Table Of Contents

Onkar Sumant

Koyel Ghosh

The Future of Finance: Unlocking New Possibilities with Embedded Finance

Embedded finance has moved from an idea for the future to a reality in many industries today. It refers to the seamless integration of financial services into non-financial platforms, allowing users to access services such as payments, lending, and insurance directly within apps they already use. This shift has been driven by the increasing demand for more convenient, integrated financial solutions across sectors like e-commerce, transportation, and digital services.

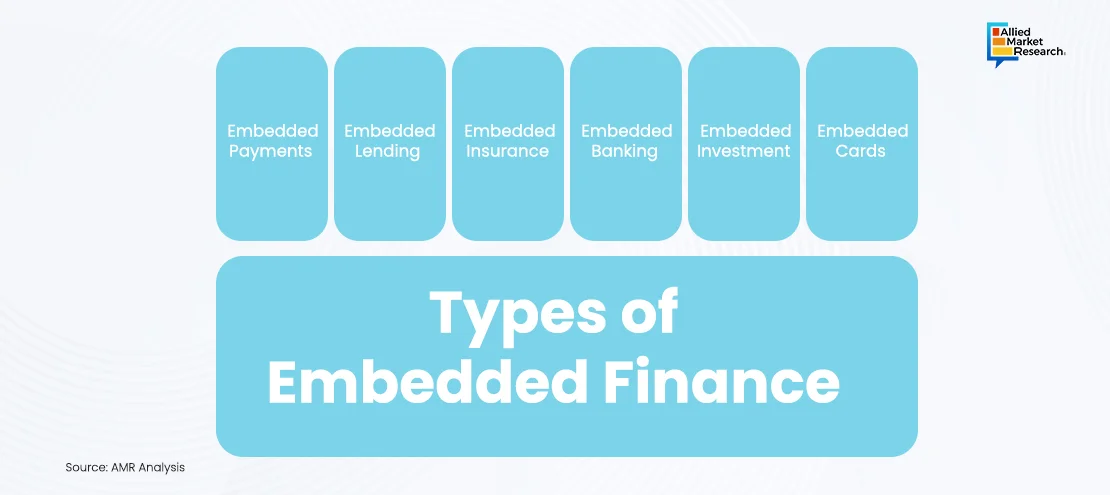

Embedded finance includes services like payments, lending, insurance, and banking, built directly into everyday apps and services. For example, embedded payments allow companies to offer in-app purchases or transactions, while embedded lending includes services like Buy Now, Pay Later (BNPL). Additionally, embedded insurance provides real-time coverage options during transactions, and embedded banking services enable account creation and money transfers directly within apps. This flexibility drives customer engagement and creates new revenue opportunities across multiple industries.

A prime example of embedded finance in action is Uber, which allows users to make payments within the app, streamlining the entire transaction process. Additionally, Uber offers integrated banking solutions that enable drivers to receive payments directly through the platform, seamlessly blending financial services into its business model. Similarly, Shopify provides embedded banking services, empowering small businesses to manage their finances within the platform, offering a streamlined alternative to traditional banking methods.

The rise of embedded finance is also supported by fintech companies like PayPal, which has embedded card payments, making transactions faster and more efficient. Users can now access PayPal’s financial services, such as instant fund transfers, right from within e-commerce platforms. Similarly, the fintech app Klarna has popularized embedded lending with its “Buy Now, Pay Later” option, which allows users to split payments into installments at the point of purchase.

On the regulatory front, the development of embedded finance solutions has necessitated stringent compliance measures. In November 2023, J.P. Morgan highlighted the need for companies to understand the purpose behind their embedded finance initiatives. They advised businesses to ensure these services support their overall strategy while staying compliant with KYC and AML regulations and addressing security risks.

Embedded finance has become a driving force in creating more integrated, user-friendly financial experiences, providing businesses with new revenue streams and consumers with a seamless, convenient way to manage their finances. This field is expected to grow quickly as more industries have started using embedded finance solutions.

Driving Innovation across Industries

Embedded finance is driving innovation in various industries by integrating financial services into everyday platforms. This improves the user experience and creates new ways for businesses to earn money. For example, in the ride-hailing industry, companies like Ola in India are using embedded finance to offer convenient payment options and financial services to their customers. Ola, similar to its global peers, has integrated an in-app payment solution, Ola Money, which allows customers to pay for rides, make peer-to-peer transactions, and even handle other everyday financial needs, all from within the app. This has created a frictionless payment experience, enhancing customer loyalty and retention.

Another sector seeing a transformation is e-commerce. Klarna's BNPL service offers customers flexibility at checkout, allowing them to split payments into installments. This embedded lending model has driven significant growth for online retailers by increasing conversion rates and making purchases more accessible to consumers.

In the travel industry, Booking.com and Airbnb are utilizing embedded finance to simplify transactions. Users can now pay for accommodation and other services directly on the platform, improving the overall booking experience. This streamlined payment process has increased customer satisfaction by reducing friction during transactions.

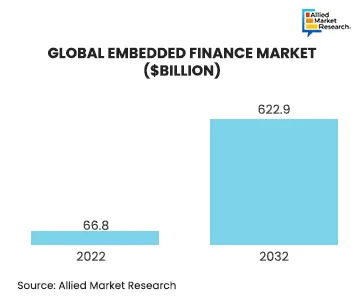

The growth of embedded finance is also being reflected in projections. The global embedded finance market is projected to reach $622.9 billion in revenue by 2032, growing nearly nine times its size from 2022. This rapid expansion highlights the need for businesses to embrace embedded finance to remain competitive in a changing market.

By integrating financial services into their platforms, companies across various sectors are not only simplifying customer interactions but also unlocking new opportunities for revenue generation and growth.

Enhancing Customer Experience and Loyalty

Embedded finance is transforming how companies interact with their customers, giving way to deeper engagement and increased loyalty. By integrating financial services directly into their platforms, businesses offer financial services on their platforms, providing a smooth and personalized experience for consumers.

A prime example of how embedded finance enhances customer loyalty is the Starbucks Rewards Program, which has been highly successful. Through their app, customers can load funds, make payments, and earn rewards all within one system. By the end of 2022, Starbucks reported that its loyalty platform contributed 55% of its U.S. revenue, with over 28.7 million members. The app’s seamless experience and efficiency promote customer loyalty, encouraging repeat visits and boosting retention rates.

In the retail sector, Home Depot is making the most ofembedded finance to enhance customer experience through innovative programs like Save Now, Buy Later (SNBL). This system allows customers to save up for major purchases while earning discounts, which helps build a sense of trust and long-term engagement. It also offers flexibility, allowing customers to avoid opening new credit accounts during major financial commitments like buying a home.

Another approach is offering branded cards that reward customers for both in-store and everyday spending. These programs boost brand visibility and loyalty by keeping the brand part of customers' daily lives.

These examples show how embedded finance fosters convenience, increases customer engagement, and offers personalized financial solutions, all of which contribute to higher customer retention and satisfaction. Integrating financial services into their offerings helps businesses build stronger customer relationships, boosting loyalty and growth.

Regulatory and Security Considerations

As embedded finance is growing, regulatory and security challenges are becoming key concerns. Integrating financial services into non-financial platforms requires strong data protection and compliance with financial rules. A major challenge is safeguarding customer data and meeting Know Your Customer (KYC) and Anti-Money Laundering (AML) standards. These measures help prevent fraud and ensure compliance as financial transactions become more integrated into daily platforms. Addressing these challenges is crucial for maintaining security and trust in embedded finance systems.

In the UK, regulatory bodies like the Financial Conduct Authority (FCA) are actively shaping the regulatory framework for embedded finance. For instance, the FCA is working to reduce exemptions for certain financial products like BNPL, which often escape stringent oversight. By the end of 2023, it is expected that these exemptions will shrink, bringing more financial products under direct regulatory scrutiny, particularly those targeting consumers.

The European Commission has also taken steps to ensure embedded finance products adhere to standardization and security measures. For example, the proposed Payment Services Directive 3 (PSD3) aims to establish clearer frameworks around data sharing and fraud prevention, ensuring that embedded finance remains secure and transparent for end-users.

Regulatory changes support both innovation and compliance. Working with industry leaders, regulators balance growth and consumer protection. This teamwork ensures embedded finance offers safe, reliable services for businesses and consumers.

Future Trends and Opportunities in Embedded Finance

The future of embedded finance is shaped by key trends, especially the growth of financial services in non-financial platforms. One major trend is the rise of embedded finance in B2B transactions, with solutions for instant payments, supply chain financing, and real-time expense management. This is especially beneficial in the gig economy. Another trend is the growth of embedded lending, particularly Buy Now Pay Later (BNPL) services, which are gaining popularity in both consumer and business markets, offering flexible payment options.

Additionally, personalized financial solutions are gaining traction, with companies using customer data to offer tailored products like insurance, loans, and investment services. This personalization is not only enhancing customer experiences but also creating new revenue streams for businesses.

The rise of Web3 technologies and decentralized finance (DeFi) is also anticipated to influence the future of embedded finance. Web3's potential to enhance transparency and reduce costs could make embedded finance more accessible, especially in areas like cross-border payments and digital asset management.

Case Study: Donde - Travel-as-a-Benefit with Embedded Finance

Overview

Donde, a Travel-as-a-Benefit company, empowers employers to help employees save and spend on travel experiences directly through their payroll. Donde offers employees a Donde Wallet to save for travel, and employers can enhance the benefit by matching these funds. Employees can then use their Donde Everywhere Card to book travel or spend during vacations.

The Challenge

Donde faced the challenge of connecting multiple stakeholders, including employers, employees, and travel vendors such as hotels and car rental companies. They needed a seamless, scalable financial solution without having to commit substantial resources to engineering, design, and management.

The Solution

To address these needs, Bond Financial Technologies Inc. (hereinafter Bond) developed an embedded finance solution utilizing account creation APIs, enabling Donde to create both commercial and consumer deposit accounts. This integration enabled automatic payroll deductions and employer matching, allowing employees to use virtual or physical cards for travel expenses.

Bond's solution also lutilized credit rails instead of traditional debit cards, ensuring that employees could easily transact with travel services where debit cards are often less accepted, like hotels and car rental companies.

Approach

Bond’s approach combined robust APIs with a deep understanding of Donde’s business model, allowing them to integrate a hybrid consumer and commercial financial program. This facilitated seamless money transfers between employers and employees, ensuring real-time fund movement and maximum acceptance of payments through credit networks.

By working closely with Donde, Bond delivered a cost-effective, friction-free solution that enabled Donde to offer a superior travel benefit to its employees, all while minimizing operational overhead.

Conclusion

Donde’s collaboration with Bond illustrates how embedded finance solutions can enhance employee benefits by simplifying financial management and offering flexibility in spending. Bond’s ability to seamlessly integrate complex systems allowed Donde to deliver a differentiated employee perk, strengthening its competitive advantage in the travel-as-a-benefit space.

In conclusion, embedded finance is rapidly transforming industries by seamlessly integrating financial services into everyday platforms, creating new revenue streams, and enhancing customer experiences. From travel and retail to healthcare and beyond, companies are taking recourse to embedded finance to offer tailored, convenient solutions to consumers and businesses alike. Moreover, with market revenue expected to surpass $600 billion by 2032, the future of embedded finance holds immense potential to reshape financial ecosystems and redefine consumer relationships with financial services. Businesses utilizing this have the potential to lead the next phase of digital finance.

Allied Market Research provides comprehensive insights into the landscape of embedded finance, offering in-depth analysis of trends, technological advancements, and regulatory developments that shape this rapidly evolving sector. Our detailed reports enable stakeholders to understand how embedded finance transforms industries by integrating financial services into non-financial platforms, enhancing customer experience, and creating new revenue streams. Our insights help businesses grab opportunities, drive innovation, and implement reliable, scalable financial solutions that meet the needs of today's consumers.

Contact our experts today for a thorough analysis of the growth drivers and investment opportunities in embedded finance!