Safeguarding Your Adventures: The Prominent Role of Travel Insurance in a Globalized World

Travel insurance is a specialized insurance product designed to protect travelers from the various risks and uncertainties that can arise before and during a trip. It is essentially a financial safety net that covers a range of potential issues, including medical emergencies, trip cancellations, lost baggage, and travel delays. The importance of travel insurance has become increasingly evident as global travel has expanded, with more people embarking on adventures across the world.

A travel insurance policy typically covers several critical areas:

Medical emergencies: One of the primary benefits of travel insurance is coverage for medical expenses incurred abroad. Healthcare costs can vary significantly from country to country, and without adequate insurance, travelers may face substantial out-of-pocket expenses. For example, in August 2024, a traveler to Sydney who fell ill unexpectedly was able to rely on his travel medical insurance to cover the high medical costs, avoiding what could have been a financially crippling situation.

Trip cancellation and interruption: Life is unpredictable, and sometimes circumstances force travelers to cancel or interrupt their plans. Travel insurance helps mitigate the financial impact of these disruptions. A real-life scenario in 2023 involved Sarah, who had to cancel her trip due to a sudden illness just days before departure. Her trip cancellation insurance allowed her to recover the non-refundable costs and reschedule her trip once she was well.

Lost or delayed baggage: Travel insurance can also cover the cost of lost, stolen, or delayed baggage, which is a common inconvenience for travelers. While it won’t make lost luggage reappear, the financial support provided by the insurance can help travelers replace essential items and continue their journey with minimal disruption.

Travel delays: Unforeseen delays can lead to additional expenses, such as extra accommodation or meals. Travel insurance can provide coverage for these unexpected costs, ensuring that travelers are not left to bear the financial burden alone.

Travel insurance is not just about financial protection; it also offers peace of mind. It helps travelers deal with modern travel challenges, giving them the confidence to explore, knowing they're protected from unexpected events.

The Evolving Needs of Modern Travelers

With the ongoing changes in global travel dynamics, the needs and expectations of today's travelers are quickly evolving. Today's travelers are increasingly seeking experiences that align with their personal values, lifestyle choices, and the growing emphasis on well-being and sustainability.

One of the most significant trends is the growing demand for longer, more immersive travel experiences. Recent data from Mastercard reveals that travelers are extending their vacations by an average of one day compared to pre-pandemic patterns. This trend is particularly prominent in regions like the Middle East and Africa, where extended stays are becoming the norm. This shift not only reflects a desire to make the most of travel opportunities but also highlights the changing priorities of travelers who are now placing greater importance on deep, meaningful experiences rather than quick getaways.

Moreover, the rise of event-driven travel is another hallmark of modern tourism. Major global events, such as the European Championship in Munich and the Carnival in Rio de Janeiro, have become significant travel motivators. These events are not just attracting tourists but are also driving substantial economic benefits for host cities. For example, during the 2024 Carnival in Rio, tourist spending at local businesses surged by 156% compared to regular business periods?. This trend highlights how travelers are increasingly planning their trips around unique experiences that offer cultural and social engagement.

Additionally, there's a noticeable shift toward sustainable travel practices, particularly among younger travelers. Business travelers, for instance, are demanding more sustainable options, with nearly 80% expressing a preference for travel choices that minimize environmental impact. Companies are responding by offering longer, more purposeful trips that reduce the need for frequent flights, thus aligning with broader sustainability goals. This trend is not only shaping corporate travel policies but also influencing leisure travel, where sustainability is becoming a key consideration for a growing number of travelers.

Finally, the growing trend of solo travel, particularly among Millennials and Gen Z, is another significant development. According to a survey by American Express, 76% of these younger travelers plan to take solo trips in 2024, focusing on self-care and personal growth. This shift reflects a broader movement toward individualistic travel experiences that cater to personal well-being and self-discovery.

These trends collectively illustrate how modern travelers are reshaping the travel industry, demanding more personalized, sustainable, and experience-driven journeys. As the travel industry evolves, insurance providers need to offer coverage that meets the diverse and changing needs of today’s travelers.

Innovations Driving the Future of Travel Insurance

To put it simpler, the travel insurance industry is experiencing significant transformations to meet the changing needs of travelers. Several emerging trends are shaping the future of travel insurance, making it more flexible, personalized, and technology driven.

One of the most notable shifts is the rise of customizable and on-demand insurance policies. Travelers today seek coverage that is tailored to their specific needs, and insurers are responding by offering more flexible options. For example, policies can now be adjusted to cover only the duration and aspects of a trip that the traveler deems necessary. This craze is particularly appealing to younger travelers who value flexibility and cost-effectiveness, allowing them to purchase coverage just for the period they need, such as a two-week vacation.

Digital and mobile solutions are also revolutionizing the travel insurance landscape. Insurance companies are increasingly integrating mobile apps and digital platforms into their services, enabling travelers to manage their policies, file claims, and receive real-time updates with ease. This shift toward digitalization not only enhances customer convenience but also streamlines the claims process, making it faster and more efficient. As a result, travelers can enjoy a more seamless experience when dealing with unexpected situations during their trips.

Another significant trend is the integration of sustainability and ethical considerations into travel insurance policies. With a growing emphasis on environmentally responsible travel, some insurers are developing policies that align with sustainable travel practices. This can include coverage for eco-friendly accommodations or incentives for choosing low-impact travel options. This trend reflects the broader shift in consumer values, where more travelers are prioritizing sustainability in their travel choices.

The adoption of artificial intelligence and emerging technologies is also revolutionizing the industry. AI is being used to enhance the personalization of insurance products, improve risk assessment, and automate claims processing. For instance, AI-driven tools can analyze vast amounts of data to offer more accurate pricing and coverage options tailored to individual travelers' profiles. This technology not only improves the efficiency of insurance services but also ensures that travelers receive coverage that best suits their needs.

Lastly, airlines are playing a significant role in the landscape of travel insurance by incorporating innovative insurance strategies into their ancillary services. Airlines like JetBlue and Ryanair are offering "Cancel for Any Reason" (CFAR) plans and annual travel insurance policies, providing travelers with added flexibility and peace of mind. These strategies are helping airlines attract more bookings while enhancing customer loyalty.

The travel insurance industry is rapidly adapting to meet the evolving demands of modern travelers. By embracing customization, digitalization, sustainability, AI, and strategic partnerships with airlines, insurers are ensuring that their offerings remain relevant and valuable in an ever-changing travel landscape.

The Global Impact of Travel Insurance on Tourism

Travel insurance plays a pivotal role in the global tourism industry, significantly influencing both the behavior of travelers and the broader economic landscape. As the tourism industry recovers from the pandemic and explores new challenges, the significance of travel insurance has become more pronounced than ever.

In 2024, the travel and tourism industry is expected to contribute a record-breaking $18 trillion to the global economy. This surge highlights the importance of travel insurance in supporting and sustaining this growth. By providing financial protection against unforeseen events, travel insurance boosts traveler confidence, encouraging more people to embark on international journeys despite the risks associated with travel disruptions, health emergencies, or natural disasters?.

One of the keyways travel insurance impacts tourism is by enhancing the resilience of the sector. Insurance policies that cover trip cancellations, medical emergencies, and travel delays help mitigate the financial risks for both travelers and the industry. This safety net protects individual travelers and supports the stability of the tourism industry, especially in times of global crises, such as the COVID-19 pandemic or natural disasters exacerbated by climate change.

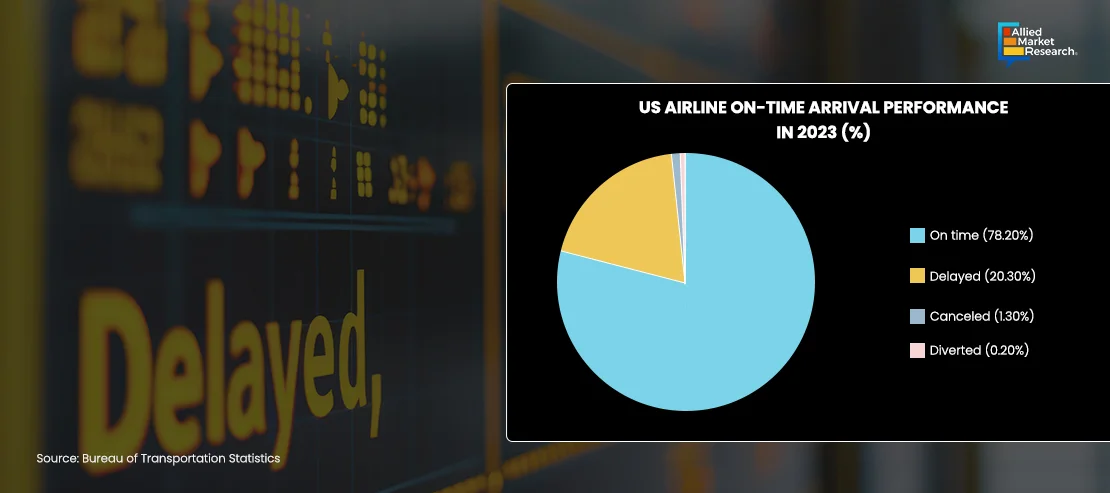

For instance, the U.S. airline industry in 2023 had an on-time rate of 78.2%, indicating that the majority of flights adhered to their schedules. However, about 20.3% of flights experienced delays, reflecting ongoing challenges in maintaining punctuality across the board. Additionally, 1.3% of flights were canceled, while a small fraction, 0.2%, were diverted. These statistics highlight the importance of travel insurance, as travelers must be prepared for potential disruptions that can impact their itineraries unexpectedly.

Moreover, travel insurance contributes to the sustainability and inclusivity of global tourism. The World Economic Forum states that travel and tourism account for 7.6% of global GDP and provide nearly 300 million jobs worldwide. The sector is particularly important for small and medium-sized enterprises (SMEs), which make up a significant portion of tourism-related businesses. By safeguarding these enterprises from the financial fallout of travel disruptions, insurance supports local economies and helps maintain employment, especially in developing regions.

Additionally, the insurance industry's adaptation to emerging risks, such as those posed by climate change, is important for the long-term sustainability of tourism. Policies that include coverage for extreme weather events or provide incentives for eco-friendly travel practices are becoming increasingly important as the world deals with the environmental impact of tourism. When it protects travelers and businesses, it also encourages more responsible and sustainable travel behaviors.

Travel insurance is a vital component of the global tourism ecosystem. It enhances traveler confidence, supports economic stability, promotes sustainable practices, and ensures that the benefits of tourism are more widely distributed, particularly in vulnerable communities and regions.

Case Study: AXA's Digital Transformation with AI-Driven Omnichannel Support

Introduction

In response to the global pandemic, AXA, a leading multinational insurance company, accelerated its digital transformation journey. This transition was driven by the need to manage an overwhelming volume of customer interactions, particularly in the travel insurance sector, due to the rapidly changing travel restrictions. The company has since embraced a fully functional e-travel model, integrating advanced AI-driven technologies to enhance customer service.

Challenge

The onset of the pandemic created a significant challenge for AXA, as its contact centers experienced an unprecedented surge in inquiries. Customers, confused by varying travel restrictions, sought clarity and assistance, leading to a 250% increase in interactions. The immediate goal was to implement a solution that could handle routine customer interactions efficiently, allowing human operators to focus on more challenging issues.

Solution

AXA partnered with Born Digital to implement an AI-powered voice assistant, which played a crucial role during the pandemic. The voice assistant managed routine calls, provided essential information, and redirected customers to self-service options, significantly reducing the load on human operators. This technology not only streamlined the handling of travel insurance queries but also extended its capabilities to manage other processes such as claims liquidation, first notice of loss (FNOL), health assistance, and damage reporting.

As the initial phase of the project proved successful, AXA expanded its self-service offerings by introducing a chat assistant and automating the processing of customer emails. The Born Digital email classifier categorizes incoming emails, forwards them to the appropriate agents, and highlights key information, enabling faster and more efficient responses. Additionally, AXA integrated fraud detection technology to verify the authenticity of documents, preventing double reimbursements of insurance claims.

Impact

The implementation of AI-driven solutions by AXA yielded significant benefits:

- Their voice bots have successfully handled over 100,000 interactions.

- 20% of customer interactions are now fully automated.

- The chatbot effectively manages 87% of all conversations.

The voice assistant significantly reduces time and costs by saving operators an average of 3 minutes on every 15-minute call.

The omnichannel approach provided 24/7 customer support across various platforms, including the website and email, ensuring that AXA's customers received timely assistance even during peak periods. This transformation enhanced operational efficiency and improved customer satisfaction by providing high-quality support in critical situations.

Conclusion

AXA's collaboration with Born Digital exemplifies how lutilizing AI and automation can drive effective digital transformation. AXA has improved customer service in the insurance industry by using innovative solutions to address pandemic challenges, ensuring reliable and efficient support across multiple channels.

Winding up

In an increasingly interconnected world, travel insurance has become an essential safeguard for modern travelers. It protects against unexpected disruptions and also contributes to the resilience and sustainability of the global tourism industry. By embracing digital innovations and adapting to changing needs, the travel insurance industry is ready to support the future of global tourism.

Allied Market Research delves into the dynamic travel insurance sector, providing in-depth analyses of industry trends, market forces, and regulatory developments that shape the sector. Our comprehensive reports equip stakeholders with valuable insights into how travel insurance enhances security, ensures peace of mind for travelers, and adapts to evolving global travel patterns. These insights empower businesses to capitalize on opportunities, innovate, and offer reliable protection across the landscape.

Contact our experts today for a detailed analysis of the factors driving growth and investment opportunities in travel insurance!