Aerospace and Defense Sector: AMR Hand-Picks Top 5 Emerging Markets in the Domain in Q3 2024

The rising geopolitical tensions in the post-pandemic world have led to several advancements in the aerospace and defense domain. Conflicts such as the Russia-Ukraine war and the Israel-Palestine dispute have further expanded the scope of the sector. In the past few years, the landscape has also been influenced by several stakeholder actions and factors. Many new markets have come up which have made significant progress in recent times. Allied Market Research, with the help of its in-house ‘Title Matrix Tool’, has identified five such emerging industries that have positively impacted the domain. Each of these markets is studied extensively in their respective reports, focusing on revenue numbers, CAGR values, and segmental and regional analysis.

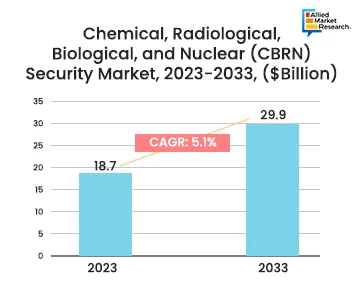

Chemical, Radiological, Biological, and Nuclear (CBRN) Security Market

In the 21st century, apart from conventional weapons, various advanced systems and methodologies are being used to target enemy nations and inflict damage. A comprehensive security arrangement, hence, becomes necessary which takes into account the different ways in which a country could be attacked. Chemical, radiological, biological, and nuclear (CBRN) security is one such set of safety protocols that are designed to detect and neutralize hazardous and malicious chemical, biological, and nuclear materials. As per the report published by Allied Market Research, the chemical, biological, radiological, and nuclear security market accounted for $18.7 billion in 2023. The industry is expected to gather a revenue of $29.9 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

The increasing budgetary allocation to modernize defense forces for countering threats from state and non-state actors has been a major force behind the growth of the landscape. The rising focus on biosecurity has also contributed to the expansion of the industry. In countries such as the United States of America, laws have been passed that make it compulsory to implement robust CBRN security measures in various sectors of homeland security, healthcare, and critical infrastructure. As a result of such initiatives, the North America region is expected to garner a significant revenue share by 2033. The Asia-Pacific region, too, is expected to witness growth on account of the growing investment in border security and emergency preparedness systems.

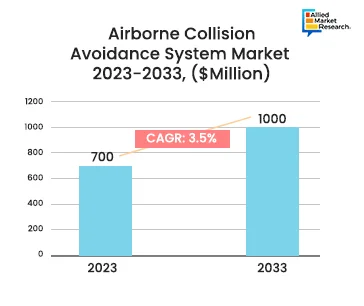

Airborne Collision Avoidance System Market

Allied Market Research recently published a report on the airborne collision avoidance system market which states that the industry is estimated to reach $1.0 billion by 2033. The landscape accounted for $0.7 billion in 2023 and is projected to rise at 3.5% CAGR from 2024 to 2033. This modern technology is primarily aimed at preventing mid-air accidents between aircraft. The rising global air traffic has increased the importance of advanced collision avoidance systems to ensure safe and efficient travel. The growing expanse of the aviation industry in developing countries has generated numerous opportunities in the third quarter of 2024.

The United States of America has been one of the major countries to invest heavily in aircraft collision avoidance systems. The Federal Aviation Administration has enacted certain stringent regulations that mandate the deployment of the technology. Furthermore, the presence of several multinational corporations such as Lockheed Martin Corp., Boeing Company (Boeing Avionics), and Honeywell International Inc., has further helped the USA to dominate the industry. Along with this, the growing advancements in sensor technology, AI, data analytics, and other innovations have created favorable conditions for the growth of the industry in the third quarter of 2024. Additionally, the launch of high-tech solutions by leading players in the landscape is anticipated to strengthen the position of the market in the coming period.

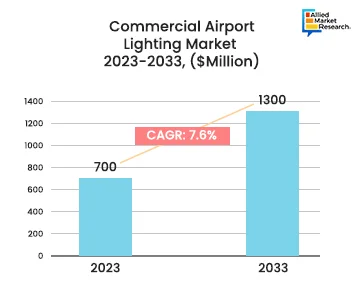

Commercial Airport Lighting Market

The commercial airport lighting market is a specialized industry referring to the production, installation, and repair of illumination systems deployed in and around airports for the safe execution of different operations. These lighting solutions play a vital role in improving visibility, thus bringing down the risk of accidents considerably. The AMR report highlights that the landscape, which accounted for $0.7 billion in 2023, is predicted to gather a revenue of $1.3 billion by 2033, rising at 7.6% CAGR from 2024 to 2033. The increasing preference for air travel has led to a surge in air traffic across the globe. The role of commercial airport lighting solutions has naturally expanded, contributing to the market's growth and success.

The AMR study also provides an in-depth analysis of different segments to aid companies in understanding the major investment areas in the industry. The report classifies the landscape on the basis of the type, technology, and position. Based on technology, the LED segment is expected to witness huge growth from 2024 to 2033. The rising demand for energy-efficient lighting solutions has contributed to the rise in the adoption of LED solutions for airport illumination systems. However, the advent of emerging technologies such as the Internet of Things has accelerated the development of smart lighting equipment which helps in predictive maintenance and real-time monitoring. Also, they are much more environmentally sustainable as compared to conventional lights, thereby reducing the carbon footprint of airports.

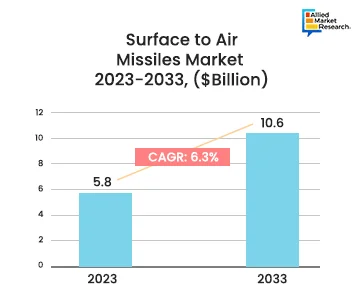

Surface to Air Missiles Market

Since the past few decades, almost all developed and developing countries across the world have been constantly upgrading their missile technologies. The development of surface to air missiles has proven to be a major development in the sphere of weapon manufacturing. These guided munitions are a special type of projectile that can be launched from the ground or ships to seek and destroy airborne targets. Allied Market Research recently published a report on the surface to air missiles market which states the industry held a revenue of $5.8 billion in 2023. The landscape is projected to amass $10.6 billion by 2033, surging at a CAGR of 6.3% in the 2024-2033 period.

According to the study, the increasing emphasis on ensuring the safety of civilian areas and critical infrastructure is predicted to become the leading factor in the growth of the market. The rapid pace of urbanization, along with population growth, has heightened the demand for these weapon systems, opening new avenues for investments in the landscape. Regional analysis shows that the Asia-Pacific region is predicted to make considerable gains in the coming period. Countries such as India and China have developed advanced surface to air missiles to safeguard their defenses against various security threats which has enabled the landscape to expand its footprint in the province. The innovations and advancements in missile technology have also created new growth opportunities in the industry.

UAV Flight Training and Simulation Market

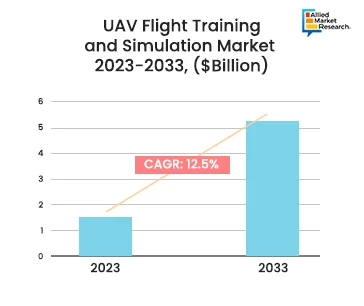

AMR’s report on the UAV flight training and simulation market provides a comprehensive analysis of various aspects of the industry to help companies understand its evolving nature. The study highlights that the landscape is anticipated to reach $5.2 billion by 2033 and surge ahead at 12.5% CAGR from 2024 to 2033. In recent times, the adoption of unmanned aerial vehicles has increased drastically. Several end-use sectors such as agriculture, defense, logistics, etc., employ drones to simplify operations and boost productivity and efficiency. Naturally, the need to create a skilled workforce to effectively handle UAVs has risen, thus augmenting the growth rate of the industry.

The advent of immersive technologies such as AR and VR has increased the quality of simulation software applications. Furthermore, many IT companies are integrating AI and machine learning to improve educational outcomes and provide enhanced experiences with different scenarios and environments. Recently, many leading players including, Kratos Defense & Security Solutions, Inc., Elbit Systems, Airbus, etc., have launched drone training programs in the US, Greece, and India to help stakeholders boost their drone manufacturing capabilities. Moreover, several major businesses have engaged in alliances such as acquisitions, mergers, partnerships, and collaborations to establish their foothold in the landscape. The heavy investments by several aviation institutes and universities in R&D activities have also contributed to the growth of the industry in Q3 2024.

The final word

Summing up, the third quarter of 2024 has witnessed many countries raising their military budgets to modernize their armies. Technological advancements in weapon manufacturing have led to the expansion of the aerospace and defense domain. The AMR reports on emerging markets in the sector throw light on the various growth drivers and investment opportunities in the landscape to aid companies in making the right business decisions in the long run.

To understand the different trends and advancements in the aerospace and defense domain holistically, contact our experts.