Public Cloud In BFSI Market Research, 2031

The global public cloud in bfsi market was valued at $49 billion in 2021, and is projected to reach $189.4 billion by 2031, growing at a CAGR of 14.6% from 2022 to 2031.

Public cloud service providers offer cloud-based services such as infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), or software-as-a-service (SaaS) to users for either a monthly or pay-per-use fee, eliminating the need for users to host these services on-site in their own data center. The data centers used by cloud service providers are divided into virtual computers and shared by tenants. Tenants have the option of paying for extra cloud-based services like software applications, application development tools, or storage in addition to simply renting the use of those virtual machines.

Growth in digital transformational strategies across the BFSI sector and rise in penetration of internet & mobile devices across the world boost growth of the global public cloud in BFSI market size. In addition, rise in demand for AI and machine learning propels popularity and positively impacts the growth of the market. However, regulatory complexities associated with data residency hampers the public cloud in BFSI market growth. On the contrary, an increase in the adoption of the Internet of Things (IoT) is expected to offer remunerative opportunities for the expansion of the public cloud in the BFSI market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the global public cloud in BFSI industry. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global public cloud in BFSI market share.

The public cloud in bfsi market is segmented into Type, Component, Enterprise Size and End User.

Segment Review

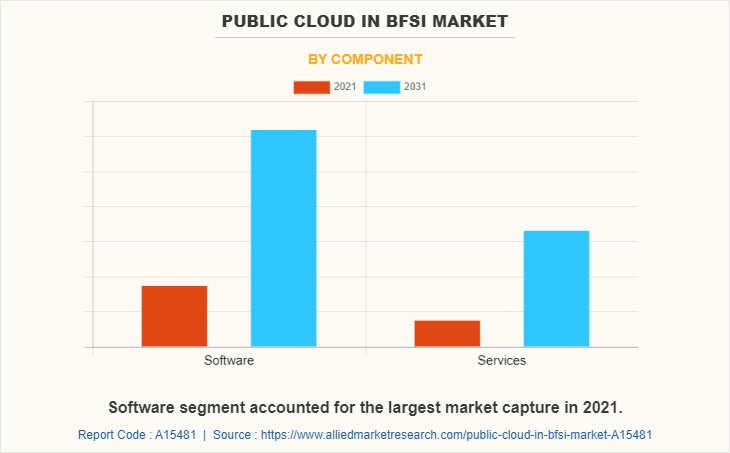

The public cloud in BFSI industry is segmented on the basis of component, type, enterprise size, end user and region. By component, the public cloud in BFSI market outlook is bifurcated into software and service. By type, the market is segmented into infrastructure as a service, platform as a service, software as a service, and others. By enterprise size, the market is bifurcated into large enterprises and SMEs. Based on end user the market is divided into banking, NBFCs and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of components, the software segment holds the largest share of the public cloud in BFSI market, as it offers a complete self-service software solution for clients or provides companies with building blocks to develop powerful self-service solutions by providing virtualization software which is boosting the demand of the segment. However, the services segment is expected to grow at the highest rate during the forecast period, as services are helping the banking and financial sectors to achieve potential growth in their businesses. These advancements and developments in facilities are expected to boost the growth of this segment.

Region-wise, the public cloud in the BFSI market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to changing landscape in the BFSI sector with changes in customer demand and rise in digitization across the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the growing banking cloud trends in the Asia-pacific region strategy of banks to attain and maintain a competitive advantage in digital financial services.

The key players profiled in the public cloud in BFSI market analysis are Adobe, Alibaba Group Holding Limited, Amazon Web Services, Inc., Google LLC., IBM, Microsoft Corporation, Oracle, Salesforce.com, Inc., SAP SE and Workday, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

COVID-19 Impact Analysis

The outbreak of COVID-19 pandemic and government-imposed restrictions such as travel restrictions impost on social contact insisted the businesses and individuals to remote working options. The financial pressures imposed by trends in domestic revenues and external flows to developing economies were already considered insufficient to support sustainable development goals, some organizations prioritized cost-cutting methods, while others went to the public cloud to swiftly grow infrastructure and meet unexpected surges in demand. In the aftermath of pandemic-related branch and corporate headquarters closures, several banks used cloud technology to keep internal operations operating smoothly. Further, Amazon Web Services (AWS) and other major public cloud providers have seized on this cloud trend, targeting financial institutions to enable remote work for thousands of users.

Another advantage of public cloud computing for BFSI sector is that it frequently assumed to be more cost-effective compared to traditional infrastructure. Self-service was a feature of several public cloud platforms that allowed consumers to provide storage and deploy apps without having to visit via physical location. Furthermore, the cloud is also a compelling option for storing data and accessing sophisticated apps. Furthermore, one of the big challenges of cloud adoption pre-Covid-19 was the amount of operational overhead and risk acceptance knowledge required to migrate workloads from on-premises to the cloud. Thus, the pandemic created a positive impact on global public cloud in BFSI industry.

Top Impacting Factors

Growth in Digital Transformational Strategies Across BFSI Sector

Cloud computing solutions in BFSI have aided in the transformation of digital banking, benefiting both front-end and back-end operational models. Since the outburst of pandemic, several enterprises across different financial domains are actively transforming their business operations through adopting public clouds. This will assist financial institutions in becoming more future-proof while laying the foundation for increased customer value and revenue generation.

Furthermore, public cloud solutions enable open banking, broadening the range of options available to consumers across traditional and non-traditional financial services. Moreover, to meet their capacity and speed requirements, banks and financial institutions are increasingly turning to digital technologies to store data and support applied analytics. Therefore, the increase in digital transformation among industries is expected to drive the public cloud in BFSI market opportunity during the forecast period.

Rising Penetration of the Internet and Mobile Devices Across the World

The increased proliferation of internet has resulted in a surge in the demand for the online segment, which significantly impacts the growth of the market. Further, in the twenty-first century, smartphones and other devices have become indispensable part of many people's lives. As a consequence, the rise in consumption of smartphones and tablets, as well as improved accessibility to internet services via 4G, 5G, and other technologies, has accelerated the adoption of technology among banking customers.

Moreover, to streamline daily operations and gain access to data from anywhere, banking firms and financial institutions are turning to cloud software, as the software keeps businesses up to date on transactions automatically. Therefore, the rising penetration of the internet and mobile devices across the world is expected to drive the growth of the public cloud in BFSI market forecast period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global public cloud in BFSI market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global public cloud in BFSI market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Public Cloud in BFSI Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 189.4 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 283 |

| By Type |

|

| By Component |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Amazon Web Services, Google LLC, SAP SE, Oracle Corporation, Microsoft Corporation, ibm corporation, Workday, Inc., Salesforce, Inc. |

Analyst Review

Organizations in the banking, insurance, and financial services sector have been slower than others in moving to the cloud due to concerns over security, data residency, and privacy. For more traditional financial institutions, there is also the not insignificant considering that their core banking systems are running on decades-old on-premises architecture that is just not possible to shift to the public cloud.

Key providers of the public cloud in BFSI market such as Adobe, Alibaba Group Holding Limited, and Amazon Web Services, Inc. account for a significant share in the market. With the larger requirement from the corporate culture, various brands are adopting strategic collaboration and partnerships to automate and simplify data management. For instance, in July 2020, Adobe, IBM and Red Hat announced a strategic partnership to enable organizations to deliver great digital experiences in any environment with flexibility and speed across the public cloud, whether in on-premises data centers or across multiple public clouds.

Furthermore, in August 2022, in line with its strategy of leading the Digital Transformation scene in Jordan and MENA STS announced its partnership with Alibaba Cloud, the digital technology and intellectual backbone of Alibaba Group, to provide state-of-the-art cloud computing services to the local enterprises.

In addition, with increase in demand for getting instant insurance solutions to the problem with all resourceful insights companies such as Amazon web services, Inc. has performed strategic collaboration to help end users. For instance, in November 2021, AWS reinvent, Goldman Sachs announced the launch of Goldman Sachs Financial Cloud for data in collaboration with Amazon Web Services, Inc. (AWS), a new suite of cloud-based data and analytics solutions for financial institutions. Such strategic advancements will contribute to the market growth over the forecast period.

The public cloud in BFSI market is estimated to grow at a CAGR of 14.6% from 2022 to 2031.

The public cloud in BFSI market is projected to reach $189,415.5 million by 2031.

Growth in digital transformational strategies across the BFSI sector, rise in penetration of internet and mobile devices across the world, and increase in demand for AI and machine learning contribute toward the growth of the market.

The key players profiled in the report include Adobe, Alibaba Group Holding Limited, Amazon Web Services, Inc., Google LLC., IBM, Microsoft Corporation, Oracle, Salesforce.com, Inc., SAP SE, and Workday, Inc.

The key growth strategies of public cloud in BFSI market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...