Recombinant Proteins Market Research, 2033

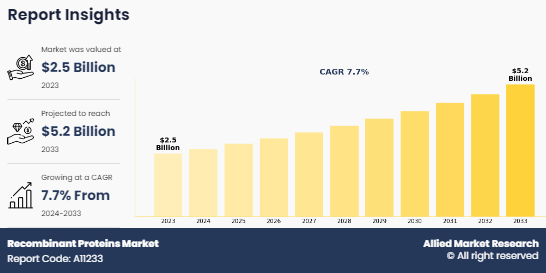

The global recombinant proteins market size was valued at $2.5 billion in 2023, and is projected to reach $5.2 billion by 2033, growing at a CAGR of 7.7% from 2024 to 2033. The growth of the recombinant protein market is driven by rise in the prevalence of chronic diseases. For instance, the International Diabetes Federation (2021), reports that 10.5% of the adult population (20-79 years) has diabetes, with almost half unaware that they are living with the condition. In addition, by 2045, the projections show that 1 in 8 adults, approximately 783 million, an increase of 46%, will be living with diabetes.

Recombinant proteins are proteins that are artificially produced by introducing a specific gene encoding the desired protein into a host organism, such as bacteria, yeast, or mammalian cells. This process involves recombinant DNA technology, where the target gene is inserted into a vector (like a plasmid) and introduced into the host. The host organism's cellular machinery then expresses the protein, which can be harvested, purified, and used for various applications. Recombinant proteins play a critical role in medicine, biotechnology, and research. They are used in the production of vaccines, therapeutic drugs (like insulin), and diagnostic tools. This allows for large-scale production of proteins with high purity, consistency, and reduced risk of contamination.

Key Takeaways

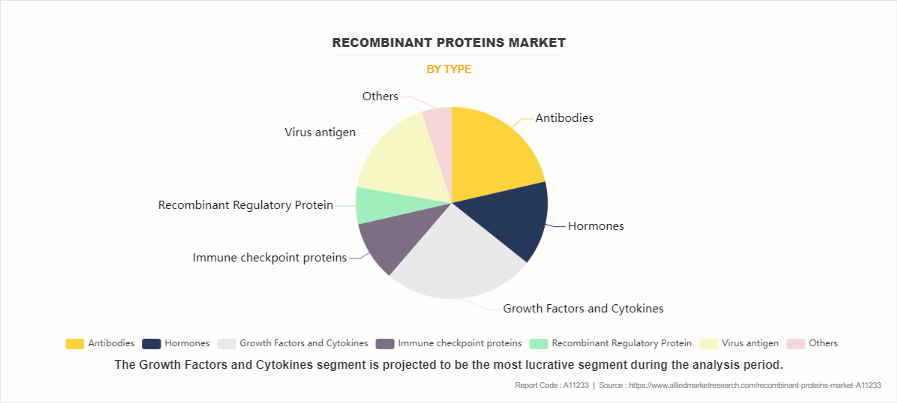

- On the basis of type, the Growth Factors and Cytokines segment dominated the recombinant proteins market share in 2023. However, the Antibodies segment is anticipated to grow at the highest CAGR during the forecast period.

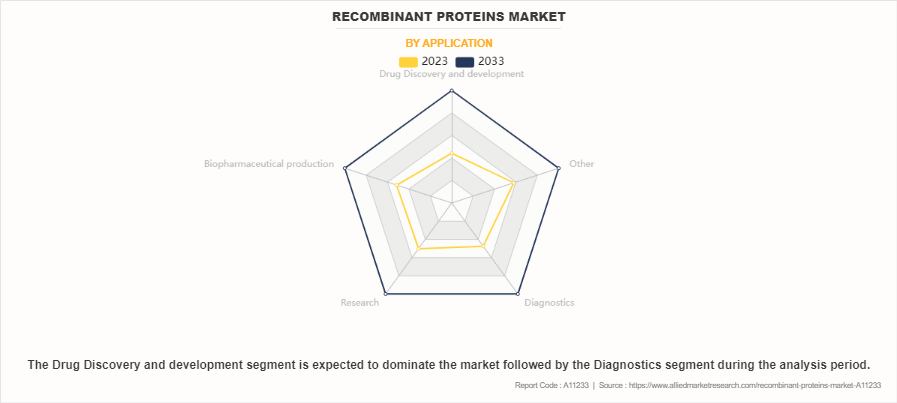

- On the basis of application, the Drug Discovery and development segment dominated the recombinant proteins market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

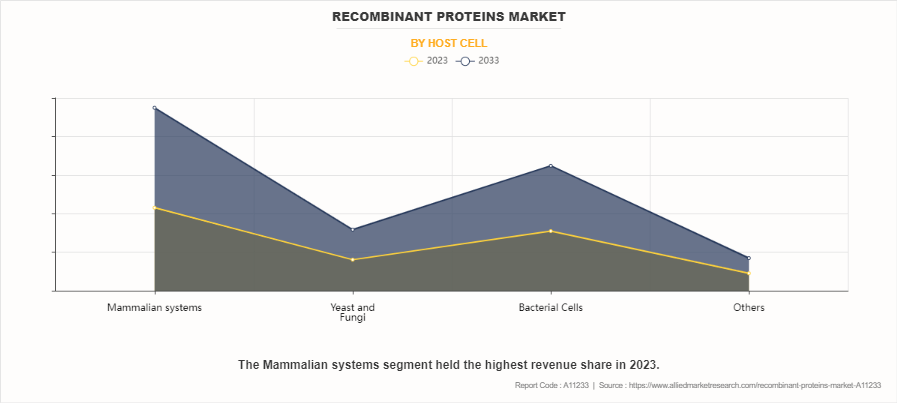

- On the basis of host cells, the Mammalian systems segment dominated the market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

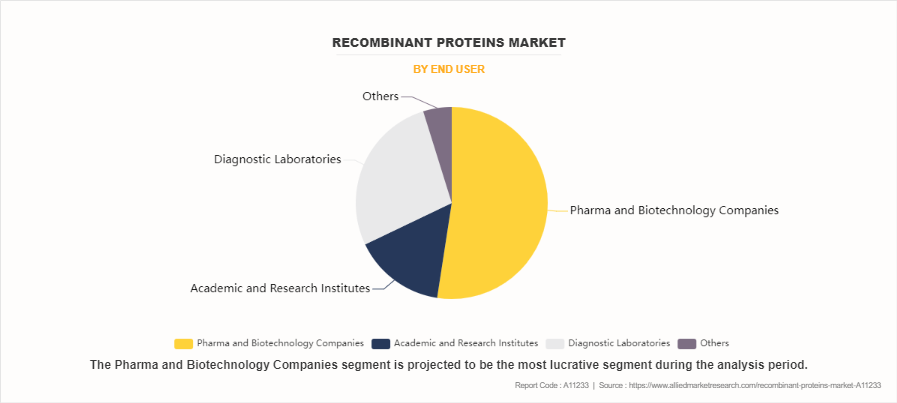

- On the basis of end user, the pharmaceutical and biotechnology companies segment dominated the market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

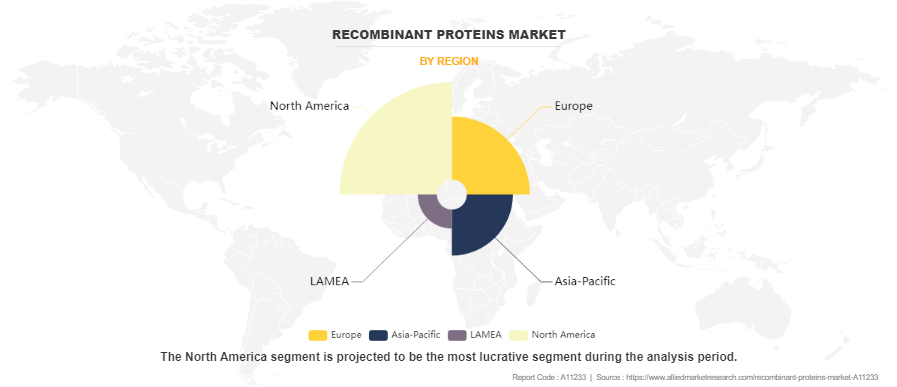

- Region wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The recombinant proteins market growth is primarily driven by their critical applications in drug development, therapeutic treatments, and research. The rising prevalence of chronic and infectious diseases, including cancer, diabetes, and autoimmune disorders, has spurred the need for targeted therapies, many of which rely on recombinant proteins such as monoclonal antibodies, hormones, and vaccines. The growing focus on personalized medicine further bolsters this demand, as recombinant proteins play a key role in developing customized treatments tailored to individual patient needs. Thus, the rise in prevalence of the chronic and infectious diseases is expected to drive the growth recombinant proteins market size.

Advancements in biotechnology and protein engineering have also contributed significantly in the recombinant proteins market growth, enabling the development of more efficient and cost-effective production methods. High-throughput screening and innovations in cell-line engineering have enhanced recombinant protein production, thus improving yield and reducing production time. Additionally, increasing investments in biopharmaceutical R&D by private companies and government bodies have accelerated the discovery and commercialization of novel recombinant protein-based therapies. Expanding healthcare infrastructure and the rising adoption of biomanufacturing technologies, especially in emerging economies, further contribute to market expansion.

However, despite its promising growth, the recombinant protein market faces several challenges. The high cost of production and purification processes is a significant barrier, limiting access to these therapies in resource-constrained regions. Developing recombinant proteins requires specialized equipment, skilled personnel, and stringent quality control, which adds to the overall expense. Regulatory hurdles and lengthy approval processes for recombinant protein-based products also hinder market growth, as compliance with international standards and safety protocols can be time-consuming and costly.

Moreover, competition from alternative therapeutic modalities, such as small molecule drugs and cell-based therapies, poses a challenge to the adoption of recombinant proteins. These alternatives often offer similar therapeutic benefits at a lower cost or with fewer complexities in production and distribution. Intellectual property and patent-related disputes further complicate market dynamics, creating barriers for new entrants and slowing innovation.

According to the recombinant proteins market forecast analysis the recombinant protein market offers numerous opportunities for growth and innovation. The increasing focus on biopharmaceuticals and biologics presents a lucrative avenue for market players, as biologics continue to gain traction in treating complex diseases. Emerging trends such as biosimilars and biobetters provide additional opportunities, offering cost-effective alternatives to branded recombinant protein therapies while maintaining therapeutic efficacy.

The rise of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in the biopharmaceutical sector is another growth driver. These organizations enable small and medium-sized enterprises to access state-of-the-art facilities and expertise, reducing production costs and accelerating time-to-market. Advancements in synthetic biology and gene editing technologies, such as CRISPR, open new possibilities for engineering recombinant proteins with enhanced functionality and stability.

Furthermore, the expansion of applications beyond therapeutics into diagnostics, regenerative medicine, and agricultural biotechnology provides additional growth prospects. Recombinant proteins are increasingly being used in cell culture systems, tissue engineering, and vaccine development, broadening their market scope.

Segmental Overview

The recombinant proteins industry is segmented into type, application, host cell, end user, and region. On the basis of type, it is segmented into antibodies, hormones, growth factors and cytokines, immune checkpoint proteins, recombinant regulatory protein, virus antigen, and others. On the basis of application, the market is classified into drug discovery and development, biopharmaceutical production, research, diagnostics, and other. On the basis of host cell, the market is classified into mammalian systems, yeast & fungi, bacterial cells, and others. On the basis of end user, it is classified into pharma & biotechnology companies, academic & research institutes, diagnostic laboratories, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

By type, the growth factors and cytokines segment dominated the market share in 2023. This was attributed to their extensive use in cell culture, regenerative medicine, and therapeutic development. Their critical role in cell signaling, wound healing, and immune response drives demand, further supported by increased research activities and advancements in biopharmaceutical production technologies.

However, the antibodies segment is expected to register the highest CAGR during the forecast period owing to the growing demand for monoclonal antibodies in targeted therapies, cancer treatment, and immunological research. Advances in antibody engineering and increased investments in biopharmaceutical R&D further accelerate market expansion.

By Application

By application, the drug discovery and development segment dominated the market share in 2023 and is expected to register the highest CAGR during the forecast period owing to the increasing demand for targeted therapies and personalized medicine. Innovations in protein engineering, high-throughput screening, and greater investments in biopharmaceutical R&D further propel the market. Recombinant proteins streamline drug candidate identification and validation, thus improving the efficiency of development processes.

By Host cell

By host cell, the mammalian system segment dominated the market in 2023 and is expected to register the highest CAGR during the forecast period. This growth is driven by their ability to produce complex proteins with accurate post-translational modifications, such as glycosylation, makes them vital for manufacturing therapeutic proteins like monoclonal antibodies, hormones, and enzymes. The rising demand for biologics, along with advancements in biomanufacturing technologies, fuels the growing adoption of mammalian systems for recombinant protein production.

By End user

By End user, the pharmaceutical and biotechnology companies segment dominated the market in 2023 and is expected to register the highest CAGR during the forecast period owing to the strong demand for therapeutic proteins, monoclonal antibodies, and vaccines. These companies lead innovation in drug discovery, development, and production, backed by substantial R&D investments, advancements in biopharmaceutical technology, and a growing emphasis on personalized medicine and targeted therapies.

By Region

Region wise, North America accounted for the largest share in terms of revenue in 2023, owing to robust pharmaceutical and biotechnology sectors, advanced research facilities, and substantial healthcare investments. The presence of leading biopharmaceutical companies, along with government support for research and development, further accelerates market expansion.

However, according to recombinant proteins market opportunity analysis Asia-Pacific region is projected to exhibit the highest CAGR in the Recombinant Proteins market during the forecast period, owing to increasing investments in biotechnology, expanding healthcare infrastructure, and the rising demand for recombinant proteins in drug development and therapeutics. Additionally, the region's expanding pharmaceutical industry, along with supportive government policies and research initiatives, further contributes to the market's growth.

Competition Analysis

Competitive analysis and profiles of the major players in the recombinant proteins industry are Bio-Rad Laboratories, Inc, Thermo Fisher Scientific Inc, Merck KGaA, Sartorius AG, Novo Nordisk A/S, Enzo Biochem, Inc, RayBiotech Inc, GenScript Biotech Corporation, Abnova Corporation, and Bio-techne. The key players have adopted product launch, geographical expansion, acquisition, collaboration, investment as the key strategies for expansion of their product portfolio.

Recent Developments in Recombinant Protein Industry

- In August 2022, Bio-Rad Laboratories, Inc., a global leader in life science research and diagnostics, launched recombinant type 1 antibodies that block evolocumab (Repatha) from binding to PCSK9, a key regulator of cholesterol. These sequence-defined antibodies support the development of selective and sensitive pharmacokinetic (PK) and anti-drug antibody (ADA) assays for evolocumab and its biosimilars.

- In October 2021, 3M Health Care and Thermo Fisher Scientific collaborated to increase process efficiency and scalability in commercial therapeutic manufacturing. The 3M Harvest RC is 3M's newest solution that utilizes proprietary fibrous chromatography media to deliver a single-stage purification solution for recombinant protein therapeutic manufacturing.

- In April 2024, Merck KGaA, a leading science and technology company, announced investing more than $314 million in a new research center at its global headquarters in Darmstadt, Germany. The Advanced Research Center brings together research on key technologies of the Life Science business sector of Merck. These include raw materials and processes for researching and manufacturing antibodies, recombinant proteins, and viral vectors.

- In July 2021, the life science group Sartorius, through its subgroup Sartorius Stedim Biotech, acquired a majority stake in the raw material manufacturer CellGenix GmbH. It develops, manufactures, and markets human cytokines, growth factors, and other recombinant cell culture components in preclinical and GMP quality as well as proprietary serum-free media for further manufacturing of ATMPs

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the recombinant proteins market analysis from 2023 to 2033 to identify the prevailing recombinant proteins market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the recombinant proteins market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global recombinant proteins market trends, key players, market segments, application areas, and market growth strategies.

Recombinant Proteins Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.2 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 405 |

| By Type |

|

| By Application |

|

| By Host Cell |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bio-Techne, Novo Nordisk A/S, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. , RayBiotech Inc., Enzo Biochem Inc., Sartorius AG, Merck KGaA, Abnova Corporation, GenScript Biotech Corporation |

The global recombinant proteins market size was valued at $2.5 billion in 2023

The market value of Recombinant Proteins market is projected to reach $5.2 billion by 2033.

The forecast period for Recombinant Proteins market is 2024-2033.

The base year is 2023 in Recombinant Proteins market

The rising demand for targeted therapies and increased biopharmaceutical R&D investments are the major factors that drive the growth of the recombinant protein market. However, the high cost of procedures restricts market growth.

Loading Table Of Content...

Loading Research Methodology...