Remote Deposit Capture Market Research, 2033

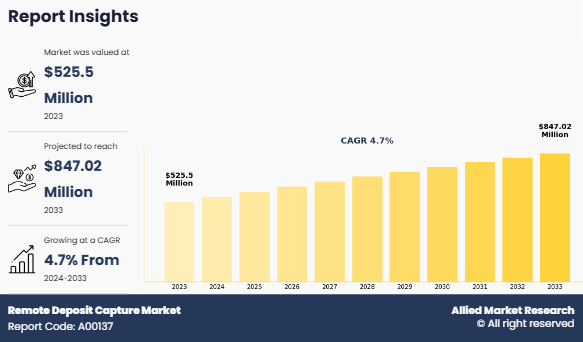

The global remote deposit capture market was valued at $525.5 million in 2023, and is projected to reach $847 million by 2033, growing at a CAGR of 4.7% from 2024 to 2033. Remote deposit capture (RDC) is a technology that allows users to deposit checks into their bank accounts using a mobile application without physically visiting a bank or ATM. This technology transforms the check deposit process into a digital format, where the user captures an image of the check using the camera of their mobile device. The image and relevant check data are then transmitted to the bank for processing and then money is deposited to the account. The demand for remote deposit capturing service is increasing among consumers, as it reduces the time required to deposit check. Along with time saving of consumers, it eliminates the need of photocopying checks & buying deposit slips as well as prevents unnecessary bank visits. Hence, remote deposit capture services are more popular among consumers, retailers, and small & medium organizations.

In addition, increase in adoption of smartphones and digital banking platforms boosted the remote deposit capture (RDC) market. With the growing use of mobile devices, consumers can now access banking services anytime and anywhere, without needing to visit a branch. This convenience has led to rise in demand for remote deposit capture solutions, as people look for simple ways to deposit checks remotely. Mobile banking apps with remote deposit capture features allow customers to easily take photos of their checks and submit them for deposit, improving the overall experience of the people. Thus, increasing shift toward contactless and digital financial transactions is driving the growth of the remote deposit capture market.

Segment Review

The remote deposit capture market is segmented on the basis of component, deployment mode, enterprise size, and region. By component, it is classified into solution and service. By deployment mode, the market is bifurcated into on-premise and cloud. By enterprise size, the market is segmented into small & medium-sized enterprises and large enterprises. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

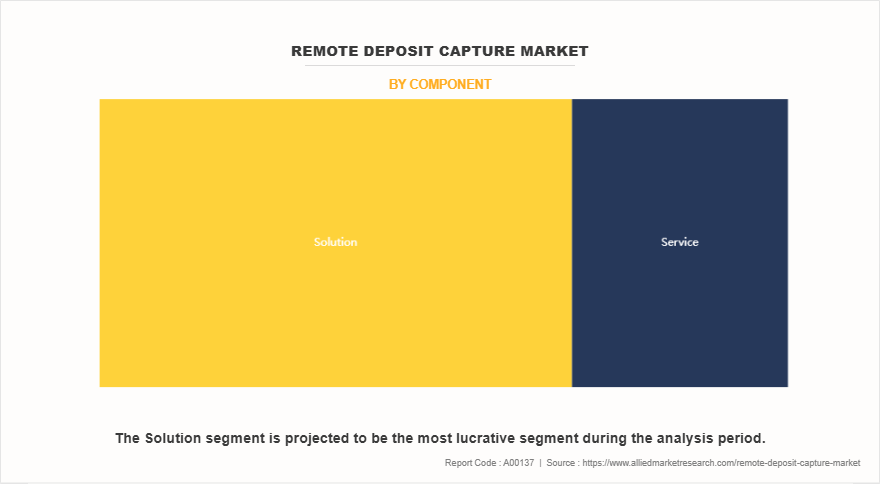

On the basis of component, the solution segment dominated the market in 2023 and is expected to maintain its dominance in the upcoming years, owing to rise in adoption of advanced remote deposit capture solutions by financial institutions to streamline check processing and enhance operational efficiency. However, the service segment is expected to register the highest CAGR during the forecast period, owing to increase in demand for professional and managed services to support the implementation, integration, and maintenance of remote deposit capture solutions.

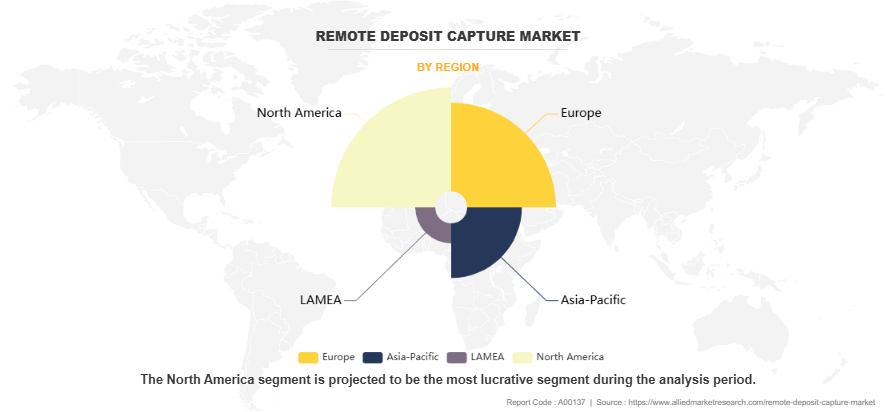

By region, North America dominated the market share in 2023, owing to the widespread adoption of advanced banking technologies, well-established financial infrastructure, and high level of digital literacy among consumers. The presence of key market players and the early implementation of remote deposit capture solutions by financial institutions, further contributed to the market growth in the region. However, Asia-Pacific is expected to exhibit the highest growth during the remote deposit capture market forecast period, owing to rise in adoption of cloud-based technologies and the expansion of internet connectivity in emerging economies such as India, China, and Southeast Asian countries, driving the demand for remote deposit capture solutions in the region.

Key Takeaways:

By component, the solution segment accounted for the largest remote deposit capture market size in 2023.

By deployement mode, the on-premise segment accounted for the largest remote deposit capture market share in 2023.

By enterprise size, the large enterprise segment accounted for the largest remote deposit capture market share in 2023.

Region wise, North America generated the highest revenue in 2023.

Competitive Analysis

The market players operating in the remote deposit capture industry are Avivatech LLC, Alogent, CheckAlt, LLC, Digital Check Corp., EFT Network, Inc, Fiserv, Inc., Jack Henry & Associates, Inc., Jaguar Software, Mitek Systems, Inc., ProgressSoft, Deluxe Corporation, FIS, NCR Corporation, Teksetra, Finastra, JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo, Apiture, and E-Zest. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the remote deposit capture industry globally.

Recent partnership in the RDC market

For instance August 2024, Alogent partnered with Mitek, to integrate Mitek's Check Fraud Defender (CFD) into its web-based enterprise deposits automation solution, Unify.

For instance May 2024, FIS unveiled FIS Digital One Flex Mobile 6.0, a new version of its mobile banking application for financial institutions. This upgrade offers a simplified design, enhanced fraud prevention, and improved functionality.

Top impacting factors

Increase in Adoption of Digital Banking Solutions

Increase in adoption of digital banking solutions significantly drives the remote deposit capture market growth. As consumers and businesses shift to digital banking, remote deposit capture offers a convenient and efficient way to deposit checks remotely. This digital shift creates rise in demand for remote deposit capture solutions, thereby propelling the market growth. Moreover, rise in adoption of banking services through online platforms is driving the demand for remote deposit capture solutions, which reduces the friction associated with traditional banking methods. The convenience of completing deposits remotely is a key factor supporting the adoption of RDC solutions, further contributing towards the market growth.

In addition, the growing use of mobile banking solutions and digital check deposit further supports the remote deposit capture market growth. For instance, in February 2023, according to survey from Chase, a consumer banking company, found that nearly 78% of consumers are using mobile banking weekly. Smartphones, with their built-in cameras and access to banking apps, provide an ideal platform for remote deposit capture services. This allows customers to capture and deposit checks anytime, anywhere, without the need to visit a bank and easily doing virtual deposit. Rise in penetration of smartphones and high-speed internet access ensures that remote deposit capture is accessible to a wider audience, including small businesses, remote workers, and consumers in rural areas. These advancements drive the adoption of remote deposit capture.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the remote deposit capture market analysis from 2023 to 2033 to identify the prevailing remote deposit capture market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network and remote deposit capture market outlook.

In-depth analysis of the remote deposit capture market segmentation assists to determine the prevailing remote deposit capture market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global remote deposit capture market trends, key players, market segments, application areas, and market growth strategies.

Remote Deposit Capture Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 847 million |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Fiserv, Inc., Bank of America, Alogent, FIS, JPMorgan Chase & Co., EFT Network, Inc., Wells Fargo, Teksetra, Finastra, E-Zest, CheckAlt LLC, ProgressSoft Corporation, Mitek Systems, Inc., Deluxe Corporation, Apiture, Digital Check Corp., Jaguar Software, Jack Henry & Associates, Inc., NCR Corporation, Avivatech LLC |

Analyst Review

The remote deposit capture is a transformative tool that enhances cash flow management and operational efficiency. It enables organizations to deposit checks from multiple locations without the need to go to the branch. In addition, businesses integrate remote deposit capture with their accounting systems, ensuring seamless reconciliation and real-time updates. This capability reduces administrative overhead and accelerates fund availability. Remote deposit capture is particularly beneficial for the companies that are handling large volumes of checks, as it minimizes processing errors and enhances reporting capabilities.

Further, the remote deposit capture market growth is driven by increase in adoption of digital banking solutions, advancements in mobile technology, and the ongoing need for efficient financial transactions. Remote deposit capture enables businesses and individuals to deposit checks remotely through the use of a scanner or a mobile app, which reduces the need for physical visits to a bank branch. This market growth is primarily fueled by its ability to enhance convenience, speed, and cost efficiency for both consumers and financial institutions, thereby driving the market growth.

Moreover, government policies play an important role in shaping the remote deposit capture market by ensuring the security and reliability of remote deposits. In the U.S., the Federal Reserve and the Office of the Comptroller of the Currency (OCC) have set regulations to standardize remote deposit capture operations and protect consumers from fraudulent activities, which supports the market growth.

The remote deposit capture market was valued at $525.50 million in 2023 and is estimated to reach $847.02 million by 2033, exhibiting a CAGR of 4.7% from 2024 to 2033.

The upcoming trends of the Remote Deposit Capture Market worldwide are the increase in the adoption of digital banking solutions and government and financial inclusion initiatives.

Technological Innovation in Remote Deposit Capture Platforms is the leading application in the Remote Deposit Capture Market.

North America will be the largest regional market for Remote Deposit Capture in 2023.

Avivatech LLC, Alogent, CheckAlt, LLC, Digital Check Corp., EFT Network, Inc, Fiserv, Inc., Jack Henry & Associates, Inc., Jaguar Software, Mitek Systems, Inc., ProgressSoft, Deluxe Corporation, FIS, NCR Corporation, Teksetra, Finastra, JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo, Apiture, and E-Zest are the top companies to hold the market share in Remote Deposit Capture

Loading Table Of Content...

Loading Research Methodology...