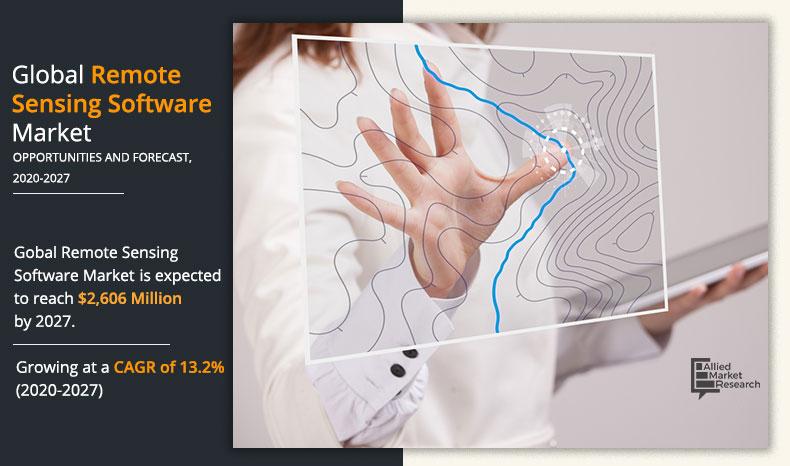

Remote Sensing Software Market Statistics – 2027

The global remote sensing software market size was valued at $ 976 million in 2019, and is projected to reach at $ 2,606 million by 2027, growing at a CAGR of 13.2% from 2020 to 2027. The remote sensing software is a software solution or platform which processes the remotely sensed data or information about properties of the areas including the land, sea, and atmosphere with the help of remote sensors located at some distance from the target. These software are similar to graphics software which enables generation of geographic information from airborne, ground based, and satellite sensor data. Its applications include weather forecasting, land-use mapping, natural hazards study, environmental study, and resource exploration. Data obtained through remote sensing software is typically stored & manipulated with computers.

The software segment dominated global remote sensing software market in 2019, and is expected to maintain this trend during the forecast period, due to the rising need in geographic imaging to process vast amounts of geospatial data every single day. These software are saving both the time as well as money, leveraging the existing data investments, and improving image analysis capabilities, with just a single software application. However, the services segment is expected to witness the highest growth, owing to the growing need for remote sensing and mapping consultancy, as well as GPS satellite surveying and positioning services in the numerous industries.

On the basis of software type, the web-based segment exhibited the highest growth in the remote sensing software market in 2019, and is expected to maintain its dominance in the upcoming years, owing to the growing need to develop an inexpensive, easy-to-use set of analytical tools for viewing remotely sensed imagery and accessing GIS data. Web-based management and analysis applications are a witnessing significant adoption due to its ability to resolve various limitations relating to the costs of installing GIS and image processing software packages. However, the mobile based segment is expected to witness highest growth during the forecast period, as the ability of the smartphone based remote sensing software to easily and quickly collect the ground level measurements is leading to the huge adoption of remote sensing software for various earth monitoring & research applications.

By Component

Services is projected as one of the most lucrative segments.

By end user, the global remote sensing software market share was dominated by the government & defense segment in 2019 and is expected to maintain its dominance in the upcoming years, owing to growing demand for accessing accurate high-resolution imagery and the ability to deliver the information within rapid timelines is observed across various national security agencies and homeland security departments. However, the commercial segment is expected to witness highest growth during the forecast period due to the ongoing adoption of remote sensing software to improve agricultural yields by measuring soil moisture and crop growth; locate sub-surface commodities such as natural gas & oil; and aid environmentalists in detecting ground, air, and water pollution.

By Deployment Mode

Cloud deployment mode is projected as one of the most lucrative segments.

North America dominates the remote sensing software market, owing to rapidly growing need to address academic and applied archaeological as well as anthropological research problems using the innovative archaeological remote sensing solutions. In addition to this, the recent advances in satellite-based remote sensing are providing new growth opportunities for the market in North America for insurance design and predictive analytics. However, Asia-Pacific region is expected to observe highest growth rate during the remote sensing software market forecast period as the rapid population growth, urban development, poverty, deforestation, and land degradation in this region is causing degradation of natural resources and deterioration of environmental quality which is leading to the need of reliable & timely information for sustainable management of natural resources as well as for environmental protection. Moreover, China and India are representing huge population along with the fast-growing economies and relatively low level of geospatial technologies adoption at present; hence, generating numerous opportunities for the remote sensing software market.

By Application

Airborne segment is projected as one of the most lucrative segments.

The report focuses on the growth prospects, restraints, and remote sensing software market analysis. The study provides Porter’s five forces analysis of the remote sensing industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the remote sensing software market trends.

Segment review

The remote sensing software market is segmented on the basis of component, deployment model, software type, application, end user, and region. On the basis of component, it is categorized into software and services. On the basis of deployment model, it is classified into on-premise and cloud. By software type, it is bifurcated into web-based and mobile. Depending on application, it is divided into ground, airborne, and satellite. By end user, the market is classified as defense (defense organizations and homeland security agencies) and commercial (energy & power, agriculture, healthcare, scientific research, weather forecasting, education, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific region is projected as one of the most significant segments.

COVID Impact Analysis

The COVID-19 pandemic has brought radical changes to daily lives of the people, work, and the surrounding environment. Investigators are adopting remote sensing software solutions for helping decision makers to implement policies on economic loss assessments, resilience of the environment, city reopening, and arrangement of medical resources. The remote sensing market is projected to prosper during the COVID-19 pandemic as well as in the upcoming years post pandemic. For instance, in March 2020, to help public health agencies as well as other organizations initiate their response, Esri announced to provide the ArcGIS Hub Coronavirus Response template with the complimentary six-month ArcGIS Online subscription for ArcGIS Hub. ArcGIS Hub is a framework that is used for building the website to analyze and visualize the crisis in the context of population and assets of community or organization.

Top impacting factors

The global remote sensing software market growth is driven by factors such as increase in advancements in the remote sensing technologies, rise in need of remote sensing data in various defense applications, and growing adoption of GIS applications for environmental risk management. Growing investments in satellite communication and Intelligence, Surveillance, and Reconnaissance (ISR) payloads is expected to further drive the growth of the remote sensing software market in the upcoming years. However, factors such as regulatory issues and the lack of comprehensive government policies as well as the higher initial investments for commissioning of the remote sensing systems may hamper the growth of the remote sensing market during the forecast period.

Increase in advancements in the remote sensing technologies

The remote sensing technologies are undergoing substantial advancements in data acquisition, interpretation, and processing. Continuous emergence of developments in unmanned autonomous vehicles (UAVs), sensors, satellite systems, and scale of surveys is further expanding the remote sensing software applications as well as leading to the greater adoption of remote sensing software. Also, the key players are offering upgraded offerings to fulfil the remote sensing demands. For instance, in October 2019, Hexagon’s Geospatial division has launched the upgraded Power Portfolio 2020, the latest version of its leading remote sensing, photogrammetry, GIS and cartography products. This Power Portfolio 2020 enables the GPU-acceleration technology to support users to rapidly address the big data management issues.

Emergence of technologies such as cloud computing, big data analytics, and Internet of Things (IoT)

Recent advances in home automation, smart cities, smart environments, and different sensor networks for military and civilian applications have combined to create the Internet of Things (IoT). The data produced by remote sensing software along with the IoT technologies have a potential to offer an extensive range of insights that can improve system performances, reduce costs, and proactive warn of impending problems. In addition to this, due to the emergence of big data analytics, the remote sensed data is witnessing numerous opportunities in different applications, such as urban planning, natural hazard monitoring, and global climate change.

Key Benefits For Stakeholders

- This study includes the remote sensing software market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and remote sensing software market opportunity.

- The remote sensing software market size is quantitatively analyzed from 2019 to 2027 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the remote sensing software market.

Remote Sensing Software Market Report Highlights

| Aspects | Details |

| By COMPONENT |

|

| By DEPLOYMENT MODEL |

|

| By Type |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | PCI GEOMATICS, MERRICK & COMPANY, TEXTRON SYSTEMS, TRIMBLE INC, HEXAGON, ESRI, EARTH OBSERVING SYSTEM, BAE SYSTEMS, HARRIS GEOSPATIAL SOLUTIONS, INC, CLARK LABS |

Analyst Review

In recent times, increased demand of geospatial data and advanced airborne, space-borne, and ground-based remote sensing data have been observed globally. Consequently, various government agencies, research institutes, as well as private organizations are enormously utilizing remote sensing software for gathering timely data. On the other hand, the trend of development of remote sensing is being transformed from panchromatic, hyper-spectral, and multi-spectral to ultra-spectral with an increase in the spectral resolution. Although digital photogrammetry and GPS technology have improved the remote sensing process, there is still a significant amount of time and effort involved in data acquisition through remote sensing software. The ongoing developments of light detection and ranging (LIDAR) and laser terrain mapping systems for remote sensing is dramatically reducing the time and efforts needed for the data acquisition.

The use of satellite imagery for forest monitoring is advancing tremendously over the past few years. The datasets produced by forest monitoring is enabling international policy agreements that are associated with the CO2 emissions in the atmosphere from deforestation and different types of changes in land-use. Moreover, in the COVID-19 pandemic, satellite based monitoring applications of remote sensing software might be helpful to detect and control the spread of virus. The high-quality geospatial data offered by remote sensing software is helping to deliver statistical and dynamic models for setting-specific characterization of risk factors, disease transmission, and forecasts of pathogen prevalence.

The remote sensing software market is competitive and comprises number of regional, and global vendors competing based on factors such as cost, reliability, advanced products, integration of new technology, processing time, and support services. The growth of the market is impacted by changes in government policies, and rapid advances in the technology offerings, whereas the vendor performance is impacted by government support, COVID-19 conditions, and industry development. Owing to the competition, vendors operating in the market are launching technologically efficient remote sensing software with an improved accuracy of sensor data which will provide numerous opportunities for the market in the upcoming years.

Loading Table Of Content...