Racing Tires Market Overview

The global racing tires market size was valued at USD 10.9 billion in 2022, and is projected to reach USD 18.7 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. Factors such as rise in popularity of motorsports events, increase in demand for sustainable racing tire manufacturing process, rise in demand for high-performance tires drive the growth of the racing tire industry. However, regulatory challenges related to safety and performance standards, and high cost of racing tires hinder the growth of the market. Furthermore, increased collaboration with drivers and teams for testing & promotion, and introduction of natural rubber- based racing tires offer remarkable growth opportunities for the players operating in the racing tire market.

Key Market Insights

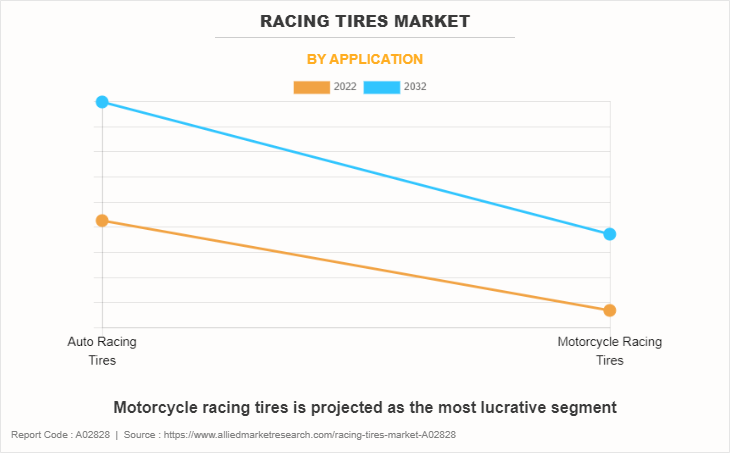

- Motorcycle racing tires expected to witness notable growth.

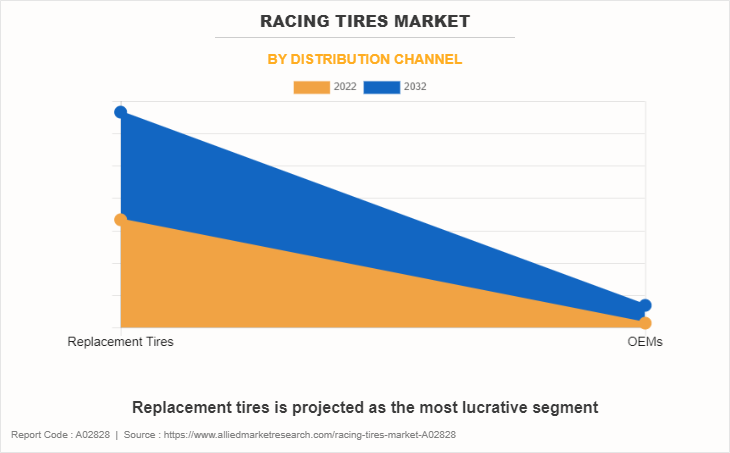

- Replacement tire segment projected for strong market expansion.

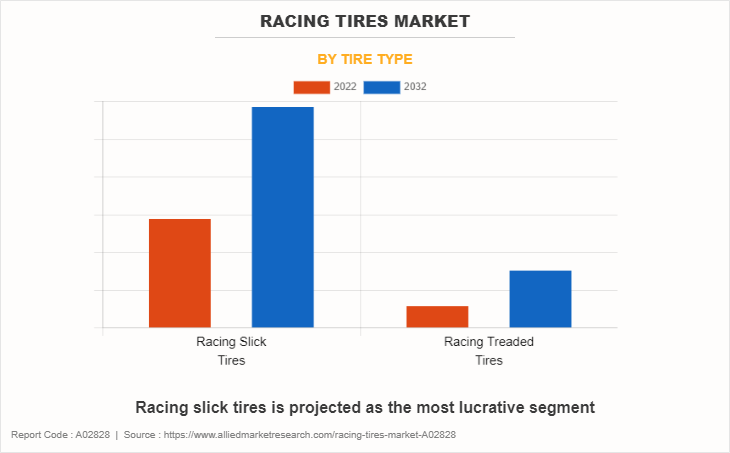

- Racing slick tires anticipated to dominate future demand.

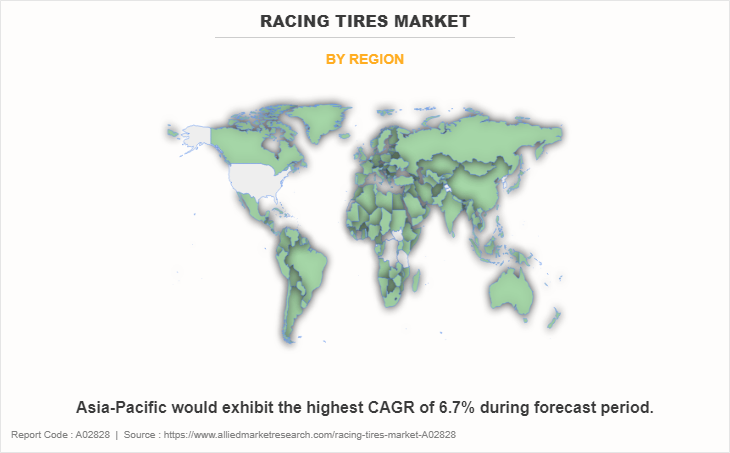

- Asia-Pacific forecasted to register the highest CAGR.

Market Size & Forecast

- 2033 Projected Market Size: USD 18.7 billion

- 2022 Market Size: USD 10.2 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 5.6%

Report Key Highlighters:

- The racing tires market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Introduction

Racing tires are specialized tires primarily used in auto racing and motorcycle racing. While all car tires are constructed with tire performance in mind, racing car tires differ in terms of durability, materials used, internal air pressure, and other features that set them apart from regular tires. Racing tires are meticulously designed to provide exceptional performance and undergo rigorous testing for quality, durability, speed, and other performance factors. While they are primarily made from natural and synthetic rubber, they also incorporate various textile reinforcements such as rayon, aramid, nylon, and polyester to optimize tire performance.

Market Segmentation

The racing tire market is segmented on the basis of application, distribution channel, tire type, and region. By application, it is bifurcated into auto racing tires and motorcycle racing tires. By distribution channel, it is fragmented into replacement tires and OEMs. By tire type, it is divided into racing slick tires and racing treaded tires. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Dynamics

Europe holds a prominent share in the racing tires market. The Europe hosts a diverse range of motorsport events, from Formula 1 to endurance racing at Le Mans. Each country's motorsport culture influences tire preferences. Europe is home to many luxury sports car manufacturers, and racing teams creating demand for high-performance racing tires that match the performance characteristics of these vehicles. European countries are increasingly focused on sustainability, prompting racing tire manufacturers to explore eco-friendly materials and manufacturing processes.

Rich motorsport heritage of Europe drives consistent demand for racing tires. Racing events such as the Monaco Grand Prix and the Nürburgring 24 Hours attract global attention. European automakers such as Ferrari, Porsche, and Mercedes-Benz often collaborate with tire suppliers for exclusive tire supply arrangements, enhancing brand image and performance.

In addition, racing tires makers expanded their presence in UK by introduction of new products in exhibition. For instance, in August 2023, Hankook and Company Co., Ltd., a premium tire manufacturer, showcased its new lineup of tires tailored for electric vehicles at the London EV Show. These tires, called iON race tires, were specifically designed to accommodate the high torque generated by powerful electric vehicles.

Motorcycle racing tires is one of the fastest growing segment in the market. Motorcycle racing encompasses a wide range of categories, including MotoGP, superbike racing, motocross, and enduro racing. This diversity contributes to a dynamic market with different tire requirements. Adventure and off-road motorcycle racing events, including rallies and enduro races, are gaining traction. These events create demand for specialized tires suitable for various terrains and conditions. The presence of prestigious motorcycle racing events globally, such as MotoGP races, fuels the demand for motorcycle racing tires.

Which are the Top Racing Tires companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the racing tires industry.

- Bridgestone Corporation

- Continental AG

- Hankook & Company Co., Ltd.

- Maxxis International–USA

- Michelin

- Nexen Tire

- Pirelli & C. S.p.A.

- The Goodyear Tire & Rubber Company

- The Yokohama Rubber Co., Ltd.

- Zhongce Rubber Group Co., Ltd.

What are the Recent Developments in the Racing Tires Market

In May 2023, Pirelli & C. S.p.A. developed & introduce F1 tires. Formula 1 is a new tougher tire constructed from the British Grand Prix to help cope with a rapid escalation in car performance.

In December 2022, THE YOKOHAMA RUBBER CO., LTD. developed ADVAN racing tires with a sustainable material content ratio of 33%. It completed the development of tires for use in dry conditions and continue developing tires for wet conditions with the aim of supplying them from 2023.

In January 2020, The Goodyear Tire & Rubber Company received contract by FIA World Touring Car Cup to supply race tires for car motorsports. Furthermore, it also secured race tire supply contracts with the FIA World Endurance Championship, European LeMans Series and British Touring Car Championship.

In October 2021, Pirelli & C. S.p.A. developed DIABLO tires with new sizes of DIABLO Superbike and DIABLO Rain in 10 inch. It also developed its first NHS competition range dedicated to small motorcycles with ten and twelve-inch wheels, including MiniGP, pitbike, minimotard and scooters.

What are the Top Impacting Factors

Key Market Driver

Rise in popularity of motorsports events

The growing interest and viewership of motorsports events such as Formula 1, NASCAR, and various other racing competitions have significantly boosted the demand for racing tires. These events attract a massive global audience, creating a lucrative platform for tire manufacturers to showcase their products. As more people engage with motorsports, the need for high-quality, performance-oriented racing tires continues to rise.

The rise in popularity of motorsports events drives the demand for racing tires. Racing tires manufactures need to develop and upgrade racing tires to maximize the sales of the company. For instance, in September 2023, Pirelli made significant changes to its Formula 1 testing schedule for the rest of 2023 as it rushes to prepare its final tires for the 2024 season. Prototype tires will be tested by Alpine and Red Bull at Monza after the Italian Grand Prix, and all teams will test them on the Japanese and Mexican Grands Prix. Pirelli focused on no-blanket tires, with the hope that these would be approved for use in the 2024 season.

In addition, in February 2023, Goodyear introduced an innovative NASCAR Cup tire for the event at Auto Club Speedway. This latest tire release incorporates fresh codes specifically designed for the final race on the 2-mile track. Notably, the left-side tire showcases modifications in its construction and mold shape, whereas the right-side tire has an upgraded construction. This trend also presents opportunities for branding and sponsorships, allowing companies to enhance their visibility and reputation in the market. Thus, the increasing popularity of motorsports events drives up the demand for racing tires, leading to higher sales and revenue for manufacturers.

Increase in demand for sustainable racing tire manufacturing process

Environmental concerns and sustainability have become crucial factors in the racing tire industry. There is a growing demand for racing tires manufactured using sustainable processes and materials. Consumers, racing teams, and event organizers are increasingly conscious of the environmental impact of racing, pushing tire manufacturers to adopt eco-friendly practices.

Moreover, major manufactures of racing tire shifted to sustainability by increasing usage of ecofriendly material for tracing tire manufacturing. For instance, in June 2023, Michelin, a major shareholder in Scandinavian Enviro Systems (Enviro), has created a racing tire for the Le Mans 24-hour race with a significant sustainability focus. This tire incorporates 63% sustainable materials, including recovered carbon black (rCB) sourced from Enviro's facility in Åsensbruk, Sweden. The tire was utilized on a vehicle participating in the race's 100th anniversary edition.

Racing tire manufacturers that invest in sustainable manufacturing processes and use eco-friendly materials gain a competitive edge. They can attract environmentally conscious customers, meet regulatory requirements, and participate in events that prioritize sustainability. For instance, in June 2021, Scandinavian Enviro Systems, a Swedish tire pyrolysis equipment manufacturer, and Michelin, a global tire manufacturer, jointly introduced a sustainable racing tire. This high-performance tire, designed for racing cars, is created using recovered carbon black from Scandinavian Enviro Systems. The tire was unveiled at Michelin's Movin'On global sustainable summit. These developments align with the broader global trend towards sustainability, which in turn supports growth of the racing tires market.

Restraints

Regulatory challenges related to safety and performance standards

Racing tires must adhere to strict safety and performance standards imposed by regulatory bodies and organizations governing motorsports. These standards ensure the safety of drivers and spectators and maintain fair competition. However, staying compliant with evolving regulations may be a significant challenge for racing tire manufacturers. Changes in safety and performance standards may necessitate costly adjustments to tire designs and materials.

Regulatory challenges may slow down the innovation and development process for racing tires. Manufacturers may need to invest in research and development to meet new standards, which can increase production costs. Furthermore, non-compliance with safety regulations can result in legal issues and damage a manufacturer's reputation. Therefore, navigating regulatory challenges is crucial for manufacturers to remain competitive and compliant in the market. Overcoming this restraint involves finding a balance between performance, cost-effectiveness, and compliance with regulations to ensure the sustained growth of the racing tires market.

Opportunity

Increased collaboration of OEMs with drivers and teams

Racing tire manufacturers can seize the opportunity to collaborate more closely with professional racing drivers and teams. This collaboration goes beyond providing tires; it involves actively engaging with drivers and teams for testing, feedback, and joint promotional efforts. By partnering with renowned drivers and successful racing teams, manufacturers can gain valuable insights into tire performance under rigorous race conditions.

Beyond testing, collaboration may extend to sponsorship and joint promotional activities. Manufacturers may collaborate with well-known event organizers, drivers and successful racing teams to promote their brand and products. This may include featuring the manufacturer's logo on race cars, driver uniforms, and other promotional materials. For instance, in December 2022, Hankook Tire secured main sponsorship for E-Prix events in Mexico, Rome, and London. In addition, Formula E unveiled its technical partner, Hankook Tire, as the title sponsor for five E-Prix races during Season 9 of the ABB FIA Formula E World Championship. Beginning in Season 9, as the technical partner of the ABB FIA Formula E World Championship, Hankook Tire will prominently feature their high-performance electric vehicle (EV) racing tires on the Gen3 race car. These tires are manufactured using materials composed of 26% sustainable rubber, and importantly, they will be fully recycled at the end of their life cycle. Such joint promotional efforts may create a win-win situation, which enhance product reputation and support the market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the racing tires market analysis from 2022 to 2032 to identify the prevailing racing tires market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the racing tires market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global racing tires market trends, key players, market segments, application areas, and market growth strategies.

Racing Tires Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.7 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Application |

|

| By Distribution Channel |

|

| By Tire Type |

|

| By Region |

|

| Key Market Players | Nexen Tire, Hankook and Company Co., Ltd., Pirelli & C. S.p.A., THE YOKOHAMA RUBBER CO., LTD., Michelin, Maxxis International USA, The Goodyear Tire & Rubber Company, Continental AG, Bridgestone Corporation, Zhongce Rubber Group Co., Ltd. |

The global racing tires market was valued at $10,908.2 million in 2022, and is projected to reach $18,695.4 million by 2032.

Increased collaboration with drivers and teams for testing & promotion, and introduction of natural rubber- based racing tires are the upcoming trends of Racing Tires Market

Auto racing tires is the leading application of racing tires market.

Europe is the largest regional market for Racing Tires

The leading companies profiled in the report include Bridgestone Corporation, Continental AG, Hankook & Company Co., Ltd., Maxxis International–USA, Michelin, Nexen tire, Pirelli & C. S.p.A., The Goodyear Tire & Rubber Company, THE YOKOHAMA RUBBER CO., LTD., and Zhongce Rubber Group Co., Ltd.

Loading Table Of Content...

Loading Research Methodology...