Ready-to-Eat Soup Market Research, 2034

Market Introduction and Definition

The global ready-to-eat soup market size was valued at $1.2 billion in 2023, and is projected to reach $2.7 billion by 2034, growing at a CAGR of 8% from 2024 to 2034. Ready-to-eat soup refers to a convenient, pre-prepared meal that requires no additional cooking, making it ready for consumption directly from the packaging. These soups are available in various forms such as canned, packaged, or frozen, and often include a variety of ingredients such as vegetables, meat, or grains, and are seasoned for taste. Manufacturers typically process them through pasteurization or sterilization to ensure safety and extended shelf life. Ready-to-eat soups cater to consumers seeking quick and hassle-free meal options, especially in busy urban environments. Ready-to-eat soups are popular for their ease of use, as they are available in multiple flavors, catering to different dietary preferences such as gluten-free, low-sodium, or organic options. The ready-to-eat soup market has grown significantly owing to an increase in demand for convenient, nutritious, and flavorful meal solutions.

Key Takeaways

The ready-to-eat soup market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major ready-to-eat soup industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in demand for convenience foods has significantly driven the growth of the ready-to-eat soup industry. As consumers lead busier lifestyles, especially in urban areas, they seek quick, nutritious meal options that require minimal preparation. Ready-to-eat soups cater perfectly to the demand by offering a hassle-free solution that fits into tight schedules. These soups, often available in various formats such as canned, packaged, or frozen, provide a convenient, ready-made meal that can be easily stored and consumed. The growing preference for time-saving meals, along with expanding retail channels such as supermarkets and online platforms, has surged the demand for ready-to-eat soups globally. Thus, manufacturers have responded by introducing a variety of flavors and innovative packaging to attract convenience-driven consumers, further boosting ready-to-eat soup market growth.

However, consumer concerns over preservatives in processed soups have become a significant restraint on the market demand for ready-to-eat soups. Many consumers perceive preservatives as harmful, associating them with potential health risks such as allergies, digestive issues, and long-term health complications. This negative perception has led to a growing preference for fresh, natural, and minimally processed foods, causing hesitation towards ready-to-eat soups that contain artificial preservatives to extend shelf life. As consumers become more health-conscious and demand clean-label products, they are expected to choose homemade or fresh alternatives over processed options. As a result, manufacturers in the ready-to-eat soup market face pressure to reformulate their products by reducing or eliminating preservatives, which can be challenging while maintaining shelf life and flavor, thereby restricting ready-to-eat soup market demand in the coming years.

Furthermore, the expansion into functional soup varieties has created new opportunities in the ready-to-eat soup market size by catering to health-conscious consumers seeking added nutritional benefits along with basic sustenance. Functional soups, loaded with ingredients such as superfoods, probiotics, and immune-boosting herbs such as turmeric and ginger, appeal to those looking for convenience combined with targeted health solutions. This trend aligns with the growing consumer focus on wellness, where soups promoting digestion, immunity, or energy become more attractive. Manufacturers are innovating by offering soups tailored to specific health needs, such as bone broth for joint support or plant-based options for vegan consumers. As consumers increasingly prioritize foods that contribute to overall well-being, the demand for functional soups is expanding, providing significant opportunities for growth and product differentiation in the competitive ready-to-eat soup market share.

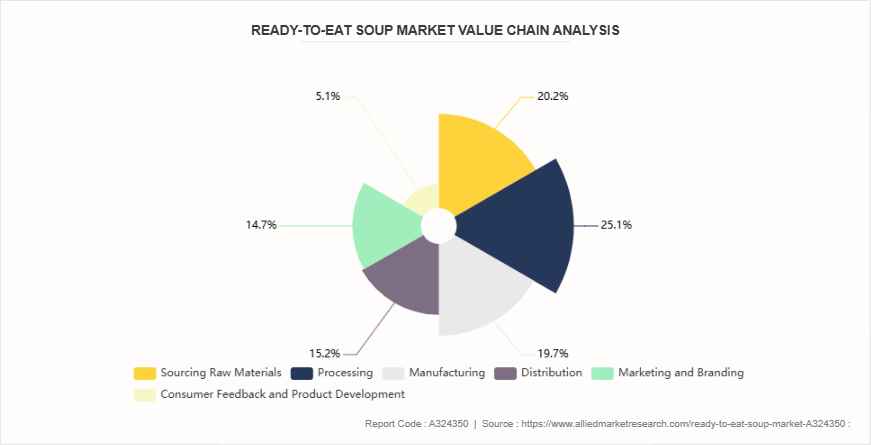

Value Chain of Global Ready-to-eat Soup Market

The value chain of the ready-to-eat soup market begins with sourcing raw materials, including vegetables, meat, grains, seasonings, and preservatives from suppliers. These ingredients are then processed using advanced techniques such as canning, dehydration, and freezing to ensure long shelf life and safety. Manufacturers play a crucial role in blending and packaging the soup into convenient formats such as cans, pouches, and cups. Distributors, including wholesalers and retailers, move the products to supermarkets, convenience stores, and e-commerce platforms. Marketing and branding teams work on positioning the products to attract health-conscious consumers or those seeking convenience. Finally, consumer feedback follows up into product development, driving improvements in flavors, packaging, and sustainability practices.

Market Segmentation

The global ready-to-eat soup market is segmented based on product type, form, packaging type, application, distribution channel, and region. Based on product type, the market is classified into tomato ready to eat soup, beans ready to eat soup, chicken ready to eat soup, beef ready to eat soup, mixed vegetables ready to eat soup, and others. Based on form, it is bifurcated into dry soup and wet soup. Based on packaging type, the market is categorized into bottles, cans, and packets. As per application the market is divided into HoReCa, residential, and others. Based on distribution channel, the market is fragmented into supermarkets/hypermarkets, convenience stores, online sales channel, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Increase in consumer demand for convenient meal options has led to a rise in the popularity of ready-to-eat soups in North America. The growing trend toward healthier eating has prompted manufacturers to introduce nutritious variants, including organic and low-sodium options in the region. In addition, the expansion of retail channels, including online grocery shopping, has improved accessibility to these products. Changing lifestyles, characterized by busier schedules, have made ready-to-eat soups a preferred choice for many consumers seeking quick, nutritious meals. Furthermore, the influence of culinary trends, such as gourmet and globally inspired flavors, has diversified product offerings, appealing to a wider audience.

Rapid urbanization and busy lifestyles drive demand for convenient meal solutions among the growing middle class in the Asia-Pacific region. Increase in health consciousness prompts consumers to seek nutritious, functional soup options, including those enriched with superfoods and organic ingredients. In addition, the diverse culinary traditions of Asia-Pacific encourage manufacturers to innovate with flavors that resonate locally, enhancing market appeal. Moreover, e-commerce expansion facilitates easier access to a variety of products, while rising disposable incomes enables consumers to explore premium and specialty soup offerings. Thus, all these factors position the Asia-Pacific market for significant growth in ready-to-eat soup market share in the coming years.

Industry Trends:

Manufacturers have responded to the rise in demand for plant-based diets by offering soups featuring vegetables, legumes, and plant-based proteins such as lentils or chickpeas. These soups target health-conscious consumers and those seeking sustainable alternatives to meat-based products. Innovative flavor combinations, such as roasted red pepper with quinoa or sweet potato with black beans, reflect the focus of manufacturers on creating nutrient-dense, flavorful options. Many brands also emphasize the absence of artificial preservatives and additives, appealing to consumers seeking clean-label products. The increase in popularity of vegan and vegetarian lifestyles, driven by environmental and ethical concerns, has made plant-based soups a prevalent trend during the ready-to-eat soup market forecast.

In addition, manufacturers have introduced functional soups, incorporating ingredients known for their health benefits, particularly immunity-boosting ingredients such as turmeric, ginger, and bone broth. These soups are marketed as filling meals and also as products that contribute to overall wellness. Companies have combined superfoods, herbs, and spices with high-nutrient vegetables to create soups that promote digestive health, reduce inflammation, or enhance immunity. Moreover, some brands have developed seasonal lines targeting cold and flu prevention, while others offer year-round options focused on improving gut health. The trend aligns with the growing interest of consumers in food products that support specific health goals along with basic nutrition.

Competitive Landscape

The major players operating in the ready-to-eat soup market include Campbell Soup Company, General Mills Inc., Amy's Kitchen, Nestle S.A., Pacific Foods, Baxters Food Group, Conagra Brands, Kraft Heinz Company, Unilever, and Kettle & Fire.

Recent Key Strategies and Developments

In July 2023, Campbell Soup Company expanded its Well Yes Sipping Soups product line, introducing new flavors focused on health-conscious consumers. The launch targeted the growing demand for functional, nutritious, and convenient meal options, emphasizing clean-label ingredients such as kale, white beans, and quinoa.

In March 2023, Amy’s Kitchen introduced new ready-to-eat organic soups to expand its portfolio of plant-based, non-GMO options.

In October 2022, Progresso launched its Spice It Up soup collection, introducing ready-to-eat soups with bold, spicy flavors, including varieties such as southwest style chicken and zesty tomato basil. The new line targeted younger consumers seeking adventurous flavors in convenient meal formats.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ready-to-eat soup market analysis from 2024 to 2034 to identify the prevailing ready-to-eat soup market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ready-to-eat soup market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ready-to-eat soup market trends, key players, market segments, application areas, and market growth strategies.

Ready-to-Eat Soup Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.7 Billion |

| Growth Rate | CAGR of 8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 285 |

| By Product Type |

|

| By Form |

|

| By Packaging Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Pacific Foods, Baxters Food Group Limited., Conagra Brands, Inc., Campbell Soup Company, Nestle S.A., Hindustan Unilever Limited, General Mills Inc., Kettle & Fire, Amy's Kitchen, Inc, The Kraft Heinz Company |

The global ready-to-eat soup market was valued at $1.2 billion in 2023.

Wet soup segment has the leading application of Ready-to-Eat Soup Market.

Upcoming trends include plant-based options, clean label ingredients, sustainable packaging, convenience-focused formats, and improved flavors catering to health-conscious consumers.

The major players operating in the ready-to-eat soup market include Campbell Soup Company, General Mills Inc., Amy's Kitchen, Nestle S.A., Pacific Foods, Baxters Food Group, Conagra Brands, Kraft Heinz Company, Unilever, and Kettle & Fire.

Based on region, North America held the highest market share in terms of revenue in 2023.

Loading Table Of Content...