Protein Engineering Market Research, 2032

The global protein engineering market size was valued at $2.2 billion in 2022, and is projected to reach $7.7 billion by 2032, growing at a CAGR of 13.2% from 2023 to 2032. The protein engineering market has experienced significant growth in recent years, driven by various factors that span the fields of biopharmaceuticals, industrial applications, and research. In addition, the rise in incidences of cancer significantly contributes to the growth of the protein engineering market size owing to the critical role of protein engineering in the development of new protein therapeutics for cancer. For instance, according to the National Center for Health Statistics, in 2023, 1,958,310 new cancer cases and 609,820 cancer deaths are projected to occur in the U.S.

Key Takeaways

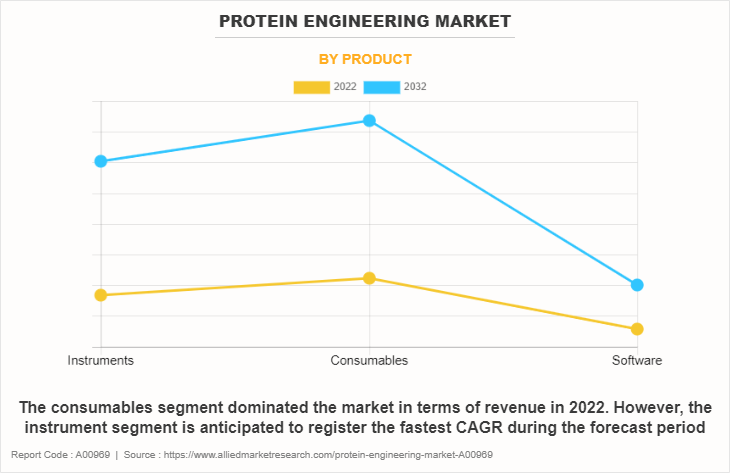

- By product type, the consumables segment dominated the market in terms of revenue in 2022. However, the instrument segment is anticipated to register the fastest CAGR during the forecast period.

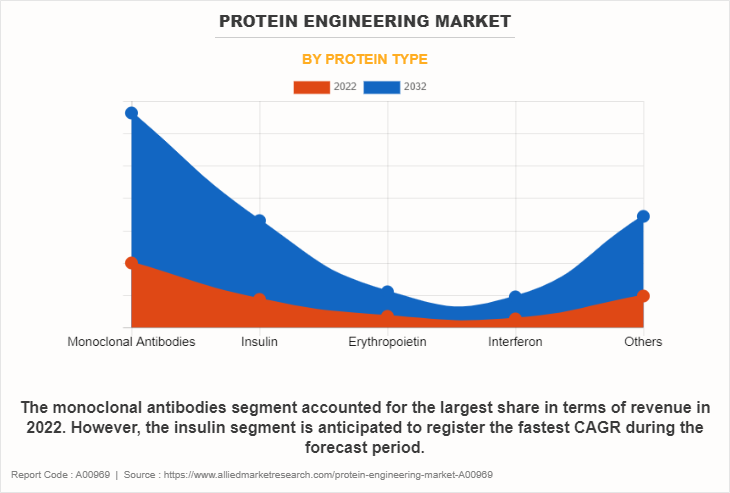

- By protein type, the monoclonal antibodies segment accounted for the largest share in terms of revenue in 2022. However, the insulin segment is anticipated to register the fastest CAGR during the forecast period.

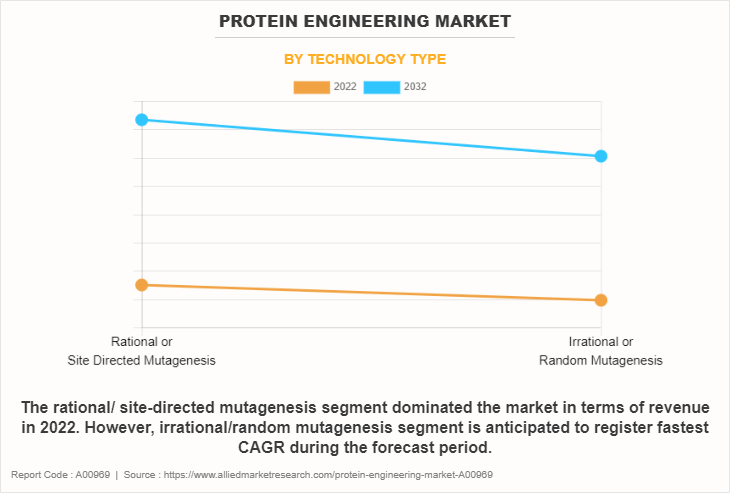

- By technology type, the rational/ site-directed mutagenesis segment dominated the market in terms of revenue in 2022. However, irrational/random mutagenesis segment is anticipated to register fastest CAGR during the forecast period.

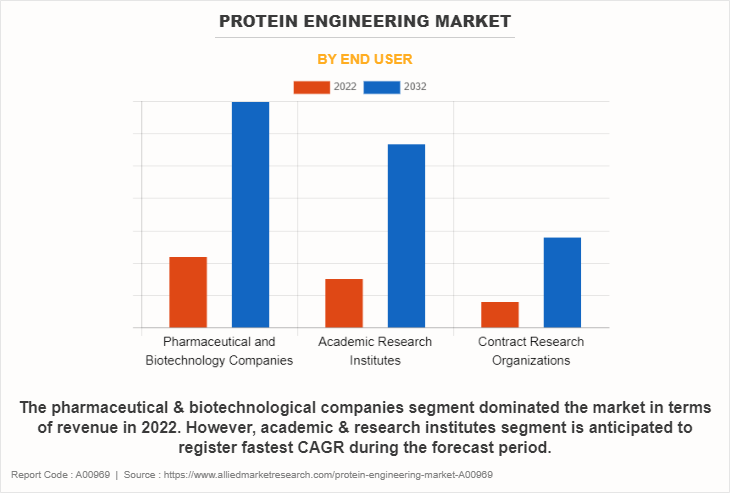

- By end user, the pharmaceutical & biotechnological companies segment dominated the market in terms of revenue in 2022. However, academic & research institutes segment is anticipated to register fastest CAGR during the forecast period.

- Region-wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period.

Market Dynamics

The major factors driving the protein engineering market growth are the growing demand for biopharmaceuticals, including monoclonal antibodies, vaccines, and therapeutic proteins. Protein engineering plays a crucial role in optimizing the properties of these biologics, improving their efficacy, safety, and specificity, which drive growth of the protein engineering market. In addition, rise in investments from both, public and private sectors in R&D activities related to protein engineering contributes to marketgrowth.

Furthermore, continuous advancements in protein engineering technologies, such as CRISPR-based approaches, directed evolution, and computational protein design, are driving the market growth. These technologies enable more precise and efficient manipulation of protein structures and functions.

Protein engineering accelerates drug development by providing tools to design and modify proteins for therapeutic purposes. In addition, rise in prevalence of chronic diseases, such as cancer, autoimmune disorders, and metabolic diseases, fuels the demand for innovative therapeutic solutions as engineered proteins offer targeted and personalized treatment options.

Moreover, the protein engineering market has expanded significantly in emerging markets, owing to the development of healthcare infrastructure and an increase in R&D activities. Rapid urbanization and economic growth in countries such as China and India have created substantial opportunities for protein engineering manufacturers to cater to the needs of these growing markets.

Segmental Overview

The protein engineering market is segmented into product type, protein type, technology type, end user and region. By product, the market is segregated into instruments, consumables, and software. By protein type, the market is classified into monoclonal antibodies, insulin, erythropoietin, interferon, and others. The others segment further includes interleukin, transforming growth factors, epidermal growth factors, tumor necrosis factor, stem cell factor, colony-stimulating factors, growth factors, and coagulation factors. By technology type, the market is segregated into rational/ site directed mutagenesis, and irrational/ targeted mutagenesis.

By end user, the market is divided into pharmaceutical & biotechnological companies, academic & research institutes, and contract research organizations. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (India, China, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product Type

The consumables segment accounted for largest protein engineering market share in terms of revenue in 2022, owing to heightened demand for consumables, alongside the wide array of available consumables. In addition, the continuous progress in biotechnology, including fields like genomics, proteomics, and synthetic biology, has led to increased research activity. More experiments and assays translate to a higher demand for consumables, which drives the growth of the segment.

However, the instruments segment is expected to register the fastest CAGR during the forecast period. This surge is attributed to continuous technological innovations in protein engineering systems. Moreover, the expansion of research activities across various scientific disciplines necessitates more sophisticated and specialized protein engineering instruments to meet varied experimental requirements, thereby propelling the growth of the segment.

By Technology Type

The rational/ site directed mutagenesis segment accounted for the largest protein engineering market share in terms of revenue in 2022, primarily owing to its wide application such as to enhance thermal stability or resistance to denaturation of a protein, to alter the substrate or ligand specificity of enzymes or binding proteins by targeted changes in key amino acid residues and enhancing or introducing specific functional properties, such as catalytic activity or substrate binding.

However, the irrational/random mutagenesis segment is expected to register fastest CAGR during the forecast period. This is attributed to various applications of random mutagenesis such as, it is used in directed evolution experiments to generate diverse libraries of protein variants, which can then be screened for improved or novel functions as well as it is also used to explore sequence-function space to identify variants with desired traits.

By Protein Type

The monoclonal antibody segment accounted for the largest protein engineering industry share in terms of revenue in 2022, owing to increase in demand for personalized medicine and the target therapy of monoclonal antibodies, which is anticipated to increase the popularity of this market. Furthermore, wide benefits of monoclonal antibodies such as less adverse effects compared to cancer surgery, chemotherapy and radiation therapy, consistency, homogeneity, and specificity are anticipated to increase the usage of monoclonal antibodies.

However, the insulin segment is expected to register fastest CAGR during the forecast period. This surge is fueled by increase in prevalence of type 1 and type 2 diabetes. Moreover, surge in adoption of sedentary lifestyle, physical inactivity, and rise in obesity along with other risk factors that lead to diabetes provide lucrative opportunities to insulin manufacturers using a protein engineering approach.

By End User

The pharmaceutical & biotechnological companies segment accounted for the largest share in 2022, owing to substantial investments in research, propelling the demand for cutting-edge protein engineering technologies. Moreover, protein engineering plays a crucial role in drug development for these entities, which also increases adoption of protein engineering instruments, consumables, and software by pharmaceutical and biotechnological companies, which drive the segment growth during the protein engineering market forecast.

However, the academic & research institutes segment is anticipated to register fastest CAGR during the forecast period as contract research organizations (CROs) play a significant role in providing R&D services to pharmaceutical, biotechnology, and academic institutions. In addition, protein engineering is a valuable component of the services offered by CROs, contributing to various stages of drug discovery, development, and biotechnological applications. Thus, such factors drive the growth of the segment.

By Region

The protein engineering market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the global protein engineering market in terms of revenue in 2022, owing to advanced healthcare infrastructure, substantial investments in R&D, presence of major key players offering advanced protein engineering products, and the presence of leading biotechnology and pharmaceutical companies. In addition, robust funding environment, coupled with supportive government initiatives, has propelled the adoption of innovative protein engineering techniques in pharmaceutical and biotechnological companies as well as in academic and research institutions.

However, Asia-Pacific is expected to register the fastest CAGR during the forecast period owing to rise in the prevalence of chronic diseases in the Asia-Pacific region, such as cancer, cardiovascular disorders, and diabetes, which necessitates advanced therapeutics. In addition, academic institutions, biotechnology companies, and research organizations conduct extensive studies in fields such as biomedicine, drug discovery, stem cell research, and genomics, driving the demand for protein engineering technologies in the region.

Moreover, the region's economic growth has led to increase in investments in healthcare infrastructure, research facilities, and life sciences. Rise in healthcare expenditure, coupled with government initiatives to improve healthcare facilities and research capabilities, has augmented the adoption of protein engineering technologies in the region and driven the market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the protein engineering industry, such as Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Takara Holdings, Inc., Promega Corporation, New England Biolabs, Jena Bioscience GmbH, Danaher Corporation, Creative Biolabs, Amgen, Inc., Bio-Rad laboratories, Inc., are provided in the report. Major players have adopted product launch, partnership, and acquisition as key developmental strategies to improve the product portfolio of the protein engineering market.

Recent Product Launch in the Protein Engineering Market

- In April 2022, Thermo Fisher Scientific launched the GMP-manufactured Gibco CTS TrueCut Cas9 Protein to help researchers meet stringent quality requirements when using genome editing tools.

Recent Acquisition in the Protein Engineering Market

- In January 2022, Thermo Fisher Scientific Inc. acquired PeproTech (a Leader in Recombinant Proteins) for a total cash purchase price of approximately $1.85 billion.

- In October 2023, Thermo Fisher Scientific agreed to acquire Olink Holding for approximately $3.1 billion, intended to expand the buyer’s presence in proteomics.

Recent Agreements in the Protein Engineering Market

- In June 2021, Thermo Fisher Scientific announced an agreement to combine essential protein separation techniques with mass spectrometry (MS) to advance therapeutic protein development through streamlined characterization.

Recent Collaboration in the Protein Engineering Market

- Amgen and Generate Biomedicines announced a research collaboration agreement to discover and create protein therapeutics for five clinical targets across several therapeutic areas and multiple modalities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the protein engineering market analysis from 2022 to 2032 to identify the prevailing protein engineering market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the protein engineering market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global protein engineering market trends, key players, market segments, application areas, and market growth strategies.

Protein Engineering Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.7 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 295 |

| By End User |

|

| By Product |

|

| By Technology Type |

|

| By Protein Type |

|

| By Region |

|

| Key Market Players | Bio-Rad Laboratories, Inc. , Amgen, Inc., Jena Bioscience GmbH, Promega Corporation, TAKARA HOLDINGS INC., Agilent Technologies, Inc., Thermo Fisher Scientific Inc. , Danaher Corporation, New England Biolabs, Inc., Creative Biolabs Limited |

Analyst Review

The protein engineering market is being propelled by several key drivers, facilitating its rapid expansion and adoption across diverse industries and research domains. Technological advancements play a pivotal role, with continuous innovations in protein engineering instruments, and software solutions enhancing the precision, resolution, and speed of protein engineering techniques.

In addition, factors such as rise in focus on drug discovery, personalized medicine, and developing antiviral peptides or other protein therapeutics, further fuels the protein engineering market growth. Moreover, increased government funding for life sciences research, expanding applications in novel therapeutics manufacturing, and growing prevalence of chronic diseases further contribute to the growth of the protein engineering market, fostering its continuous evolution and widespread adoption.

Region-wise, North America dominated the global protein engineering market in terms of revenue in 2022, owing to advanced healthcare infrastructure, substantial investments in R&D, presence of major key players offering advanced protein engineering products, and presence of leading biotechnology and pharmaceutical companies. In addition, robust funding environment, coupled with supportive government initiatives, has propelled the adoption of innovative protein engineering techniques in pharmaceutical and biotechnological companies as well as in academic and research institutions.

However, Asia-Pacific is expected to register the fastest CAGR during the forecast period owing to an increase in R&D activities, with a focus on life sciences and biotechnology. Growing investments in healthcare infrastructure, rise in awareness of advanced protein engineering technologies, and expanding biopharmaceutical sector are contributing to the heightened adoption of protein engineering products across Asia-Pacific region. Government initiatives supporting scientific research, coupled with collaborations between regional and international players, are fostering innovation in protein engineered products, positioning Asia-Pacific as a dynamic and high-potential market during the forecast period.

Protein engineering is the design of new enzymes or proteins with new or desirable functions. It is based on the use of recombinant DNA technology to change amino acid sequences. Protein engineering plays a crucial role in optimizing the properties of these biologics, improving their efficacy

increasing research & development activities in the biopharmaceutical industry, technological advancements in protein engineering and increase in developmental strategies in protein engineering by key players drive the growth of the global protein engineering market

Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Takara Holdings, Inc., Promega Corporation, New England Biolabs, Jena Bioscience GmbH, Danaher Corporation, Creative Biolabs, Amgen, Inc., and Bio-Rad laboratories, Inc. , held a high market position in 2022.

The consumables segment is the most influencing segment in protein engineering market owing to increase in adoption and availability of consumables for protein engineering process.

The forecast period for protein engineering market is 2023 to 2032.

The base year is 2022 in protein engineering market.

The total market value of protein engineering market is $2.2 billion in 2022.

The market value of protein engineering market in 2032 is $7.7 billion.

Loading Table Of Content...

Loading Research Methodology...