Protein Supplement Market Research, 2031

The global protein supplement market was valued at $23.9 billion in 2021, and is projected to reach $50.7 billion by 2031, growing at a CAGR of 7.8% from 2022 to 2031.

Protein is a critical component of hormones, vital organs, immunity system, and nervous system. It is usually found in meat & animal products such as beef, dairy, fish, & poultry and plant-based products including soy, beans, nuts, & whole grains. Modified high-quality protein sources include different types of protein supplements in the form of powder, shakes, and bars. Protein supplements build, repair and maintain muscles, skin, and hair in the body. They also help reduce weight, lower cholesterol, strengthen immunity, prevent cardiovascular diseases, and offer several other benefits. These are generally bought from online fitness stores owing to the availability of numerous options and convenience of consumers. The growth of the global protein supplement market is driven by an increase in health-related concerns, which has led to a shift of individuals toward fitness centers, gyms, and health clubs. Furthermore, rise in obesity rates and growth in disposable income are some other factors that drive the growth of the market. However, the presence of cheaper substitutes, side-effects of protein supplements, and negative publicity & claims are expected to hamper the protein supplement market growth during the forecast period. Growth in demand from the health-conscious young population and the introduction of protein supplements in untapped economies are anticipated to provide lucrative opportunities for the expansion of the protein supplement market size.

Market Dynamics

The rise in demand for sports nutrition supplements is expected to further propel the growth of the protein supplement market size since sports nutrition consists, the consumption of nutrients, such as proteins, vitamins, fats, supplements, carbohydrates, organic substances, and minerals. Sports nutritional products include sports foods, sports supplements, and sports beverages aimed at providing strength and endurance to athletes and bodybuilders to improve overall performance, stamina, muscle growth, and health. Nano-encapsulation and microencapsulation technologies have grown in popularity in recent years due to their controlled release and minimal ingredient utilization. Increased distribution channel for encapsulation technologies in food and beverage fortification are expected to open new markets for sports nutrition ingredients. Furthermore, the surge in popularity of naturally derived ingredients, owing to rise in health concerns about synthetic ingredients, is expected to fuel the demand for protein supplements in the sports nutrition industry.

However, the presence of cheaper substitutes coupled with the volatile price of raw materials for protein supplements is expected to hamper the growth of the protein supplement market revenue since price fluctuations in protein supplements are expected as a result of volatility in raw material prices, including soybean and milk, caused by demand and supply constraints. Milk is the primary raw material used to make whey and casein proteins. Milk, like crude oil, is refined into a variety of products that are traded globally, including milk powder, yogurt, cheese, casein concentrates/isolates, isolates, and whey concentrates. Political and economic factors are expected to cause milk prices to rise or fall. Furthermore, seasonal patterns influence milk supply; milk supply is higher in spring due to cow calving patterns. Consumers' consumption also follows a seasonal pattern; for example, the demand for fluid milk is highest in the fall when schools resume. Price volatility is heavily influenced by the political environment. Protein can be found in a variety of food, including eggs, fish, meats, and milk. Alternatives to protein powders include grass-fed collagen, hard-boiled eggs, grass-fed cheese, pemmican, Greek yogurt, cottage cheese, hemp seeds, and spirulina. These are widely available and less expensive than protein powders, which limits the growth of the protein supplement market demand.

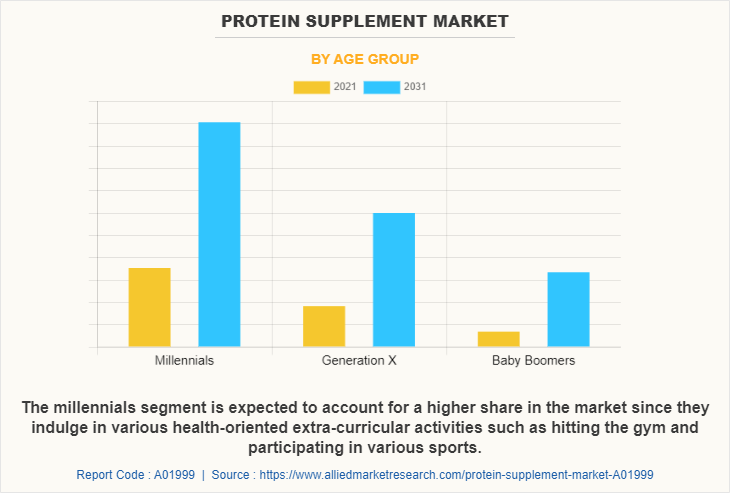

The surge in demand from the young and millennial population is expected to create an opportunity for the growth of the protein supplement industry since the young and millennial generation is becoming health-conscious and actively looking for ways to improve their overall well-being. Protein supplements have grown in popularity among this demographic because they are a quick and easy way to increase protein intake, support muscle growth, and aid in post-exercise recovery. As a result, the growth in demand from the young and millennial population is expected to boost the growth of the protein supplement market since it will increase sales and awareness among the global population. Thus, the market provides a great opportunity for manufacturers in the future.

Segmental Overview

The protein supplement market is segmented into type, form, source, gender, age group, distribution channel, and region. On the basis of type, the market is divided into casein, whey protein, egg protein, soy protein, and others. On the basis of form, it is classified into powder, RTD liquid, and protein bars. On the basis of source, the market is segmented into animal and plant sources. On the basis of gender, the market is bifurcated into male and female segments. On the basis of age group, the market is divided into millennials, generation X, and baby boomers. On the basis of distribution channel, it is categorized into supermarkets/hypermarkets, online stores, chemists/drugstores, nutrition stores, health food stores, specialist sports stores, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia-Pacific, and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

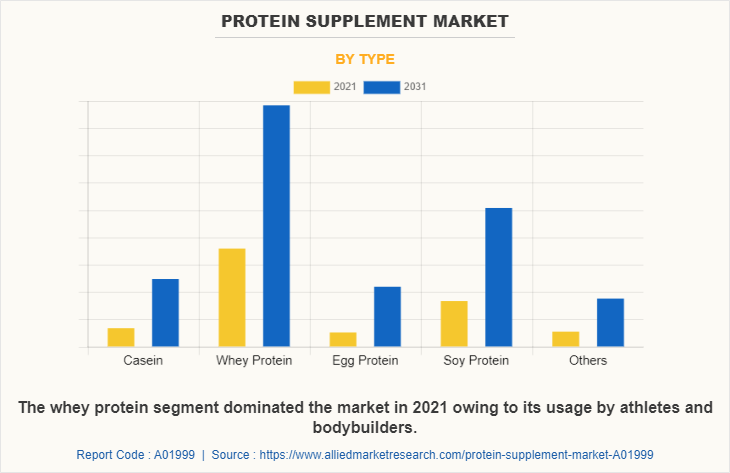

BY TYPE

On the basis of type, the whey protein segment constitutes a major protein supplement market share. Whey protein is traditionally used among athletes and bodybuilders since it promotes overall body growth and muscle building. The surge in demand for sports nutrition products and its value-added tag as clean-label ingredients are the two main factors that contribute to the overall growth of the market.

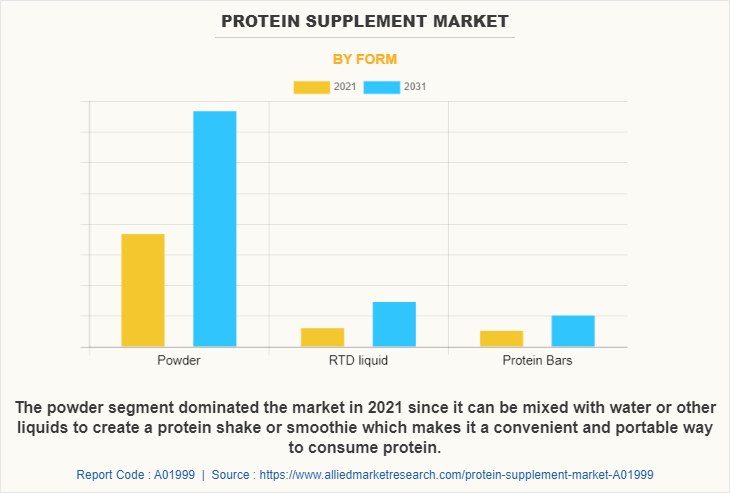

BY FORM

On the basis of form, the powder segment dominated the market in 2021 and is expected to retain its dominance during the protein supplement market forecast period. Some of the key protein supplement manufacturers have been strategizing on coming up with products that cater to customer needs and requirements with the rise in the number of health-conscious customers around the major parts of the globe. Customers look for convenience even while taking protein supplements.

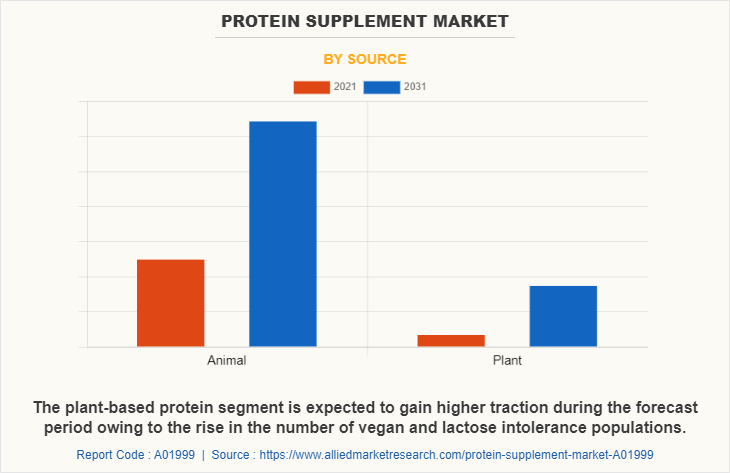

BY SOURCE

On the basis of source, the protein supplement market is classified into animal and plant-based proteins. The plant-based protein segment is expected to gain higher traction during the forecast period Owing to the rise in the number of vegan populations as lactose-free free population.

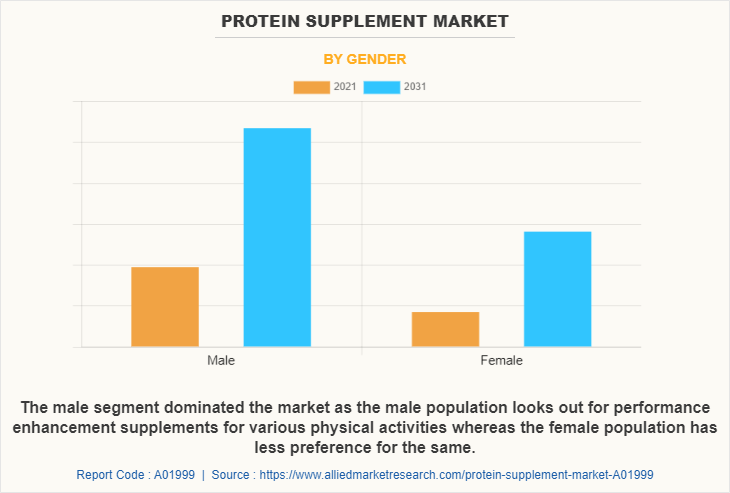

BY GENDER

On the basis of gender, the protein supplement market is bifurcated into male and female segments. The male segment is expected to gain higher traction as compared to the female segment as the male population looks out for performance enhancement supplements for various physical activities whereas the female population has less preference for the same.

BY AGE GROUP

On the basis of age group, the t market is divided into millennials, generation X, and baby boomers. The millennials segment is expected to account for a higher share in terms of consumption for the protein supplement market since they indulge in various health-oriented extra-curricular activities such as hitting the gym and participating in various sports. Similar to other demographic groups, Millennials are concerned about brain health, heart health, weight loss, weight maintenance, fighting fatigue, and maintaining high energy levels.

BY DISTRIBUTION CHANNEL

By Distribution Channel

The Online segment dominated the market since consumers now rely on the internet on gaining information and even consider Online shopping as the most convenient factor.

On the basis of distribution channel, the market is divided into hypermarket/supermarket, online, chemist/drugstore, nutrition store, health food store, specialist sports store, and others. Online distribution channels have greatly increased the reach of protein supplement manufacturers and distributors. With online platforms, businesses can sell their products to a global audience, reaching consumers who may not have had access to these products otherwise . Considering such behavior of the consumers, most of the key manufacturers have gone online where they have created their own web portals for selling products

BY REGION

On the basis of region, North America accounts for a higher protein supplement market share of the market owing to the rise in number of health-conscious customers in most of the developed regions. This is attributable to the rise in the number of U.S. consumers adopting a healthy lifestyle or indulging in activities that promote active and good health.

Competition Analysis

The key leading players operating in the Protein Supplement Industry include Abbott, Amway India Enterprises Pvt. Ltd., Glanbia plc., GNC Holdings, LLC, Vitaco, Hormel Foods Corporation, Iovate Health Science International, The Hut.com, Otsuka Pharmaceutical, and MuscleBlaze. The players have adopted various strategies like product launch, acquisition, and agreement to increase their market share.

Some examples of product launch in the market are

- In February 2022, Otsuka Pharmaceutical Co., Ltd., part of Otsuka Holdings Co., Ltd., launched the new SOYJOY Plant-Based series which includes whole-soy nutritional bars in chocolate and banana flavors.

- In November 2022, Glanbia Nutritionals, part of Glanbia PLC launched a new whey protein concentrate FerriUp for women. This launch will expand its product offering in the women's protein product line.

- In September 2022, Abbott Laboratories launched a new Ensure with HMB supplement mainly marketed toward adults to improve muscles and immune health. This launch expanded its current product portfolio and consumer offering.

Some examples of acquisition in the market are

- In November 2021, Glanbia Nutritionals part of Glanbia PLC acquired PacMoore Processing Technologies along with its research & development facility. This acquisition will add new production technologies such as extrusion, spray-drying, and blending.

- In April 2021, THG plc acquired Brighter Foods Limited which is a nutritional product manufacturing company, from Real Good Food plc. This acquisition will expand THG's knowledge and expertise in the production and development of healthy snacks and bars.

Some examples of agreement in the market are

- In June 2021, GNC Holdings, LLC entered into an agreement with Walmart, which is a retail company. Through this agreement GNC will sells its products through Walmart's retail stores and will incorporate its national foodprint, to further its product reach and consumer base.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the protein supplement market analysis from 2021 to 2031 to identify the prevailing protein supplement market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the protein supplement market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global protein supplement market trends, key players, market segments, application areas, and market growth strategies.

Protein Supplement Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 50.7 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 315 |

| By Type |

|

| By Form |

|

| By SOURCE |

|

| By GENDER |

|

| By AGE GROUP |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | Otsuka Holdings Co., Ltd., GNC Holdings, LLC, Abbott Laboratories, Bright LifeCare Pvt. Ltd., Glanbia PLC, Vitaco Health Australia Pty Limited, THG plc, Iovate Health Sciences International Inc., Amway Corp., Hormel Foods Corporation |

Analyst Review

According to CXOs of leading companies, the protein supplements market is expected to grow, as more and more people become conscious of their health. There's a growing interest in protein supplements among young people. Demand for protein supplements is anticipated to increase over the forecast period in order to build health through a balanced diet. Protein supplements are necessary for the benefit of younger athletes, as they provide a number of advantages such as increased muscle mass, improved strength, lowered cholesterol levels, battle against cancer, enhanced immunity, and reduced blood pressure. The aforementioned factors are expected to fuel market growth.

Furthermore, it is expected that growth will be sustained over the next seven years due to a rise in consumption of dried fruit snacks on account of changing lifestyles. In addition, it is expected that the market will be driven by increasing demand for protein bars, RTDs, and powders from bodybuilders, elite athletes as well as casual exercisers. The growth of the protein supplement market is anticipated to be further supported by a significant number of brands including Optimum Nutrition, Inc., Quest Nutrition, BioEngineered Supplements & Nutrition, Inc., and MuscleTech Substrate Technology, Inc.

The global protein supplement market size was valued at USD 23.9 billion in 2021, and is projected to reach USD 50.7 billion by 2031

The global protein supplement market is projected to grow at a compound annual growth rate of 7.8% from 2022-2031 to reach USD 50.7 billion by 2031

The key players profiled in the reports includes Abbott, Amway India Enterprises Pvt. Ltd., Glanbia plc., GNC Holdings, LLC, Vitaco, Hormel Foods Corporation, Iovate Health Science International, The Hut.com, Otsuka Pharmaceutical, and MuscleBlaze.

North America dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Rising Demand for Sports Nutrition, Advancements in Technology, Demand for Naturally Derived Ingredients and Popularity Among Millennials majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...