Relief And Aid Transportation Logistics Market Research, 2033

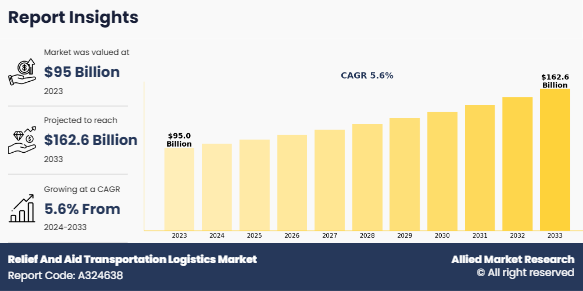

The global Relief And Aid Transportation Logistics Market Size was valued at $95 billion in 2023, and is projected to reach $162.6 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033.

Increasing penetration of the Internet of Things (IoT) in the logistics sector enables freight companies and consumers to have direct access to the company network via the internet. The logistics infrastructure is constantly upgraded to meet the need. Increasing use of artificial intelligence (AI), machine learning, radio-frequency identification (RFID), and Bluetooth, coupled with other newly introduced technologies, such as drone delivery and driverless vehicles, is being witnessed in logistics services. These growing technological advancements act as the catalyst to the growth of the logistics market size. In addition, some of the logistics companies across the world are increasing their spending and using technologically advanced systems for logistics enhancement, which are further expected to propel the growth of the logistics market. For instance, SimpliRoute, an urban logistics solution, raised $3 million in funding to improve its AI-powered logistics platform.

Highlights of the Report

- The Relief And Aid Transportation Logistics Market Size report provides exclusive and comprehensive analysis of the global Relief And Aid Transportation Logistics Industry trends along with the market forecast.

- The report elucidates the Relief And Aid Transportation Logistics Market Opportunity along with key drivers and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessments by industry analysts.

- Porter's five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the Relief And Aid Transportation Logistics Industry analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the market growth.

The new funding will help the startup to grow its logistics intelligence platform and expand to other countries besides Mexico, Chile, Peru, and Uruguay. In addition, AT&T provides Internet of Things (IoT) solutions for Honeywell's transport and logistics offerings internationally in countries across Europe, North America, Latin America, Asia, Africa, and Australia.

However, logistics demands good infrastructure, supply chain, and trade facilitation. Without these, firms must build up more stock reserves and working capital, which can strongly affect national and regional competitiveness due to high financial costs. In addition, lack of infrastructure hinders the logistics market as it increases costs and reduces supply chain reliability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of logistics professionals. For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of the region's roads are unpaved. Further, inconsistency in the address and postal system is the other challenge for parcel delivery in Latin American countries. As many countries lack postal codes and rely on local landmarks for addresses, shipping companies often have trouble delivering parcels successfully. Moreover, logistics costs are heavily determined by the availability and quality of infrastructure. Infrastructure directly influences transport costs and indirectly affects the level of inventories, and consequently financial costs.

Thus, owing to poor transport infrastructure, firms need to have high levels of inventories to account for contingencies, which can result in higher overall logistics cost. Therefore, poor infrastructure along with high inventory prices and insufficient warehousing space are expected to hamper the logistics market growth.

Collaborative partnerships between governments, NGOs, and private sectors are pivotal in enhancing the efficiency and scalability of aid and relief logistics. By pooling resources and expertise, these partnerships streamline logistical operations, ensuring faster response times and more effective distribution of aid during emergencies. For instance, the partnership between the United Nations Children's Fund (UNICEF), various national governments, and pharmaceutical companies significantly improved the delivery of vaccines and medical supplies to underserved regions, particularly during the COVID-19 pandemic. Such collaborations optimize resource allocation as well as foster innovation in logistics technologies and practices, driving market growth. The ability to leverage diverse strengths from each sector ensures that logistical challenges are met comprehensively, thereby strengthening global disaster preparedness and response capabilities.

Segmental Overview

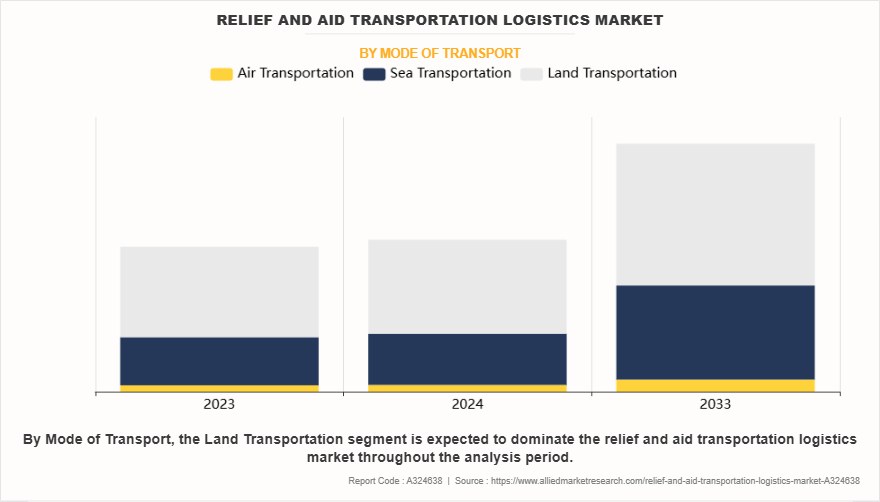

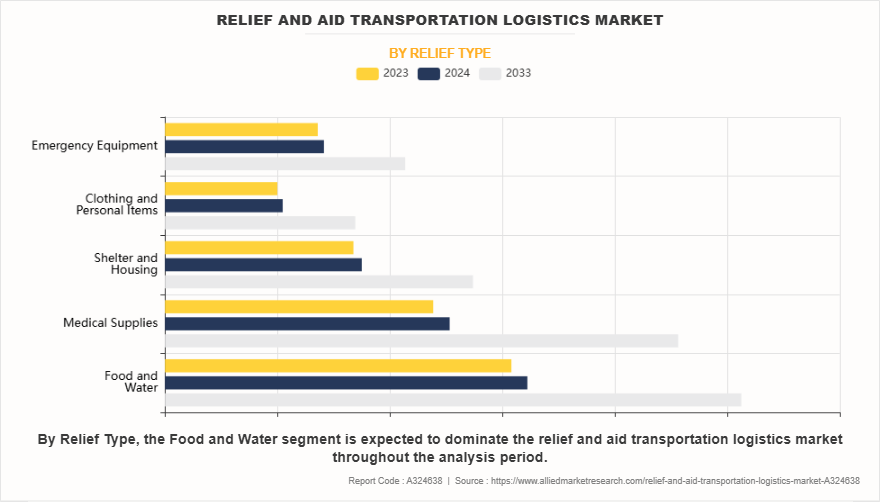

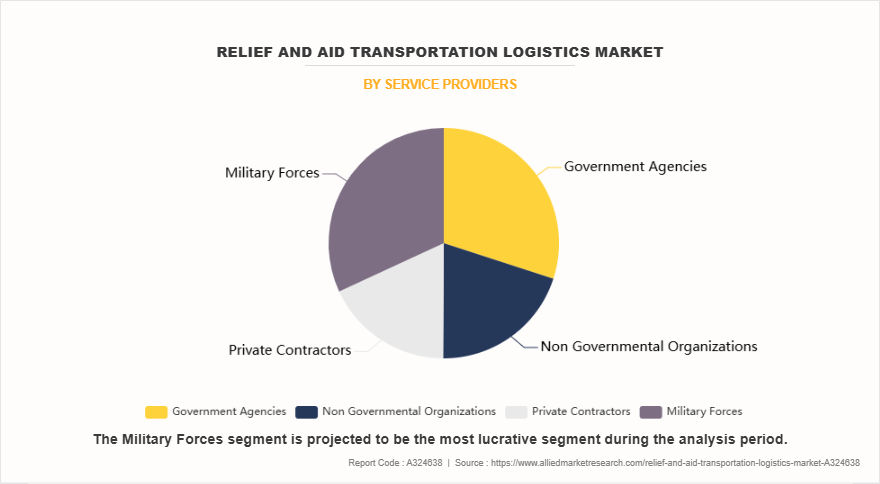

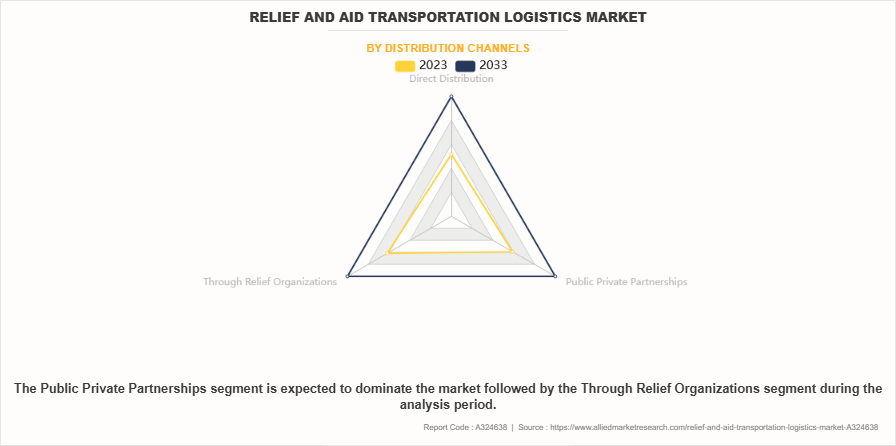

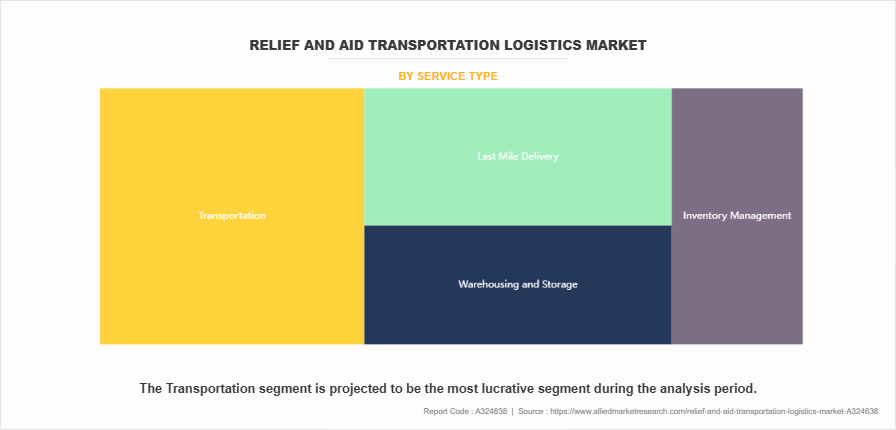

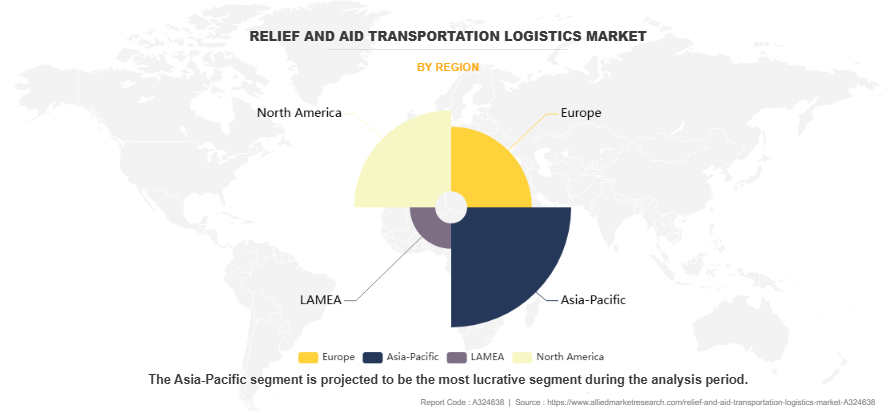

The Relief and Aid transportation logistics market is segmented based on mode of transport, relief type, service providers, distribution channels, service type, and region. Based on mode of transportation, the market is classified into air transportation, sea transportation, and land transportation. Based on relief type, the market is categorized into food and water, medical supplies, shelter and housing, clothing and personal items, and emergency equipment. Based on service provider, the market is further divided into government agencies, non-governmental organizations, private contractors, and military forces. Based on distribution channel the market is categorized into direct distribution, through relief organizations, and public-private partnerships. Based on service type, the market is classified into transportation, warehousing and storage, inventory management, and last mile delivery. Based on region the market is sub divided into North America, Europe, Asia-Pacific, and LAMEA.

By mode of transportation, land transportation segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. Land transportation enables the delivery of essential supplies to remote and hard-to-reach areas where other modes of transportation might not serve effectively. The flexibility of trucks and other land vehicles allows for quick response times and adaptability to various terrains and conditions, ensuring timely distribution of aid.

By relief type, food and water segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. Factors such as escalating frequency of natural disasters and humanitarian crises, which heighten demand for robust logistics solutions, drive the growth of the market. Innovations in packaging, such as lightweight and biodegradable materials, are also driving market development. Opportunities are emerging from public-private partnerships aimed at enhancing disaster response capabilities.

By service provider, military forces segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. Military forces serve as key providers in the relief and aid transportation logistics market due to their robust infrastructure, strategic positioning, and rapid response capabilities. Their extensive logistical networks, including air, land, and sea transport, enable swift deployment of personnel and resources to disaster-stricken areas globally. This reliability stems from their training in crisis management and operational efficiency, making them indispensable during humanitarian crises.

By distribution channels, through relief organizations segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. Through relief organizations, such as NGOs and international aid agencies, serves as a crucial distribution channel in the relief and aid transportation logistics market. These organizations possess extensive networks and expertise in coordinating the procurement, storage, and distribution of relief supplies to disaster-affected regions worldwide.

By service type, the transportation segment had the dominating Relief And Aid Transportation Logistics Market Share in the year 2023 and is likely to remain dominant during the forecast period. Transportation services play a critical role in aid and relief logistics, facilitating the timely and efficient delivery of essential supplies to disaster-stricken areas worldwide. Key trends include the integration of advanced tracking and monitoring technologies to enhance supply chain visibility and optimize route planning. Relief And Aid Transportation Logistics Market Growth is driven by rise in Relief And Aid Transportation Logistics Market Demand for rapid response capabilities, particularly in regions prone to natural disasters or conflict.

By region, the North America region dominated the global market in the year 2023 and is likely to remain dominant during the Relief And Aid Transportation Logistics Market Forecast period. In North America, th e relief and aid transportation logistics market is experiencing significant innovation and growth, driven by advanced technologies and strategic initiatives by key market players. One notable trend is the incorporation of Artificial Intelligence (AI) in logistics planning, with companies like FedEx leading the way.

Key Players included in the relief and aid transportation logistics market analysis are Bollore Logistics SAS, CEVA Logistics, Express Freight Management, DHL International GmbH, IFRC, BLUE WATER SHIPPING, Move One INC, Kuehne+Nagel Inc., Red Arrow Logistics, and DSV.

- April 2024, DHL Group expanded the GoHelp program in Europe to provide global relief efforts in disaster areas. This program covers all global disaster hotspots in Europe. Furthermore, it also started its Disaster Response Team (DRT) at the Istanbul International Airport. The DRTs deploy to airports in need when called upon by the United Nations Office for the Coordination of Humanitarian Affairs.

- April 2023, DHL Group shipped more than 60,000 care packages free of charge from Germany to Ukraine. Through this strategy, DHL initiated a campaign where private customers could send care packages free of charge to support people who are in urgent need of food, medical products, household items(such as blankets) and hygiene articles(such as diapers).

- March 2023, DHL Group, through its subsidiary DHL Supply Chain, collaborated with American Red Cross Humanitarian Mission through the Disaster Responder Program with an annual pledge of $250 million. In addition to providing financial support, DHL Supply Chain deploys employees to work in Red Cross disaster warehouses around the country when disasters strike.

- July 2022, DHL Group partnered with Blue Dart Disaster Response Team to provides support for relief goods in Assam, India. DHL & Blue Darts disaster response team facilitated delivery of 30 tones of relief material to warehouse in Guwahati.

- March 2021, CEVA Logistics acquired Spedag Inter freight company, leading freight logistics companies in East Africa. Through this acquisition, CEVA Logistics continued to expand in the Africa country. Spedag Inter freight is one of the logistics providers in East Africa that is engaged in transpiration of energy and infrastructure, aid and relief, oil and gas, and commodities.

- March 2021, CEVA Logistics collaborated with Singapore Changi Airport community to transport oxygen concentrators from the U.S. to Indonesia via Singapore. Through this shipment, CEVA logistics delivered more than 14,000 kilograms of oxygen concentrators to Indonesia.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the relief and aid transportation logistics market analysis from 2023 to 2033 to identify the prevailing relief and aid transportation logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the relief and aid transportation logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global relief and aid transportation logistics market trends, key players, market segments, application areas, and market growth strategies.

Relief And Aid Transportation Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 162.6 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Mode of Transport |

|

| By Relief Type |

|

| By Service Providers |

|

| By Distribution Channels |

|

| By Service Type |

|

| By Region |

|

| Key Market Players | Express Freight Management, Bollore Logistics SAS, IFRC, Move One INC, Blue Water Shipping, DHL Group, Red Arrow Logistics, DSV, CEVA Logistics, Kuehne Nagel |

Analyst Review

The Relief and Aid Transportation Logistic Market is an essential and rapidly evolving sector that demands the utmost efficiency and innovation. At its core, this market involves the management and coordination of the transportation and distribution of critical humanitarian aid to areas affected by natural disasters, conflicts, and other crises.

One significant trend shaping the sector is the increasing adoption of digital transformation initiatives. Companies like Maersk have pioneered digital platforms that optimize supply chain operations, facilitating faster and more accurate delivery of humanitarian aid. These innovations not only streamline logistics processes but also improve transparency and accountability, crucial in crisis scenarios. Such digital advancements are projected to foster the market significantly over the forecast period, enhancing overall operational effectiveness.

Moreover, collaborative partnerships between governments, NGOs, and private entities are driving market expansion. Organizations like the World Food Programme (WFP) have partnered with logistics giants such as DHL to improve last mile delivery capabilities. These partnerships leverage combined expertise to overcome logistical challenges and deliver aid quickly to affected regions, thereby enhancing disaster response capabilities. Such collaborations not only optimize resource utilization but also foster innovation in logistics strategies, positioning the market for sustained growth.

Furthermore, sustainability has emerged as a critical focus area in aid logistics. Companies like Aramex are pioneering green logistics initiatives by integrating electric vehicles and sustainable packaging solutions into their operations. These eco-friendly practices not only reduce carbon footprints but also align with global environmental goals, presenting new opportunities for market expansion amidst increasing emphasis on sustainable development.

The global relief and aid transportation logistics market was valued at $91.3 billion in 2023, and is projected to reach $156.2 billion by 2033, registering a CAGR of 5.6% from 2024 to 2033.

The Relief and Aid Transportation Logistics market is product type, and region. 2024-2033 would be the forecast period in the market report.

The passenger segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Relief and Aid Transportation Logistics market were valued at $91.3 billion in 2023.

The Relief and Aid Transportation Logistics market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Relief and Aid Transportation Logistics market report.

The top companies that hold the market share Bollore Logistics SAS, CEVA Logistics, Express Freight Management, and DHL International GmbH.

Loading Table Of Content...

Loading Research Methodology...