Regional Jet Market Research, 2032

The global regional jet market size was valued at $5.7 billion in 2022, and is projected to reach $10.6 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032. Regional jets are small to medium-sized commercial aircraft designed to serve short to medium-haul routes within a specific region or geographic area. Regional jet market share in the commercial aircraft industry is around 6%. They are typically used by regional airlines, which operate flights on behalf of larger airlines to connect smaller airports to major hubs. These jets are characterized by their smaller size, seating capacity, and range compared to larger commercial aircraft like airliners. They usually accommodate between 15 and 125 passengers, although some models can carry slightly more or fewer.

Report Key Highlighters:

Report Key Highlighters:

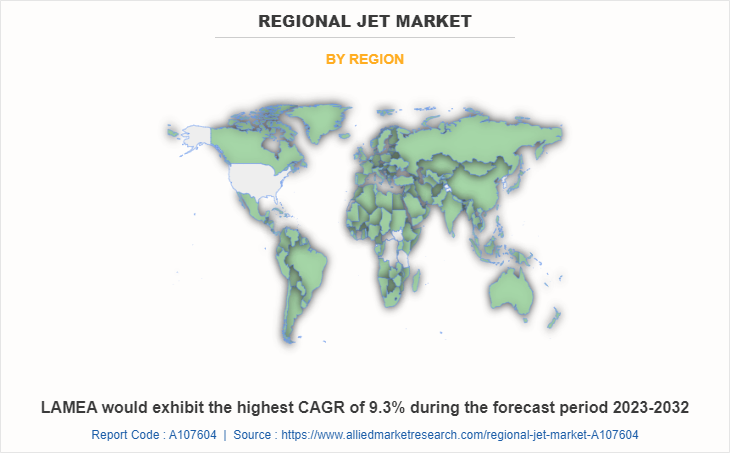

The regional jet market study covers 14 countries. The research includes regional and a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The regional jet industry is highly fragmented, with several players including Airbus, Antonov Company, ATR, BAE Systems, Bombardier, Commercial Aircraft Corporation of China, Ltd., De Havilland, Embraer, MHI RI Aviation ULC, and Saab AB. Also tracked key strategies such as acquisitions, product launches, mergers, expansion, etc. of the players operating in the market.

The regional jet market outlook is driven by factors such as the increase in demand for air travel, growing demand for regional connectivity, and fleet renewal and efficiency. However, infrastructure limitations and airport constraints and competition from larger aircraft and high-speed rail hamper the market growth. Moreover, the increasing interest in expanding air connectivity, opening new routes, and expanding existing ones create lucrative growth opportunities for the regional jet industry.

In addition, the regional jet industry plays a vital role in regional air transportation, providing efficient and convenient options for passengers traveling within a specific region. The growing demand for air travel, particularly in regional and short-haul routes, is driving the the regional jet market growth. As more people choose air transportation for regional journeys, the need for efficient connectivity and convenient travel options within a specific region has increased, leading to higher demand for regional jets.

Airlines are investing in fleet renewal and modernization efforts to improve operational efficiency and reduce operating costs. The introduction of newer regional jet models with advanced technologies, improved fuel efficiency, and enhanced passenger comfort are driving the replacement of older aircraft with more modern and capable regional jets.

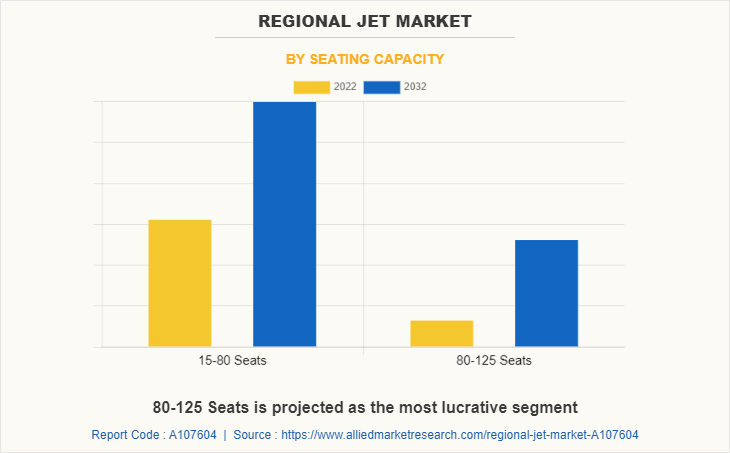

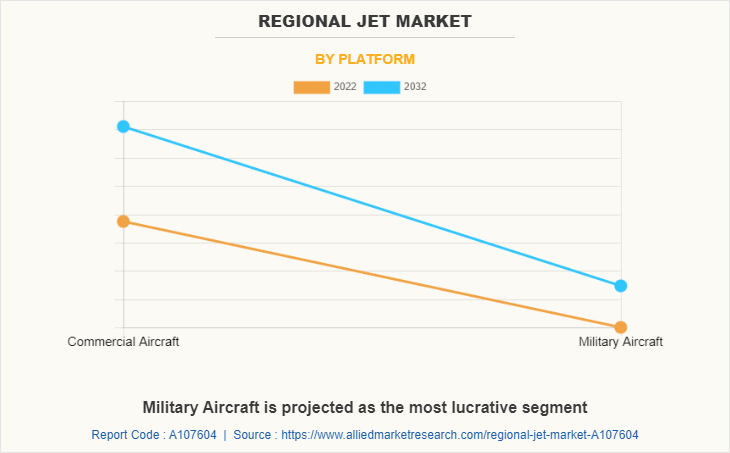

The regional jet market is segmented on the basis of platform, seating capacity, maximum take-off weight, and region. By platform, the market is segmented into commercial aircraft and military aircraft. Further, by seating capacity, the market is segmented into 15-80 seats and 80-125 seats.

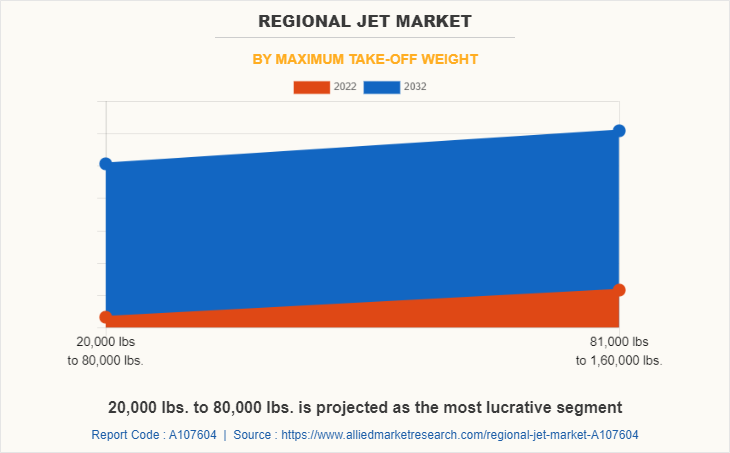

By maximum take-off weight, the market is segmented into 20,000 lbs. to 80,000 lbs. and 81,000 lbs. to 1,60,000 lbs. By region, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region.

North America includes countries such as the U.S., Canada, and Mexico. Regional airlines in North America are increasingly focusing on fleet modernization by replacing older aircraft with newer, more fuel-efficient regional jets. This trend is driven by the need to reduce operating costs, improve environmental sustainability, and enhance passenger comfort. Airlines are looking for aircraft with advanced technology, improved fuel efficiency, and reduced maintenance requirements.

Regional jets have been a significant segment within the commercial aviation industry, especially for short to medium-haul flights. They play a crucial role in connecting smaller cities and towns, providing essential air transportation services to regional markets.

Regional airlines, as well as major carriers, have utilized these jets to serve routes that may not be suitable for larger aircraft due to factors like runway length and passenger demand. In recent years, some key regional jet market manufacturers included Bombardier with its CRJ (Canadair Regional Jet) series, Embraer with its E-Jet family, Mitsubishi Aircraft Corporation with its Mitsubishi Regional Jet (MRJ), and Sukhoi Civil Aircraft Company with its Sukhoi Superjet 100.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In May 2023, Airbus through its Airbus Corporate Jets (ACJ) signed a partnership with CTT, a Swedish specialist on humidity control products for aviation to equip the ACJ TwoTwenty with a state-of-the-art cabin humidification system. The cabin air humidifier system raises the cabin humidity during cruise to a comfortable, ground-like level.

- In December 2022, Commercial Aircraft Corporation of China, Ltd. (COMAC) delivered the 100th ARJ21 aircraft. It is designed with 95 seats; all economy class & has a range of up to 3,700 kilometers.

- In July 2022, Airbus through its Airbus Corporate Jets (ACJ) delivered an ACJ319neo, offered by CFM International LEAP-1A engines, to a new West European undisclosed private customer from the final assembly line in Hamburg.

- In October 2021, ATR signed an agreement with NAC to lease four ATR 72-600 aircraft to Ireland's regional airline ramp operator of the Aer Lingus regional routes, Emerald Airlines.

Increase In Demand For Regional Connectivity

As air travel becomes more accessible and affordable, there is an increasing need to connect smaller cities and towns to larger hubs. Regional jets play a vital role in facilitating these connections by offering efficient and cost-effective transportation options. For instance, the ATR 72 is a popular turboprop regional aircraft that has been widely used by regional airlines around the world. It offers a perfect balance of passenger capacity and range, making it ideal for connecting smaller airports with major regional hubs. With its ability to operate on short runways and its cost-effective operations, the ATR 72 enables regional airlines to serve underserved markets profitably and meet the growing demand for regional connectivity.

In addition, the rise of low-cost carriers and the expansion of regional airline networks have further fueled the demand for regional connectivity. Airlines such as Flybe, SkyWest Airlines, and ExpressJet Airlines have expanded their regional jet fleets to cater to the growing demand for regional travel. As more passengers seek convenient and time-saving air travel options, regional jets play a crucial role in bridging the gap between smaller communities and major transportation hubs, enhancing regional connectivity, and facilitating economic development. Rise in demand for electrical components in aircraft

Fleet Renewal and Efficiency

Airlines strive to optimize their operations, reduce costs, and improve environmental sustainability. This driver is characterized by the replacement of older, less fuel-efficient aircraft with newer regional jets that offer enhanced performance and operational benefits. Many regional airlines are replacing older, less fuel-efficient aircraft with newer regional jets that offer improved fuel economy and reduced emissions.

For instance, the Bombardier CSeries, now known as the Airbus A220. The A220 offers significant fuel savings and lower operating costs compared to its predecessors. It incorporates advanced aerodynamics and fuel-efficient engines, making it an attractive choice for regional airlines looking to modernize their fleets. With its superior fuel efficiency and reduced environmental impact, the A220 helps regional airlines achieve sustainability goals while improving their bottom line.

Infrastructure Limitations and Airport Constraints

Regional jets offer the flexibility to operate in smaller airports and serve regional markets, the limited infrastructure and constraints at these airports can pose challenges for their growth and operation. For instance, many regional airports have shorter runways, limited taxiway and gate capacity, and inadequate terminal facilities. These limitations can restrict the ability of regional jets to operate efficiently, causing delays, congestion, and reduced operational flexibility. In some cases, regional jets may require modifications or face restrictions due to runway length or weight-bearing capacities.

Embracing Significant Improvements To Cabin Comfort At Reasonable Costs

There has been a shift in focus for original equipment manufacturers (OEMs) in the regional aircraft market, with a strong emphasis on enhancing cabin comfort to provide passengers with a seamless and enjoyable experience. Consequently, OEMs have prioritized noise reduction by integrating innovative technologies into both the engine and airframe.

For instance, the Mitsubishi SpaceJet was introduced by Mitsubishi Aircraft Corporation. The SpaceJet represents a significant breakthrough in the regional aviation market, setting unprecedented standards for cabin comfort through its advanced aerodynamic design and technology. With its sleek airframe, the SpaceJet offers exceptional noise reduction and fuel efficiency, elevating the level of passenger comfort to new heights.

After its maiden flight in 2015, the Mitsubishi SpaceJet is set to make its mark in the industry, with an expected rollout by 2021. The aircraft has already garnered significant attention, securing 203 pre-orders slated for delivery by 2022. By focusing on cabin comfort and incorporating state-of-the-art technologies, the Mitsubishi SpaceJet aims to redefine the regional aviation experience and meet the evolving expectations of passengers.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the regional jet market analysis from 2022 to 2032 to identify the prevailing regional jet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the regional jet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global regional jet market trends, key players, market segments, application areas, and market growth strategies.

Regional Jet Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.6 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 258 |

| By Seating Capacity |

|

| By Maximum Take-off Weight |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Airbus, Embraer, BAE Systems, Saab AB, ATR, Bombardier, De Havilland, Commercial Aircraft Corporation of China, Ltd., MITSUBISHI HEAVY INDUSTRIES, LTD., ANTONOV COMPANY |

The global regional jet market was valued at $5.7 billion in 2022, and is projected to reach $10.6 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

The upcoming trends of Regional Jet Market are increasing demand for regional connectivity, fleet renewal and efficiency and increased passenger air traffic.

The leading application of Regional Jet Market is Commercial Aircraft.

The largest regional market for Regional Jet market is North America

The top companies to hold the market share in Regional Jet include Airbus, Antonov Company, ATR, BAE Systems, Bombardier, Commercial Aircraft Corporation of China, Ltd., De Havilland, Embraer, MHI RI Aviation ULC, and Saab AB.

Loading Table Of Content...

Loading Research Methodology...