Regulatory Data Market Research, 2033

The global regulatory data market size was valued at $1.8 billion in 2023, and is projected to reach $9.1 billion by 2033, growing at a CAGR of 17.6% from 2024 to 2033. Regulatory data refers to the information and records maintained by organizations or government agencies to ensure compliance with laws and regulations. This market serves organizations that must adhere to legal, financial, environmental, and operational regulations set by governments, international bodies, and industry regulators. The primary focus is on ensuring accuracy, transparency, and efficiency in regulatory reporting, risk assessment, and compliance management.

As regulatory environments become increasingly complex, businesses rely on specialized regulatory data industry solutions to maintain compliance, avoid penalties, and streamline operational processes. The demand for these solutions has grown significantly due to the rise in frequency of regulatory updates, stricter enforcement, and increase in volume of data that organizations must manage. In additon, technological advancements play a critical role in the evolution of the regulatory data industry. The integration of artificial intelligence (AI), machine learning, and big data analytics enhances data accuracy, automates compliance processes, and provides predictive insights for regulatory risk management. Cloud-based platforms further facilitate seamless data integration and real-time monitoring, allowing businesses to respond swiftly to regulatory change.

Key Takeaways:

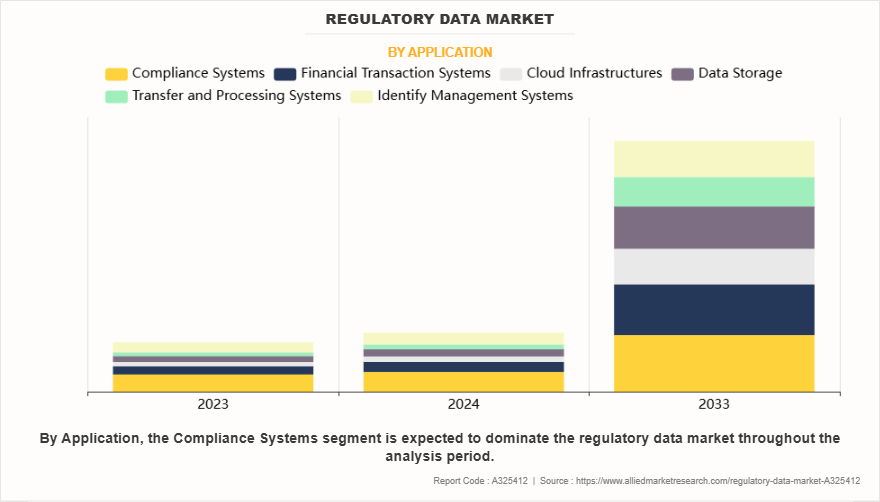

By application, the compliance system segment held the largest share in the regulatory data market for 2023.

By organization size, the large enterprise segment held the largest share in the regulatory data market for 2023.

By industry vertical, the others segment held the largest share in the regulatory data market for 2023.

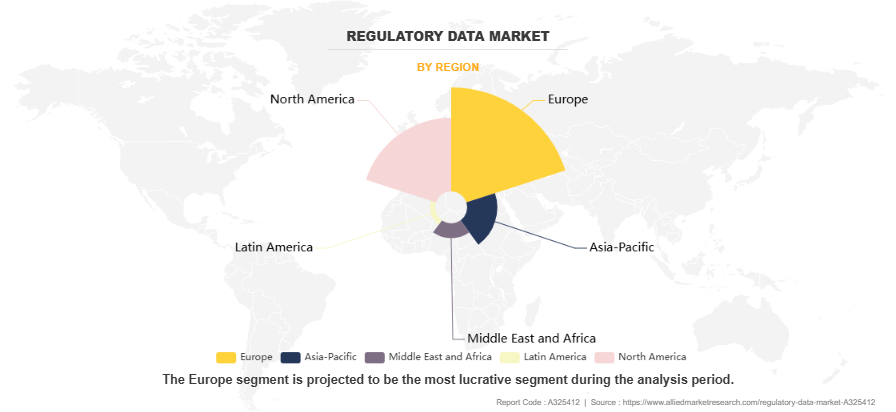

Region-wise, Europe held largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Segment Review

The regulatory data market size is segmented on the basis of application, organization size, industry vertical, and region. By application, it is classified into compliance systems, financial transaction systems, cloud infrastructures, data storage, transfer & processing systems, and identify management systems. By organization size, the market is bifurcated into small & medium-sized enterprises and large enterprises. By industry vertical, the market is divided into BFSI, healthcare, IT & telecommunication, energy & utilities, retail & e-commerce, manufacturing, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, Latin America, and MEA.

On the basis of application, the compliance system segment attained the highest growth in 2023. This is attributed to increasing regulatory requirements, advancements in AI-driven compliance solutions, and a rising focus on risk management across industries. On the other hand, the cloud infrastructure segment is attributed to be the fastest-growing segment during the forecast period, driven by increasing adoption of cloud-based compliance solutions, scalability, and the need for real-time regulatory data processing. This increasing demand for efficient compliance solutions is driving the growth of the regulatory data market.

Region wise, the regulatory data market was dominated by Europe in 2023 and is expected to retain its position during the forecast period, owing to strong its strict data protection laws, such as the General Data Protection Regulation (GDPR), and strong regulatory frameworks across industries like finance, healthcare, and energy. European businesses and government institutions are required to comply with complex legal requirements, driving the demand for regulatory data solutions. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to rapid economic growth, increasing digitalization, and evolving regulatory frameworks. As industries in countries like China, India, and Japan expand, there is a rising need for businesses to comply with new and evolving regulations, particularly in finance, manufacturing, and data privacy, further expected to contribute to the growth of the market in this region.

Competition Analysis

The report analyzes the profiles of key players operating in the regulatory data market share such as Refinitiv, Bloomberg, IBM Corporation, Moody's Analytics, MetricStream, Accenture, Oracle Corporation, SAP SE, SAS Institute, Finastra, Experian Inc., Veeva Systems, Inc., Wolters Kluwer N.V., COMPLY, IQVIA Inc., compliance.ai, Regology, RegDesk, Inc., QbD Group and CUBE Content Governance Global Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the regulatory data market.

Recent Product Launch in the Regulatory data Industry

For instance July 2021, Refinitiv upgraded its post-trade regulatory reporting capabilitiesthrough a partnership with Xinthesys LLC that enablessell-side tradersto potentiallysave costs with a single and fully integrated platform for trade reporting. Refinitiv’sintegration of Xinthesys’ ADEPT SaaS platform allows broker-dealers accessto critical regulatory risk management toolsthrough a 360-degree view of their trading and reporting data.

Top Impacting Factors

Driver

Increasing Regulatory Complexity

Surge in complexity of global regulations drives the regulatory data market growth. Governments and regulatory bodies continuously introduce new laws, policies, and reporting requirements across various industries, such as finance, healthcare, and pharmaceuticals. Organizations must keep up with evolving compliance mandates, such as GDPR in Europe, CCPA in the U.S., and financial reporting standards such as Basel III. As a result, businesses require sophisticated regulatory data market demand solutions to track, analyze, and implement regulatory changes efficiently. Failure to comply with these regulations lead to hefty fines, reputational damage, and operational disruptions, making regulatory data management a top priority for organizations. With regulations varying across jurisdictions and industries, businesses need centralized, automated platforms that provide real-time regulatory intelligence and data governance. Traditional manual tracking methods are no longer sufficient to handle the increasing volume and complexity of regulatory changes. AI-powered regulatory data market forecast solutions help companies monitor regulatory updates, assess compliance risks, and automate reporting processes.

Advancementsin AI and Automation

The rapid advancements in artificial intelligence (AI) and automation are significantly driving the growth of the regulatory data market insights. With regulatory requirements becoming increasingly complex and dynamic, organizations need faster, more efficient ways to track, analyze, and comply with constantly changing regulations. AI-powered regulatory data solutions leverage natural language processing (NLP), machine learning, and predictive analytics to automate the identification and interpretation of regulatory changes across jurisdictions. This reduces the reliance on manual processes, saving time and reducing compliance risks. By using AI, companies can quickly assess the impact of new regulations on their operations and take proactive measures to ensure compliance. Automation also plays an important role in streamlining compliance workflows and reducing operational costs. Traditional regulatory data management methods involve manual tracking of legal updates, regulatory filings, and compliance reporting, which are time-consuming and prone to errors.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the regulatory data market analysis from 2023 to 2033 to identify the prevailing regulatory data market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the regulatory data market segmentation assists to determine the prevailing regulatory data market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global regulatory data market trends, key players, market segments, application areas, and market growth strategies.

Regulatory Data Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9.1 billion |

| Growth Rate | CAGR of 17.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 431 |

| By Application |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Veeva Systems, Inc., CUBE Content Governance Global Limited, Refinitiv, Accenture, COMPLY, Finastra, Regology, MetricStream., Compliance.ai, SAS Institute, QbD Group, IBM Corporation, Moody's Analytics, Bloomberg, Experian Inc., RegDesk, Inc., Oracle Corporation, Wolters Kluwer N.V., IQVIA Inc., SAP SE |

Analyst Review

The regulatory data market has experienced significant growth as industries face increase in regulatory complexities and compliance demands. Organizations across sectors such as finance, healthcare, pharmaceuticals, energy, and telecommunications must navigate evolving legal frameworks, making efficient regulatory data management essential. This market provides solutions for data collection, processing, validation, and reporting, enabling businesses to comply with stringent regulations while mitigating legal and financial risks. With rise in regulatory oversight, companies must ensure transparency, accountability, and adherence to governance standards. Financial institutions depend on regulatory data for Anti-Money Laundering (AML), Know Your Customer (KYC), and fraud detection, while industries such as healthcare and pharmaceuticals require it for patient safety, clinical trials, and compliance reporting. As regulations become more stringent and data volumes grow, businesses increasingly invest in automated and data-driven compliance solutions to enhance efficiency and reduce costs. Technological advancements have restructured the regulatory data landscape. Artificial intelligence (AI), machine learning, and big data analytics have improved data accuracy, streamlining compliance processes and providing predictive insights into regulatory risks. Cloud-based platforms have further enhanced real-time data integration, allowing organizations to stay agile in responding to regulatory changes. These innovations help businesses manage compliance more effectively while minimizing operational disruptions. For instance, in July 2024, Regnology, a leading software provider with a focus on regulatory reporting solutions, partnered with Regdata, a developer of data security. This collaboration aims to enhance end-to-end data security and provide a secure pathway for the end-to-end operation of Regnology Regulatory Tax (“RegTax”), keeping critical banking data fully protected. RegTax solution delivers tax control and reporting compliance across financial institutions and their branches through a centralized model. The solution covers reporting to tax authorities and several domestic regimes for 140 countries, offering powerful features such as automated corrections, reconciliation, and secured submissions of the deliveries. The solution is hosted on Rcloud, Regnology’s deployment platform powered by Google Cloud.

$9.1 billion was the estimated industry size of the Regulatory Data Market in 2033.

Increasing regulatory complexity and advancements in AI and automation are the upcoming trends in the regulatory data market worldwide.

Compliance systems are the leading application in the regulatory data market.

Europe was the largest regional market for Regulatory Data in 2023.

Wolters Kluwer N.V., Refinitiv, Bloomberg, Oracle Corporation, IBM Corporation, SAP SE, Moody's Analytics, SAS Institute, CUBE Content Governance Global Limited, MetricStream., Finastra, Experian Inc., Veeva Systems, Inc., Accenture, COMPLY, Regology, RegDesk, Inc., QbD Group, IQVIA Inc., Compliance.ai are the top companies to hold the market share in Regulatory Data.

Loading Table Of Content...

Loading Research Methodology...