Table Of Contents

- Essential Trends Influencing the Future of the Food and Beverage Industry

- Growing Technological Advancements

- Rising Sustainability and Eco-Friendly Practices

- Rising Demand for Functional Foods and Beverages

- Consumer Behavior Trends

- Evolving Preferences

- E-Commerce Dominance

- Social Media Influence

- Geographical Insights

- North America

- Notable Developments:

- PepsiCo partnered with startups to integrate biodegradable packaging into its supply chain.

- Europe

- Notable Developments:

- Asia-Pacific

- Notable Developments:

- Latin America

- Notable Developments:

- Middle East and Africa

- Notable Developments:

- Challenges and Effective Solutions in the Food and Beverage Industry 2024

- Supply Chain Challenges

- Regulatory Compliance

- Consumer Trust

- Circular Economy in Food Waste

- Geopolitical Tensions and Food Security

- Preparing for the Industry in 2025

- Enhanced Sustainability Goals: Companies are anticipated to increase their investments in water-efficient technologies and renewable energy as global climate initiatives gain momentum.

- Personalized Nutrition: Customized dietary solutions are projected to become more widely available due to developments in AI and genetics.

- Automation in Food Production: Labor-intensive tasks are estimated to be handled by robotics and artificial intelligence, which will lower costs and increase consistency.

- Conclusion

- Referred Links:

Roshan Deshmukh

Koyel Ghosh

Comprehensive Review of the Food and Beverage Industry in 2024

In 2024, the food and beverage sector is changing dramatically due to rapidly advancing technology, a greater emphasis on sustainability, and shifting customer tastes. Innovative technologies like blockchain and artificial intelligence are being adopted by businesses to improve production efficiency and ensure traceability. Meanwhile, improvements in functional beverages, eco-friendly packaging, and alternative proteins are being driven by customer desire for healthier and more sustainable solutions. These developments are creating a more robust and adaptable sector in addition to changing the competitive environment. This revolutionary change offers new opportunities for market growth but also creates challenges that need innovative solutions.

Improvements in efficiency and sustainability have been made possible by advances, but challenges like growing raw material costs, supply chain interruptions, and changing regulatory environments are calling for more flexibility. This article explores the major factors influencing the food and beverage sector in 2024, analyzes the lessons discovered, and offers predictions for 2025 and beyond.

Essential Trends Influencing the Future of the Food and Beverage Industry

Growing Technological Advancements

Technological innovation is transforming the food and beverage industry by boosting efficiency, reducing waste, and personalizing customer experiences. AI is being used by major companies to examine customer behavior and create personalized product recommendations. Coca-Cola, for example, uses AI algorithms in its Freestyle vending machines to generate customized beverage mixtures. Similarly, Nestlé employs data analytics to adjust its product offers and marketing efforts according to regional preferences. Startups like Spoon Guru are also contributing by employing machine learning to offer individualized dietary advice to people with certain sensitivities or dietary requirements. These developments are establishing new standards for customer happiness and involvement.

Production line optimization, cost reduction, and demand forecasting are all being aided by artificial intelligence (AI). AI-powered solutions provide predictive analytics for market trends, improve inventory control, and cut down on food waste. AI-powered quality control systems, for example, can now identify product or packaging flaws with unmatched accuracy. Devices from the Internet of Things (IoT) are making it possible to monitor storage conditions in real-time, guaranteeing maximum freshness and reducing spoiling. In retail environments, smart shelves monitor inventory levels and notify employees before stockouts happen. Consumer demand for transparency is rising, and blockchain is making sure that supply chain traceability is maintained. This system provides real-time tracing of food sources from farm to fork, increasing customer confidence and ensuring strict rules are followed.

Rising Sustainability and Eco-Friendly Practices

Similarly, sustainability has emerged as a key component of the industry's development as businesses adapt to customer needs and international environmental objectives. A 2023 NielsenIQ poll found that 73% of consumers globally are prepared to pay more for sustainable goods, which encourages companies to implement eco-friendly procedures. Additionally, according to the World Economic Forum, t the industry could reduce carbon emissions by up to 25% in the next decade by using sustainable packaging. The sector’s dedication to striking a balance between environmental responsibility and profitability is demonstrated by these initiatives.

The market for lab-grown and plant-based meats is expanding quickly, addressing ethical and environmental issues. High-protein foods with smaller environmental impacts are being produced because of advancements in cellular agriculture and fermentation. Waste is decreasing as packaging options become more minimalistic, reusable, and biodegradable. Compostable plastics and wraps made from seaweed are becoming more popular. Companies are implementing water-efficient technologies, especially in the beverage industry to lower consumption and raise sustainability measures.

Rising Demand for Functional Foods and Beverages

Demand for functional products that provide advantages beyond basic nutrition is being driven by health-conscious customers. According to a Market Insights analysis from 2024, 62% of people worldwide are actively looking for functional foods that offer health advantages including better digestion and immunity. Furthermore, keeping in tab with a poll conducted by the International Food Information Council, 45% of participants place a higher priority on foods that have been reinforced with probiotics or vitamins.

Probiotics, elderberries, and turmeric are gaining popularity for boosting immunity. Drinks with adaptogens like ginseng and ashwagandha help reduce stress and improve focus. High-protein snacks, drinks, and meal replacements have become an appealing choice to fitness enthusiasts and busy professionals.

Consumer Behavior Trends

Evolving Preferences

Transparency and authenticity are growing increasingly popular among consumers. According to a McKinsey & Company survey from 2024, 78% of customers like products with clear labels and materials obtained responsibly. This trend encourages companies to spend more on comprehensive sourcing data and certifications like Fair Trade and Organic.

E-Commerce Dominance

The rise of direct-to-consumer business models and online grocery shopping has transformed the industry. At the same time, convenience has been capitalized by platforms such as Instacart and Amazon Fresh, while conventional shops are improving their online visibility. Over the past year, subscription services that provide specialized food boxes and carefully designed meal kits have grown by 40%.

Social Media Influence

Social media sites are influencing food trends, particularly Instagram and TikTok. Influencer endorsements and viral challenges are fueling the market for particular products including unique drinks, artisanal snacks, and exotic fruits. The huge online appeal has enabled brands like Gigi Hadid's Vodka Pasta and Dalgona Coffee to become overnight global sensations.

Geographical Insights

North America

Alternative proteins and functional beverages had strong growth in the North American market in 2024. Sales of plant-based dairy substitutes increased by 12%, especially in the United States. While smaller firms launched innovative allergen-free products, larger companies like Impossible Foods increased their store presence.

Notable Developments:

PepsiCo partnered with startups to integrate biodegradable packaging into its supply chain.

- Maple Leaf Foods in Canada launched a range of carbon-neutral meat alternatives.

Europe

Europe has continued its legacy to lead the world in sustainability efforts due to stringent laws that encourage the development of environmentally friendly production methods and packaging.

Notable Developments:

- Nestlé launched a pilot program in France, using blockchain to ensure supply chain transparency for its baby food products.

- Germany’s Oatly expanded operations, doubling production capacity for oat-based beverages to meet growing demand.

Asia-Pacific

The fastest-growing region is Asia-Pacific, which is being fueled by changing consumption habits, increased disposable incomes, and increasing urbanization. China and India are the top two countries driving the 15% growth in the functional foods and beverages industry.

Notable Developments:

- India’s Tata Consumer Products partnered with health startups to launch wellness teas enriched with Ayurvedic herbs.

- China’s Mengniu Dairy introduced probiotic-enriched milk products aimed at improving digestive health.

Latin America

Products like quinoa, chia seeds, and acai are becoming more well-known globally, and Latin America is starting to take the lead in exporting superfoods. The market for plant-based foods expanded by 18% in the region due to growing knowledge of the advantages for the environment and human health.

Notable Developments:

- Brazil’s Fazenda Futuro brought out innovative plant-based meat products aimed at the mass market.

- Peru expanded its organic certification program, boosting exports of sustainable produce.

Middle East and Africa

Africa and the Middle East are becoming important markets for high-end, halal-certified culinary products. Even if there are still infrastructure issues, gaps are being filled by the growing use of technology.

Notable Developments:

- UAE-based Al Rawabi Dairy adopted IoT solutions to optimize production and reduce waste.

- Tiger Brands in South Africa introduced nutrient-rich snacks to tackle regional nutritional deficiencies

Challenges and Effective Solutions in the Food and Beverage Industry 2024

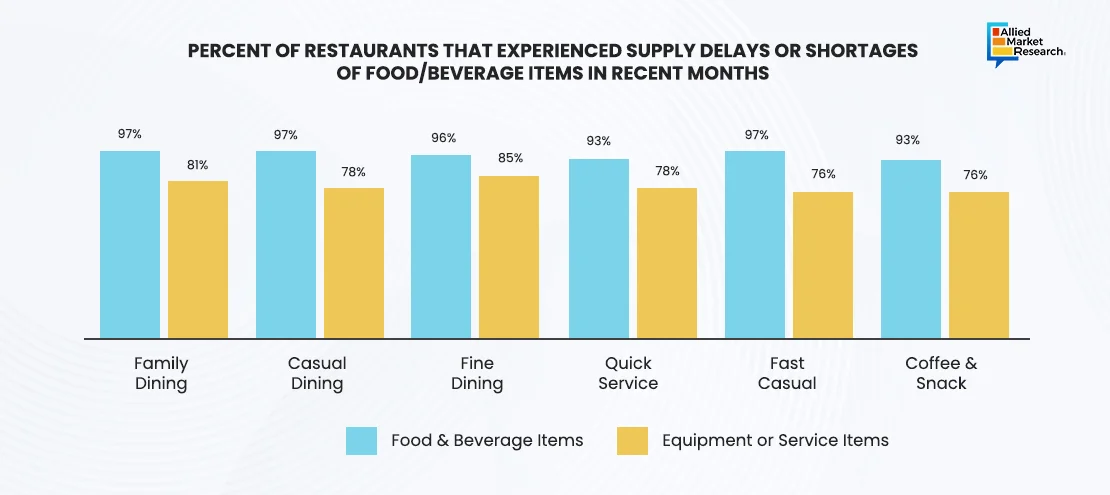

Supply Chain Challenges

Geopolitical concerns and rising transportation costs are putting pressure on global supply systems. Companies are addressing these problems by investing in local sourcing and diversifying their suppliers to reduce their reliance on imports. Delivery times are being improved, and operations are being streamlined by AI-powered logistics.

Regulatory Compliance

Compliance expenses are rising because of new sustainability and labeling rules. By working with regulatory agencies to modify standards and investing in automated compliance systems, companies are reducing these difficulties.

Consumer Trust

Product recalls and false information reduce trust. Rebuilding consumer confidence is being achieved through transparency initiatives like blockchain for certifications and traceability.

Circular Economy in Food Waste

An estimated 1.3 billion tons of food are wasted globally each year, making food waste a serious problem. Companies like Too Good To Go and Olio are using technology to reconnect customers with excess food from stores and eateries, greatly cutting down on waste. Initiatives to compost and repurpose food supplies are also becoming more popular.

Geopolitical Tensions and Food Security

The world's volatility has brought attention to food security risks. Local agricultural investments are being promoted by groups such as the World Food Program to reduce reliance on imports. Kenya began a government-supported urban farming initiative in 2024, increasing the supply of food in large cities.

Preparing for the Industry in 2025

As we move into 2025, the food and beverage industry is expected to witness huge innovation and growth. Key areas to watch include:

Enhanced Sustainability Goals: Companies are anticipated to increase their investments in water-efficient technologies and renewable energy as global climate initiatives gain momentum.

Personalized Nutrition: Customized dietary solutions are projected to become more widely available due to developments in AI and genetics.

Automation in Food Production: Labor-intensive tasks are estimated to be handled by robotics and artificial intelligence, which will lower costs and increase consistency.

The food and beverage industry's resilience and adaptability ensures its capacity to satisfy changing customer needs and overcome upcoming obstacles. The sector is set up for a revolutionary 2025 with an emphasis on sustainability, innovation, and health consciousness.

Conclusion

In 2024, the food and beverage sector is embracing digital platforms and technology to meet rising consumer demand for on-demand access. Delivery services like DoorDash and Uber Eats, along with digital ordering systems, are improving convenience. Companies are using tools like AI, predictive analytics, and smart supply chain management to better serve customers. A key focus is personalized nutrition, with businesses investing in DNA testing and health apps to offer tailored solutions for health and wellness, including functional foods and supplements for specific needs.

Sustainability, food safety, and transparency are also gaining importance, with governments enforcing stricter regulations on product traceability and labeling. The European Union's Farm to Fork Strategy is guiding these efforts, and companies are using these rules to build consumer trust by being open about sourcing and production. Consumers are increasingly seeking natural, organic, and non-GMO ingredients, pushing companies to use cleaner labels and simpler formulas. As a result, the food and beverage sector is evolving, with a focus on sustainability, digitalization, and consumer health, despite challenges like supply chain issues and rising costs.

For more updates about the prevailing trends in the food & beverages industry, contact our experts today!