Table Of Contents

Lalit Janardhan Katare

Pooja Parvatkar

The Evolution of Electric Vehicle Batteries: Powering the Future

In the search for a better and more eco-friendly future, electric cars have become a great solution. They help reduce pollution and lessen the need for oil production. Recent technological improvements in these batteries have led to electric cars getting better and cleaner. With increase in adoption of EVs, the battery demand has increased wherein, the global electric vehicle battery market size was valued at $23.8 billion in 2021, and is projected to reach $108.2 billion by 2031, growing at a CAGR of 16.6% from 2022 to 2031.

The Evolution of Batteries

The evolution of electric vehicle batteries has been characterized by a continuous series of innovations and enhancements. In its early stages, electric vehicles relied on lead-acid batteries, known for their heaviness, limited range, and environmental concerns arising from the use of toxic materials. However, advancements in technology paved the way for nickel-metal hydride (NiMH) batteries, which offered improved energy density and a reduced environmental footprint.

The real turning point, however, occurred with the advent of lithium-ion (Li-ion) batteries. These batteries brought about a paradigm shift in the electric vehicle industry by delivering higher energy density, lighter weight, and an extended lifespan. This groundbreaking development made electric vehicles more practical for everyday use, enhancing their range and performance significantly.

Current Market Scenario

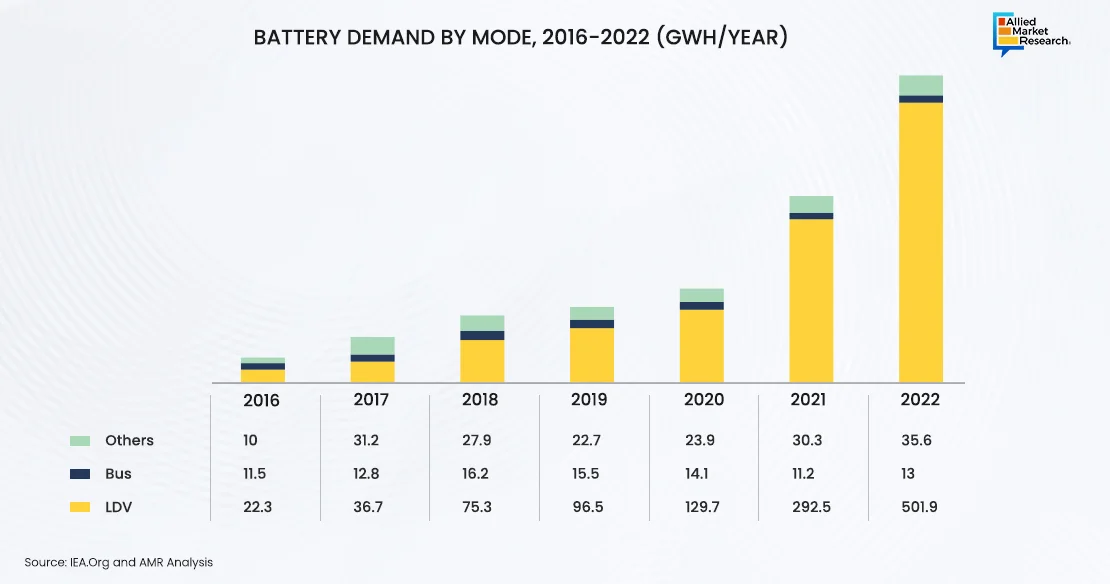

More people are looking for ways to make cars better for the environment and are opting for lithium-ion (Li-ion) batteries in electric cars. These batteries gained massive traction in 2022 globally, with 65% increase in demand as compared to 2021. In 2021, about 330 GWh of these batteries were needed, but in 2022, that number increased to 550 GWh.

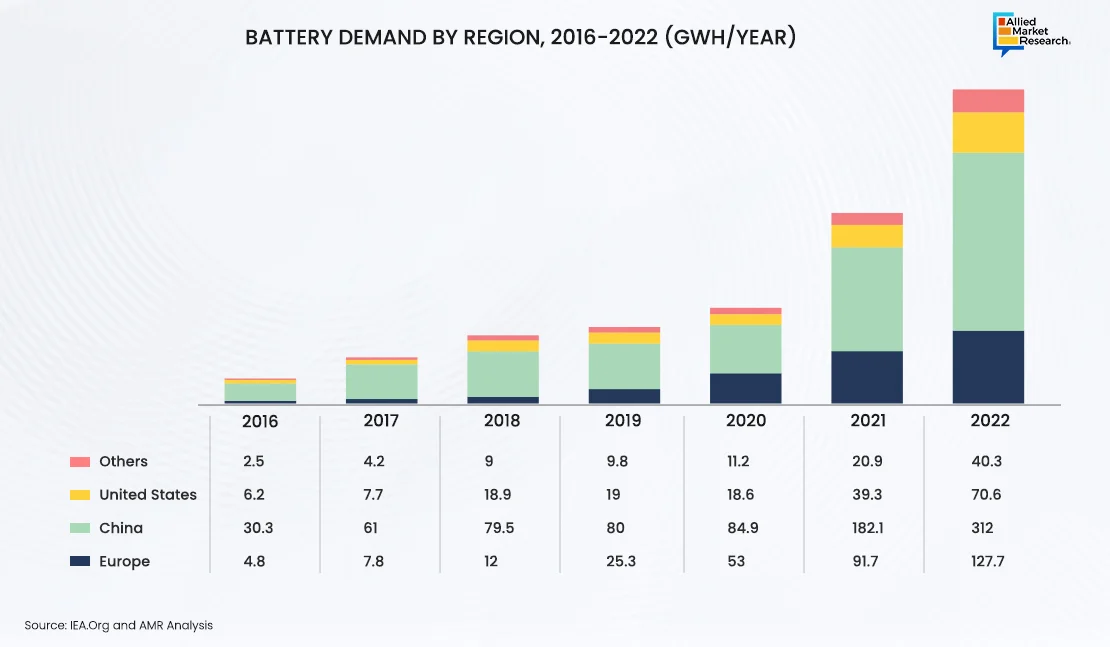

Battery Demand By Region 2016-2022

With rise in government initiatives globally, OEMs and buyers wanted eco-friendly options, thus resulting in increase in sales of electric cars for passengers. A significant growth in sales of electric vehicles was witnessed across the U.S. where the market grew by 55% in 2022 as compared to 2021. The automotive battery sector in China witnessed rise in demand by 70% whereas the demand for battery powered vehicle increased by 80% in 2022 as compared to 2021.

The U.S. witnessed increase in demand for batteries, increasing by 80% in 2022. Even though the U.S. is not leading in sales, it plays a crucial role in rise of eco-friendly cars.

The average size of batteries in electric cars in the U.S. grew by a small amount, about 7%, in 2022. But interestingly, the average battery size in the U.S. is much bigger as compared to the rest of the world, standing at 40% higher. This difference shows how the U.S. has its own unique way of doing things, especially with the popularity of SUVs and the strategies of car companies.

Adoption of BEVs and PHEVs

Globally, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) are becoming more popular as compared to hybrid electric vehicles (HEVs). BEVs and PHEVs are selling more than hybrids, especially with their bigger batteries. This promises a future where eco-friendly cars become even more popular.

Currently, car companies are concentrating on making advanced electric car systems, such as smaller engines and batteries, which should emit less pollution and cost less to manufacture. A material called lithium-nickel-manganese-cobalt-oxide (NMC) is the most commonly used for production of electric vehicle batteries. In the U.S., electric cars such as Tesla Model X, S, and 3 use other material such as lithium-nickel-cobalt-aluminum oxide (NCA).

For instance, in March 2020, BYD Motors Inc. launched a new blade battery for electric vehicles that optimizes the battery pack structure by above 50%, as compared to the traditional lithium iron phosphate batteries. It also exponentially increases battery safety. In addition, governments globally are supporting the purchase of electric vehicles, in terms of tax credits and incentives.

Government Initiatives and Promotions

Various governments around the globe are taking steps to reduce carbon emissions by promoting the use of electric bikes, electric vehicles, and bicycles, owing to rise in awareness of the harmful effects of vehicles running on fossil fuels. In addition, governments are urging vehicle manufacturers to decrease carbon emissions from diesel fuel combustion and address greenhouse gas emissions, thus encouraging investment in electric vehicle development.

Furthermore, governments globally are offering incentives to promote the use of electric vehicles. For example, in India, the government plans to reduce the goods and service tax (GST) on electric vehicles from 5% to 12% to encourage their faster adoption. Similarly, South Korea has announced tax exemptions and subsidies totaling $900 million to support the development and purchase of electric and fuel cell vehicles. This increased government support, including tax credits, subsidies, and incentives, is a significant factor driving the demand for electric vehicles. This in turn, is expected to create a lucrative market opportunity for the EV battery market during the forecast period.

This increase in government support for the development and purchase of electric vehicles, through tax credits, subsidies, and incentives, is expected to drive demand for electric vehicles, thus, creating a profitable growth opportunity for the EV battery market.

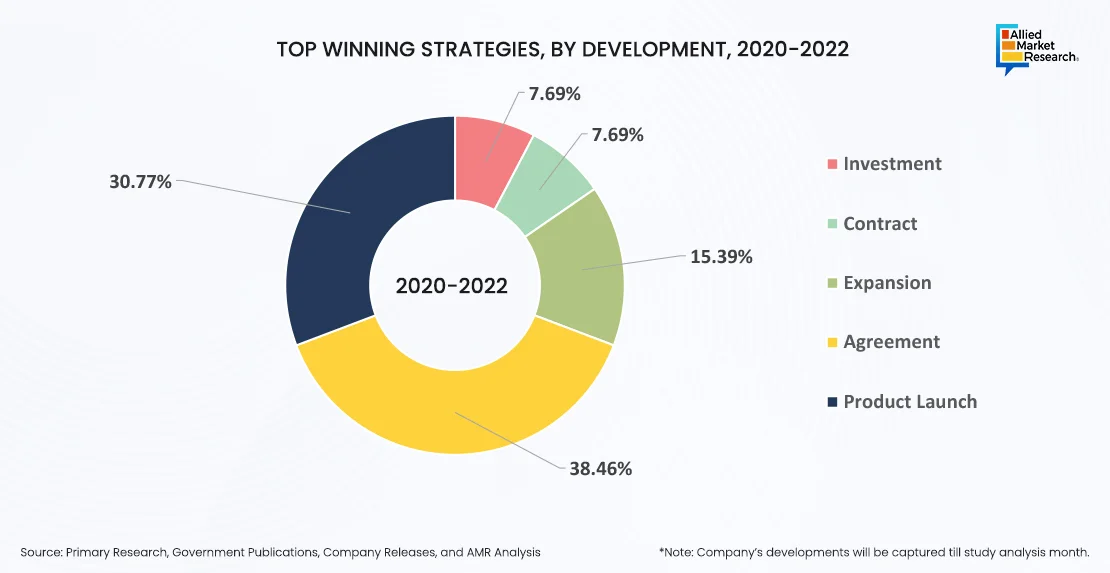

Top Winning Strategies Adopted by Key Players

The leading players operating in the electric vehicle battery market are BYD Company Ltd, Contemporary Amperex Technology Co., Limited., ENERSYS, GS Yuasa International Ltd., LG Chem Ltd, Panasonic Corporation, Pride Power, Samsung Electronics Co. Ltd., Tianneng rechargeable battery manufacturers, and Wanxiang Group Corporation. Moreover, the growing emphasis of prominent automobile manufacturers, including Ford Motors, General Motors, and BMW AG on launching EVs is anticipated to drive the market growth. For instance, in 2019, Ford entered into a partnership agreement with Rivian for production of an all-electric vehicle, which is under the Ford Motor’s luxury Lincoln brand.

The electric vehicle battery market accounts to have significant opportunities for stakeholders across the ecosystem. For instance, as per Allied Market research, the total addressable market (TAM) for different verticals of electric ecosystem is as below:

- The global electric vehicle battery market size was valued at $23.8 billion in 2021, and is projected to reach $108.2 billion by 2031, growing at a CAGR of 16.6% from 2022 to 2031.

- The global electric vehicle battery swapping market size was valued at $1.8 billion in 2022, and is projected to reach $49.3 billion by 2032, growing at a CAGR of 39.6% from 2023 to 2032.

- Electric Vehicle Battery Recycling Market Size, Share, Competitive Landscape and Trend Analysis Report by Application (Electric Cars, Electric Buses, Energy Storage Systems, and Others): Global Opportunity Analysis and Industry Forecast, 2018 – 2025.

- The global electric vehicle battery thermal management system market was valued at $2.3 billion in 2021, and is projected to reach $8.4 billion by 2031, growing at a CAGR of 14.6% from 2022 to 2031.

A Promising Future

In conclusion, the electric vehicle battery market is experiencing remarkable growth and demand as the world moves towards a greener and more sustainable future. Surge in demand for lithium-ion batteries, driven largely by the rise in popularity of electric vehicles, underscores the pivotal role these batteries play in shaping the automotive industry. With advancements in battery technology and manufacturing processes, coupled with supportive government policies and growing consumer awareness, the electric vehicle battery market is poised for continued expansion in the coming years. As the market evolves, stakeholders must continue to invest in research and development, innovation, and infrastructure to meet the rising demand for electric vehicles and contribute to a cleaner, more environmentally friendly transportation landscape.

For further insights, get in touch with AMR analysts.