Rail Gangways Market Overview

The global rail gangways market size was valued at USD 560.8 million in 2022, and is projected to reach USD 961.1 million by 2032, growing at a CAGR of 5.6% from 2023 to 2032.

Report Key Highlighters

- The rail gangways market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The rail gangways market share is moderately fragmented among several players including The leading companies profiled in the report include Airflow Equipments (India) PVT. Limited., ATG AUTOTECHNIK GmbH, Chongqing Hengtairail Equipment Co., Ltd. (Hengtai Electromechanical Equipment Co., Ltd.), Dellner, HUBNER GMBH AND CO. KG, Hutchinson, Kasper-Elektronik GmbH, KTK Group, Narita Mfg., Ltd., and Victall.

Introduction

A rail gangway refers to a narrow passageway or platform that is utilized to connect sections of the railcars. A gangway system provides a comfortable pathway to allow passengers to walk between railcars and includes a flexible component that enables movement between the compartments. The gangways are designed to withstand significant stresses and meet the highest safety and comfort standards. The components of a rail gangway system include hinge or pitching articulation, corrugated or double-corrugated bellows, articulation floors, energy guiding systems, air ducts, integrated lighting, and others.

Factors such as increase in allocation of budget for development of railways, growth in demand for passenger capacity, and rise in demand for passenger comfort and experience drive the growth of the market. However, regulatory compliance and safety standards, and high initial investment hinder the growth of the market. Furthermore, the surge in the development & testing of autonomous trains, and technological advancements offer remarkable growth opportunities for the players operating in the rail gangways market.

Segment Overview

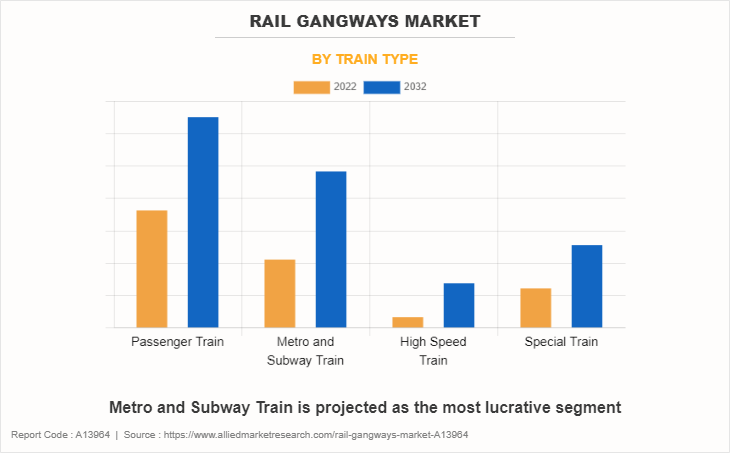

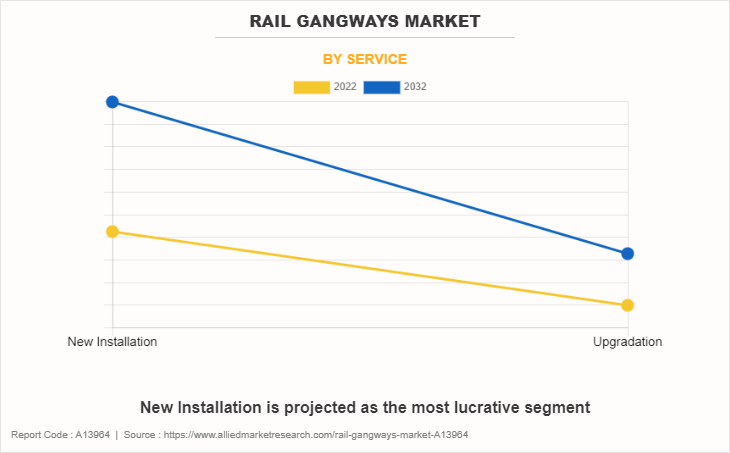

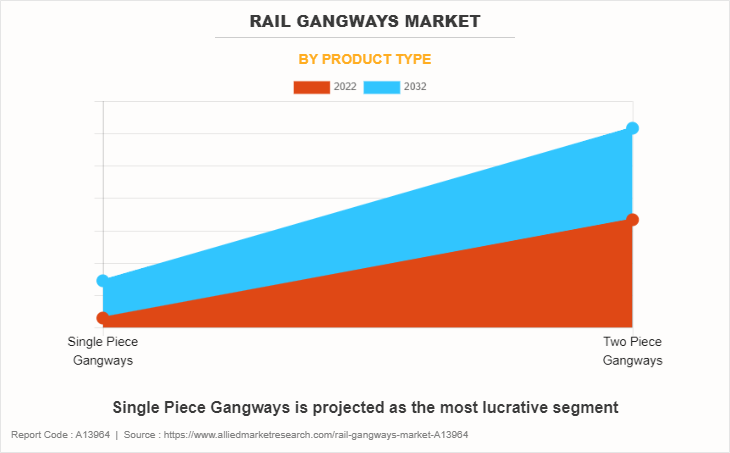

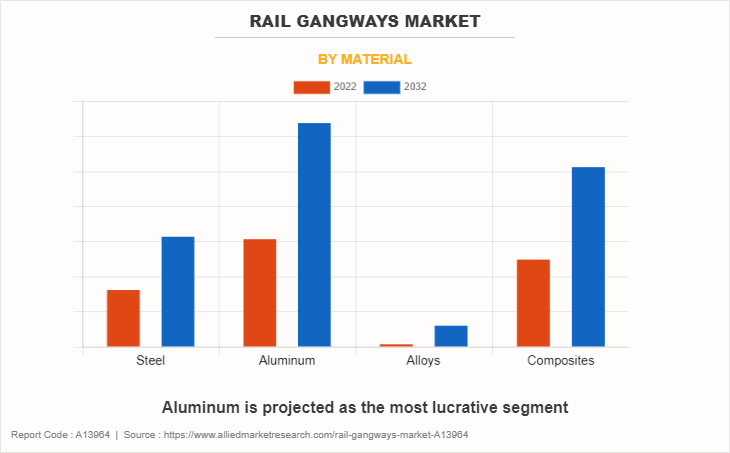

The rail gangways market is segmented on the basis of product type, material, train type, service, and region. By product type, it is bifurcated into single piece gangways, and two-piece gangways. By material, it is categorized into steel, aluminum, alloys, composites, and others. By train type, it is divided into passenger train, metro and subway train, high-speed train, and special train. By service, it is categorized into new installation, and upgradation/refurbishment. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific holds a prominent share in the rail gangways market. Asia-Pacific includes countries such as China, India, Japan, South Korea, and the rest of Asia-Pacific. Increasing investments in metro and rail systems, coupled with contracts for rail gangway modernization and local manufacturing units, are driving the market in Asia-Pacific. Countries such as China, India, Australia, and Japan are largely focused on developing metros and monorails for intra-city travel to reduce the travelling time and regulate the pollution in the region. Moreover, increase in trade in the region is attributed to increase in investments by governments for rail freight used for movement of goods.

Moreover, India is one of the biggest importers of gangways due to its large railway network across country. German gangway manufacturer, HUBNER established manufacturing unit in India to provide new gangways for numerous trains running across country. For instance, in May 2023, HUBNER, a German company, inaugurated a new eco-friendly facility in Bengaluru, which will serve as a crucial supplier for Vande Bharat trains. This facility has the capacity to produce 5,000 flexible connectors, known as gangways, that can be attached to railway coaches, metro rails, Vande Bharat trains, and more. By the end of 2023, it is anticipated that the factory will manufacture 540 gangways specifically for Vande Bharat trains. In addition, the company signed a contract with Alstom, a multinational rolling stock provider to provide 400 gangway systems for projects in RRTS, Pune, Kanpur, Agra, Bhopal, and Indore.

Key Developments

The leading companies are adopting strategies such as collaboration, agreement, partnership, and product launches to strengthen their position in rail gangways industry.

- In May 2023, HUBNER GmbH & Co. KG received a contract from Construcciones y Auxiliar de Ferrocarriles (CAF) to supply 172 gangway systems for the new generation of DLR trains in London. The Hübner gangway systems on the new Docklands Light Railway (DLR) trains offer passengers a higher level of comfort and convenience. Hübner developed new gangway systems with a length of 1.5 meters for CAF's new generation of trains that are longer than conventional gangways.

- In April 2023, HUBNER GmbH & Co. KG started a new facility in Bengaluru, India to manufacture gangway systems for the Vande Bharat trains with an investment of $11.97 million. It operates in India through its Indian subsidiary, HUBNER Interface Systems India Pvt Ltd. It is spread over 9,000 sq. ft. with an annual capacity of producing 5,000 gangway systems.

- In October 2022, HUBNER GmbH & Co. KG received a contract from Stadler, one of the rail vehicle manufacturers, to deliver up to 1,008 gangway systems for the VDV Tram-Train project. Also, it received a maintenance contract for 32 years for the project. HÜBNER plans to supply three different gangway variants for the six operators in the project consortium between 2023 and 2031.

- In August 2021, Dellner signed a contract with PESA Bydgoszcz S.A. to equip its new fleet of DMU REGIO160 platform with a complete range of Dellner´s Train Connection Systems. It includes couplers, gangways, articulation joints, adapters, and side-buffers.

Top Impacting Factors

Increase in allocation of budget for development of railways

The governments of various countries across the globe are increasing the budget allocated to the railway industry to expand and modernize the railway infrastructure. The developing countries such as India, China, and others are focused on the development of their railway infrastructure by allocating higher budget. For instance, in February 2023, the Finance Minister of India announced a budget allocation of $32.88 billion for the railway industry.

Moreover, the railway ministry also requested additional funds to support various initiatives, including the introduction of new Vande Bharat trains, expansion of railway infrastructure through the laying of new tracks, and the enhancement of security measures. In addition, various countries invest heavily in rail infrastructure projects to improve transportation and promote economic growth. For instance, in September 2021, China announced to invest $154 billion for the expansion of the railway network in the Yangtze River Delta region.

Furthermore, there is a rise in the adoption of trains with cutting edge technologies and innovations. Governments of different countries are also spending significantly on the development of new types of trains such as high-speed trains, maglev trains, and others. establishment of fresh railway routes, enhancing current rail tracks, and upgrading railway terminals. A rise in the railway budget is expected to encourage investments in the railway system, including infrastructure, safety, and passenger comfort. Such an increase in focus generates a demand for gangway systems in rail, which is expected to drive the growth of the rail gangways industry.

Growth in demand for passenger capacity

The global population continues to grow, and this directly impacts the demand for passenger capacity. As the population increases and urbanization continues, cities and countries require efficient transportation systems. The railway industry has witnessed significant growth in passenger ridership as compared to other public transit, owing to its fare frequency and overall commute time along with growing integration of high-end technologies to achieve advanced safety and comfort. Urbanization has increased significantly across the globe. As more people move to cities, the demand for public transportation, including buses and trains, increases.

Moreover, there is a rise in the passenger traffic in the railway industry owing to convenience and comfort. For instance, according to CEIC, Indian Railways experienced an increase in the number of passengers. The number of passengers increased by a significant 59.21% from October 2021 to September 2022. In addition, railway has witnessed a significant rise in ridership, and is expected to continue in the coming years. Thus, an increase in ridership is expected to create demand for rail gangways, which is expected to propel the growth of the rail gangways market.

Regulatory compliance and safety standard

A significant restraint in the rail gangways market is the stringent regulatory requirements and safety standards that must be met. Railways are subject to rigorous safety regulations to protect passengers and workers. Any new gangway designs or retrofitting existing trains with gangways must adhere to these standards, which can be costly and time-consuming. For manufacturers and operators looking to introduce new gangway systems or upgrade existing ones, this restraint can translate into a time-consuming and costly process.

Meeting safety regulations often involves rigorous testing, certification procedures, and the incorporation of specific safety features. These requirements can substantially prolong the development and implementation of new gangway solutions, delaying their entry into the market. Moreover, the need to comply with safety standards can also increase production costs. Manufacturers must invest in research and development to create gangways that meet these standards, and operators may need to allocate additional resources for staff training and safety equipment. Such factors can act as barriers to the rapid adoption of innovative gangway systems within the railway industry.

Technological advancements

Recent technological advancements, notably in artificial intelligence and advanced sensor technologies, have spurred the development of gangways tailored for high-speed trains and unique rail vehicles such as monorails. Manufacturers constantly introduce technological innovations, and advanced safety features and systems that can be seamlessly integrated into gangway designs. These include real-time obstacle detection, automated emergency braking, and surveillance systems. Such advancements increase passenger safety and align gangway systems with contemporary safety standards. Gangways can be seamlessly integrated with modern train control systems, enhancing operational efficiency and safety. This allows for real-time communication between gangways, train operators, and signaling systems, optimizing train coordination.

For instance, Dellner, a manufacturer of train connection systems provides gangway for railways designed with cutting-edge sound insulation materials and engineering methods, to minimize the noise levels and create a serene travel environment. Moreover, the gangway systems incorporate advanced bellows technology that enhances pressure stability, making them ideal for high-speed train applications, where pressure fluctuations may occur. Such advanced features and technological advancements in gangway systems to enhance passenger experience, and safety are expected to provide significant opportunities for the growth of the rail gangways market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rail gangways market analysis from 2022 to 2032 to identify the prevailing rail gangways market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the rail gangways market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global rail gangways market trends, key players, market segments, application areas, and market growth strategies.

Rail Gangways Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 961.1 million |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 265 |

| By Train Type |

|

| By Service |

|

| By Product Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | HBNER GmbH & Co. KG, KTK Group, HUTCHINSON, ATG AUTOTECHNIK GmbH, Narita Mfg., Ltd., Victall, Dellner, Kasper-Elektronik GmbH, Airflow Equipments (India) PVT. Limited., Chongqing Hengtairail Equipment Co., Ltd. |

The rail gangways market was valued at $560.8 million in 2022 and is estimated to surpass $961.1 million by 2032, exhibiting a CAGR of 5.6% from 2022 to 2032.

Factors such as increase in allocation of budget for development of railways, growth in demand for passenger capacity, and rise in demand for passenger comfort and experience drive the growth of the rail gangways market

Passenger Train is the leading application of Rail Gangways Market

In 2021, Europe is the largest regional market for Rail Gangways

The leading companies profiled in the report include Airflow Equipments (India) PVT. Limited., ATG AUTOTECHNIK GmbH, Chongqing Hengtairail Equipment Co., Ltd. (Hengtai Electromechanical Equipment Co., Ltd.), Dellner, HUBNER GMBH AND CO. KG, Hutchinson, Kasper-Elektronik GmbH, KTK Group, Narita Mfg., Ltd., and Victall.

Loading Table Of Content...

Loading Research Methodology...