Table Of Contents

- Energy Sector Outlook 2024

- Power Sector Outlook 2024

- 5 D’s Driving Energy and Power System Changes across the Globe in 2024

- Decarbonization: It refers to the process of reducing carbon emissions by transitioning energy sources, services, and consumption patterns to those with lower carbon intensity.

- Digitization: Digitization is transforming the entire energy value chain by integrating digital technologies, reshaping industrial and domestic practices, behaviors, and processes.

- Decentralization: It refers to the transition from traditional, centrally controlled energy systems to decentralized models, which are typically situated closer to customers and end-users, enabling more localized energy generation and distribution.

- Disruption: In 2024, significant shifts in energy consumption patterns have driven major changes in demand across various energy types.

- Diversification: It involves the strategic transition towards relying on multiple energy sources to enhance energy security and reduce dependence on any single source.

- Role of Digitization in the Energy and Power Sector

- Regional Outlook

- Energy and Power Investments in Middle East and Africa

- Supply Chain Challenges

- Raw Material Availability

- Increasing manufacturing capacity to meet regional demand

- Supply Chain Solutions

- Energy and Power Industry Future Preparations

- AMR Verdict

Yerukola Eswara Prasad

Koyel Ghosh

2024 Energy and Power Industry Outlook: Trends, Insights, and Projections

Energy Sector Outlook 2024

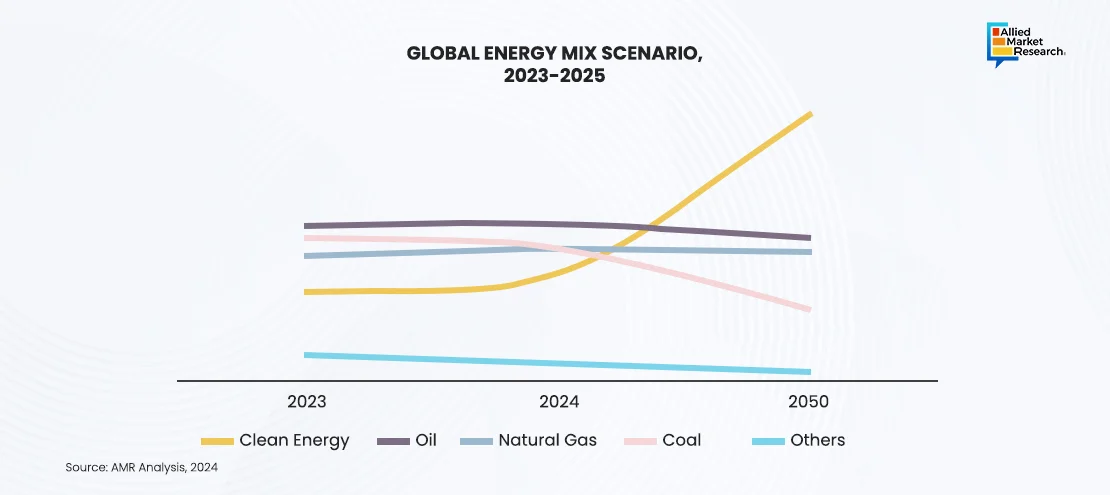

In 2024, energy demand has grown by about 15%, with 40% of this increase coming from clean energy sources, including renewable energy and Carbon Capture, Utilization, and Storage (CCUS). In the emerging economies, which accounts more than 85% of the world’s population, the energy demand has increased by approximately 2.5% as compared to that of 2023, supported by various driving factors such as rapidly increasing population, increasing industrial output, and others. Over the past decade, there has been a decline in the use of fossil fuels, along with a modest reduction in the reliance on natural gas.

By 2030, coal demand is expected to decline sharply, with natural gas emerging as the dominant source in global energy demand. Clean energy, driven by the rapid growth of wind power and solar photovoltaic (PV) technology, is projected to outpace the overall growth in energy demand between 2023 and 2035. By the end of 2030, clean energy is expected to become the world’s largest energy source.

Power Sector Outlook 2024

Energy consumption and production account for approximately 65% of global greenhouse gas (GHG) emissions, yet the energy sector holds the greatest potential to mitigate climate change. By accelerating the innovation and large-scale deployment of sustainable energy technologies, the pace of renewable energy advancements is steadily increasing. Solar and wind power, in particular, have seen rapid cost reductions, placing these technologies at the forefront of the global energy transformation. To fully utilize their potential while maintaining low electricity costs, more flexible and adaptive power systems are essential.

Sustainable energy, sourced from renewable resources, can meet current energy needs without compromising the ability of future generations to do the same. This includes not only generating energy but also ensuring its efficient collection and distribution. As technological innovations in renewable energy power continue to evolve, they have the potential to reshape the global energy landscape, addressing the pressing challenges posed by climate change. With rising investments in renewable energy, manufacturers and engineers are deploying cutting-edge solutions that optimize energy generation, storage, and distribution, all while minimizing environmental impacts.

5 D’s Driving Energy and Power System Changes across the Globe in 2024

Decarbonization: It refers to the process of reducing carbon emissions by transitioning energy sources, services, and consumption patterns to those with lower carbon intensity.

Digitization: Digitization is transforming the entire energy value chain by integrating digital technologies, reshaping industrial and domestic practices, behaviors, and processes.

Decentralization: It refers to the transition from traditional, centrally controlled energy systems to decentralized models, which are typically situated closer to customers and end-users, enabling more localized energy generation and distribution.

Disruption: In 2024, significant shifts in energy consumption patterns have driven major changes in demand across various energy types.

Diversification: It involves the strategic transition towards relying on multiple energy sources to enhance energy security and reduce dependence on any single source.

Role of Digitization in the Energy and Power Sector

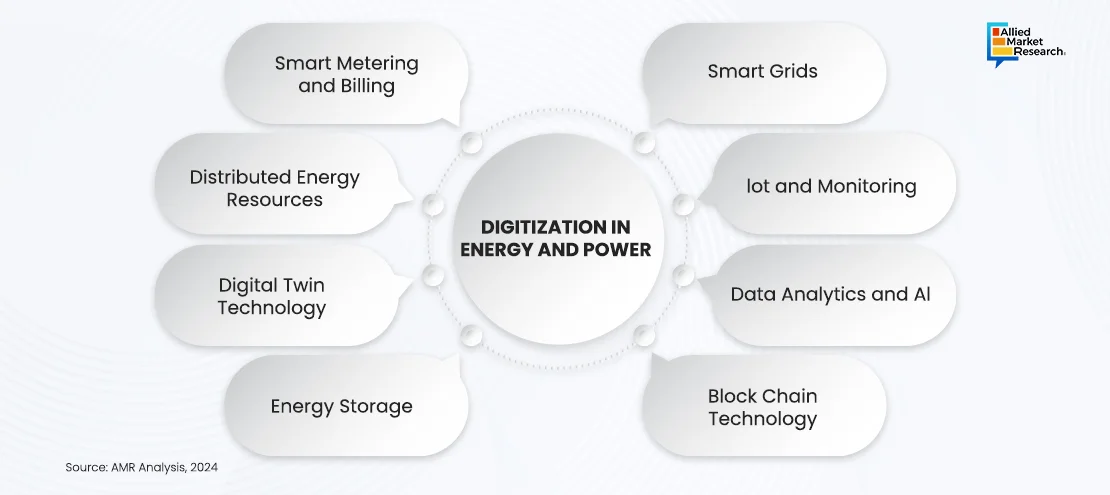

The clean energy transition demands a fundamental transformation of power systems, driven by the need for extensive digitalization across all grid domains—from generation and transmission to distribution and end-use. This shift is essential to minimize carbon emissions and improve electricity access, particularly in underserved and low-income regions.

However, the renewable energy sector faces significant challenges, such as geographically dispersed energy data, lack of integrated platforms, inability to track assets, and others. Digital technologies offer solutions to enhance climate impact, enhance power system resilience, and ensure cost-effective energy delivery. Digitalization plays an important role in advancing and optimizing various factors of renewable energy, contributing to its growth and effectiveness. Digitization equipment and systems in renewable energy improve automatic processes and minimize downtime. Addressing the challenges of climate change and improving energy access in low-income communities demands innovative and sustainable solutions like these.

Regional Outlook

In 2024, investors primarily focused on three prominent regions: East Asia, Europe, and North America. The energy and power sector attracted significant attention as investors evaluated countries and regions based on factors such as government support, market potential, political stability, infrastructural development, environmental policies, and more. The regions experiencing the highest levels of investment successfully balanced these factors, offering an appealing risk-reward proposition to stakeholders.

The Asia-Pacific region accounted for more than half of global energy consumption, driven by rapid industrialization and population growth. The renewable energy market witnessed substantial growth in nations like China and India. China, in particular, strengthened its position as a leader in hydropower, onshore wind energy, solar photovoltaics, and bioelectricity, becoming the world's largest producer of bioelectricity in 2024. Additionally, the growing production of electric vehicles in the region created lucrative opportunities for energy market expansion. Asia-Pacific also led in geothermal energy development, contributing 33.3% of global geothermal capacity at 27.53 GW, according to World Bank data. Companies like Ormat Technologies played a pivotal role, offering heat converters for geothermal projects such as the Sarulla power plant. The region’s increasing demand for cleaner and sustainable energy sources further boosted the development of geothermal power and other renewables.

North America continued to demonstrate its leadership in clean energy technologies. The U.S., the world’s second-largest energy consumer and CO2 emitter, witnessed rapid advancements in renewable energy infrastructure, battery technology, heat pumps, electrolyzers, and electric vehicle sales. In 2024, North America maintained its position as the largest producer of biofuels globally, while coal consumption in the U.S. dropped to historic lows. This contributed to a 4% reduction in CO2 emissions from the energy sector, with the electricity sector accounting for 65% of the decrease. These advancements cemented North America’s role as a global innovator in the transition to sustainable energy systems.

Europe remained a global leader in renewable energy, with clean energy sources accounting for two-thirds of the continent's electricity mix in 2024. Wind and solar energy collectively produced 27% of total EU electricity, surpassing nuclear power (23%) and hydropower (12%). Bioenergy and other renewables contributed an additional 5.9%. Europe's focus on reducing carbon emissions and shifting toward renewable power generation continues to drive energy demand and investment across the continent. This transition underscores the region's commitment to achieving a more sustainable energy landscape.

Energy and Power Investments in Middle East and Africa

Saudi Arabia's domestic oil consumption ranges between 2 to 3 million barrels per day. This has significantly increased pollution, making the Gulf States one of the largest emitters of carbon dioxide per capita in the world. In response, these countries have been working to reduce their carbon footprint while increasing revenue from crude oil and natural gas exports. A key part of this strategy involves developing a substantial local renewable energy supply. Given the abundance of strong sunlight in the Gulf States and North Africa, considerable efforts have been directed towards solar energy development. Additionally, regions in North Africa, where consistent wind flow is present, have been generating wind power. The growing oil and gas sector is expected to play a pivotal role in the energy and power sector’s expansion in the future.

Supply Chain Challenges

Raw Material Availability

As the world is shifting to clean energy sources like wind and solar power, manufacturers are facing challenges in securing raw materials at stable prices. A major issue is the limited supply of key materials, such as rare earth metals, which are needed for wind turbines. For example, neodymium, a metal used in turbine magnets, is expected to face a 50-60% shortage by 2030, according to Allied Market Research. This shortage could slow the growth of renewable energy production.

Increasing manufacturing capacity to meet regional demand

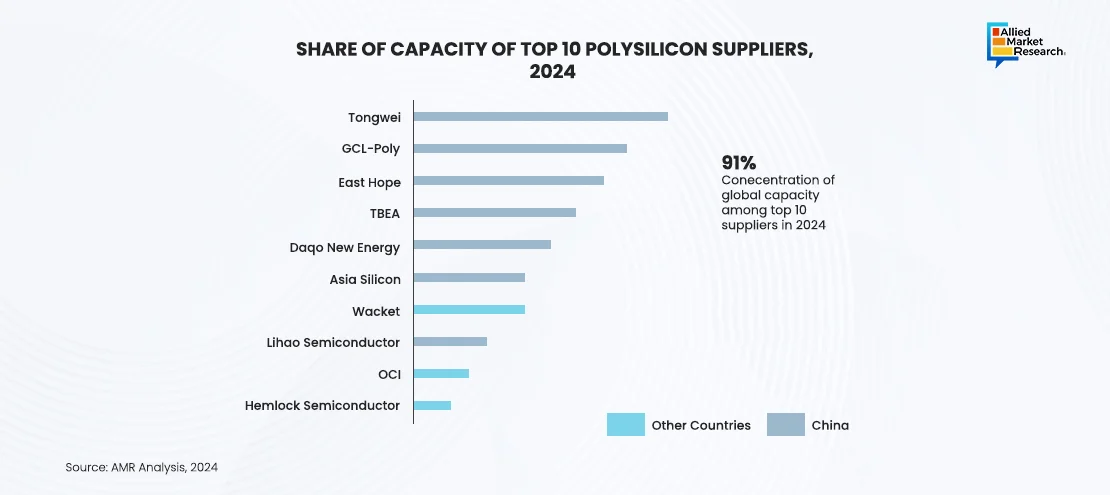

The rising demand for renewable energy has stretched manufacturing capacities worldwide. To meet this demand and close supply gaps, manufacturers need to invest in expanding production. A key challenge is the dominance of certain regions in raw material supply. For example, China produces about 80% of the world’s polysilicon, leading to major supply chain disruptions when issues arise in this region.

Supply Chain Solutions

Establishing long-term partnerships, entering into strategic agreements, and pursuing targeted acquisitions are critical strategies for securing raw materials and mitigating price fluctuations of key components. For example, Orsted, a Denmark-based multinational company, collaborated with German steel producer Salzgitter AG to supply hydrogen and zero-carbon electricity. This enables Salzgitter to produce green steel, which Orsted will subsequently procure for use in its wind turbines.

Energy and Power Industry Future Preparations

“Capacity Additions to Support Sustainable Innovations in Power Industry”

Renewable power capacity additions are expected to increase in the coming five years, with solar power and wind power accounting for more than 95% of overall capacity, as their generation costs are lower for both fossil and non-fossil alternatives in several countries across the globe. In addition, solar photovoltaic and wind power capacities are expected to double by 2028, compared with 2022 to reach almost 710 GW.

Among sustainable energy technologies, hydropower was the largest renewable source in terms of installed capacity in 2022. However, its large need for water and land, along with high environmental and social costs, limits its future role in the transition. As a result, the growing demand for renewable energy capacity is anticipated to be largely met by solar and wind power, with solar capacity projected to increase fivefold by 2030. This growth is driven by significant cost reductions enabled by technological advancements, high learning rates, supportive policies, and innovative financing models, establishing solar photovoltaics as the leading technology for sustainable power generation.

AMR Verdict

The global energy and power sector in 2024 is both challenging and full of opportunities. The renewable energy market has experienced significant growth worldwide, driven by environmental concerns and regional dynamics. Technological advancements are playing a key role in shaping the industry's future. Breakthroughs in battery and storage technologies, as well as innovations in areas like green hydrogen and photovoltaics, are expected to drive further growth. Governments worldwide are introducing supportive policies and investments to promote green energy solutions, opening new opportunities for growth. To understand these trends, identify strategic opportunities, and leverage emerging technologies, connect with our AMR analysts today!

Some trending reports in the domain are as follows-