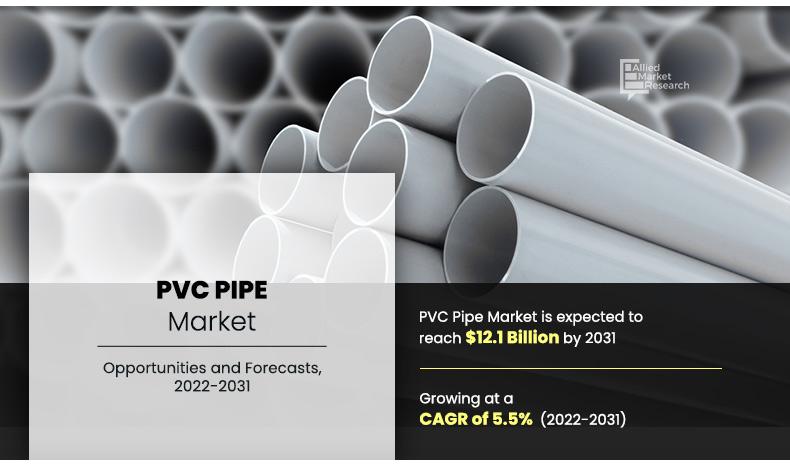

The PVC pipe market was valued at $6.3 billion in 2021, and is projected to reach $12.1 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

Polyvinyl chloride (PVC) pipe is white plastic pipe used in plumbing and drainage. PVC has become a popular alternative to metal piping. PVC is extensively used plastics across the globe, due to its strength, durability, ease of installation, and low cost. PVC is a thermoplastic polymer which is used to make pipes, fittings, valves, and other liquid handling equipment.

PVC-U stands for unplasticised PVC, which means the PVC compound has not been treated with a plasticizer. Rigid PVC is another name for unplasticized PVC. PVC-U is the most widely used PVC type for pipes and fittings in drinking water, soil & waste transportation, sewage & subsurface drainage, and industrial uses.

Chlorinated PVC is abbreviated as C-PVC. C-PVC and PVC-U pipe both are suitable to use with drinking water and have good impact and corrosion resistance but C-PVC pipes, on the other hand, are temperature-resistant compared to standard PVC-U due to greater chlorine concentration. As a result, C-PVC is a common material for water piping systems in both residential and commercial construction. PVC-U is substantially less ductile compared to C-PVC. C-PVC pipes and fittings are 100 % recyclable.

Increase in demand for pipes in the building & construction and irrigation industry drives the demand for PVC pipe during the forecast period. Surge in use of PVC pipes as a good alternative to metal and concrete pipes in the construction industry is expected to be a major driver for PVC pipe market growth in the future. The benefits of PVC pipes, such as ease of installation and durability are expected to boost demand for PVC pipes.

The availability of substitutes like cross-linked polyethylene (PEX), steel, ABS, and steel is hindering the growth of the PVC pipes market. Moreover, the toxicity of PVC pipes is hindering the market growth.

Growth in awareness toward clean water supply in rural areas and increase in investments in developing regions are expected to provide lucrative growth opportunities to the PVC pipes market. Molecularly Oriented Polyvinyl Chloride (PVC-O) pipes have improved as a result of technological innovation that uses molecular orientation in PVC pipes.

For the purpose of analysis, the PVC pipe market is segmented into type, material, application, and region. Depending on type, it is classified into chlorinated PVC, plasticized PVC, and unplasticised PVC. On the basis of material, the PVC pipes market is segmented into PVC resin, stabilizers, plasticizers, lubricant, pigment base, and others. Based on the application, it is fragmented into irrigation, water supply, sewerage, plumbing, oil & gas, HVAC, and others. Region wise, the PVC pipe market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The PVC pipe market share is analyzed across major regions and countries.

Key players profiled in this PVC pipe market include Advanced Drainage Systems, Inc., China Lesso Group Holdings Ltd., Egeplast a.s., Finolex Industries Ltd, IPEX Inc., JM Eagle Company, Inc., North American Pipe Corporation, Pipelife International GmbH, Plastika AS, Polypipe Plc, Royal Building Products, Sekisui Chemical Company Ltd., Tessenderlo Group, Tigre SA, and Formosa Plastics Group.

Other major players (not profiled in report) in the PVC pipe market are Mexichem, Radius Systems Ltd., National Pipes & Plastics, Georg Fischer Ltd., REHAU, Uponor, Astral Pipes, Yonggao Co., Ltd., Vinidex Pty Ltd, COEMAC, and Adequa Water Solutions, S.A.

PVC Pipe Market, by Material

The PVC resin segment held the significant share in the PVC pipe market in 2021 and is expected to grow at a CAGR of 5.3% during the forecast period. PVC resin is economical and versatile compared to other material used to manufacture PVC pipes.

By Material

Stabilizers is projected as the most lucrative segment and PVC Resins segment holds maximum share in 2021.

PVC Pipe Market, by Type

The unplasticized PVC segment held the significant share in the PVC pipe market in 2021 and is estimated to grow with a CAGR of 4.9% during the forecast period. Unplasticized PVC pipes is widely used in transportation of soil and waste, sewage & underground drainage and drinking water. Owing to which unplasticized pipes are in high demand.

By Type

Chlorinated PVC is projected as the most lucrative segment.

PVC Pipe Market, by Application

The sewer & drain segment held the significant share in the PVC pipe market in 2021 and is expected to grow at a CAGR of 5.9% during the forecast period. Increased government spending on efficient water management is driving the demand for PVC pipes in sewer & drain application. In addition, PVC pipe offers numerous advantages such as light weight than metal or concrete and it can be installed without heavy equipment etc.

By Application

Sewer & Drain holds a dominant position in 2021 and Plumbing is projected as the most lucrative application over the forecast period.

PVC Pipe Market, by Region

Asia-Pacific garnered the highest share i.e. 44.2% in the PVC pipe market in 2021, in terms of revenue and is anticipated to maintain its dominance during the forecast period. This is attributed to increase in construction activities in this region. There is surge in maintenance and repair activities in the construction industry, owing to increase in government maintenance activities and initiatives, which further contributes significantly in the growth of PVC pipe market.

By Region

Asia-Pacidic holds a dominant position in 2021 and is projected as the most lucrative region over the forecast period.

COVID-19 Impact on Market

- The COVID-19 outbreak impacted the PVC pipe market negatively. The market witnessed a sharp decline in demand for PVC pipe.

- The COVID-19 pandemic banned import and export, thereby disrupting the supply chain and hampering the PVC pipe market growth.

- Lockdown imposed by the government impacted the construction sector as many of the construction projects have been ceased or postponed.

- There was a huge supply and demand gap created due to the COVID-19 pandemic.

- Fluctuations in the prices of raw material during COVID-19 were the major hindrance for the market growth.

Key Benefits For Stakeholders

- The report includes in-depth analysis of different segments and provides market estimations between 2022 and 2031.

- The PVC pipe market size is provided in terms of million meters and $million.

- The demand for PVC pipes was considered while estimating the market size and not consumption of PVC in pipes application.

- A comprehensive analysis of the factors that drive and restrict the growth of the PVC pipe market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and forecasts are based on factors impacting the PVC pipe market growth, in terms of $million and kilotons.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current PVC pipe market trends and future estimations from 2022 to 2031, which helps to identify the prevailing market opportunities.

PVC Pipe Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Other players in the value chain include | Mexichem, Radius Systems Ltd., National Pipes & Plastics, Georg Fischer Ltd., REHAU, Uponor, Astral Pipes, Yonggao Co., Ltd., Vinidex Pty Ltd, COEMAC, Adequa Water Solutions, S.A. |

Analyst Review

According to the CXOs of leading companies, growth in investment toward R&D, increase in demand for PVC pipes in various applications, and excellent physical properties of these pipes drive its demand among various end users. PVC pipes are usually used in construction sector for building sewer & drain systems and water supply. However, factors such as carcinogenic property of PVC and toxicity to environment may hamper the market growth. Presently, the sewer & drain and water supply are the major applications for PVC pipes. As per the CXOs, the demand for PVC pipes is expected to witness significant growth in all the regions, owing to its physical properties and opportunities that they create for market players.

China emerged as the global leader in the PVC pipe market both in terms of volume and value. This is attributed to the numerous factors such as manufacturing facilities, R&D infrastructure, and key players in the region. However, the market in India is expected to grow at a rapid rate in the future.

Increased construction activities specially in developing region such as Asia-Pacific owing to increasing population is driving the demand for PVC pipes.

The PVC pipe market was valued at $6.3 billion in 2021, and is projected to reach $12.1 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

Tessenderlo Group, Tigre SA, and Formosa Plastics Group, Finolex Industries Ltd, IPEX Inc., JM Eagle Company are some of the most established player of global PVC pipes market.

Building and construction industry is projected to increase the demand for PVC pipes.

By Material o PVC Resin o Stabilizers o Plasticizers o Lubricant o Pigment Base o Other • By Type o Chlorinated PVC o Plasticized PVC o Unplasticized PVC • By Application o Irrigation o Water Supply o Sewer & Drain o Plumbing o Oil & Gas o Heating, Ventilation, and Air Conditioning (HVAC) o Others

Increased government spending on water and waste water treatment across the globe is the main driver of PVC pipe market.

Sewer & drain application is projected to increase the demand for PVC pipes

COVID-19 had negatively impacted PVC pipes market in 2020 but now all the construction activities are back to the normal, which is expected to boost the demand for PVC pipes.

Loading Table Of Content...