Recycled Carbon Fiber Market Research, 2031

The global recycled carbon fiber market was valued at $139.0 million in 2021, and is projected to reach $432.5 million by 2031, growing at a CAGR of 12% from 2021 to 2031. Advancements in recycling technologies and processes have significantly improved the efficiency, quality, and scalability of recycled carbon fiber production, making it a viable and cost-effective alternative to virgin carbon fiber. These innovations ensure better retention of material properties during recycling, enabling its use in high-performance applications. Thus, driving the growth of the recycled carbon fiber market.

Report Key Highlighters

- The recycled carbon fiber industry is consolidated in nature among companies such as include Toray Industries, Inc., SGL Carbon, Carbon Conversions, Procotex, Vartega Inc, Sigmatex, Carbon Fiber Remanufacturing, Gen 2 Carbon Limited.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global recycled carbon fiber market such as undergoing R&D activities, key regulation for the production for recycled carbon fiber, raw material availability, and government initiatives are analyzed across 19 countries in 4 different regions.

Introduction

Recycled carbon fiber is a sustainable material derived from reclaiming and reprocessing carbon fiber composites that would otherwise be discarded as waste. This process involves recovering the fibers from end-of-life products or manufacturing scraps through methods such as pyrolysis, solvolysis, or mechanical grinding. Recycled carbon fibers retain much of the strength, stiffness, and lightweight properties of virgin carbon fibers, making them an eco-friendly alternative for various applications in automotive, aerospace, construction, and sporting goods industries.

Market Dynamics

Growing population base has led to rapid urbanization in both developed and developing economies such as the U.S., China, and India. This has increased government spending on building & construction sector to develop various upcoming infrastructure projects. For instance, according to a report published by National Investment Promotion and Facilitation Agency, the infrastructure activities accounted for 13% share of the total foreign direct investment (FDI) inflows in 2021. Furthermore, rapid development of water supply, sanitation, urban transport, schools, and healthcare are aiding the growth of the building & construction sector.

Recycled carbon fiber is widely used in constructing windows, door systems, exterior trim, decks, columns, fences, and pergolas. Fatigue resistance and flexibility properties make it more crack-resistant than traditional materials such as steel and concrete, especially when exposed to repeated load-bearing weight. These factors are anticipated to fuel the demand for recycled carbon fiber in the growing building & construction sector.

Furthermore, factors such as increase in disposable income, technological upgrades, and spurring rise in number of original equipment manufacturers (OEMs) have led the automotive & transportation sector to witness a significant growth. For instance, according to a report published by India Brands Equity Foundation, the domestic automobile production increased by a compound annual growth rate (CAGR) of 2.36% from 2016 to 2020 with 26.36 million vehicles being manufactured in India in 2020.

Recycled carbon fiber products are used in hoods, wheels, front gearings, engine, and others. The use of carbon fiber products is increasing in the automotive industry due to superior strength-to-weight ratio and corrosion resistance. Carbon fiber materials are increasingly substituting metal in various automotive end uses, primarily to reduce fuel consumption. Recycled carbon fiber offer higher weight savings and thus a better fuel economy than traditional materials such as steel and aluminum. Vehicle manufacturers are obliged to reduce the average energy consumption of vehicles, and this goal can be met using lightweight products.

Moreover, ultra-expensive vehicle manufacturers such as BMW, Mercedes Benz, and Lamborghini plan to increase the use of recycled carbon fiber in their super vehicles. The increased demand for eco-friendly and low-volatile organic products (VOCs) in vehicles enhance the need for recycled carbon fiber in the automotive industry. The number of models manufactured using recycled carbon fiber has witnessed huge rise as vehicles are nowadays electrified and manufacturers constantly look for solutions that increase fuel efficiency. The rise in use of electric vehicles and stringent regulatory norms for maintaining fuel economy standards are major factors that are expected to further boost the demand for recycled carbon fiber in the automotive industry.

However, there are several methods involved in recycling carbon fiber such as mechanical-based recycling process, chemical-based recycling process, and thermal-based recycling process. These processes consist of several intermediate steps that need to be carried out for recycling carbon fiber scrap and composites, which in turn require highly skilled professionals with good technical knowledge of equipment handling and recycling. Thus, the lack in number of skilled professionals and dearth of technical knowledge may restrain the recycled carbon fiber market growth during the forecast period.

On the contrary, governments of both developed and developing economies are constantly engaged in promoting the utilization of environment-friendly products among various end use sectors. Countries such as the U.S., Japan, Germany, and others are focusing on the use of sustainable products instead of petroleum-derived products. This factor has led end use sectors such as building & construction, automotive, aerospace & defense, and others to use recycled carbon fiber for various end uses.

Moreover, volatile Organic compounds (VOCs) are compounds having low water solubility and high vapor pressure. They are emitted as gases from certain solids or liquids and include a variety of chemicals that may have short- and long-term adverse health effects. Furthermore, several government agencies such as the United States Environmental Protection Agency (U.S. EPA), European Union, Central Pollution Control Board, and others have laid down laws and regulations for the emission limits of VOCs. For instance, the United States Environmental Protection Agency (U.S. EPA) regulates VOCs at Federal level in 40 CFR 59, which is the National Volatile Organic Compound Emission Standard for consumer and commercial products.

Recycling of carbon fiber produces little or no VOCs, which in turn has surged the potential end uses of recycled carbon fiber among several end use sectors. This is anticipated to increase the demand for recycled carbon fiber; thus, creating lucrative opportunities for the market.

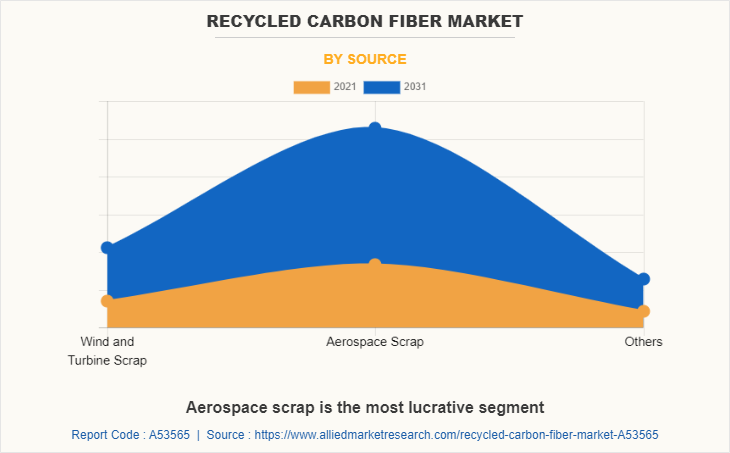

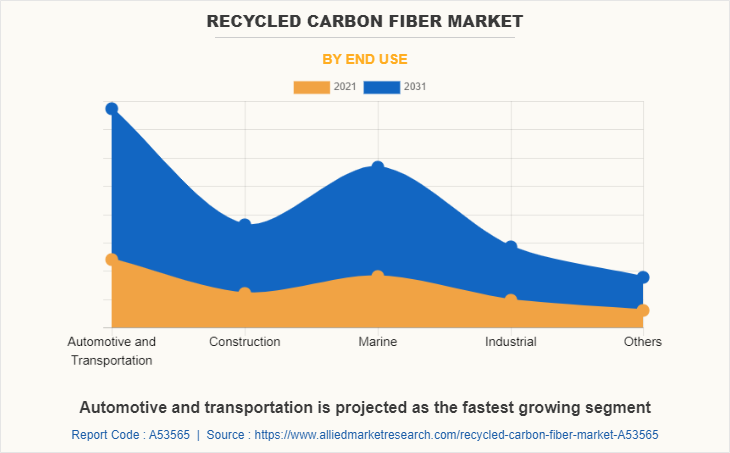

The recycled carbon fiber market is segmented on the basis of source, end use, and region. On the basis of source, the market is categorized into wind & turbine scrap, aerospace scrap, and others. On the basis of end use, it is divided into automotive & transportation, construction, marine, industrial, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2021, the aerospace scrap segment was the largest revenue generator, and is anticipated to grow at a CAGR of 12.3% during the forecast period. The rising advancements in producing high-tech fighter jets where carbon fiber is widely used owing to its lightweight and high strength has eased the availability of used carbon fiber for carbon fiber recycling companies from aerospace scrap. Furthermore, recycling carbon fiber from aerospace composite scrap has environmental and business benefits. This factor is leading to progress in a shift from pilot scale to industrial operations of carbon fiber recycling from aerospace scrap.

By end use, the automotive & transportation end use segment dominated the global market in 2021 and is anticipated to grow at a CAGR of 12.5% during forecast period. Sustained economic growth has surged the need for faster and reliable mode of transportation where recycled carbon fiber is widely used in various transportation equipment owing to its light weight/high stiffness, low bending, high-speed operation, and other significant characteristics. This may act as one of the key drivers responsible for the growth of the recycled carbon fiber market.

Furthermore, factors such as increasing disposable income, technological upgrades, and spurring rise in original equipment manufacturers (OEMs) have led the automotive & transportation sector to witness a significant growth where recycled carbon fiber is used as for manufacturing various auto parts to absorb large amount of impact energy and increase overall safety of the vehicle. For instance, according to a report published by the Government of Canada, the automotive industry in Canada plays a key role in Canada’s economy with a contribution of around $12.5 billion to gross domestic product (GDP) in 2020.

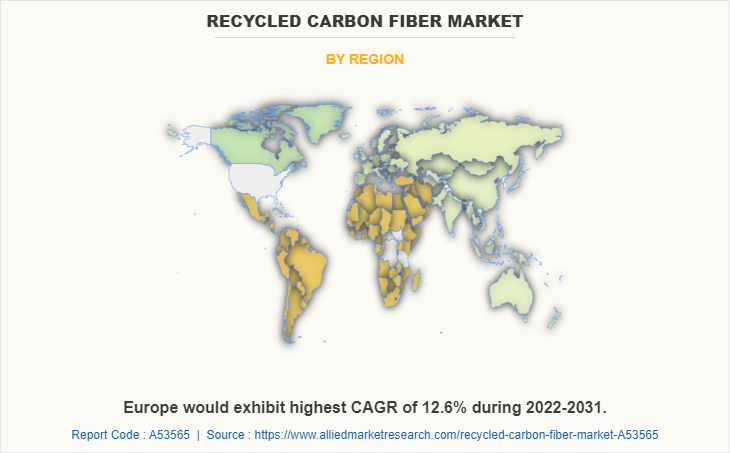

The North America recycled carbon fiber market size is projected to grow at the CAGR of 12.1% during the forecast period and accounted for 38.9% of recycled carbon fiber market share in 2021. The building and construction sector in the U.S. is expanding rapidly, which in turn has increased the demand for recycled carbon fiber used for constructing windows, door systems, exterior trim, decks, columns, fences, and pergolas. According to a report published by the U.S. Census Bureau, the total construction spending during May 2021 was estimated at a seasonally adjusted annual rate of $1,545.3 billion, which is 7.5% above the May 2020 estimate of $1,437.7 billion.

In addition, the automotive sector in Canada is growing at a rapid pace, which in turn may enhance the performance of the recycled carbon fiber products used for producing various automotive parts. According to data revealed by the government of Canada, the country’s automotive & transportation sector grew by around 1.1% in 2019 as compared to 2018 owing to the increase in imports and exports activities. Furthermore, key automotive manufacturers have headquarters in this region and favorable government regulations help in recycled carbon fiber’s product penetration.

The three domestic sports cars made with recycled carbon fiber materials include Chevrolet Corvette Stingray, Viper SRT, and Ford Mustang Shelby GT500KR. This may act as one of the key drivers responsible for the growth of the recycled carbon fiber market. Moreover, the increasing use of recycled carbon fiber products in BMW models and global players such as Apple Inc. planning to adopt carbon fiber body of BMW “i3” series for its electric car are anticipated to further broaden the demand and applications of recycled carbon fiber products in this region; thus, creating remunerative opportunities for the market.

The global recycled carbon fiber market profiles leading players that include Toray Industries, Inc., SGL Carbon, Carbon Conversions, Shocker Composites, LLC, Bcircular, Procotex, Vartega Inc, Sigmatex, Carbon Fiber Remanufacturing, Gen 2 Carbon Limited. The global recycled carbon fiber market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the recycled carbon fiber market analysis from 2021 to 2031 to identify the prevailing recycled carbon fiber market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the recycled carbon fiber market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global recycled carbon fiber market trends, key players, market segments, application areas, and market growth strategies.

Recycled Carbon Fiber Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 432.5 million |

| Growth Rate | CAGR of 12% |

| Forecast period | 2021 - 2031 |

| Report Pages | 430 |

| By Source |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Gen 2 Carbon Limited, Bcircular, Sigmatex, Carbon Fiber Remanufacturing, Shocker Composites, LLC, Procotex, Vartega Inc, Toray Industries, Inc., Carbon Conversions, SGL Carbon |

Analyst Review

According to CXOs of leading companies, the global recycled carbon fiber market is expected to exhibit high growth potential. Recycled carbon fiber composites, due to their higher weight bearing capacity and stiffness property, are used in the production of front & rear fenders, front wheelhouses, sports equipment, defense & commercial aircrafts, hoods & roofs, and others in a variety of end-use sectors such as building & construction, automotive, aerospace, and wind turbines. Aerospace and defense equipment that require high strength, corrosion protection, and abrasion resistant properties can be accomplished with the use of recycled carbon fiber.

In addition, recycled carbon fiber possesses significant properties such as high mechanical strength, thermal resistance, chemical resistance, and corrosion resistance that make it best suited for automotive end uses. Furthermore, recycled materials are extensively used in high-end end uses in the aerospace industry due to their strength-to-weight ratio. These materials exhibit properties, such as exceptional weight bearing, high tensile strength, elastic modulus, impact resistance, and fuel efficiency, which make recycled carbon fiber ideal for use in the aerospace industry. Furthermore, recycled carbon fiber offers cost competitiveness as compared to original carbon fiber, which in turn may surge the utilization of recycled carbon fiber across numerous end use sectors. CXOs further added that sustained economic growth and development of the building & construction sector have increased the popularity of recycled carbon fiber.

Escalating demand for recycled carbon fiber from building & construction sector, surge in demand for recycled carbon fiber from automotive sector, and robust demand for recycled carbon fiber from aerospace sector are the upcoming trends of recycled carbon fiber market.

Automotive and transportation is the leading application of recycled carbon fiber market.

North America is the largest regional market for recycled carbon fiber,

The recycled carbon fiber market valued for $139.0 million in 2021 and is estimated to reach $432.5 million by 2031, exhibiting a CAGR of 12% from 2021 to 2031

The top companies that hold a prominent share in the recycled carbon fiber market includes Toray Industries, Inc., SGL Carbon, Carbon Conversions, Shocker Composites, LLC, Bcircular, Procotex, Vartega Inc, Sigmatex, Carbon Fiber Remanufacturing, Gen 2 Carbon Limited

Loading Table Of Content...