Table Of Contents

- Technology integration and regulatory evolution emerging as the main trends influencing the sector's growth

- Intuitive strategies adopted by major players helping the sector flourish

- Adoption of AI and blockchain technology redefining the BFSI domain

- Mergers, acquisitions, and partnerships among major companies transforming the sector

- Ingenious product and service launches by industry leaders increasing the revenue share of the sector

- Winding up

Onkar Sumant

Koyel Ghosh

BFSI Domain in 2025: How Are the Technological Advancements, Trends, Strategies, and M&A Deals Likely to Impact the Sector?

The growing digitalization of different monetary services, including banking, insurance, accounting, wealth management, etc., has revolutionized the BFSI domain in the last few years. Moreover, the increasing emphasis of governments across the globe on financial inclusion to help vulnerable and marginalized sections of the population come out of poverty has broadened the scope of the sector. In addition, several federal banking agencies have taken proactive steps in the post-pandemic period to revive their national economy, thus opening new avenues for growth in the sector. Along with this, certain trends, technological advancements, and actions by industry participants are expected to contribute to the growth of the landscape in 2025. This newsletter explores the various aspects of these factors and highlights their impact on the BFSI domain comprehensively.

Technology integration and regulatory evolution emerging as the main trends influencing the sector's growth

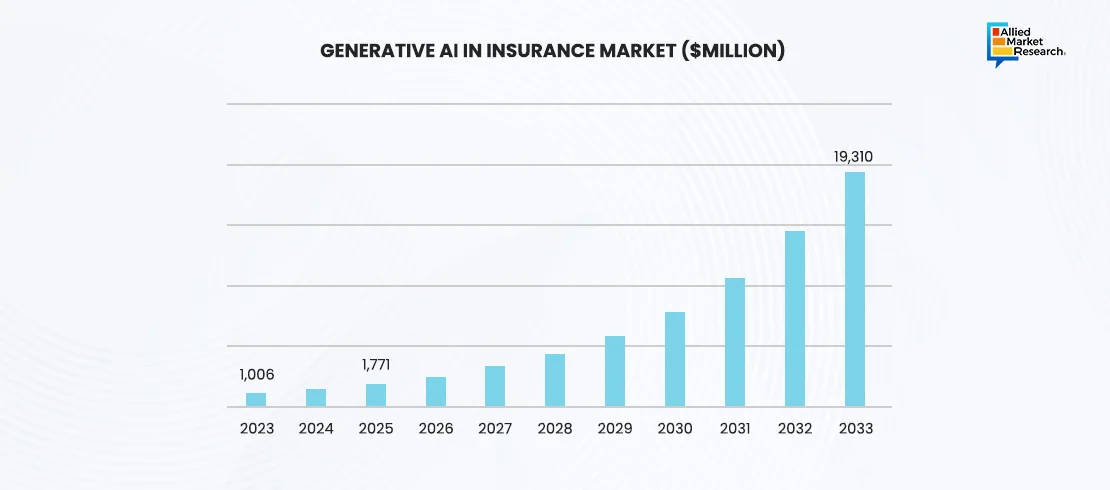

Over the last few years, leading financial corporations and multinational investment banks have been integrating advanced technologies such as machine learning, blockchain, etc., to improve their operational efficiency and increase their productivity. For instance, companies are developing applications using cloud computing technology to cater to the diverse demands of their customers efficiently. Moreover, insurance companies are using generative AI tools to analyze data obtained from studying behavioral patterns, transaction histories, and shopping preferences.

Along with this, governments across the globe are enacting laws and legislation to improve the regulatory compliance of different financial entities. The main purpose of establishing such a legal framework is to reduce the chances of fraud, misappropriation, identity theft, etc. In the last few years, the problem of cyber threats and malware attacks has also increased. To tackle this issue, many private financial institutions are deploying blockchain-based solutions to enhance their credibility and customers’ trust. These legal and technological factors are expected to maximize the revenue share of the domain in 2025.

Intuitive strategies adopted by major players helping the sector flourish

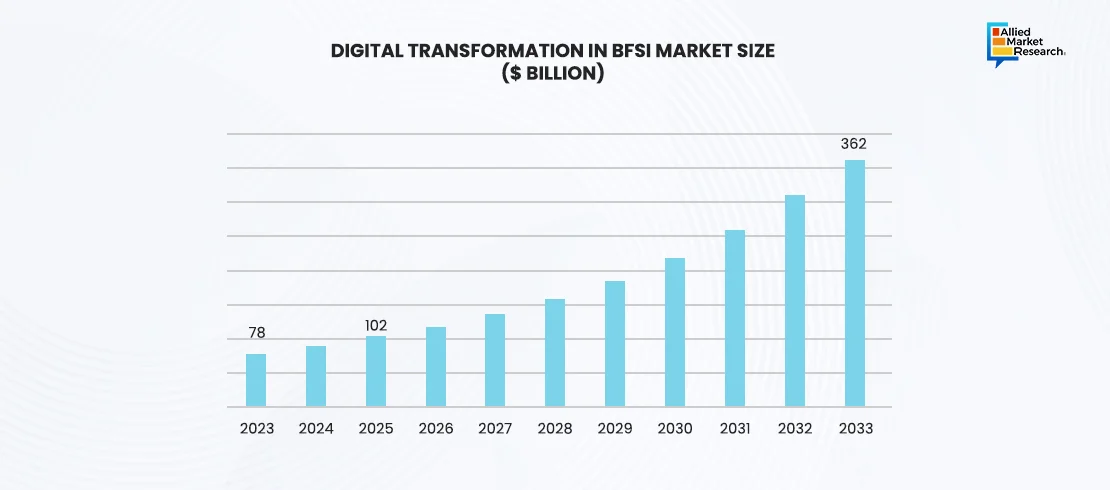

The growing adoption of digital technologies by public and private entities is expected to strengthen the foothold of the BFSI domain in 2025. Many developed and developing countries around the world have launched 5G services in the past few years. Financial institutions such as banks and insurance companies are using these digital innovations to expand their customer base in the remotest parts of the globe. Furthermore, governments are actively supporting these initiatives to ensure the marginalized sections of the population enter the formal banking channels. These innovative strategies adopted by various stakeholders are anticipated to help the digital transformation in the BFSI industry increase its footprint across the globe.

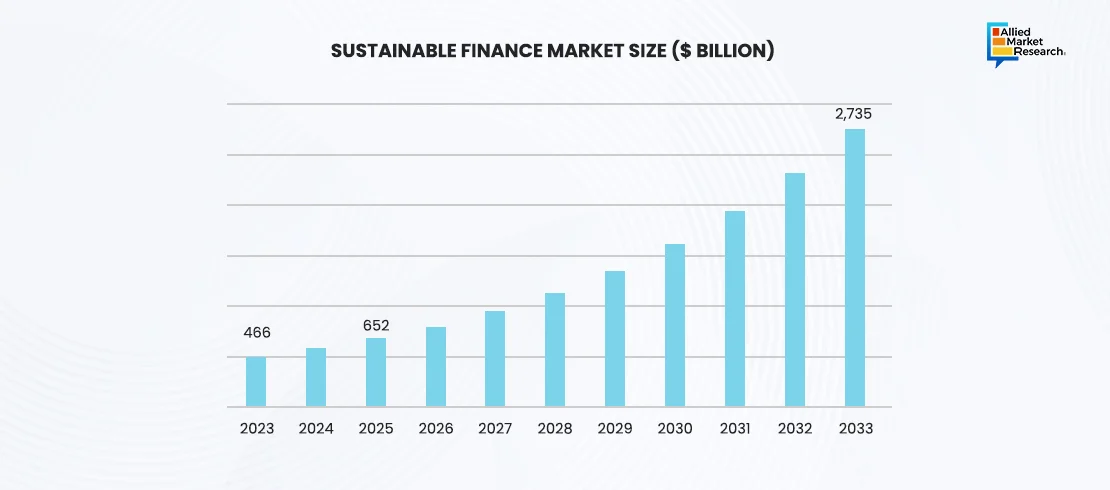

Apart from this, the surge in awareness regarding environmental sustainability is predicted to create favorable conditions for the growth of the landscape in 2025. Banks and other finance companies are developing products that adhere to the environmental and social governance (ESG) norms enacted by regional governments and legal authorities. Furthermore, sustainable finance initiatives such as paperless banking, digital currency, etc., are projected to play a significant role in reducing the carbon footprint of the BFSI domain in 2025.

Adoption of AI and blockchain technology redefining the BFSI domain

The increasing number of financial frauds and money laundering activities have led to a gradual reduction in the trust in digital banking and insurance. To address this issue, companies are deploying modern technologies such as AI and blockchain to anticipate risks and make informed business decisions. For instance, AI-based tools are now used by banks to analyze vast volumes of data to provide personalized services to account-holders. Moreover, ML-powered algorithms are also utilized for anomaly detection purposes wherein suspicious activity is detected proactively, thus minimizing the possibility of financial crimes.

Along with this, the role of the blockchain in the BFSI industry is projected to expand substantially in the coming year. This decentralized ledger technology is primarily used by financial institutions to create secure networking channels to facilitate international transactions and payments. Studies have shown that the use of blockchain significantly reduces the operational costs for banks, thus increasing their profitability in the long run. Due to these advantages, the adoption of these innovations in the BFSI domain is anticipated to grow drastically in 2025.

Mergers, acquisitions, and partnerships among major companies transforming the sector

Along with technological advancements, the sector is expected to witness significant growth due to the upcoming strategic alliances between major stakeholders in the BFSI domain. For instance, Capital One Financial Corporation, a leading bank holding company, has announced its plans to acquire Discover Financial Services in early 2025. Similarly, PNC Financial Services Group has expressed its interest in acquiring stakes in banks and financial institutions that have strong retail deposit bases in different end-use sectors. Both these M&A deals are predicted to open new investment avenues in the landscape of BFSI in the coming year.

On the other hand, certain companies are forming collaboration to address the demands of their customers comprehensively. Recently, Fidelity International, a key financial services company, released a press statement announcing its intentions to establish a partnership agreement with Fidelity Investments, a multinational wealth management company. The collaboration is aimed at capitalizing on the opportunities offered by the BFSI sector holistically. Such partnerships are estimated to accelerate the domain’s growth and success in 2025.

Ingenious product and service launches by industry leaders increasing the revenue share of the sector

Over the years, major financial enterprises and multinational businesses have invested heavily in developing innovative products to align their operations with the evolving industry dynamics. Some of these companies plan to launch their services in the coming year in order to gain a competitive edge over their peers. For example, QBE International Markets, a major insurance company in the US, has recently revealed its plans to expand its specialty insurance portfolio in all 50 states of the country. Many industry experts have stated that this move is predicted to help the company establish itself as a leader in the inland marine offerings segment.

Along with private companies, federal banks in many developed and developing countries are also launching new schemes and initiatives to improve the stability of their economy. For instance, the Reserve Bank of India, the country’s central financial institution, has announced that it would be launching a pilot project in 2025 to offer local cloud data storage to different monetary organizations. While multinational conglomerates have the fiscal capacity to easily shift their operation to cloud-based services, micro, medium, and small-scale enterprises find it hard to make this transition. This pilot project is, hence, mainly aimed at helping these MSMEs to easily adopt modern cloud computing solutions and compete with these industry giants effectively.

Winding up

The BFSI domain is expected to experience a huge growth in its revenue share due to the increasing adoption of digital technologies such as cloud computing, AI, and blockchain by financial institutions to improve their security, operational efficiency, and productivity. At the same time, the growing transition toward environmental sustainability is anticipated to create numerous growth opportunities for the sector. In addition, the M&A deals, partnerships, and product launches by leading stakeholders in the sectors are expected to augment the growth rate of the landscape in 2025.

Get in touch with our experts for growth drivers and investment opportunities in the BFSI domain!