Regenerative Medicine Market Research, 2033

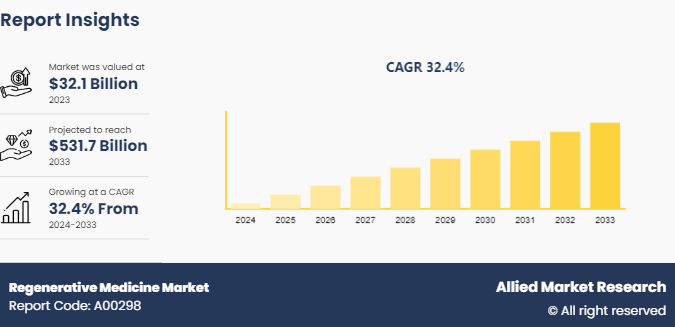

The global regenerative medicine market size was valued at $32.1 billion in 2023, and is projected to reach $531.7 billion by 2033, growing at a CAGR of 32.4% from 2024 to 2033.The increasing demand for personalized medicine is a significant driver for the regenerative medicine market growth.

Market Introduction and Definition

Regenerative medicine is a multidisciplinary field focused on harnessing the body's natural healing processes to repair, replace, or regenerate damaged tissues and organs. It involves the use of stem cells, tissue engineering, growth factors, and biomaterials to stimulate tissue regeneration and restore normal function. The benefits of regenerative medicine include the potential to treat a wide range of medical conditions, including degenerative diseases, traumatic injuries, and congenital defects, with therapies tailored to individual patients. By promoting tissue repair and regeneration, regenerative medicine offers the promise of improved outcomes, reduced reliance on conventional treatments like organ transplantation, and enhanced quality of life for patients.

Key Takeaways

- The regenerative medicine market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major regenerative medicine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The increasing demand for personalized medicine is a significant driver for the regenerative medicine market. Personalized medicine involves tailoring medical treatment to the individual characteristics of each patient, including genetic makeup, lifestyle, and environmental factors. Regenerative medicine, with its ability to provide customized treatments using techniques such as stem cell therapy and gene editing, aligns well with the principles of personalized medicine. Patients seek treatments that offer higher efficacy, fewer side effects, and better outcomes tailored to their unique needs, driving the demand for regenerative therapies.

However, the high cost of research, development, and commercialization of regenerative therapies poses a significant restraint on market growth. These therapies require substantial investment in clinical trials, manufacturing processes, and regulatory compliance, contributing to their high price tags. Additionally, reimbursement challenges and uncertain long-term outcomes further hinder market expansion by deterring investment and adoption. The lack of clear reimbursement mechanisms and concerns about the efficacy and safety of regenerative therapies create barriers to their widespread adoption, impeding market growth.

Moreover, technological advancements present significant opportunities for the regenerative medicine market forecast period. Innovations in stem cell research, tissue engineering, gene editing techniques such as CRISPR-Cas9, and 3D bioprinting have revolutionized the field, enabling more precise, efficient, and scalable regenerative therapies. These advancements enhance the development, manufacturing, and delivery of regenerative treatments, making them more accessible and cost-effective. Additionally, advancements in biomaterials and bioinformatics further expand the possibilities for regenerative medicine applications, fostering growth and innovation in the field.

Regenerative Medicine Market Segmentation

The regenerative medicine industry is segmented into product type, material, application, and region. By product type, the market is classified into cell therapy, gene therapy, tissue engineering, and small molecule & biologic. Depending on material, it is categorized into synthetic material, biologically derived material, genetically engineered material, and pharmaceutical. Synthetic material is further divided into biodegradable synthetic polymer, scaffold, artificial vascular graft material, and hydrogel material. Biologically derived material is further bifurcated into collagen and xenogenic material. Genetically engineered material is further segmented into deoxyribonucleic acid, transfection vector, genetically manipulated cell, three-dimensional polymer technology, transgenic, fibroblast, neural stem cell, and gene-activated matrices. Pharmaceuticals are further divided into small molecules and biologic. By application, it is categorized into cardiovascular, oncology, dermatology, musculoskeletal, wound healing, ophthalmology, neurology, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America region boasts a robust healthcare infrastructure and significant investments in research and development, fostering innovation and driving advancements in regenerative therapies. Additionally, favorable regulatory frameworks and reimbursement policies support the commercialization and adoption of regenerative treatments, facilitating market growth. Furthermore, the high prevalence of chronic diseases and an aging population create a growing demand for regenerative therapies to address age-related degenerative conditions, driving market expansion.

Furthermore, Asia Pacific is witnessing rapid growth in the regenerative medicine market share owing to rapid economic development, increasing healthcare expenditure, and a large patient population. The region's emerging economies, such as China, India, and Japan, are witnessing a rise in healthcare infrastructure and investments in biomedical research, driving innovation and adoption of regenerative therapies. Additionally, the growing prevalence of chronic diseases and lifestyle-related disorders in the APAC region fuels demand for advanced treatments, including regenerative medicine, further contributing to market growth.

- In April 2023, Metcela Inc. announced the acquisition of Japan Regenerative Medicine Co., Ltd. (“JRM”) , a wholly owned subsidiary of Kidswell Bio Co., Ltd. Through this acquisition, Metcela will add an autologous cell product for pediatric congenital heart disease to its pipeline and significantly strengthen its clinical development infrastructure for regenerative medicine products.

- In January 2021, Integra LifeSciences Holdings Corporation, a global leader in regenerative tissue technologies and neurosurgical solutions, hosted a ribbon-cutting ceremony to commemorate the grand opening of new state-of-the-art 14, 000 square foot research and development (R&D) facility. It is dedicated to pioneering new advances in treatment pathways and contributions to regenerative medicine by naming its new facility, the Dr. Richard E. Caruso Center of Innovation and Learning

Industry Trends

- In May 2022, the Washington University received $2.3billion grant from the National Heart Lung and Blood Institute (NHLBI) to investigate the effectiveness of a novel engineered TRIM72 protein to regenerate vasculature and skeletal muscles in high blood sugar and diabetic Critical Limb Ischemia (CLI) .

- Global financing for the regenerative medicine and advanced therapy sector set an annual record of $15.9 billion through just the first three quarters of 2020, according to data released by the Alliance for Regenerative Medicine (ARM) , the leading international advocacy organization dedicated to realizing the promise of regenerative medicines.

Clinical Trial by Therapeutic Approach and Phase Statistics of Global Regenerative Medicine Market

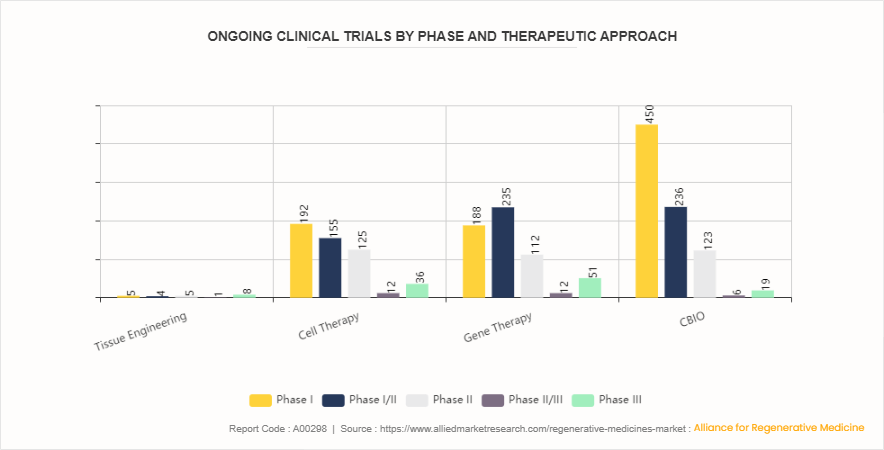

The clinical trial statistics of the global regenerative medicine market provide insights into the distribution of trials across different therapeutic approaches and phases. Among therapeutic approaches, cell therapy and gene therapy dominate with 520 and 598 clinical trials, respectively, indicating significant research and development activities in these areas. Cell therapy involves the use of living cells to regenerate or repair damaged tissues, while gene therapy focuses on modifying genes to treat genetic disorders or enhance therapeutic effects. Tissue engineering, with 23 clinical trials, involves the creation of functional tissues using a combination of cells, biomaterials, and biochemical factors. Additionally, CBIO (Cell-Based Immunotherapy and Oncolytic Virotherapy) accounts for 834 clinical trials, reflecting the growing interest in immunotherapy-based approaches for regenerative medicine and cancer treatment. These statistics highlight the diverse therapeutic approaches being explored in clinical trials, underscoring the multifaceted nature of regenerative medicine research and development.

The major players operating in the regenerative medicine market size include Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic Plc., Athersys, Inc., U.S. Stem Cell, Inc. (Bioheart, Inc.) , Organogenesis, Inc. (Advanced Biohealing) , Integra Lifesciences Holdings Corporation, Acelity Holdings, Inc., Isto Biologics (Isto Biologics Medical Systems, Inc.) , and CryoLife, Inc. Other players in regenerative medicine market includes Shimadzu Recursion Pharmaceuticals, Inc., Baxter International, Inc., DePuy Synthes Siemens Healthineers, General Electric (GE) Company, Koninklijke Philips N.V., Cloudmedx, Inc., and Bay Labs, Inc and so on.

Recent Key Strategies and Developments

- In March 2024, Integra LifeSciences Holdings Corporation, a global leader in regenerative tissue technologies and neurosurgical solutions, announced the launch of MicroMatrix Flex in U.S. It is a dual-syringe system enabling the convenient mixing and precise delivery of MicroMatrix paste to provide convenient access to hard-to-reach spaces and to help prepare an even wound surface in challenging wound areas.

- In March 2022, Wipro Limited, a leading global information technology, consulting, and business process services company, and Pandorum Technologies, a biotechnology company working in the field of tissue engineering and regenerative medicine, today announced a long-term partnership. The partnership combines the Artificial Intelligence (AI) capabilities of Wipro Holmes with Pandorum’s expertise in regenerative medicine.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the regenerative medicine market analysis from 2024 to 2033 to identify the prevailing regenerative medicine market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the regenerative medicine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global regenerative medicine market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- World Health Organization (WHO)

- National Health Service (NHS)

- American Society of Gene & Cell Therapy (ASGCT)

- Alliance for Regenerative Medicine

- Integra LifeSciences Holdings Corporation

- Surgical Innovation Associates (SIA)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Regenerative Medicine Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 531.7 Billion |

| Growth Rate | CAGR of 32.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Product Type |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Medtronic Plc., Stem Cell, Inc., Isto Biologics, Athersys, Inc., Zimmer Biomet Holdings, Inc., Integra Lifesciences Holdings Corporation, Organogenesis, Inc, Acelity Holdings, Inc, CryoLife, Inc., Stryker Corporation |

Analyst Review

The demand for synthetic and biologically derived materials is high in the market due to their characteristics such as cellular adoption and high immune response. Tissue engineering and regenerative medicine are widely used in the biomedical sector for regeneration and repair of diseased or traumatized tissues. Tissue regeneration is conducted both in vitro and in vivo conditions. Tissue engineering requires artificial matrix for regeneration of tissues. This artificial matrix aids in the proliferation and differentiation of cells, leading to the regeneration of tissues. The demand for synthetic tissue engineering material is currently high due to its higher efficiency as compared to other naturally derived materials.

The recent progress in the design of synthetic materials has led to the use of hydrogel in tissue-engineered scaffolds. These synthetic materials comprise interlinked polymers that form a network-like structure through physical and chemical cross-linking. Although the synthetic materials used in tissue engineering hold promising potential in the market in terms of revenue, it may face challenges from the external market forces. Combination materials and time-sensitive use of materials are expected to be crucial factors for choosing synthetic materials in future.

The use of regenerative medicine is highest in North America, particularly in the U.S., owing to increase in prevalence of chronic disorders, rise in demand for artificial organs due to organ failure, and presence of highly sophisticated healthcare infrastructure. Although the use of regenerative medicine in Asia-Pacific and LAMEA regions is low, the adoption rate is expected to increase due to the presence of high unmet medical needs and constant improvement in the healthcare infrastructure to treat chronic disorders. In addition, countries such as China, India, Australia, and Japan, contribute to the market growth owing to their large population and rise in demand for tissue-engineered and regenerative medicine products. These countries have varying demographics and cultural conditions, which highly influence their respective markets.

The total market value of Regenerative Medicine Market is $32.1billion in 2023.

The forecast period for Regenerative Medicine Market is 2024 to 2033

The market value of Regenerative Medicine Market in 2033 is $531.7 billion

The base year is 2023 in Regenerative Medicine Market.

Top companies such as Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic Plc., Athersys, Inc., U.S. Stem Cell, Inc. (Bioheart, Inc.), held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The Cell Therapy segment is the most influencing segment in Regenerative Medicine Market

Loading Table Of Content...