Table Of Contents

- BFSI Industry Advancements in 2024

- Technological Advancements and Digital Transformation

- Cybersecurity and Risk Management

- Sustainability and ESG Considerations

- Customer Experience and Open Banking

- Regional Insights

- Reviving International Banking Initiatives: Global banks resumed their previously stalled technological investments following a time of economic instability and high borrowing prices. The Indian IT industry, which mainly depends on BFSI clients for income, benefited from this renaissance. Prominent Indian IT companies, including Wipro, Infosys, and Tata Consultancy Services (TCS), observed a slight rebound in demand for BFSI.

- Global Banks' Increased Technology Spending: Bank of America and JPMorgan Chase, two of the biggest financial organizations, have raised their technology spending considerably. These efforts were concentrated in areas like cloud migration, cybersecurity, customer experience improvement, and regulatory compliance. The focus on technology innovations was intended to improve customer service and streamline processes.

- Revenue Growth for Indian IT firms: The financial performance of Indian IT firms improved, driven by higher spending from international banks. Infosys recorded a 2.3% revenue gain in its BFSI unit in October 2024, which was its highest performance in seven quarters and helped to generate a 5.1% increase in overall revenue. Wipro also witnssed growth in its BFSI division for the first time since March 2024, suggesting that the industry is on the rise.

- The Road Ahead: BFSI Industry 2025

- Some of the trending reports in the domain are listed below:

Onkar Sumant

Koyel Ghosh

BFSI Industry 2024: Exploring Innovation, Adaptability, and Sustainable Growth

In 2024, technology breakthroughs, changing customer needs, and a shifting economy brought significant changes to the BFSI sector. This review looks at how the industry used new technologies to improve customer satisfaction by offering better banking and financial services. The BFSI sector in 2024 showed flexibility, innovation, and a proactive approach to solving global challenges. Financial institutions focused on building a more sustainable, transparent, and customer-friendly financial system by using advanced technologies, promoting sustainability, and putting customers first. The advancements made in 2024 is likely to guide the industry’s growth and changes in the future.

BFSI Industry Advancements in 2024

Technological Advancements and Digital Transformation

With a focus on using cutting-edge technologies to improve operational effectiveness and customer experience, the BFSI sector underwent a swift digital transition in 2024. A key technology that helped banks achieve revenue growth of about 6% and productivity increases of 20–30% was generative artificial intelligence. This technology simplified customer interactions, enhanced risk assessments, and enabled individualized financial planning. In 2024, several banks and financial institutions integrated generative AI into their business processes to boost efficiency and improve customer service. Some of them are included below:

- In November 2024, JP Morgan Chase to increase efficiency among its 200,000 workers, unveiled the LLM Suite, a generative AI assistant. By simplifying processes like email writing and enabling intricate workflow linkages, the AI tool encouraged healthy competition among departments to embrace the technology.

- Goldman Sachs to maximize asset allocation for wealth management clients, introduced an AI-driven solution in March 2024. This generative AI system represented a breakthrough in individualized financial planning services by developing tailored investment strategies based on individual risk profiles and financial objectives.

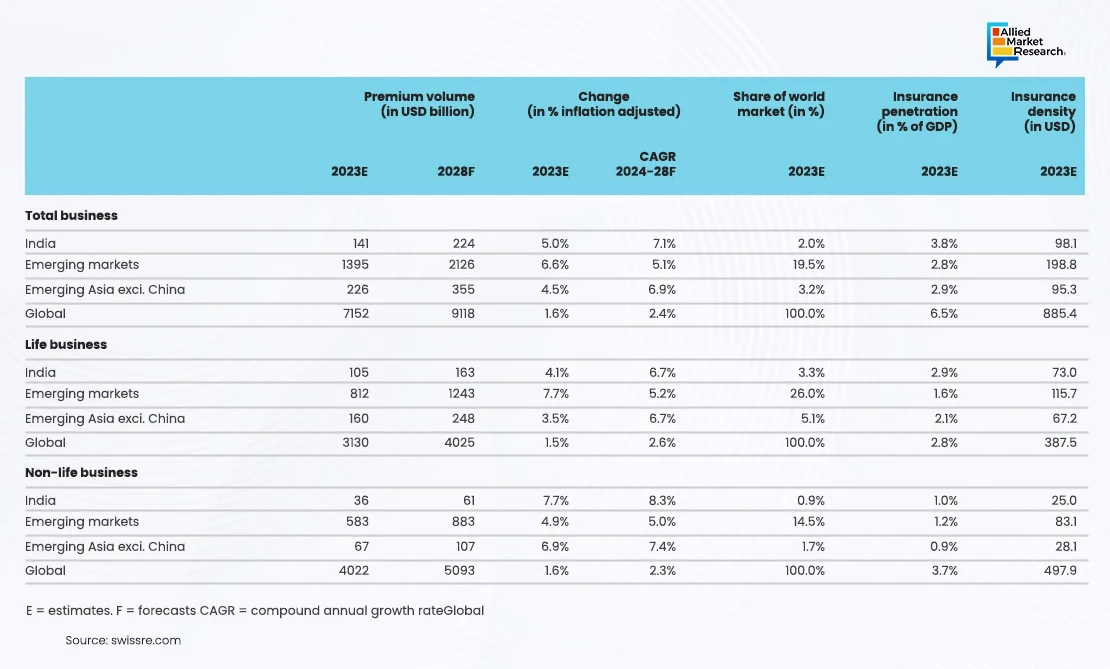

The adoption of generative AI technology to improve client experiences, streamline processes, and keep a competitive edge in the quickly changing financial sector is reflected in the above integrations. Additionally, the below graph shows the growth in active online banking users over the years, driving digitalization in the BFSI industry.:

Cybersecurity and Risk Management

In 2024, the BFSI industry faced ongoing cybersecurity challenges as it relied more on digital platforms. Different cyber threats made it essential to invest in advanced security measures and strong risk management strategies. In 2024, several banks and financial institutions integrated AI and other advanced technologies to augment their cybersecurity defences. Some of notable investment include:

- To improve its operations, particularly cybersecurity, Commonwealth Bank of Australia (CBA) made large investments in AI in November 2024. The bank's AI systems showed a significant boost in fraud detection and prevention skills by successfully reducing scam losses by 50%. Furthermore, call centre wait times were lowered by 40% because of AI integration, suggesting increased operational effectiveness.

- Mastercard Inc., in October 2024, announced an investment of $2.65 Billion to acquire Recorded Future, a firm specializing in threat intelligence cybersecurity solutions. Through the integration of cutting-edge AI technologies, this strategic purchase seeks to improve Mastercard's cybersecurity, identity verification, and fraud prevention services. The deal is expected to close by early 2025, putting Mastercard in a better position to defend its network of financial institutions and commercial clients from changing cyberthreats.

These advancements highlight a larger industry trend toward implementing AI and cutting-edge technologies to improve cybersecurity defences, optimize processes, and fend off ever-more-sophisticated cyberthreats.

Sustainability and ESG Considerations

In 2024, environmental, social, and governance (ESG) considerations gained importance and influenced business plans and investment choices in the BFSI sector. In order to comply with regulatory requirements and satisfy the increasing demand from consumers for responsible banking, financial institutions gave priority to sustainable activities, such as financing renewable energy projects and implementing eco-friendly procedures. Many banks prioritized ESG initiatives i 2024, with several notable examples highlighted below.

- In March 2024, Deutsche Bank outlined eight important ESG themes to keep an eye on, highlighting the significance of precise, quantifiable, and doable routes to net-zero emissions. The bank noted that since December 2020, the number of corporate net-zero pledges has more than doubled, reflecting the financial industry's increasing focus on sustainability.

- To improve several facets of its business, including ESG initiatives, Commonwealth Bank of Australia (CBA) announced large investments in artificial intelligence in November 2024. The bank's AI technologies demonstrated gains in governance and customer service by successfully reducing fraud losses by 50% and call centre wait times by 40%.

With banks realizing the value of ESG considerations in risk assessment, investment strategies, and operational procedures, these advances portray a global movement toward sustainable finance.

Customer Experience and Open Banking

Enhancing customer experience remained a top priority, with banks utilizing AI-driven chatbots and personalized services to meet evolving customer needs. By encouraging data sharing between banks and outside providers, open banking further transformed the industry and created a more cohesive, customer-focused ecosystem. This change made it possible to create cutting-edge financial services and solutions that are customized to meet the demands of everyone.

Regional Insights

The BFSI industry grew significantly in the Asia-Pacific area in 2024, especially in India. Increased investments in technology, rise in international banking initiatives, and a greater focus on digital transformation were the main drivers of this expansion. Some of the important factors impacting the growth include:

Reviving International Banking Initiatives: Global banks resumed their previously stalled technological investments following a time of economic instability and high borrowing prices. The Indian IT industry, which mainly depends on BFSI clients for income, benefited from this renaissance. Prominent Indian IT companies, including Wipro, Infosys, and Tata Consultancy Services (TCS), observed a slight rebound in demand for BFSI.

Global Banks' Increased Technology Spending: Bank of America and JPMorgan Chase, two of the biggest financial organizations, have raised their technology spending considerably. These efforts were concentrated in areas like cloud migration, cybersecurity, customer experience improvement, and regulatory compliance. The focus on technology innovations was intended to improve customer service and streamline processes.

Revenue Growth for Indian IT firms: The financial performance of Indian IT firms improved, driven by higher spending from international banks. Infosys recorded a 2.3% revenue gain in its BFSI unit in October 2024, which was its highest performance in seven quarters and helped to generate a 5.1% increase in overall revenue. Wipro also witnssed growth in its BFSI division for the first time since March 2024, suggesting that the industry is on the rise.

Some of the major developments observed across the year take in-

- Infosys in October 2024 recorded an 5.1% increase in overall sales after reporting a 2.3% revenue gain in its BFSI unit, the best in seven quarters. Major financial industry clients' renewed expenditure was cited as the reason for this development.

- In August 2024, Tata Consultancy Services (TCS) noted a slight recovery in demand within the BFSI sector, anticipating that reduced interest rates and diminished uncertainty surrounding the US election would enhance customer confidence.

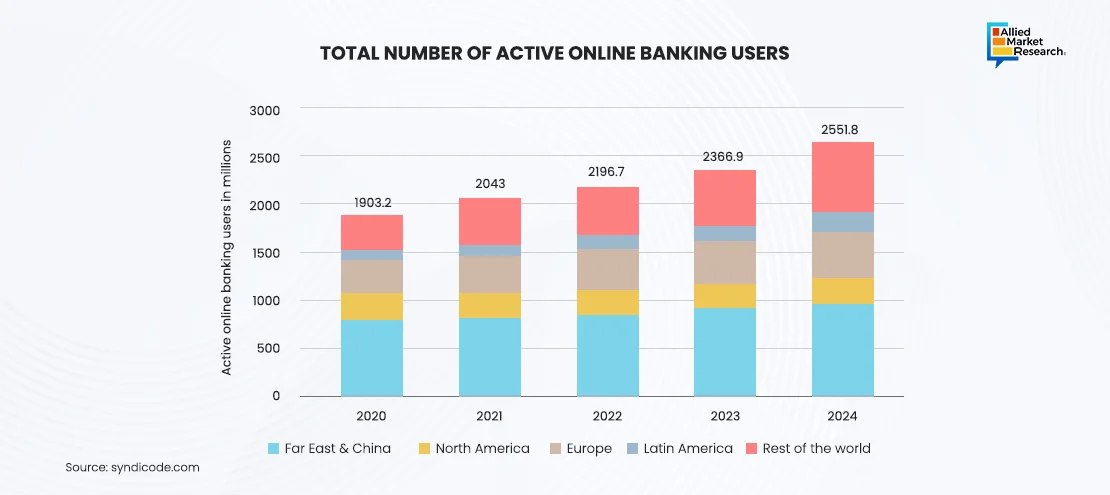

Additionally, the below graph shows the snapshot of Inian insurance market compared with other global regions-

Thus, owing to the above factors, the BFSI industry grew most rapidly in the Asia-Pacific area in 2024, especially in India. The resurgence of international banking initiatives, higher financial institution technology expenditures, and the uptake of AI technologies all contributed to this expansion. Major Indian IT companies' strong financial results highlight the region's crucial position in the global BFSI scene.

The Road Ahead: BFSI Industry 2025

As 2025 approaches, the BFSI sector is facing a changing landscape influenced by evolving customer expectations, new technologies, and shifting regulations. Key technologies like AI and machine learning are enhancing decision-making, automating processes, and improving customer experiences. Investment banks, for example, are using AI to free up junior bankers for more strategic work. Additionally, the rise of neobanks, which offer mobile-first, digital-only services, is challenging traditional banking models. With increasing neobank adoption in 2025, established banks need to upgrade their digital offerings to stay competitive.

The macroeconomic environment presents both challenges and opportunities. The US Federal Reserve is expected to lower interest rates, reducing banks' net interest margins. To stay profitable, banks have to adjust their strategies for earning interest. However, there is optimism for revenue growth in areas like mergers, IPOs, and regulatory changes, which could boost advisory income. International banks are also expected to witness benefits from growth in trading, underwriting, and deal-making.

For more insights in the BFSI domain, contact our specialists today!

Some of the trending reports in the domain are listed below: