Ready-to-drink (RTD) Coffee Beverage Market Research, 2032

The global ready-to-drink (RTD) coffee beverage market was valued at $33.0 billion in 2022, and is projected to reach $53.5 billion by 2032, growing at a CAGR of 5% from 2023 to 2032. The RTD coffee market is driven by factors such as convenience, busy lifestyles, and on-the-go consumption habits of consumers. Increase in health consciousness, demand for innovative flavors, and premiumization trends has further contributed to rapid market growth.

Ready-to-drink (RTD) coffee is a pre-packaged, convenient coffee beverage that is prepared and bottled in various packaging formats such as cans, bottles, and tetra packs, for consumption without the need for brewing or additional preparation. RTD coffee beverages are typically a blend of brewed coffee, milk or cream, sweeteners, and flavorings, providing consumers with a quick and hassle-free way to have a cup of coffee on the go. RTD coffee has gained popularity for its convenience, allowing individuals to satisfy their coffee cravings without the time and effort required for traditional brewing methods.

Key Takeaways of Ready-to-drink (RTD) Market Report

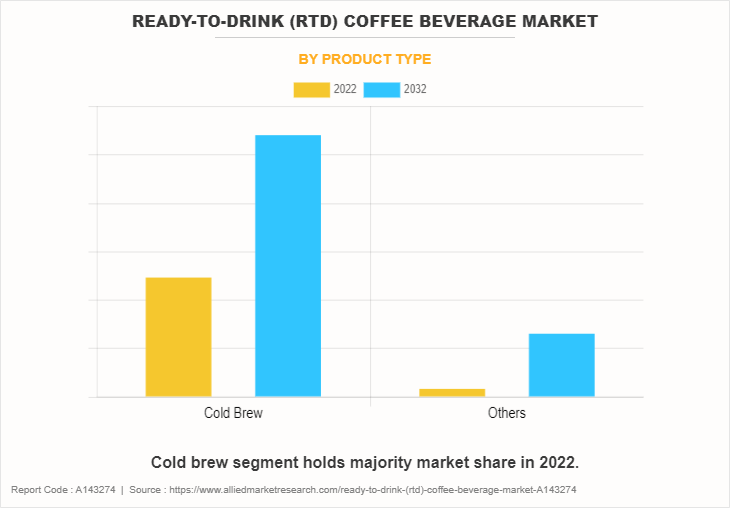

- By product type, the cold brew segment was the highest revenue contributor to the ready-to-drink (RTD) coffee beverage market in 2022 owing to the distinct flavor, smoother taste, and reduced acidity of it as compared to hot-brewed coffee.

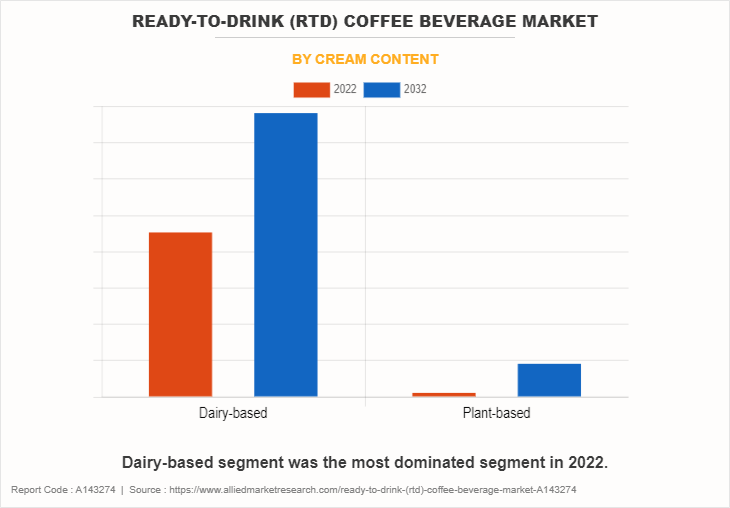

- By cream content, the dairy-based segment was the largest segment in the global ready-to-drink (RTD) coffee beverage market during the forecast period.

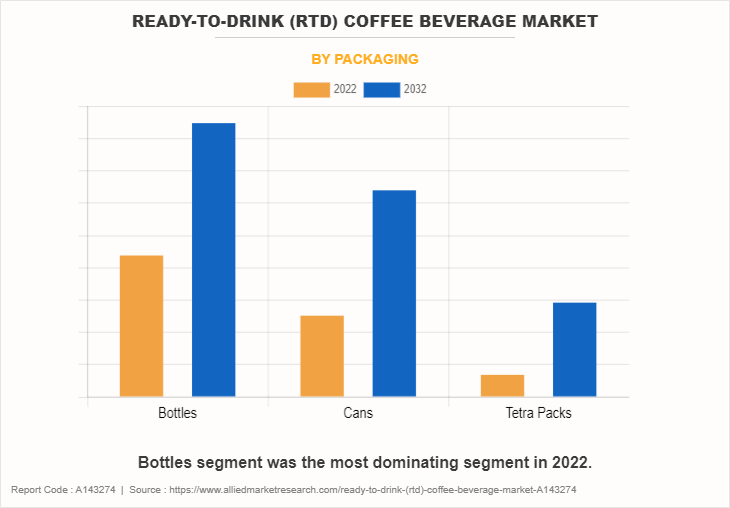

- By packaging, the bottle segment was the largest segment in 2022 owing to the convenient, spill-proof solution for consumers on the move, preserving freshness and flavor while aligning with fast-paced lifestyles.

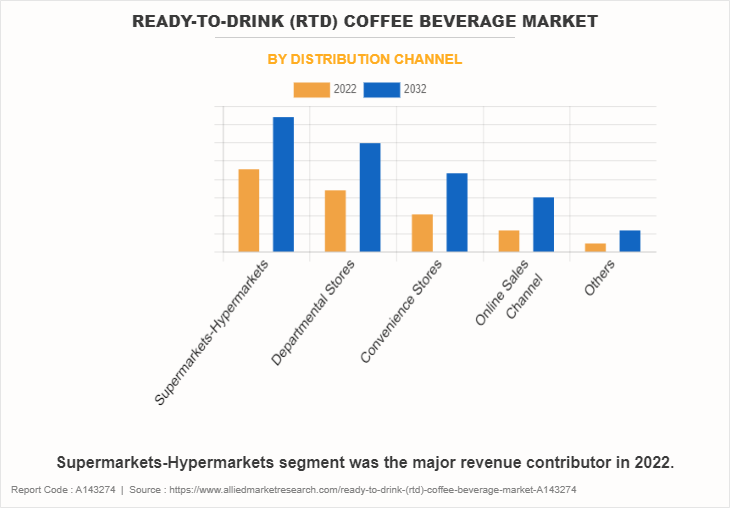

- By distribution channel, the supermarkets/hypermarkets segment was the largest segment in 2022.

- Region-wise, North America was the highest revenue contributor in 2022 due to the culture of takeout and coffee tradition in the region.

Market Dynamics

Convenience and portable nature of ready-to-drink (RTD) coffee

The convenience and portable nature of ready-to-drink (RTD) coffee has significantly fueled the surge in market demand in recent years. RTD coffee offers consumers a quick and hassle-free solution, which eliminates the need for brewing or waiting in coffee shops. The on-the-go lifestyle of modern consumers aligns perfectly with the grab-and-go concept of RTD coffee, providing a convenient energy boost for busy individuals. The portable packaging of RTD coffee, typically in cans or bottles, caters to the need for mobility and flexibility of consumers globally, which has helped increase the market share during the ready-to-drink (RTD) coffee beverage market forecast. The portable nature enables consumers to enjoy their favorite coffee beverages anywhere, whether commuting, working, or during recreational activities for various groups such as teenagers, travelers, working population, among others. The absence of preparation time and the ease of disposal contribute to the overall convenience, making RTD coffee a convenient choice for those seeking efficiency in their daily routines.

Moreover, the global increase in urbanization and a fast-paced lifestyle has further boosted the demand for RTD coffee, as it seamlessly integrates into the dynamics of metropolitan living. As a result, the rise of busy lifestyles with the convenience and portability of ready-to-drink coffee has helped to shape the consumption patterns among consumers, thus driving the ready-to-drink (RTD) coffee beverage market in recent years.

Fluctuation in raw material prices to restraint the market growth

Although the ready-to-drink coffee market share has increased, there are certain challenges owing to the fluctuation in raw material prices, which is expected to hamper the growth of Ready-to-drink (RTD) Coffee Beverage Industry. Ready-to-drink coffee is made from processed coffee beans, and any fluctuations in the prices of raw coffee beans directly affect the production cost of ready-to-drink coffee. Extreme weather changes such as drought, frosts, and pests significantly damage coffee crops, which reduces production and disrupts timely supply of coffee beans to the market. For instance, in November 2021, global coffee prices surged due to challenging conditions in Brazil, including drought, frost, and unusual weather patterns. This trend continued into 2022, with a 14.8% increase in coffee product prices observed in grocery stores.

Moreover, the return of El Nino weather condition has been officially confirmed by the US Climate Prediction Center, and forecasters anticipate it to be possibly even a strong weather event. This weather phenomenon is expected to bring about hotter and drier conditions, particularly in key Robusta coffee-growing regions such as Vietnam and Indonesia. The increased risk of adverse weather conditions poses a threat to crucial coffee supplies from these areas, thus contributing to supply shortages and fluctuations in prices of coffee beans used in ready-to-drink coffee production.

As per the data provided by the International Monetary Fund (IMF), the global price of coffee exhibited fluctuations throughout the year 2022, ranging from a high of 279.83 US cents per pound in February to a low of 210.38 US cents per pound in December. The manufacturers of ready-to-drink coffee often operate with tight profit margins. Rapid or unpredictable increases in raw material prices can erode these margins, affecting the overall profitability of the business operating in the ready-to-drink coffee market. The competitive landscape of the ready-to-drink coffee market further increases this challenge, with manufacturers hesitant to raise prices for fear of losing market share to competitors.

In addition, the global supply chain's exposure to factors such as weather conditions and geopolitical events, which are expected to disrupt Robusta bean supply, adds a risk factor to the ready-to-drink coffee market. These uncertainties may affect the quality of ready-to-drink coffee and hinder potential investments and expansion efforts in the industry, thereby impeding overall ready-to-drink (RTD) coffee beverage industry growth.

Innovative paper and cardboard packaging

Innovative paper and cardboard packaging are creating significant opportunities in the ready-to-drink (RTD) coffee market by addressing environmental concerns and appealing to eco-conscious consumers. As sustainability becomes a central focus in consumer preferences, brands adopting eco-friendly packaging solutions gain a competitive edge over other players operating in the market. Paper and cardboard, being renewable and biodegradable materials, reduce the ecological footprint of ready-to-drink coffee products, thus increasing the ready-to-drink (RTD) coffee beverage market demand among environmental conscious customers. Brands utilizing innovative paper packaging often emphasize their commitment to environmental responsibility, attracting environmentally conscious consumers who seek sustainable alternatives. Thus, the shift toward eco-friendly packaging aligns with global efforts to reduce plastic waste and promotes a positive brand image, that results in increased customer loyalty and expansion of ready-to-drink (RTD) coffee beverage market share.

Furthermore, advancements in packaging technology allow for features such as resealable lids and improved insulation, maintaining the freshness of the ready-to-drink coffee beverage and extending the shelf life of the product. The versatility of paper and cardboard enables eye-catching designs and branding, which contributes to product visibility on shelves of the store, which has helped boost the. Thus, the ready-to-drink coffee market is expected to experience rise in demand owing to the increase in adoption of innovative and sustainable packaging in coming years.

Segmental Overview

The ready-to-drink (RTD) coffee beverage market is segmented into Product Type, Cream Content, Packaging and Distribution Channel.

By Product Type

By product type, the cold brew coffee segment dominated the global ready-to-drink coffee market in 2022 and is anticipated to maintain its dominance during the forecast period. Cold brew RTD coffee holds dominance in the market owing to the unique flavor profile, smoother taste, and lower acidity of cold brew ready-to-drink coffee compared to traditional hot-brewed coffee. The cold brewing process involves steeping coffee grounds in cold water for an extended period, resulting in a less bitter and more concentrated beverage. This method aligns with consumer preferences for refreshing and less acidic options. The surge in health-conscious consumers seeking lower-calorie and less sugary alternatives also contributes to the popularity of cold brew RTD coffee, making it the preferred choice in the rapid ready-to-drink (RTD) coffee beverage market growth.

By Cream Content

By cream content, the dairy segment dominated the global ready-to-drink coffee market in 2022 and is anticipated to maintain its dominance during the forecast period. Dairy-based creams, such as milk or creamers, provide a familiar and comforting taste that resonates well with a broad consumer base. Moreover, dairy based ready-to-drink options cater to individuals seeking a traditional coffee experience, making them a preferred choice for a wide range of ready-to-drink coffee consumers who appreciate the indulgence and smoothness that dairy-based creams bring to their on-the-go coffee consumption.

By Packaging

By packaging, the bottle segment dominated the global ready-to-drink coffee market in 2022 and is anticipated to maintain its dominance during the forecast period. The sealed, portable nature of bottles ensures the preservation of freshness and flavor, while also providing a secure, spill-proof solution for consumers on the move. Bottled RTD coffee aligns with the fast-paced, on-the-go lifestyle, offering a hassle-free and efficient way to enjoy coffee without the need for additional accessories. In addition, the transparency of bottles allows consumers to visually assess the product, enhancing trust and appeal. All such factors contribute to the widespread popularity of bottled packaging in the RTD coffee market, which overall results in ready-to-drink (RTD) coffee beverage market size.

By Distribution Channel

By distribution channel, the supermarkets/hypermarkets segment dominated the global ready-to-drink coffee market in 2022. Consumers prefer purchasing ready-to-drink coffee from supermarkets and hypermarkets owing to the convenience, variety, and accessibility these retail environments offer in recent times. Supermarkets and hypermarkets typically provide a one-stop shopping experience, allowing consumers to easily find a diverse selection of RTD coffee brands, flavors, and formulations in one location. The extensive shelf space and strategic product placement in these stores enhance visibility, enabling consumers to explore different options. Furthermore, the ability to compare prices, read product labels, and take advantage of promotional offers contributes to the appeal of purchasing RTD coffee in supermarkets and hypermarkets, making it a convenient and efficient choice for consumers seeking quick and accessible coffee solutions.

By Region

Region wise, North America is anticipated to dominate the market with the largest share during the forecast period. The fast-paced lifestyles prevalent in North America align well with the convenience offered by RTD coffee, making ready-to-drink coffee a popular choice for on-the-go consumers. The culture of takeaway and a strong coffee-drinking tradition contribute to the acceptance of convenient coffee options.

In addition, a strong market presence of well-established RTD coffee brands, continuous product innovations, and aggressive marketing campaigns have created widespread awareness and acceptance of RTD coffee beverages. The diverse consumer base in the region also benefits from the wide array of flavors and formulations available, catering to various taste preferences of consumers. Moreover, the combination of lifestyle, cultural openness to convenience, and a dynamic RTD coffee market presence contribute to the higher preference for ready-to-drink coffee beverage products in North America.

Competitive Analysis

The key players include Nestle SA, The Coca-Cola Company, Starbucks Corporation, illycaffè S.p.A., Danone SA, Lotte Chilsung Beverage Co., Califia Farms, LLC, La Colombe Coffee Roasters, Suntory Beverage & Food Limited, and Gujarat Co-Operative Milk Marketing Federation.

Several well-known and up-and-coming brands are vying for market dominance in the expanding ready-to-drink coffee industry. Smaller, niche firms have become more well-known for catering to particular consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than‐¯well-known companies. An important competition component‐¯is innovation in formulations, ingredient sourcing, and sustainability policies. Brands that are able to change‐¯the tastes of their target market and align with their ethical and environmental values have an advantage over rivals.

Recent Developments in Ready-to-drink (RTD) Coffee Industry

- In September 2022, Sinopec's Easy Joy convenience stores in China collaborated with TH International Limited, the exclusive operator of Tim Hortons coffee shops in China, to introduce two co-branded ready-to-drink coffee products.

- In May 2022, Sleepy Owl expanded its product range and accessibility by introduction of ready-to-drink cold coffee cans. Sleepy Owl has launched three flavors namely, caramel, hazelnut, and classic to cater diverse consumer preferences.

- In March 2020, illy, a U.S.-based company, introduced its new product, illy cold brew RTD coffee to expand the product lineup.

- In February 2020, STok Cold Brew, a brand under Danone, launched its cold brew RTD Coffee, to increase the market share in the ready-to-drink beverage market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ready-to-drink (rtd) coffee beverage market analysis from 2022 to 2032 to identify the prevailing ready-to-drink (rtd) coffee beverage market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ready-to-drink (rtd) coffee beverage market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ready-to-drink (rtd) coffee beverage market trends, key players, market segments, application areas, and market growth strategies.

Ready-to-drink (RTD) Coffee Beverage Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 295 |

| By Product Type |

|

| By Cream Content |

|

| By Packaging |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Nestle SA, La Colombe Coffee Roasters, Gujarat Co-Operative Milk Marketing Federation, The Coca-Cola Company, Lotte Chilsung Beverage Co., Illycaffe S.p.A., Danone SA, Suntory Beverage & Food Limited, Califia Farms, LLC, Starbucks Corporation |

Analyst Review

The perspectives of the leading CXOs in the ready-to-drink coffee industry are presented in this section. The CXOs have highlighted the importance of innovation in flavors, packaging, and marketing strategies to differentiate products in a competitive market. Moreover, some have also emphasized the potential for expansion into new demographics and regions. In addition, the growing interest in organic and sustainable ready-to-drink coffee products is one of the significant trends for market growth. Brands are being driven to produce organic ready-to-drink coffee as consumers' awareness regarding the benefits of the organic ready-to-drink coffee market over conventional ones grows. Recyclable packaging and manufacturing of organic products have grown in popularity. Furthermore, convenient packaging formats such as recyclable tins, PET bottles, and tetra packs cater to busy lifestyles and changing consumer preferences, which helps drive the demand for ready-to-drink coffee market.

The ready-to-drink coffee industry has further seen a digital transition, with e-commerce being a key factor. Online platforms provide wider reach and access to a global consumer base, bypassing traditional distribution channels. Consumers can now acquire a variety of ready-to-drink coffee more easily due to online sales channels, and other e-commerce sites. Social media sites are developed into effective marketing tools that enable firms to interact directly with their target audience. Thus, all such factors are expected to boost the ready-to-drink coffee market growth.

The global ready-to-drink (RTD) coffee beverage market was valued at $33.0 billion in 2022, and is projected to reach $53.5 billion by 2032

The global Ready-to-drink (RTD) Coffee Beverage market is projected to grow at a compound annual growth rate of 5% from 2023 to 2032 $53.5 billion by 2032

Califia Farms, LLC, Gujarat Co-Operative Milk Marketing Federation, Starbucks Corporation, Illycaffe S.p.A., Suntory Beverage & Food Limited, The Coca-Cola Company, Lotte Chilsung Beverage Co., Danone SA, La Colombe Coffee Roasters, Nestle SA

Region wise, North America is anticipated to dominate the market with the largest share during the forecast period.

Convenience And Portable Nature Of Ready-To-Drink Coffee, Growth In Popularity Of Cold Brew Variants, Incorporation Of Health-Focused Ingredients In Ready-To-Drink Coffee

Loading Table Of Content...

Loading Research Methodology...