Remittance Market Research, 2032

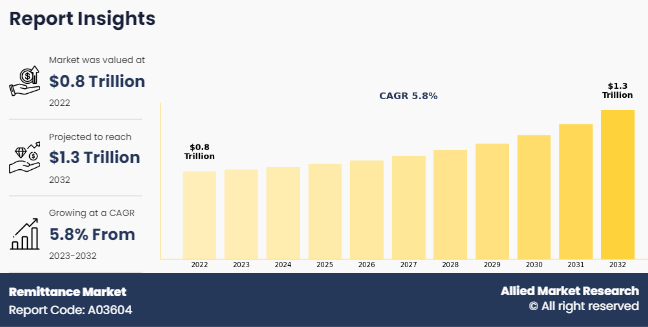

The global remittance market was valued at $784.25 billion in 2022 and is estimated to reach $ 1,329.92 billion by 2032, exhibiting a CAGR of 5.8% from 2023 to 2032.

Remittance is referred to as sending of money by foreign migrant cross border to another person via electronic payments, drafts, and check. In addition, the majority of remittance services providers are focusing on digital remittance to enhance their business and provide customers with easier and quicker transferring services. Numerous benefits of using digital channels such as high speed, availability of digital channels 24 hours a day, transparency, ease of use, high security, and others, for sending money create numerous opportunities for the remittance market.

KeyTakeaways

- By application, the consumption segment accounted for the largest remittance market share in 2022.

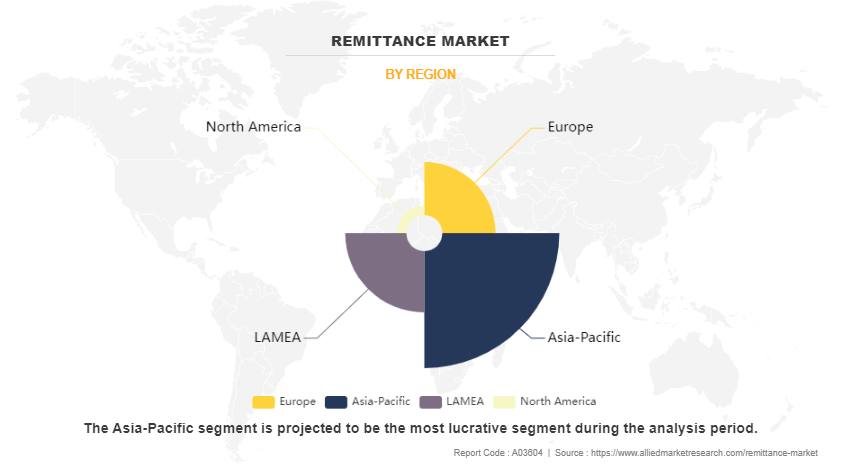

- Region-wise, North America generated the highest revenue in 2022.

- By remittance channel, the money transfer operator segment accounted for the largest remittance market share in 2022.

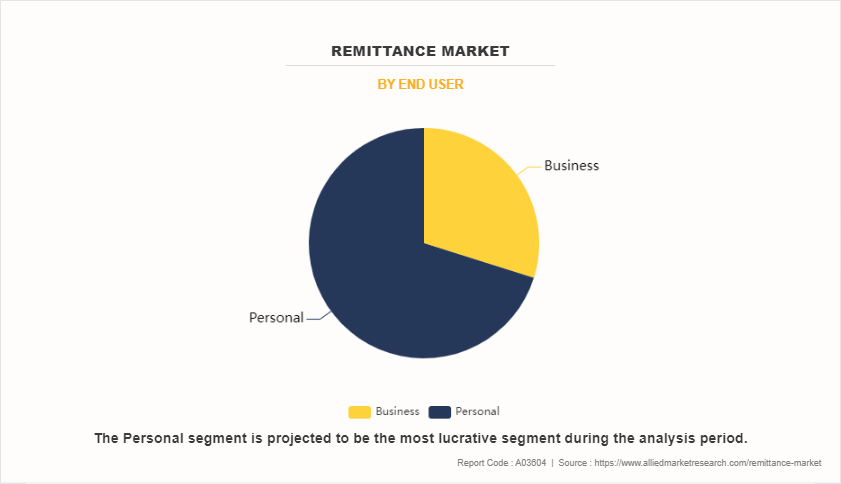

- Depending on the end user, the personal segment generated the highest revenue in 2022.

The increase in cross-border transactions and mobile-based payment channels, along with lower remittance cost & money transfer time drive the growth of the market. In addition, the rise in the adoption of banking & financial sectors across the globe fuels the growth of the market. However, a lack of awareness of digital remittance and stringent regulations to prevent rapid growth is expected to impede market growth.

Furthermore, continuous technological innovations in the digital remittance industry as well as a rise in internet and mobile penetration are expected to provide lucrative opportunities for remittance market growth.

Segment Review

The global remittance market size is segmented based on application, remittance channel, end user, and region. In terms of application, the market is classified into consumption, savings, and investments. By channel, it is divided into banks, money transfer operators, and others. By end user, is divided into business and personal. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on end user, the personal segment dominated the remittance market share in 2022 and is expected to continue this trend during the forecast period, owing to the rise in usage of digital payment channels and mobile money services, which has made it easier and more convenient for individuals to send money to their loved ones across borders these type of remittance segment led the market. However, the business segment is expected to witness significant growth in the upcoming years owing to an increase in the use of digital channels to receive money from their clients abroad.

Region-wise, the remittance market was dominated by Asia-Pacific in 2022 and is expected to retain its position during the forecast period owing to the presence of some prominent players in the remittance market, such as Bank of America Corporation and Citigroup, Inc. Moreover, fintech companies in North American countries are aggressively partnering with prominent players to leverage their capabilities. However, Asia-Pacific is expected to witness significant growth during the forecast period. The growth is attributed to the fact that the major remittance recipient countries, such as India, the Philippines, and China, are located in Asia-Pacific. Moreover, several remittance service providers in the region have made efforts to capture the booming regional industry. Thus, these factors are expected to witness considerable growth during the forecast period.

The key remittance companies profiled in the remittance market analysis are Bank of America, Citigroup Inc., JPMorgan Chase & Co., MoneyGram International, Inc., RIA Financial Services Ltd., TransferWise Ltd., UAE Exchange, Wells Fargo, Western Union Holdings Inc. and XOOM. These players have adopted various strategies to increase their market penetration and strengthen their position in the remittance industry.

Market Landscape and Trends

The remittance market has witnessed significant growth in recent years, driven by several key factors and evolving trends. In addition, with increasing awareness about the importance of preventive healthcare measures, insurance providers are integrating wellness and activity-based programs into their offerings. These programs incentivize policyholders to adopt healthier lifestyles by rewarding them for participating in activities such as regular exercise, health screenings, and nutrition counseling. Moreover, advancements in technology, particularly wearable devices, and mobile apps, have revolutionized the remittance market. Insurers leverage data collected from these devices to track policyholders' health metrics in real time, allowing for personalized health interventions and more accurate risk assessments.

Competition Analysis

Recent Strategies in the Global Remittance Market

April 3, 2024: MoneyGram International, Inc., a leading global financial technology company that connects the world's communities, announced a new partnership with Tencent Financial Technology, the fintech division of Tencent. The partnership enables consumers to send funds through MoneyGram Online, MoneyGram's leading direct-to-consumer website and app, directly to recipients' Weixin Pay wallet, a leading payment and digital wallet service in China.

May 27, 2021, Ria Money Transfer announced the extension of its distribution network through a strategic collaboration with Mooney, one of Italy's foremost proximity banking and payments companies. This partnership enables Ria to deliver its key principles of the remittance sector by increasing convenience, simplicity, and value for money to Mooney's nationwide coverage in Italy of approximately 45,000 points of sale and 20 million customers who make more than 200 million transactions per year.

On November 12, 2021, The Western Union Company, a global leader in cross-border, cross-currency money movement and payments, and Mastercard, a global technology company in the payments industry, bolstered their decade-long strategic partnership. The partnership expanded Mastercard Send integration into Western Union's global money movement network, and also Mastercard's Cross-Border Services delivery via Western Union Business Solutions.

Top Impacting Factors

Rise in Cross-border Transactions and Mobile-based Payment Channels

Rise in cross-border transactions and move toward mobile banking and mobile-based payment solutions dominate payment trends in Asia-Pacific, which is expected to drive the growth of the remittance market. For instance, in 2021 Malaysia is undergoing major shift from paper to electronic methods of payment to support initiatives taken by Bank Negara Malaysia to accelerate migration to electronic payment. Furthermore, in February 2024, Visa signed an agreement with an Egyptian Banks Company and introduced innovative solutions around electronic payment services, digital wallets, and other offerings. The partnership aims to expand the scope of instant payments and streamline the receipt of international remittances from Egyptian expatriates.

Furthermore, a number of banks are striving to deliver timely cross-border remittances and value-added services using a relationship-centric approach, which fuels the growth of the remittance market. For instance, in January 2021, Bank of China (Hong Kong) Limited made continuous technological investments in its ‐BOC Remittance Plus‐ product, which is designed to accommodate the requirements of United States dollar (USD) and Hong Kong dollar (HKD) cross-border remittances. This remittance product provides same-day credit to the ultimate beneficiary via different payment channels such as internet banking, Swift, and branch counters.

Reduced Remittance Cost & Transfer Time

Adoption of digital transfer network such as mobile phone technology, mobile money, digital currencies, distributed ledgers, and electronic identification to remit money has made cross-border payments negligible in cost, instant, auditable, and accessible to everyone. The adoption of digital remittance is projected to reduce the dependency on cash agents in both the send and receive countries, which currently contribute toward sustaining high transaction fees. Moreover, it is projected to address many risks, barriers, and costs associated with know-your-customer (KYC) and security. Hence, banks and money transfer operators adopt digital technology to offer remittance services at significantly lower costs than traditional over-the-counter services, which increases penetration of digital remittance across the globe.

Moreover, the integration of new technology and government-led awareness campaigns drastically reduces remittance costs. This reduction is expected to drive the adoption of digital remittance. For instance, Transparency initiatives such as SendMoneyPacific, which enable remittance senders to compare high remittance prices and learn about the benefits of innovative digital remittance providers. In addition, mobile apps and digital wallets enable users to send and receive money anytime and anywhere. For instance, in March 2024, Australian digital wallet provider and payment startup Stables launched international remittances that is expected to help 130 countries send Australian Dollars or Philippine Pesos to over 140 million people across Australia and the Philippines, all powered by stablecoins. This is expected to boost the awareness of digital remittance among the consumers.

Restraints

Stringent Regulations to Prevent Rapid Growth

The remittance market is subject to stringent regulatory requirements and AML measures to prevent illicit financial activities, including money laundering and terrorism financing. In addition, compliance with these regulations is complex and costly for remittance service providers, particularly smaller operators who struggle to meet the necessary regulatory standards. Compliance efforts lead to increased transfer costs and delays in processing remittances. Such factors restrain market growth.

Lack of Awareness for Digital Remittance

Lack of awareness & guidance is a major factor that restrains people from opting for digital remittance transfer mode. The market share of digital-only providers is still relatively small despite the development of the Internet and rise in mobile penetration offer opportunities to digitize remittance origination. For instance, in 2023, according to international journal research around 69% are aware and using digital payment method. Only 31% have never used a digital payment system. Cash is the dominant method of payment in Asia despite the many digital alternatives such as Alipay. Moreover, the survey found people are reluctant to steer away from cash due to a lack of available information on digital wallets. Furthermore, lack of awareness about technologies, such as use of blockchain technology in making their businesses restricts the growth of the market.

Opportunities

Technological Innovations in the Digital Remittance Industry

Technological innovations in the digital remittance industry in this region primarily to provide user-friendly apps, smarter ways to connect to domestic payment systems are expected to provide growth opportunities for the remittance market. Money transfer companies of Asia-Pacific partner with mobile money providers for remittance payouts and with the companies, which use cryptocurrencies as an instant settlement mechanism. For instance, in August 2022, Trustly, an open banking payments company, partnered with Conotoxia, a Poland-based multi-currency company, to provide users with a secure, fast, and safe method to transfer money internationally via their bank accounts. The partnership aimed at allowing future and current customers to benefit from improved flexibility when remitting money into North America. Such initiatives are expected to boost market growth.

Furthermore, integration of technologies such as artificial intelligence, machine learning, and remote digital identity verification offers potentially more efficient ways to comply with the broad and fragmented regulatory requirements, which characterize the industry and deliver better service to customers. For instance, in April 2024, MoneyGram International, Inc partnered with Tencent Financial Technology, the fintech division of Tencent. The partnership enables consumers to send funds through MoneyGram Online, MoneyGram's leading direct-to-consumer website and app, directly to recipients' Weixin Pay wallet.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the remittance market forecast from 2022 to 2032 to identify the prevailing remittance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the remittance market outlook segmentation assists to determine the prevailing market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global remittance market trends, key players, market segments, application areas, and market growth strategies.

Remittance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.3 trillion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Remittance Channel |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | MoneyGram., Xoom, Wells Fargo, Wise Payments Limited, Western Union Holdings, Inc., Bank of America Corporation, UAE Exchange Centre Co., Citigroup Inc., JPMorgan Chase & Co., Ria Financial Services. |

| COMPANY PROFILES: STARTUP’S | AZIMO LTD., .CWALLET, DENARII CASH, INSTAREM INDIA PVT. LTD., NOW MONEY, REMITNOW, .REMITR, SCI VENTURES, INC., SENDAH, SURECASH |

Analyst Review

According to top level CXOs, the adoption of remittance services has increased over time, due to migration of population to other countries for job and business and evolving supportive government regulations across the globe. In addition, the penetration of digital financial services has increased in the Asia-Pacific region in the last few years, which is an important development in the process of transformation for remittance market.

Furthermore, as per the discussions with the CXOs of leading companies, it was found that the remittance market is highly fragmented and competitive, owing to the presence of well-diversified remittance channels. However, continuous increase in presence of digital remittance providers makes the marketplace highly competitive. For instance, in December 2022, RSM Canada LLP, a leading global provider of audit, tax and consulting services, announced that it entered into a reseller partnership with Vic.ai, the artificial intelligence (AI) platform for accounting productivity and financial intelligence. RSM, a longtime Vic.ai customer, is expected to offer Vic.ai solutions to its clients, which include entities in financial services, facilities services, hospitality, and the nonprofit sector. Therefore, such strategies are expected to boost the growth of the remittance market in the upcoming years.

In addition, with the surge in demand for remittance, various companies have expanded their current product portfolio to continue with the rising demand for digital services in the market. For instance, in April 2024, QicSEND, a leading Canadian fintech company regulated by FINTRAC, launched RoundUp, an innovative remittance service designed exclusively for the Canada-to-India corridor, with a specific focus on Indian students in Canada. This strategic development is expected to drive market growth

Similarly, in January 2024, Arab Bank and Mastercard announced the launch of cross-border payment services RemitEx. The new collaboration leverages Mastercard's Cross-Border Services platform to provide a remittance product that is likely to enable Arab Bank’s customers to make faster, safer, and full-value transfers without fees for the recipient. This strategic development is expected to drive market growth.

Continued Digital Transformation is the upcoming trends of Remittance Market in the world

Consumption is the leading application of Remittance Market.

Asia-Pacific is the largest regional market for Remittance.

$1,329.92 billion by 2032 is the estimated industry size of Remittance

The key players profiled in the remittance market analysis are Bank of America, Citigroup Inc., JPMorgan Chase & Co., MoneyGram International, Inc., RIA Financial Services Ltd., TransferWise Ltd., UAE Exchange, Wells Fargo, Western Union Holdings Inc. and XOOM. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...

Loading Research Methodology...