc, String Bio, Cellena Inc., Glanbia PLC, Bluebiotech International GmbH, Burcon Nutrascience Corporation, Kerry Group Plc, Aspire Food Group, Roquette Freres, Enterra Corporation, Cargill, Incorporated |

Analyst Review

According to the insights of the CXOs, the global protein alternatives market is expected to witness robust growth during the forecast period. This is attributed to animal nutrition increasing demand for protein alternative. Protein alternative is crucial to the livestock industry since it is fed to a variety of animals, including cattle, fish, poultry, swine, pets, and horses. Moreover, plant-based proteins supplying nutrition and taste has fueled the growth of the global protein alternatives market. Plant-based protein sources like soy protein are used commonly in burger patties, mince, and sausages due to their acceptable quality attributes in terms of texture & flavor. The demand for meat analogs is being driven by consumer attention to sustainability, rise in health concerns, and the desire for delicious meat substitutes. Furthermore, to attract consumers around the globe, key players in the market are investing in R&D activities and advertising & promotion of protein alternatives products.

CXOs further added about the increasing awareness among consumers regarding the harmful health effects of meat & meat products which further boosts the market growth. The demand for meat analogs is being driven by growing knowledge of the consumer about the negative health impacts of meat and meat products, which is anticipated to have a beneficial impact on the market for protein alternatives. However, stringent regulatory compliances along with the inability to digest protein are expected to hamper the growth of the protein alternatives market in the future.

The global protein alternatives market size was valued at $16.6 billion in 2021, and is projected to reach $73.9 billion by 2031

The global Protein Alternatives market is projected to grow at a compound annual growth rate of 16.2% from 2022 to 2031 $73.9 billion by 2031

Some of the key players in the market include Armstrong Cricket Farm Georgia, Aspire Food Group, Axiom Foods Inc, Burcon NutraScience Corporation, Enterra Feed Corporation, Entomo Farms, Glanbia PLC, Now Foods, Pond Technologies Holdings Inc, Protix B.V, Archer Daniels Midland Company. Bluebiotech International GmbH, Calysta, Inc., Cargill, Incorporated, Cellena Inc., JR Unique Foods Ltd., Kerry Group Plc, Plantible Foods, Inc., Roquette Frères, String Bio, MycoTechnology, Inc, Farbest Brands.

The North America protein alternatives market is projected to witness the fastest growth during the forecast period

The rise in the consumption of clean proteins as well as growing awareness of consumers and adoption of proteins from sustainably derived sources drive the growth of the global protein alternatives market

Loading Table Of Content...