Table Of Contents

Onkar Sumant

Pooja Parvatkar

BFSI Industry’s Notable Transition in the Year 2023

The BFSI sector, as analyzed by Allied Market Research (AMR), underwent significant transformations in 2023. Various substantial changes occurred within the BFSI sector, propelled by the advancements in technology, regulatory changes, and an emphasis on sustainability. Collection strategies were updated, new payment methods were evaluated, and advancements in AI and machine learning altered the way businesses operate. The reimagining of payments and the industry’s dedication to sustainability highlighted a future-targeted approach. Rapid digitalization, driven by technological innovations like artificial intelligence and blockchain, transformed customer experiences and operational efficiencies. However, increasing cybersecurity threats and regulatory complexities posed significant hurdles for industry players. Despite these challenges, the sector continued to evolve, with a growing emphasis on sustainable finance and inclusive banking practices.

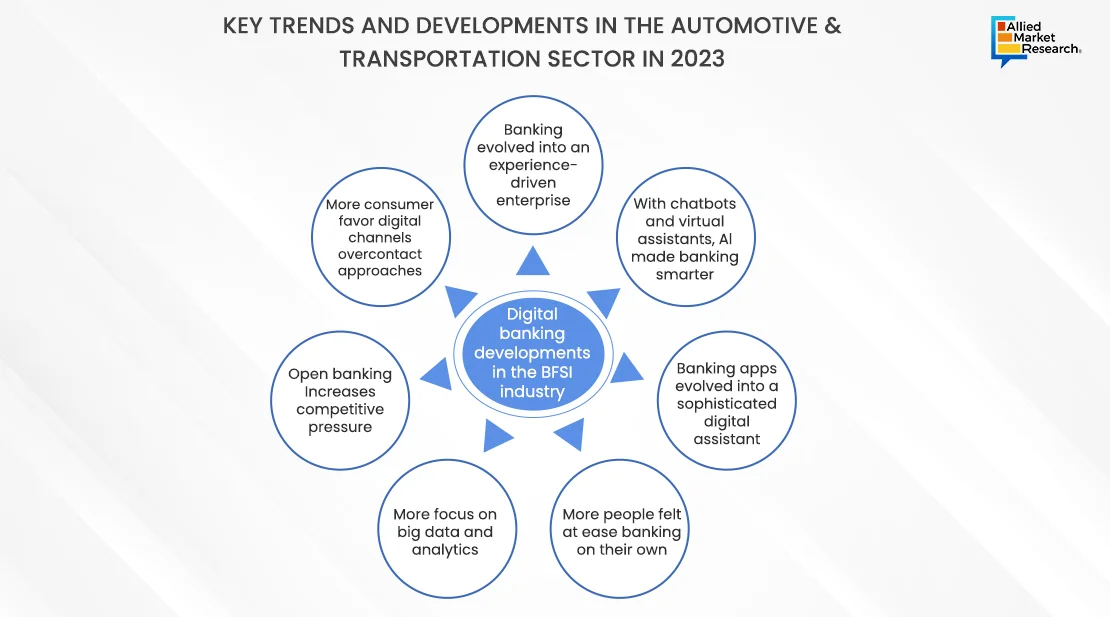

The Banking, Financial Services, and Insurance (BFSI) sector experienced notable shifts in 2023, marked by transformative trends that shaped its trajectory.

Amidst rapid digitalization, artificial intelligence and blockchain technologies emerged as key drivers, revolutionizing customer engagement and operational efficiency. The sector also witnessed a growing emphasis on sustainable finance and inclusive banking practices, alongside strategic mergers and alliances reshaping the competitive landscape.

Digital Transformation in BFSI

In order to analyze the growth and digital transformation of the BFSI sector, the majority of key players made investments in technology.

Increased Customized IT Solutions for Specific banking needs: IT solutions adaptation to banks’ specific and changing needs is important to the banking industry’s digital transformation. Traditional banking solutions are not able to meet the changing needs of clients and organizations. As a result, in 2023, banks turned to customized IT solutions to meet their specific needs, delivering personalized experience and specialized functionality. Moreover, the main benefits of custom-written software are that it provides improved security for customers’ and organizations’ data and reduces the chances of system cyberattacks and phishing attacks, besides providing market access growth. Furthermore, banks collaborated with fintech companies to develop customized solutions that integrate with new technologies. These partnerships resulted in customized solutions for specific banking needs. For instance, in January 2023, HDFC Bank, India’s largest private sector bank, teamed with Microsoft to drive its digital transformation journey and unleash business value by transforming the application portfolio, upgrading the data landscape, and securing the company with Microsoft Cloud. Therefore, these factors fueled the need for digital transformation resulting in the increased demand for customized IT solutions for specific banking needs.

Increased Adoption of Advanced Technology, AI and ML: The banking and fintech industry has experienced a drastic change over centuries, owing to the emergence of disruptive technologies. Thus, the increased application of artificial intelligence (AI) and machine learning (ML) in banking and fintech institutions boosted the BFSI sector in 2023. Furthermore, many banks and financial institutions adopted AI-based banking solutions to provide customers with faster and more efficient customer services. In addition, to improve the security features of the banking platform, many banks adopted machine learning to predict fraud even before it happens. These innovations were constantly being developed and accounted for numerous opportunities for the sector. For instance, in May 2023, American multinational financial services company JPMorgan Chase applied to trademark a product called IndexGPT, indicating its development of a ChatGPT-like software service that uses artificial intelligence (AI) to select investments for customers.

Rise of Fintech:

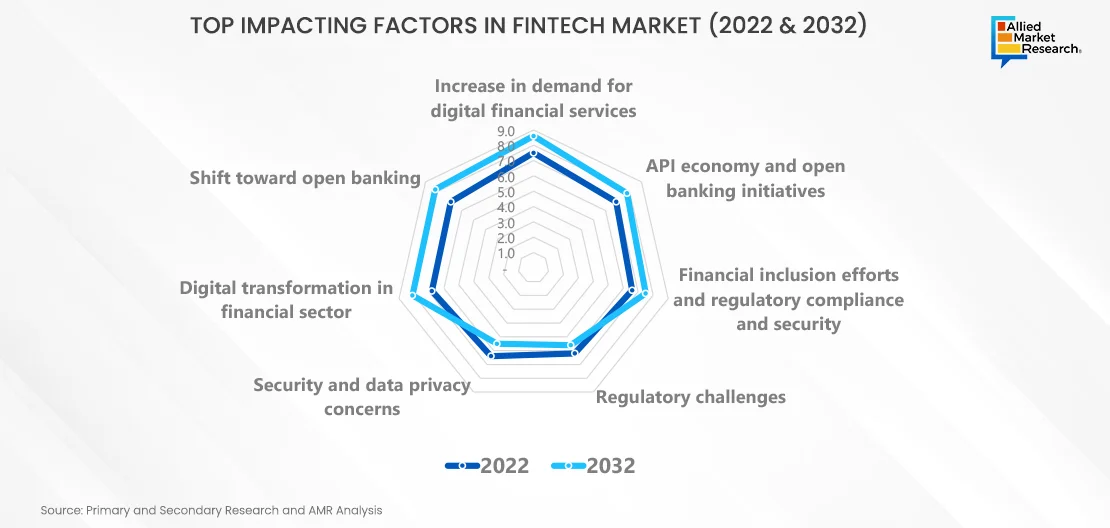

The rise of fintech and the idea of ??open finance have transformed the financial industry over the last decade. The number of people using mobile devices to gain access to offers including investing, budgeting, lending, fees and mobile banking has grown significantly in 2023. The FinTech industry continued to grow as 5G is implemented and new technologies, such as AI, ML, Web 3.0, and metaverse have emerged. According to the Allied Market Research report, the fintech technologies market is projected to reach $698.48 billion by 2030. Leading trends in the growing market included digital-only neo-banking platforms (also known as neo-banks), technology-driven insurance (also known as InsurTech), digital lending, and platforms for alternative investments.

Surge in Digital Financial Services:Global neo-banking players have been drawn to the explosion of digital financial services. In 2023, neo-banks, which are fully online and run on the cloud, expanded as compared to traditional banks, which have physical branches. They filled the space between traditional banking services and services for modern, internet-savvy customers. During the pandemic, the neo-banking industry accelerated notably and is worth almost $40 billion in 2023, representing 2.2% of the overall banking market. According to analysts, over 10 million customers in India use neo-banking services. The popularity of Neo-bank lies in its personalized offerings, which are created using AI and data analytics. To offer specific products and services, some neo-banks also concentrated on specific customer segments, including blue-collar workers, seniors, working professionals, women, students, and global citizens. For instance, a neo-bank that serves students offers credit cards to those going to the US for higher studies or employment, after analyzing their current credit history and other parameters using big data and analytics.

InsurTech:The COVID-19 pandemic completely changed the insurance industry, with tech businesses collaborating with insurers to introduce novel ideas for products and client distribution strategies. In May 2023, Wefox, a Germany-based insurance technology firm raised $110 million funding from investors including JPMorgan and Barclays. The development is an indication of trust towards the insurance technology market, which faces strong macroeconomic challenges. Wefox specializes in personal insurance products, such as home insurance, motor insurance and personal liability insurance. Furthermore, the insurance sector transformed from identifying and fixing issues to forecasting and preventing them by utilizing AI, machine learning, deep learning, artificial neural networks, blockchain, and IoT. Using intelligent bots, robotic process automation, natural language processing, and mobile and video alternatives, InsurTech startup platforms also digitized the claim-handling process.

Alternative Investment Platforms: With easier digital onboarding of customers and cost-effective access to investment platforms, new-age customers and HNIs used alternative investment platforms for wealth creation. The alternative investment solution ecosystem, which includes data analytics providers, insights providers, B2B software solution providers, and online platforms; supports customers in taking informed decisions, especially in non-traditional areas, such as tokenized real estate, digital gold, startups, and non-fungible tokens (NFTs).

Digital Lending: The digital lending ecosystem that bridges the credit gap between small enterprises and the low-income population?faced a decision over the use of robotics, machine learning, and automated data analysis tools for improved credit evaluations. Digital lenders adopted several ML-based models to customize their offerings and modernized their technologies with unified dashboards and analytics. End-to-end automation was implemented for customer acquisition and onboarding procedures, which included application processing, applicant assessment, screening, service, collection, and analysis.

Cybersecurity in BFSI:

The banking, financial services, and insurance industry leveraged technology to adapt to the changing needs of its clients while also rapidly transforming itself. From keeping paper records to providing a range of digital services such as?premium payments, online shopping, and others. While the BFSI industry’s bottom line and customer experience have both benefited from this digital transformation, security issues have also grown. The industry is subjected to numerous attacks starting from phishing attacks, DoS attacks, spear-phishing, ransomware, malware attacks, and others, that try to steal cash and sabotage the brand’s reputation. Governments and regulatory bodies across the world emphasized heavily on strict security protocols and technology to stop these attacks.

Government Initiatives for the Development of Cybersecurity in the BFSI industry: The increase in digitization initiatives by a range of governments in developing countries was one of the major factors driving the growth of the cyber security in BFSI market. For instance, ISO/IEC 27001 is a widely accepted worldwide standard for lowering security risks and safeguarding information systems. ISO/IEC 27001 is an internationally recognized set of security policies and processes that provide direction on how to improve a company's security posture in any industry. Financial institutions that wanted to demonstrate their exceptional cybersecurity procedures to stakeholders pursued ISO/IEC 27001 accreditation, given its image as an internationally recognized benchmark for cyber-attack resilience.

Data Analytics and AI:

The banking industry and financial institutions rely on data analytics and AI to perform properly. With the continuous development and innovation in banking and financial services in 2023, AI helped BFSI organizations to merge human and technical abilities to make financial savings, increase productivity, and ensure safety. It empowered the BFSI industry by automating employee knowledge as well as safeguarding the entire automation process against rising cyber hazards.

Data analytics and AI in BFSI Industry: With data analytics and AI, the BFSI employed big data to increase organizational success and assure risk management, profitable growth, and efficient performance. According to AMR report, the global data analytics in banking market was valued at $4.93 billion in 2021 and is projected to reach $28.11 billion by 2031. The expansion in the velocity, volume, and variety of banking and financial data drove the industry to extract insights from numerous sources utilizing data analytics and AI technology. Moreover, technology powerhouses, such as Google, Amazon, and Paytm entered the BFSI space by expanding their offerings and creating payment and banking applications. For instance, in June 2023, Moody’s Corporation and Microsoft formed a partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. Built on a combination of Moody’s robust data and analytical capabilities and the power and scale of Microsoft Azure OpenAI Service, the partnership created innovative offerings that enhanced insights into corporate intelligence and risk assessment, powered by Microsoft AI and anchored by Moody’s proprietary data, analytics, and research.

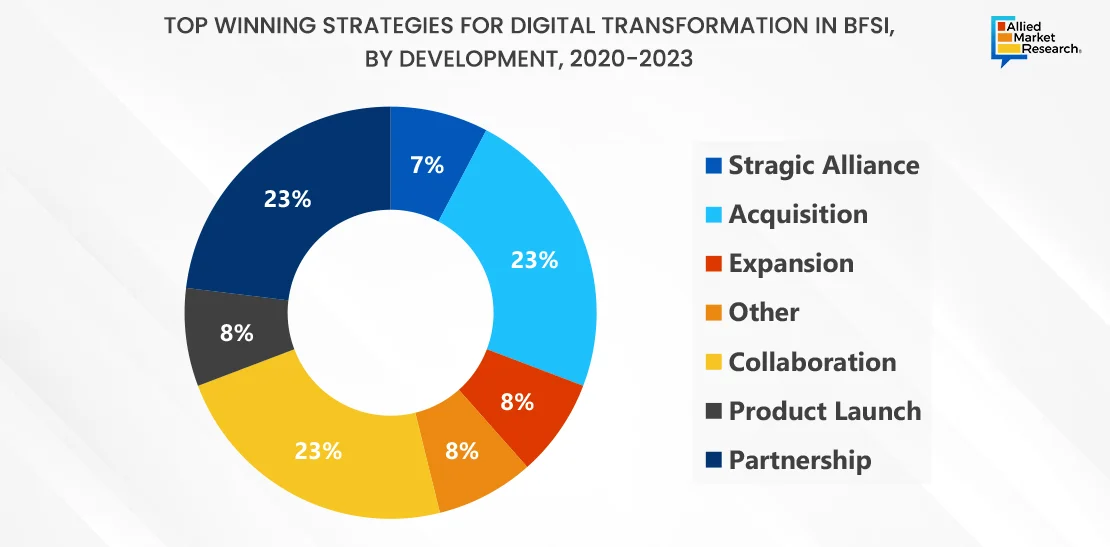

Strategic Collaboration Between Industry Players and Private-public Partnerships Resulting in Market Expansion: Governments and companies around the world encouraged collaboration and private-public partnerships between banks and fintech providers, thus helping the growth of BFSI sector. For instance, in March 2023, Morgan Stanley Wealth Management (MSWM) launched a strategic initiative to create a bespoke solution with OpenAI, the artificial intelligence research and deployment lab. The business unit is one of a handful of GPT-4 launch organizations, and Morgan Stanley is currently the only strategic client in wealth management receiving early access to OpenAI’s new products.

In addition, in September 2023, Temenos launched an industry-first secure solution for banks using Generative Artificial Intelligence (AI) to automatically classify customers’ banking transactions. Transaction classification helps banks provide personalized insights and recommendations, offer more engaging and intuitive digital banking experiences, and enhance customer loyalty through more relevant products and offers. It is, therefore, analyzed that strategic collaboration between industry players and fintech partnerships played a significant role in the growth of data analytics and AI in BFSI market. Among industry sectors, banking has one of the largest opportunities: an annual potential of $200 billion to $340 billion (equivalent to 9 to 15 percent of operating profits), largely from increased productivity.

Future of the BFSI Sector

The BFSI revolution is driven by two fundamental components including digitization and digitalization. These innovative methods allow banks to investigate and experiment with disruptive technologies and business processes such as AI, blockchain, robotic process automation, and cyber security in order to provide competitive BFSI services. Digitization offers strong security and cost-efficiency and is expected to provide lucrative growth opportunities to the BFSI sector industry in the upcoming years. Key players are poised to bank on digitization for leveraging opportunities in the market in the coming years. Here’s where AMR can help your business with comprehensive strategies tailored to the specific needs of the company. Get in touch with AMR analysts.