Pyrogen Testing Market Research, 2033

Market Introduction and Definition

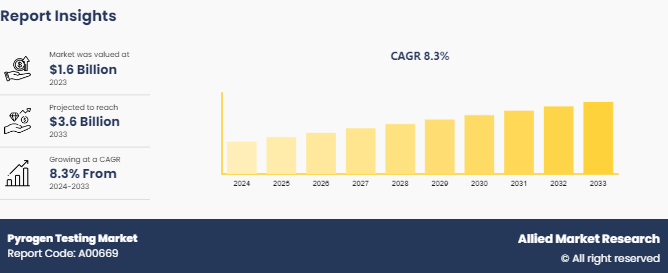

The global pyrogen testing market size was valued at $1.6 billion in 2023, and is projected to reach $3.6 billion by 2033, growing at a CAGR of 8.4% from 2025 to 2033. Pyrogen testing is a critical procedure in the healthcare industry used to ensure the safety and efficacy of medical products and pharmaceuticals. Pyrogens are fever-inducing substances that can be present in injectable medications, medical devices, and other products. They are often microbial toxins, such as endotoxins produced by gram-negative bacteria, which can cause severe reactions if introduced into the human body. Pyrogen testing is employed to detect and quantify contaminants. The major factors driving the growth of the pyrogen testing market are increase in pharmaceutical and biotechnology activities, stringent regulatory requirements for pharmaceutical and medical devices, and rise in awareness of the potential risks associated with pyrogens in medical products. In addition, rise in prevalence of chronic diseases and rise in drug development activities create a higher demand for pyrogen testing.

Key Takeaways

- The pyrogen testing market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Pyrogen Testing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives

Key Market Dynamics

According to the pyrogen testing market forecast analysis the key factors driving the growth of the market are regulatory requirements, growth in biopharmaceuticals industry, technological advancement, and surge in research and development. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) mandate stringent pyrogen testing protocols to ensure the safety and efficacy of biopharmaceutical products. These regulations require manufacturers to conduct pyrogen tests on injectable drugs and medical devices to detect bacterial endotoxins, which can cause severe adverse reactions in patients. According to the UK Government, the UK life sciences industry grew about 13% from 2021 to 2022. As the biopharmaceutical sector expands, driven by the increasing demand for novel therapies and biologics, the need for comprehensive pyrogen testing becomes more critical. The growth of this industry propels advancements in pyrogen testing technologies, as companies seek to meet regulatory standards and maintain product safety. Thus, growth in biopharmaceuticals and pharmaceutical industry is expected to contribute significantly in the pyrogen testing market growth.

In addition, according to the pyrogen testing market analysis, technological advancement and a surge in research and development (R&D) are pivotal drivers in the pyrogen testing market. As technology continues to evolve, the development of more sophisticated and precise testing methods enhances the ability to detect pyrogens with greater accuracy and speed. This includes advancements in techniques such as the Limulus Amebocyte Lysate (LAL) test and recombinant Factor C (rFC) assays, which offer improved sensitivity and reliability. The push for innovation in testing technologies is driven by rise in demand for stringent quality control in pharmaceutical and biotechnology industries. According to a 2023 article by International Federation of Pharmaceutical Manufacturers & Associations, biopharmaceutical R&D spending increased from $129 billion in 2012 to $196 billion in 2023. The investment in R&D by companies and research institutions fosters the creation of novel testing solutions. Thus, technological advancement and surge in R&D activities are expected to contribute to the growth of the pyrogen testing market size.

Pyrogen Test by Test Type

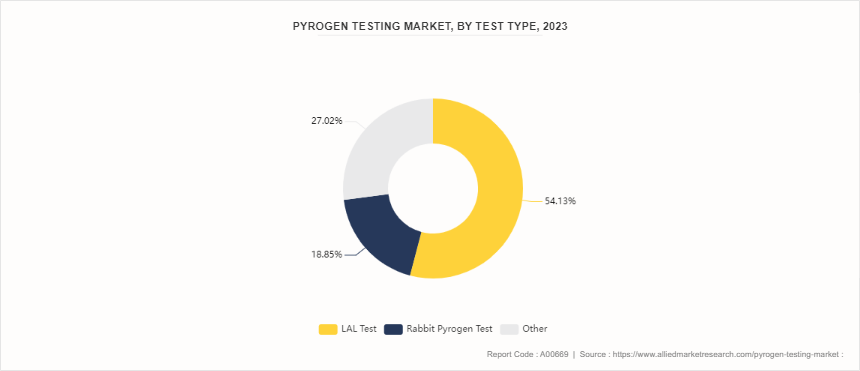

Pyrogen testing is a set of procedures and assays designed to detect the presence of pyrogens in pharmaceuticals, medical devices, and other healthcare products. Pyrogens are substances that induce fever when introduced into the human body, and they are often associated with the presence of bacterial endotoxins. In the pharmaceutical and healthcare industries, controlling and testing pyrogens is crucial as they cause adverse reactions in patients, such as fever and other immune responses. In 2023, the pyrogen testing market demonstrated a varied distribution among different test types. The Limulus Amebocyte Lysate (LAL) test emerged as the most dominant method, accounting for 54.13% of the market share. This test, known for its high sensitivity and specificity in detecting endotoxins, is widely preferred in the industry. The Rabbit Pyrogen Test followed with a substantial share of 18.85%. Despite its traditional use and effectiveness, this method is less favored as compared to LAL due to factors such as the ethical considerations and variability in results. In addition, the others segment held a significant 27.02% of the market.

Market Segmentation

The pyrogen testing industry is segmented on the basis of product & service, test type, end user, and region. By product & service, the market is classified into reagents & kits, instruments, and services. By test type, the market is divided into LAL tests, rabbit pyrogen test, and others. By end user, it is segregated into pharmaceutical & biotechnology companies, medical device companies, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the pyrogen testing market share in 2023 owing to substantial R&D activities, strong presence of major key players, well-established pharmaceutical industry, technological advancements, and stringent regulations and standards imposed by agencies such as the U.S. Food and Drug Administration and U.S. Pharmacopeia. According to pyrogen testing market opportunity analysis in the Asia-Pacific region, rapid market expansion is anticipated due to improving healthcare infrastructure, growing pharmaceutical and biopharmaceutical industry, and rise in drug manufacturing. Surge in drug manufacturing activities and contract manufacturing organizations (CMOs) in Asia-Pacific increases the demand for pyrogen testing to meet both local and international regulatory requirements.

- According to a 2024 article by Invest India, Government of India, India is among the Top 12 destinations for biotechnology globally and 3rd largest destination for biotechnology in Asia-Pacific. India’s BioEconomy has crossed an estimated $130 Bn in 2024 and has witnessed increase in valuation in the past eleven years.

- According to a 2023 fact sheet by Invest India, the hospital sector in India is expected to grow at CAGR of 18.24% from 2021 to 2027.

- According to a 2023 article by Government of UK, businesses in the UK life sciences industry generated $120.85 billion in turnover in 2021/22

Industry Trends

- According to a 2021 report by the National Library of Medicine, U.S. Pharmacopeia (USP) , Japanese Pharmacopeia (JP) , and European Pharmacopeia (Ph. Eur.) harmonized three types of Limulus Amebocyte Lysate tests (gel-clot, chromogenic, and turbidimetric techniques) for the purpose of evaluating endotoxin contamination in parenteral drugs, medical devices, and raw materials.

- According to a 2021 report by the U.S. National Science Foundation, an estimated 70 million endotoxin tests are performed each year in the U.S. alone.

- According to a 2021 article by the National Library of Medicine, amebocyte lysate test is the most sensitive and reliable method applied for in vitro detection of bacterial endotoxins.

- According to a 2023 article by National Library of Medicine, the standard pyrogenicity assessing methods required by the European Pharmacopoeia are the rabbit pyrogen test (RPT) , the bacterial endotoxin (BE) test (the LAL test) , the recombinant factor C test, and the monocyte activation test (MAT) .

Competitive Landscape

The major players operating in the pyrogen testing market include Merck KGaA, Lonza Group, Thermo Fisher Scientific Inc., FUJIFILM Holdings Corporation, GenScript, SEIKAGAKU CORPORATION, Charles River Laboratories, STERIS, WuXi AppTec, and Eurofins Scientific. Other players in the pyrogen testing market are Fuzhou Xinbei, and Wako Chemicals

Recent Key Strategies and Developments

- In August 2023, Lonza Group launched the Nebula Absorbance Reader, a new absorbance microplate reader, which joins the company’s portfolio of optimized instruments for streamlined endotoxin and pyrogen testing.

- In October 2023, Lonza Group launched two new rapid monocyte activation test (MAT) systems, the PyroCell MAT Rapid System and PyroCell MAT Human Serum (HS) Rapid System, to streamline and simplify rabbit-free pyrogen testing.

- In March 2022, Lonza Group launched the PyroCell Monocyte Activation Test - Human Serum System (PyroCell MAT HS System) , which uses human serum instead of fetal bovine serum. This new in vitro pyrogen testing system exhibits enhanced sensitivity for detection of non-endotoxin pyrogens as well as reduced interferences from complex drug products such as biologics-based pharmaceuticals.

- In December 2022, Charles River Laboratories International, Inc. launched the Endosafe Nexus 200, expanding its robust endotoxin testing portfolio.

- In December 2021, FUJIFILM Wako Pure Chemical Corporation launched the recombinant protein reagent PYROSTAR Neo for detection of bacterial endotoxin.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pyrogen testing market analysis from 2025 to 2033 to identify the prevailing pyrogen testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pyrogen testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pyrogen testing market trends, key players, market segments, application areas, and market growth strategies.

Pyrogen Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.6 Billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product And Service |

|

| By Test Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Lonza Group AG, Eurofins Scientific SE, Thermo Fisher Scientific Inc., Steris Corporation, Charles River Laboratories, FUJIFILM Corporation, Wuxi AppTec, Genscript Technology Corporation, SEIKAGAKU CORPORATION, Merck KGaA |

The global pyrogen testing market size was valued at $1.6 billion in 2023

The market value of pyrogen testing market is projected to reach $3.6 billion by 2033

The forecast period for pyrogen testing Market is 2024-2033.

The base year is 2023 in pyrogen testing market

Major key players that operate in the pyrogen testing Market are Merck KGaA, Lonza Group, Thermo Fisher Scientific Inc., and FUJIFILM Holdings Corporation.

Loading Table Of Content...

Loading Research Methodology...