Battery Management Systems (BMS): Trends, Challenges and Opportunities

Battery Management Systems (BMS) are indispensable components in modern battery-operated devices and electric vehicles (EVs) for several crucial reasons. Firstly, BMS ensures the safe and efficient operation of batteries by monitoring various parameters such as voltage, current, and temperature, thus preventing overcharging, over-discharging, and overheating, which can lead to performance degradation, reduced lifespan, or even safety hazards like fires or explosions. Secondly, BMS optimizes battery usage, enhancing overall energy efficiency and extending battery life, which is paramount for both consumer electronics and EVs to meet performance expectations and sustainability goals. Additionally, as the demand for electric vehicles and renewable energy storage systems grows, manufacturers and investors increasingly recognize the pivotal role of BMS in advancing battery technology. Investing in BMS technology not only promises competitive advantages in product performance and safety but also aligns with the broader push towards clean energy solutions, attracting interest from both established manufacturers and new investors eager to capitalize on the burgeoning market opportunities and contribute to a greener future.

Why are BMS Gaining Global Interest?

Increases in the costs of fuel, coupled with stringent government regulations pertaining to carbon dioxide emissions have pushed the adoption of electric vehicles, hybrid electric vehicles, and plug-in hybrid vehicles in developed regions such as North America and Europe recently. The battery management system (BMS) is critical in maintaining and monitoring the operation of battery packs in EVs and HEVs, assuring optimal efficiency, safety, and lifetime. The demand for advanced BMS systems develops in tandem with the demand for EVs and HEVs. These developments and the rapid adoption of electric vehicles (EVs) & hybrid electric vehicles (HEVs) are expected to drive the demand for BMS solutions.

The global electric vehicle (EV) sales doubled from the previous year in 2021, reaching a new high of 6.6 million. In 2021, about 10% of global car sales were electric, four times the market share in 2019. China led the increase in EV sales in 2021, accounting for half of the gain. In 2021, China sold more vehicles (3.3 million) than the rest of the world combined. Sales in Europe continued to climb strongly (up 65% to 2.3 million) after the 2020 boom, and they increased in the U.S. as well (to 630 000) after two years of decline.

Battery Management Systems Market Dynamics

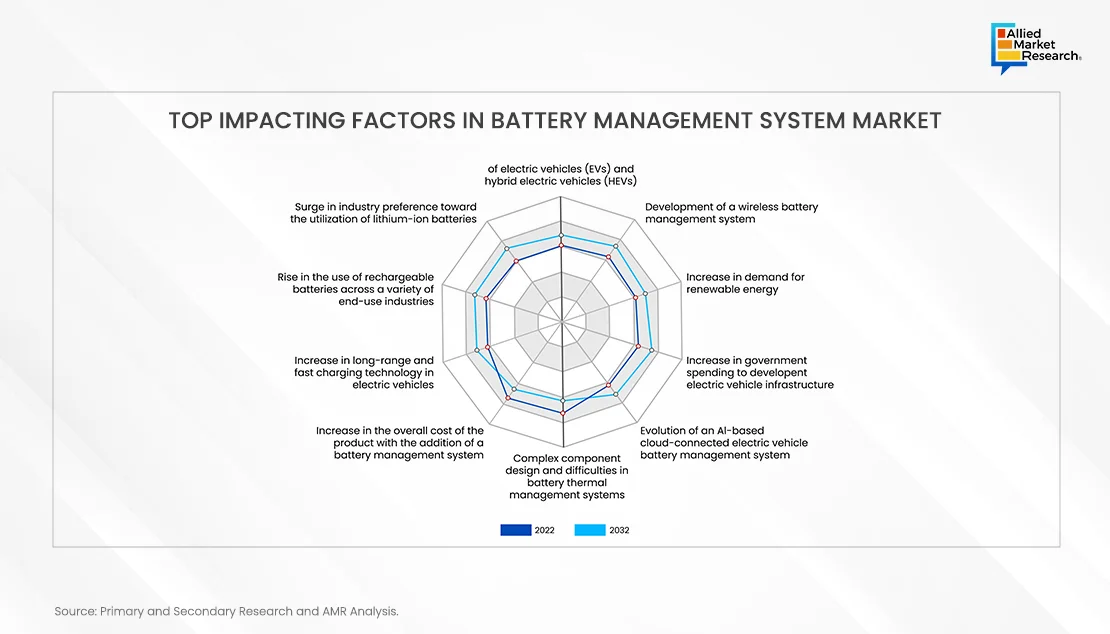

Factors such as accelerated adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) and a surge in industry preference toward the utilization of lithium-ion batteries drive the growth of the battery management system market. In addition, growth in adoption of rechargeable batteries across multiple end-use industries propels the market growth. However, the rise in overall price of products with addition of battery management system hinders growth of the market. Further, increase in adoption of cloud-connected battery management systems, growth in demand for renewable energy, and rise in demand for e-bikes and e-scooters provide remarkable growth opportunities for players operating in the market.

BMS in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs)

Governments across the globe have implemented stringent regulations and policies, such as the Kyoto Protocol, to reduce Greenhouse Gas (GHG) emissions. In addition, the rise in awareness regarding the harmful effects of petrol and diesel-fueled vehicles on the environment has led to innovations in the automotive industry in the form of electric and hybrid vehicles. In addition, the rise in awareness regarding the harmful effects of petrol and diesel-fueled vehicles on the environment has led to innovations in the automotive industry in the form of electric and hybrid vehicles. With the increasing promotion for using the EVs the demand for battery management system is also poised to increase parallelly.

Moreover, vehicle manufacturers have announced plans to shift their focus toward electric and hybrid vehicles. For instance, in February 2023, The European Parliament decided to pass a new regulation prohibiting the sale of gasoline and diesel vehicles effective from 2035. The new law, which is part of a larger EU effort to address climate change, is anticipated to accelerate the transition to electric vehicles. For instance, in January 2021, General Motors announced plans to phase out all diesel and gasoline-powered cars, trucks, and SUVs by 2035 and transition its entire new fleet to electric vehicles as part of a strategy to achieve carbon neutrality by 2040. Such push by the OEMS will increase the demand for alternate fuel vehicles, boosting the BMS market.

Wireless Battery Management System: The Current Trend

A wireless battery management system (BMS) monitors and controls the performance, safety, and longevity of a battery using wireless communication technology. Instead of using wired connections between the battery cells and the BMS, a wireless BMS transmits data between the battery cells and the BMS using Wi-Fi, radio frequency (RF), and Bluetooth technology.

Traditional wired BMS systems are frequently complicated and costly to install and include considerable wiring and cabling between battery cells and management units. Wireless BMS has various advantages, including simplified BMS installation and maintenance, lowering the risk of wiring errors, and enabling real-time monitoring and management of the battery from a distant location. Wireless BMS is widely utilized in electric vehicles, renewable energy storage systems, and other applications that require dependable and efficient battery management.

A wireless BMS system provides increased battery placement and design flexibility, and cost & installation advantages. Batteries may be installed in remote or difficult-to-reach locations without extensive wiring, and the system may be quickly altered as battery requirements change.

The advancement of wireless communication technology and the growth in demand for more flexible and cost-effective energy storage options are poised to drive the development of wireless BMS systems. The growth in need for more advanced and efficient BMS systems is anticipated as the need for electric vehicles and renewable energy sources grows, which is predicted to propel the growth of the battery management system market.

Key players operating in the ecosystem include Sensata Technologies, Inc., NXP Semiconductors, Renesas Electronics Corporation., Analog Devices, Inc., Texas Instruments Incorporated, STMicroelectronics, Leclanché SA, Nuvation Energy, Elithion Inc., Eberspächer Gruppe GmbH & Co. KG, Infineon Technologies AG, and Exponential Power. The leading companies adopt strategies such as product launch and collaboration to strengthen their market position.

The Future of Battery Management Systems

As per AMR analysis, the global battery management system market size was valued at $7.5 billion in 2022, and is projected to reach $41 billion by 2032, growing at a CAGR of 19.1% from 2023 to 2032.

AI-based cloud technology may be utilized in battery management systems (BMS) to provide advanced capabilities such as predictive maintenance, real-time monitoring, and data analytics. These systems collect data on the performance and condition of batteries using sensors and data processing tools, which are then uploaded to the cloud for analysis. AI algorithms are used to find patterns, abnormalities, and potential issues in this data. This enables the prediction of battery failures or degradation, allowing for preventive maintenance and battery replacement before a problem occurs.

Cloud-based BMS systems may further track batteries in real-time, allowing for remote access and control of battery performance. This is especially beneficial in large-scale applications such as electric vehicle fleets and renewable energy storage systems. AI-based BMS may significantly boost the efficiency and lifespan of EV batteries by real-time optimizing charging, discharging, and balancing processes. The development of an AI-based, cloud-connected battery management system for electric vehicles offers the Battery Management System (BMS) market a lucrative opportunity. Development of an AI-powered cloud connected electric vehicle battery management system thus represents a big opportunity for BMS companies. The combination of cloud connectivity and machine learning algorithms has the potential to greatly enhance the efficiency and lifespan of EV batteries, benefiting EV owners and driving growth in the BMS market.