Real Estate Services Market Research, 2032

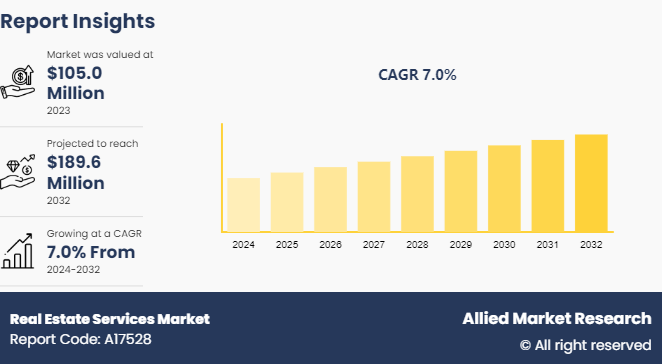

The global real estate services market was valued at $105.0 million in 2023, and is projected to reach $189.6 Million by 2032, growing at a CAGR of 7% from 2024 to 2032.

Market Introduction and Definition

The real estate industry covers a wide array of services aimed at simplifying the processes of buying, selling, renting, and overseeing properties. This sector consists of experts and firms specializing in real estate deals, property management, valuation, funding, and advisory services. Essential elements comprise real estate brokerage services, where agents aid clients in property transactions property management services, which focus on the day-to-day operations of properties; and real estate appraisal services for determining property worth. Consulting services offer strategic advice and market intelligence, while real estate financing services assist with funding transactions. Economic conditions, technological advancements, regulatory changes, consumer preferences, and globalization all impact the market, shaping its trends and dynamics. Stakeholders must grasp these factors to effectively and profitably navigate real estate activities.

Key Takeaways

The real estate services market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major real estate services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends

In October 2023, RICS in Europe created a Leaders’ Forum called ‘Future of valuations: The impact of ESG’, with Joël Scherrenberg MRICS as the chair. The forum is guided by RICS staff members Sander Scheurwater and Gina Ding, aiming to integrate ESG requirements into valuations and the valuation process. Understanding the Leaders’ Forum composition and workstreams is crucial for this purpose.

Key Market Dynamics

The rise in urbanization significantly impacts the global real estate services market as it creates a surge in the need for housing, offices, and other real estate services. Urbanization also brings about higher population densities, necessitating improved infrastructure and services, thereby boosting the demand for real estate services. Additionally, urbanization contributes to increased economic activity, resulting in higher disposable incomes and a greater demand for real estate services. The surge in urbanization has sparked a rising fascination with sustainable and eco-friendly practices in the real estate sector. To cater to the growing desire for sustainable living spaces, developers are now integrating energy-efficient technologies, green architectural designs, and eco-friendly infrastructure. This global trend is clearly reflected in the widespread adoption of green building certifications such as LEED (Leadership in Energy and Environmental Design) in urban real estate projects. The report highlights a steady rise in the real estate services market share across multiple regions.

The rise in consumer purchasing power plays a crucial role in the worldwide real estate services industry. As disposable incomes increase, consumers have the ability to acquire a wider range of real estate services, including renting, buying, and property investment. Purchasing power also determines the level of services accessible to consumers, ranging from essential to luxury offerings. With greater purchasing power, consumers are inclined to opt for premium services, thereby boosting the demand for real estate services. This trend is especially noticeable in the U.S., where real wages have increased for all income groups, providing significant advantages to middle- and lower-income households. Consequently, the median American worker now possesses greater purchasing power, leading to a surge in affordability and housing demand.

Furthermore, the rise in consumer purchasing power is clearly seen in global markets as well. For example, countries in the Asia-Pacific region, such as India, are witnessing substantial growth in their real estate industries. With the expansion of these economies and the middle class, the surge in purchasing power is boosting the need for residential and commercial properties, leading to more advancements in the market. Furthermore, this trend has caused a change in investor tactics in the real estate sector. Investors are now placing more emphasis on top-notch properties that meet the needs of wealthier consumers. This involves luxury housing projects, high-end office buildings, and upscale shopping centers. Given the competitive market environment, investors must juggle defensive and aggressive strategies to take advantage of new prospects. The real estate services market forecast indicates steady growth amidst evolving consumer preferences.

Parent market analysis for real estate services

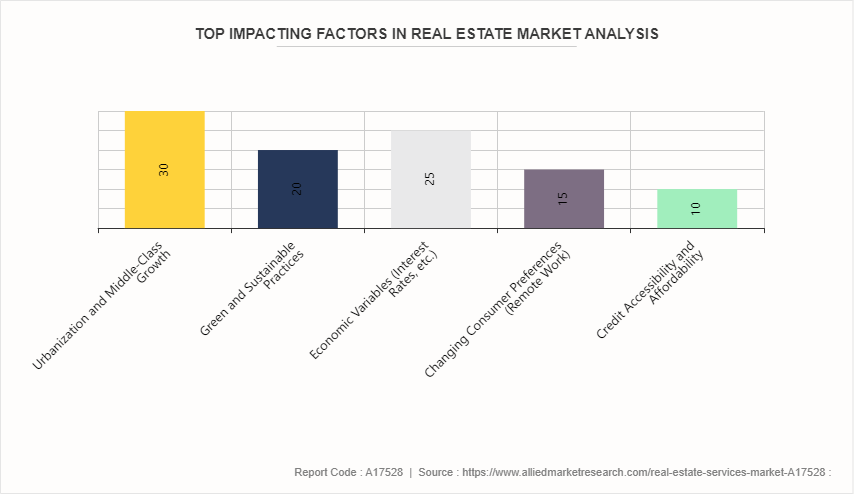

The real estate sector, a vital component of economic stability and progress worldwide, is experiencing substantial changes due to a variety of market trends and influences. The demand for residential and commercial properties is being fueled by urbanization, especially in metropolitan regions and emerging markets where rapid urban expansion is accompanied by a growing middle-class population. Moreover, the industry is embracing greener practices and prioritizing energy-efficient buildings and sustainable urban development in response to the increasing awareness of climate change. Economic variables, such as changing interest rates and financial market volatility, have a substantial effect on the market. Increased interest rates impact borrowing expenses and investment choices. Changes in consumer preferences, like the rising popularity of remote work, impact the demand for residential and commercial properties, leading to a shift towards secondary markets and a greater need for adaptable housing options. Furthermore, the accessibility and affordability of credit play a vital role, as current patterns suggest a stricter credit environment. The strong financial position of both individuals and businesses is evident, with debt levels being kept under control despite economic challenges. The real estate services market size is projected to reach new heights by the projected period of 2024 to 2032.

Market Segmentation

The real estate services market is segmented into service, type, application, and region. On the basis of type, the market is divided into residential, commercial, and other property types. As per service, the market is segregated into property management, valuation services, and other services. On the basis of application, the market is classified into personal, business, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Asian region's Real Estate Services Market is currently undergoing a period of rapid expansion. This growth can be attributed to several factors, such as the region's increasing urbanization, the growing demand for housing, and the influx of foreign investors. As urbanization continues to rise, more individuals are relocating to cities in pursuit of improved job prospects, leading to a surge in housing demand. Strategic initiatives have driven significant real estate services market growth in urban areas. Moreover, there has been a notable increase in real estate transactions, as well as a rise in the number of real estate agents and brokers. Additionally, the influx of foreign investors has further fueled the demand for housing in the region. The potential for high returns and the affordable entry cost have attracted investors to the market. Additionally, governments in the region have incentivized developers and investors, leading to a surge in new projects, real estate agents, and brokers. The Asian Real Estate Services Market is currently undergoing rapid growth owing to factors such as urbanization, housing demand, and foreign investments.

Competitive Landscape

The major players operating in the real estate services market include Associa, CBRE, Intero Real Estate, Pacific Real Estate Services, Vylla, Bellrock Group, Centex, Pulte Home, Lennar, Zillow, Tecnocasa, and Barnes.

Recent Key Strategies and Developments

In February 2024, SVI has partnered with Restb.ai to incorporate their cutting-edge AI and computer vision technology into SVI's VALIDITY inspection applications for iOS and Android. Restb.ai, a prominent provider of AI-powered computer vision solutions in the real estate industry, will integrate their advanced generative AI and computer vision software into SVI VALIDITY Pro. This collaboration will enhance the quality of property valuation by leveraging Restb.ai's latest technology. SVI serves a vast network of over 37, 000 active appraisers, brokers, and agents in the field.

In July 2022, JLL has completed the acquisition of Metropolitan Valuation Services, a leading independent commercial property appraisal and real estate consulting firm in the greater New York metropolitan area. By integrating 20 new valuation professionals into JLL's current team of 10, the company has significantly bolstered its advisory capabilities during a time of heightened pricing analysis. With this addition, JLL now boasts a team of 30 dedicated valuations experts based in the NYC Tri-State area, further enhancing its ability to assist investors and lenders in adapting to the evolving real estate landscape.

In January 2022, CBRE Group has revealed its acquisition of Buildingi, a top provider of occupancy planning and technology services, in response to the increasing demand from occupiers for comprehensive occupancy management services. Buildingi will be seamlessly integrated into CBRE's Occupancy Management team and will begin the transition from Buildingi to CBRE. With its expertise in space utilization data management and Computer-Aided Design (CAD) services, Buildingi will enhance CBRE's occupancy management solutions.

In January 2022, Long & Foster Real Estate has further strengthened its dominant position in Richmond by partnering with local franchise Dew Realty. Dew Realty, established in 1978 and currently under the leadership of Bob Flanagan, Trey Flanagan, Lou Flanagan, and Sharon Coleman, is renowned for its expertise in residential resale, new construction, land, relocation, and commercial sales across Central Virginia.

Key Sources Referred

Urban Land Institute (ULI)

National Association of Realtors (NAR)

Royal Institution of Chartered Surveyors (RICS)

Real Estate Research Institute (RERI)

Urban Institute

CoreLogic

Key Benefits for Stakeholders

This report provides a quantitative analysis of the real estate services market segments, current trends, estimations, and dynamics of the real estate services market analysis from 2024 to 2032 to identify the prevailing real estate services market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the real estate services market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global real estate services market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global real estate services market trends, key players, market segments, application areas, and market growth strategies.

Real Estate Services Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 189.6 Million |

| Growth Rate | CAGR of 7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 390 |

| By Type |

|

| By Service |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vylla, Associa, Intero Real Estate, Lennar, CBRE, Centex, PulteGroup, Inc., Bellrock Group, Pulte Home, Pacific Real Estate Services, Tecnocasa |

The property management segment is the most influential segment in the real estate service market.

The top companies analyzed for real estate service market report are Associa, CBRE, Intero Real Estate, Pacific Real Estate Services, Vylla, Bellrock Group, Centex, Pulte Home, Lennar, and Tecnocasa

The global real estate services market was valued at $189.6 million by 2032, registering a CAGR of 6.2% from 2024 to 2032.

The forecast period in the real estate service market report is 2024 to 2032.

The base year calculated in the real estate service market report is 2023.

The commercial segment holds the maximum market share of the real estate service market

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the real estate service market in 2023 was $105 million

Loading Table Of Content...