Table Of Contents

- A Brief Recap of 2023

- Key Trends Shaping the Automotive Sector in 2024

- 1. Electric Vehicles (EVs): Investing in Sustainable Transportation

- 2. The Rising Popularity of Autonomous Vehicles

- 3. Hydrogen Fuel Cell Vehicles: Pioneering Emission-Free Transportation

- 4. Automotive Speech Recognition Systems: A Hands-Free Future

- 5. Truck Platooning: Innovating Freight Transportation

- 6. The Evolution of EV Charging: Powering Ahead into the Future

- 7. The Spotlight on the Pre-Owned Car Market

- 8. Generative AI Shapes the Future Automotive Landscape

- Prepping for the Road Ahead: Additional Trends to Monitor in 2024

Lalit Janardhan Katare

Abhay Singh

What’s Behind the Transformative Landscape of the Automotive Industry in 2024 and Beyond?

In recent years, the automotive industry has undergone significant transformations. The industry grappled with challenges such as global supply chain disruptions, shifting consumer preferences, and the imperative to reduce environmental impact. Despite these challenges, the automotive sector has shown tremendous growth, with a notable surge in electric vehicle adoption, the exploration of autonomous technologies, and a heightened focus on sustainable practices.

Looking ahead to 2024, the automotive sector is poised for further evolution. Anticipated trends include an increased emphasis on electric vehicles, advancements in autonomous driving capabilities, and a continued commitment to meeting stringent environmental regulations. The year 2024 is expected to witness a pivotal moment in the industry's trajectory, with transformative technologies and strategic shifts shaping its landscape. Allied Market Research (AMR) has taken a proactive initiative to illuminate the promising future of the automotive sector in 2024. Through comprehensive research and analysis, AMR aims to provide insights that will guide industry stakeholders, policymakers, and investors in navigating the opportunities and challenges that lie ahead.

A Brief Recap of 2023

The year 2023 proved to be a pivotal period for the automotive industry, witnessing a surge in electric vehicle adoption and the integration of cutting-edge technologies. The drive towards sustainability gained momentum, with a notable increase in the development and implementation of eco-friendly practices. Autonomous vehicles continued to evolve, promising a future of safer and more efficient transportation. Additionally, the industry grappled with the impending impact of stringent emission regulations and explored innovative manufacturing techniques. As the year unfolded, it set the stage for a transformative era in the automotive sector, laying the groundwork for continued advancements and novel approaches in the years to come.

Key Trends Shaping the Automotive Sector in 2024

The automotive industry is on the brink of transformative changes, with several trends expected to reshape its landscape in 2024. Here are a few key trends that will significantly influence the sector's trajectory.

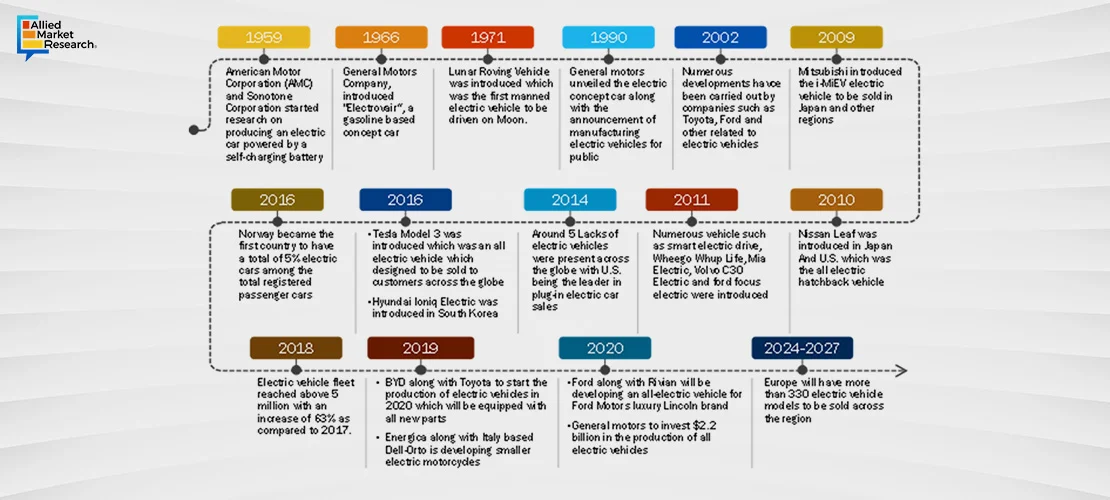

1. Electric Vehicles (EVs): Investing in Sustainable Transportation

In response to the growing demand for sustainable transportation, automotive companies are heavily investing in Electric Vehicle (EV) technology and infrastructure. This trend is indicative of a broader shift towards reducing reliance on traditional fossil fuels. Insights are derived from a combination of primary research, government publications, and company releases. The electric vehicle market on a global scale is anticipated to achieve a value of $823.75 billion by the year 2030, demonstrating a CAGR of 18.2% during the period from 2021 to 2030.

Surge in Demand for High-performance, Fuel-efficient, and Low-emission Vehicles

With gasoline being a non-renewable fossil fuel projected to deplete in the future, there is a compelling need to explore alternative fuel sources to support sustainable development. Electric vehicles, which do not rely on gasoline and offer greater economic efficiency compared to conventional vehicles, play a pivotal role in meeting this demand. Electric vehicles exhibit an impressive conversion rate, translating over 50% of the electrical energy from the grid into wheel power, while traditional gas-powered vehicles manage to convert only about 17%-21% of the energy stored in gasoline. The recent spike in demand for fuel-efficient vehicles can be attributed to escalating petrol and diesel prices, driven by diminishing fossil fuel reserves and a corporate inclination to maximize profits from existing oil reserves. Consequently, there is a burgeoning demand for advanced fuel-efficient technologies, propelling the surge in electrically powered vehicles for travel.

Government Initiatives for Controlling Vehicle Emissions on Rise

Heightened environmental concerns have prompted governments and environmental agencies worldwide to enact rigorous emission norms and regulations aimed at curbing vehicle emissions. These regulatory initiatives include stringent targets for reducing nitrogen oxides (NOx) and carbon dioxide (CO2) emissions into the air. Governments at the federal and state levels in the U.S. are intensifying efforts to enhance transportation cleanliness, exemplified by the U.S. Environmental Protection Agency's (EPA) announcement of new rules to decrease emissions from heavy-duty trucks. Additionally, the California Air Resources Board (CARB) is adopting the heavy-duty Low NOx Omnibus Regulation, aspiring to achieve a 90% reduction from current NOx emissions limits by 2027. In Europe, the European Union (EU) is committed, under the Paris agreement (COP21), to achieving a 20% reduction in greenhouse gas emissions by 2020 as part of the second phase of the Kyoto Protocol. Furthermore, the EU has set a target to achieve a 40% reduction in greenhouse gas emissions by 2040 and attain net-zero emissions by 2050.

2. The Rising Popularity of Autonomous Vehicles

Autonomous vehicles operate with minimal or no driver interference, relying on self-driving technology to interpret data from sensors for real-time decision-making. This includes tasks such as navigation route planning, obstacle avoidance, acceleration, deceleration, and implementing protective measures. The safety enhancements of autonomous vehicles extend to their ability to autonomously detect and respond to various elements on the road, including other vehicles, pedestrians, cyclists, construction sites, accidents, road defects, and traffic congestion. These vehicles adhere strictly to safety protocols, addressing concerns that human drivers might consciously or unintentionally neglect.

Connected Infrastructure Growth Driven by Technological Advancements

Technological developments have spurred the expansion of connected infrastructure, acting as a catalyst for market growth. Automation technologies integrated into autonomous vehicles facilitate seamless connectivity through machine learning systems, LiDAR, sensors, RADAR, processors, cameras, and other hardware and software components. The coordination of autonomous driving systems relies on advanced technology to maintain complete control over the vehicle and interpret the surrounding environment. Similar to human capabilities, autonomous vehicles must analyze judgments, interpret sensory data, and make informed decisions to intelligently respond to external factors. The adoption of intelligent transportation systems is a key factor, allowing autonomous vehicles to plan and manage operations for optimized traffic flow. Urban connectivity solutions are emphasized, leading to the deployment of LTE/5G small cells and public Wi-Fi end-to-end architectures in both newly constructed and retrofitted modular street infrastructure assets.

Rising Government Investments in Autonomous Car Infrastructure

Governments, particularly at the federal and state levels, are actively investing in the development of autonomous car infrastructure. Notable initiatives include a USD 9.85 million federal grant awarded to the University of Michigan in May 2023 by the U.S. Department of Transportation Federal Highway Administration to stimulate connected vehicle research. This project is recognized as part of the federal government's infrastructure endeavors. Moreover, the U.S. plans to allocate $200 billion in funding for international infrastructure initiatives through the Partnership for Global Infrastructure and Investment (PGII) approach. This collective investment target, inclusive of contributions from G7 nations and private entities, aims to reach $600 billion by the end of 2025. The convergence of connected and autonomous vehicles (CAVs) holds the potential to mitigate road accidents linked to human errors. CAVs function as perpetual sensors, constantly monitoring real-time traffic conditions, resulting in enhanced traffic flow, decreased congestion, and a more effective utilization of road infrastructure. Advanced smart traffic management systems leverage data analytics and AI, resulting in shortened waiting periods, decreased fuel usage, and reduced emissions.

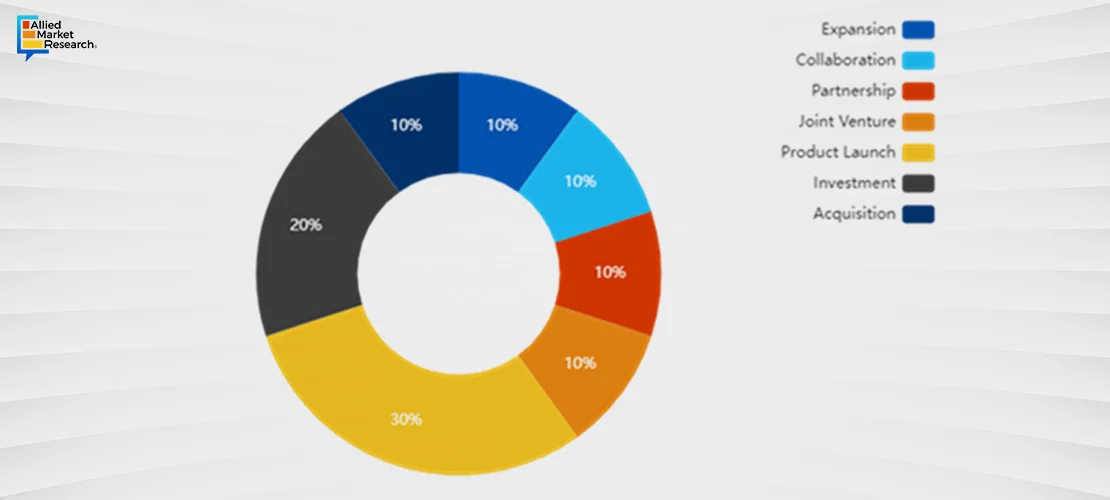

Exploring Top Strategies that Led to Success in Autonomous Vehicle Development from 2020 to 2022

In the rapidly evolving landscape of autonomous vehicles, strategic development has been a key focus for stakeholders across the automotive industry. The period from 2020 to 2022 witnessed innovative approaches, and Allied Market Research (AMR) conducted a thorough analysis drawing insights from primary research, government publications, and company releases.

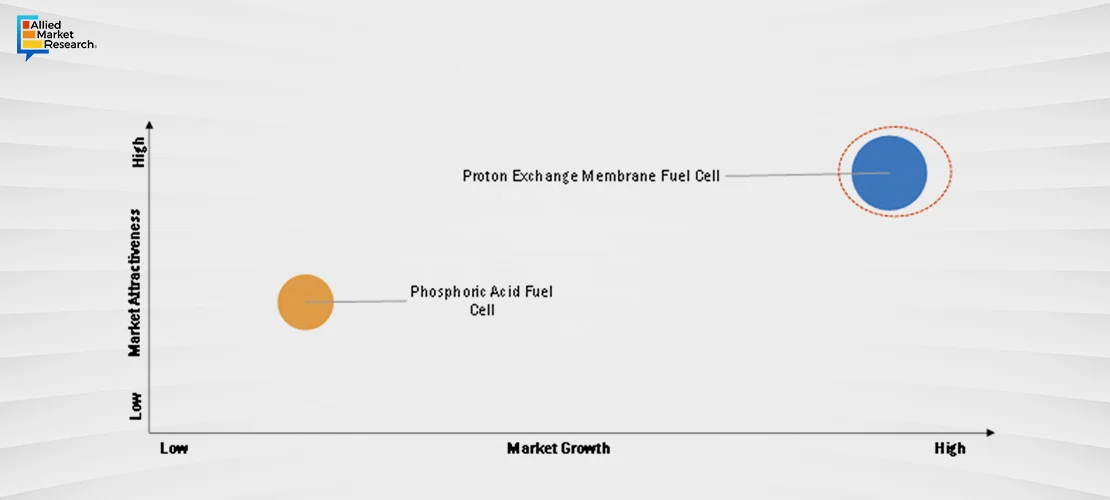

3. Hydrogen Fuel Cell Vehicles: Pioneering Emission-Free Transportation

Hydrogen fuel cell vehicles represent a revolutionary approach to sustainable and emission-free transportation. These vehicles utilize hydrogen as a fuel to power electric motors, ensuring a transmission devoid of emissions. The process involves a reverse electrolysis mechanism where hydrogen reacts with oxygen, producing electricity, heat, and water. The anticipated size of the global market for hydrogen fuel cell vehicles is expected to achieve $57.9 billion by 2032, demonstrating a CAGR of 43% from 2023 to 2032. AMR's research extends to identifying top investment pockets in the hydrogen fuel cell vhicle market from 2023 to 2032.

Government Initiatives Driving Hydrogen Fuel Cell Infrastructure

Governments worldwide are playing a crucial role in shaping the market for hydrogen fuel cell vehicles. Notably, California in the U.S. has committed funds for the development of 100 hydrogen refueling stations, aligning with its target of 1.5 million zero-emission vehicles by 2025. Furthermore, the Inflation Reduction Act (IRA) of 2022 in the U.S. is set to boost sales by offering substantial tax credits for hydrogen fuel cell vehicles.

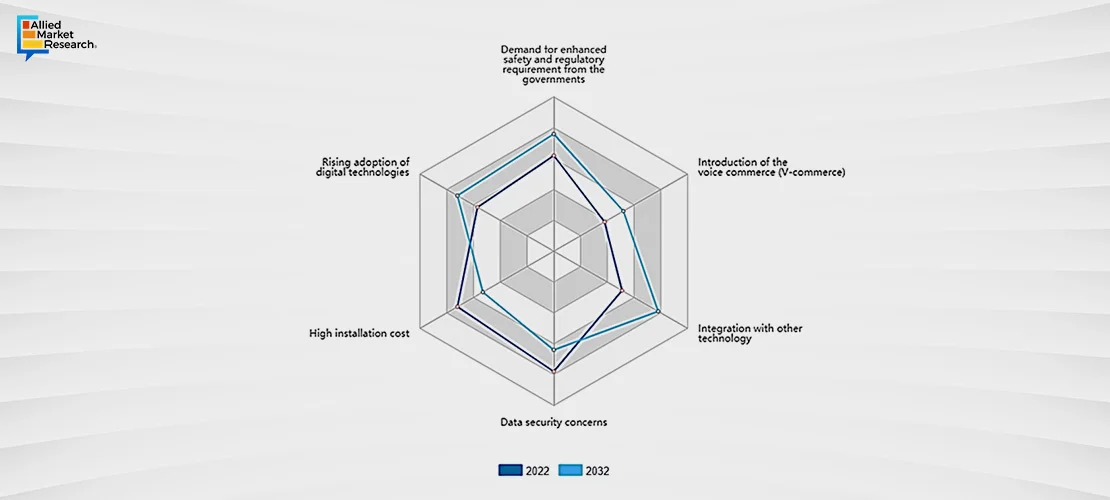

4. Automotive Speech Recognition Systems: A Hands-Free Future

Speech recognition systems in the automotive sector have become pivotal for enabling hands-free interactions between drivers and vehicles. These systems, comprising both software and hardware components, decipher human voice instructions. The global automotive voice recognition system market is anticipated to witness substantial growth, reaching $14.7 billion by 2032. The growth of the automotive voice recognition system market is propelled by the increasing demand for enhanced safety, regulatory requirements from governments, and the widespread adoption of digital technologies. However, challenges such as high installation costs and concerns related to data security may hinder market growth. On the positive side, opportunities emerge through the integration with other technologies and the introduction of voice commerce (V-commerce), creating new avenues for key players in the automotive voice recognition system industry.

Voice Commerce Revolutionizing Driver Interaction

The integration of voice commerce, often referred to as V-commerce, introduces a new dimension to automotive interactions. Early-stage yet promising, V-commerce allows customers to make purchases through voice instructions, leveraging voice assistants like Amazon's Alexa and Google Home. This novel approach is anticipated to transform the revenue streams for manufacturers, connecting drivers and passengers seamlessly to various services.

5. Truck Platooning: Innovating Freight Transportation

Truck platooning, characterized by linking multiple trucks in a convoy, is a technological advancement in freight transportation. The technology employs connectivity and advanced driving assistance, ensuring synchronized speed and distance maintenance within the platoon. A recent study by the American Journal of Transportation highlighted a substantial shortage of 80,000 truck drivers in the U.S., a number projected to double to 160,000 by 2030. Given the crucial role of the trucking industry in facilitating inter-country goods transport in the U.S., there is an anticipated surge in demand for truck platooning technologies in the coming years. Key drivers for this growth include stringent government regulations in the transportation sector, initiatives to reduce fuel consumption and enhance road safety, and strategic collaborations between industry stakeholders and public-private partnerships. The global market for truck platooning is anticipated to achieve $6,092.2 million by the year 2035, with a notable CAGR of 23.7% from 2025 to 2035.

Strategic Collaboration: Shaping the Future of Truck Platooning

Strategic collaboration emerges as a linchpin in shaping the future landscape of truck platooning, an innovative approach to freight transportation. Governments and companies worldwide are actively encouraging collaborative efforts and fostering public-private partnerships between truck manufacturers, road operators, research institutes, policymakers, and platooning solution providers. This concerted approach is instrumental in advancing automated and connected technologies within the truck platooning sector. An exemplary instance is the Sweden 4 Platooning project, a collaborative initiative involving prominent entities such as Volvo Technology Corporation, Scania CV AB, The Royal Institute of Technology (KTH), DB Schenker AB, RISE/SICS, and Trafikverket (Swedish Transport Administration). This project aimed to develop coordinated platooning of trucks, improve their functional safety, and establish a protocol for vehicle-to-vehicle (V2V) communication. Such strategic collaborations are poised to play a significant role in the growth and evolution of the truck platooning market, fostering technological advancements and ensuring safer and more efficient freight transportation systems.

6. The Evolution of EV Charging: Powering Ahead into the Future

A substantial increase in charging infrastructure throughout 2024, reaching about 2 million stations globally is anticipated. Both governments and Original Equipment Manufacturers (OEMs) are channeling significant investments into infrastructure development, with a particular emphasis on the dominance of DC fast charging and ultra-fast charging technologies. China, playing a pivotal role, is set to triple its fast-charging capabilities by the year 2024. Additionally, notable growth is anticipated in E-Forecourts and depot charging solutions. Projections indicate that the number of chargers dedicated to new electric commercial vehicles will hit 347,000 units in 2024, experiencing further expansion to reach 1.14 million by the year 2030. DC chargers are expected to make a substantial contribution to this surge. Furthermore, the market for electric vehicle charging systems is expected to reach $42,623.0 million by 2030, rising with a CAGR of 26.2% from 2021 to 2030.

7. The Spotlight on the Pre-Owned Car Market

The global used car market, valued at $1.4 trillion in 2021, is anticipated to reach $2.6 trillion by 2031, displaying a CAGR of 6.5% from 2022 to 2031. This industry encompasses second-hand vehicles available for resale and is fueled by diverse outlets, including franchise and independent car dealers, rental car companies, auctions, private party sales, and leasing offices. A key driving factor is the preference of millennials for used cars, driven by cost considerations and a trend toward cutting expenses on personal vehicles. High costs of new cars, affordability concerns, and the need for personal transportation due to the COVID-19 pandemic contribute to the growth of the used car market.

The industry is experiencing a transformative shift towards online sales channels facilitated by e-commerce players leveraging digital transformation. Notable trends include increasing investments by industry players, with leading automakers expanding their dealership networks in the used car market. The market is dominated by unorganized players in C2C sales, particularly in developing nations, presenting challenges related to warranty offerings and malpractices. Several factors contribute to the growth of the used cars industry, including a rise in population, affordability, increasing disposable incomes, and a lower rate of vehicle ownership among millennials. Key players in the market, such as AutoNation, Asbury Automotive Group, Cars24, CarMax, and Carvana, are adopting strategies like product launches and expansions to strengthen their market positions. The industry faces challenges related to high new vehicle prices, unorganized sales, and a lack of regularization, but opportunities arise from the advent of e-commerce, online technologies, and the rise in electric vehicle business globally. Car-sharing services have also contributed to the industry's growth, offering flexible options and increasing demand for personal transportation.

8. Generative AI Shapes the Future Automotive Landscape

Generative AIis emerging as a revolutionary force in the automotive sector, introducing profound changes across various domains. This advanced technology, capable of generating new and innovative content, is reshaping fundamental aspects of the automotive industry, including vehicle design, navigation, predictive maintenance, voice assistants, manufacturing processes, supply chain management, and quality control. This comprehensive impact extends to elevating safety measures, enhancing operational efficiency, and delivering personalized in-car experiences, marking a paradigm shift towards more intelligent and responsive automotive technologies.

Generative AI is reshaping the automotive sector, impacting vehicle design, navigation, predictive maintenance, voice assistants, supply chain, manufacturing, and quality control. It will elevate safety, efficiency, and personalization of in-car interactions. Leading automotive companies, including Toyota and BMW for vehicle design, Tesla in Advanced Driver-Assistance Systems (ADAS), Continental in digital cockpits, and Mercedes-Benz in Personal Voice Assistants, are increasingly adopting this technology to stay at the forefront of technological innovation. Tesla, for instance, leverages Generative AI in its Advanced Driver-Assistance Systems (ADAS), enhancing the vehicle's ability to navigate and respond to its environment autonomously. The adoption of Generative AI marks a significant milestone in the evolution of intelligent and responsive automotive technologies, promising a future where vehicles are not just modes of transportation but seamlessly integrated and personalized companions.

Prepping for the Road Ahead: Additional Trends to Monitor in 2024

As the automotive industry evolves, several trends are poised to reshape its landscape in 2024 and beyond. Smart manufacturing, characterized by advanced automation and data exchange, promises to enhance production processes, optimizing efficiency and resource utilization. Gigacasting, a manufacturing technique involving the casting of large, complex parts, is set to revolutionize vehicle design and assembly. Digital twins, virtual replicas of physical systems, are becoming integral for simulations, testing, and predictive maintenance, ensuring a more streamlined development lifecycle. Additionally, the impending impact of Euro-7 norms underscores the industry's commitment to environmental sustainability, with stringent emissions standards likely to influence the design and performance of vehicles. Together, these trends demonstrate a transformative year for the automotive sector, where innovation and adaptability will be key drivers of success. For a deeper understanding of emerging trends and strategic insights shaping the automotive industry, contact Allied Market Research analysts today. Stay ahead in the transformative journey of automotive excellence.