Food and Beverages Industry in Q4 2024: Consumer Trends and Supply Chain Innovations

The food and beverages industry witnessed significant growth in Q4 2024, driven by evolving consumer preferences and innovative product launches. The dominance of health and wellness trend increased the demand for functional beverages, plant-based alternatives, and low-sugar options during the period. Moreover, the holiday season boosted sales of ready-to-eat meals and gourmet snacks, highlighting the appeal of convenience and indulgence.

Also, e-commerce platforms became more essential as consumers increasingly opted for online grocery shopping. Additionally, sustainability and transparency influenced purchasing decisions, prompting brands to adopt eco-friendly practices. However, challenges like supply chain disruptions and rising costs pressured profit margins, leading companies to optimize operations and explore local sourcing strategies, showcasing the sector's resilience amid changing market conditions.

Factors driving food and beverages sales in Q4 2024

In the fourth quarter of 2024, which was a festive season, the sales of the food and beverages industry surged significantly due to seasonal discounts and promotions, particularly in the ready-to-eat meals and gourmet snacks categories. The sector experienced a remarkable 20% increase in sales during the period. However, this increased demand during the holiday season often led to supply chain disruptions, causing delays in product deliveries. Retailers faced the significant challenges of balancing inventory to meet the peak holiday demand while avoiding overstocking, which resulted in stockouts.

During the quarter, health-focused products, particularly plant-based and low-sugar alternatives, experienced a robust 12% year-over-year growth, reflecting increasing consumer interest in healthier options. Additionally, functional beverages, aimed at boosting immunity and wellness, gained significant traction among shoppers. Meanwhile, e-commerce continued to expand, with online grocery sales rising by 18% as consumers increasingly prioritized convenience. Digital platforms, simultaneously, captured a larger share of total department sales, highlighting the shift toward online shopping in the food and beverages sector. This combination of health-oriented products and e-commerce growth illustrates evolving consumer preferences in today's market.

On the other hand, sustainability initiatives significantly boosted the growth of the food and beverages industry in Q4 2024. Products featuring eco-friendly packaging witnessed a 65% preference among consumers. This transition was complemented by an increased adoption of locally sourced ingredients, aimed at reducing carbon footprints and supporting local economies. Many brands integrated environmentally conscious practices into their operations to align with the rising trend of eco-friendly approaches during the quarter. Concurrently, there was a notable rise in demand for premium and artisanal food items, reflecting consumers' willingness to invest in quality. In addition, high-end beverages and specialty food products experienced high demands in that period, as shoppers sought authentic and unique culinary experiences.

Many companies implemented local sourcing strategies to address supply chain challenges, which further helped mitigate disruptions and enhance product availability and customer satisfaction. This initiative aligned with the growing consumer preference for fresh and sustainable options. Additionally, specific categories such as beverages, especially festive and functional types, observed remarkable demands. The snacks segment also thrived well in Q4 2024, benefiting from both indulgent and health-conscious trends. Such developments signify the adaptability of the industry to evolving consumer preferences and emphasis on local sourcing and sustainability.

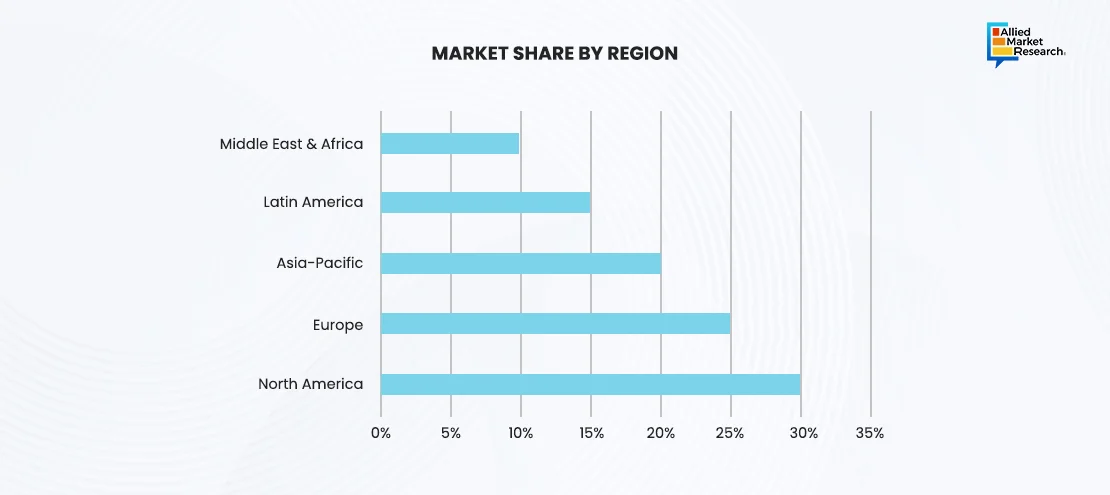

Regional trends shaping the growth of the food and beverages sector in Q4 2024

According to the above graph, the global food and beverages industry is highly diversified, with distinct market shares across different regions. In Q4 2024, North America led the market, accounting for approximately 30-35% of the global market share. This dominance was driven by high consumer spending, advanced food production technologies, and a strong retail presence.

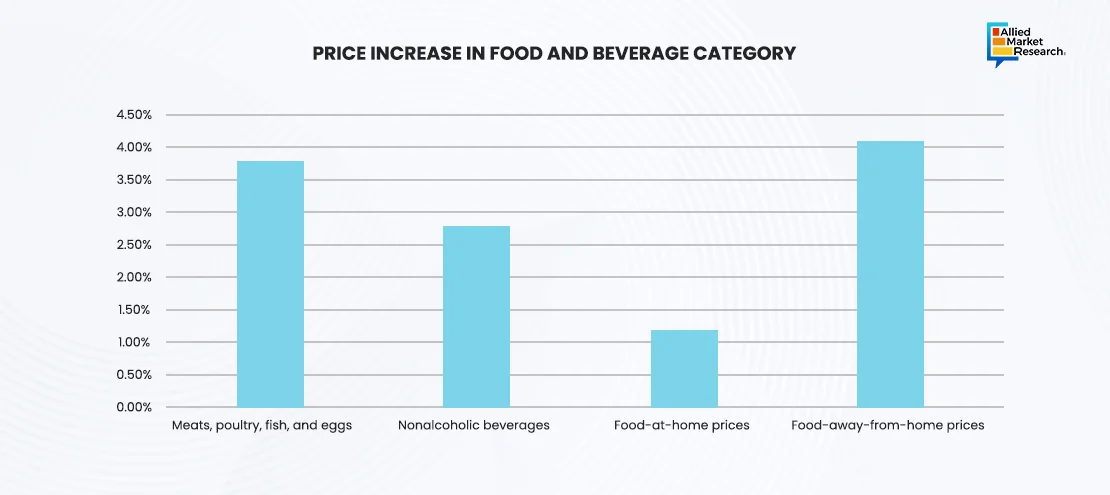

As per the above infographics, in 2024, the U.S. food and beverage industry experienced varied price increases across different categories. The food-away-from-home segment witnessed the largest rise at 4.1%, driven by escalating dining costs. The meats, poultry, fish, and eggs segment followed with a 3.8% increase due to supply chain issues and demand fluctuations. The nonalcoholic beverages segment rose by 2.8%, while food-at-home prices increased by a modest 1.2%, indicating easing inflationary pressures in grocery shopping. These trends reflect the notable economic factors influencing different segments of the industry.

On the other hand, Europe followed closely to the growth experienced by North America, holding around 25-30% of the market, supported by its large, diverse consumer base and robust food manufacturing sector. In Europe, the demand for artisanal and premium products surged by 18%, particularly in Western markets. Almost 40% of food and beverages companies shifted to local suppliers to address supply chain challenges. Additionally, sales of functional foods and beverages, especially those enhancing immunity, increased by 12%, reflecting a growing consumer focus on health and wellness.

Moreover, Asia-Pacific was also a significant player in the fourth quarter of 2024, contributing to 20-25% to the global market, driven by rapid urbanization, increasing disposable income, and growing demand for packaged and processed foods. In the Asia-Pacific region, e-commerce sales surged by 25%, with significant growth observed in China and India. The rising health awareness among consumers contributed to a 10% increase in sales of low-sugar and plant-based products. Additionally, the festive season drove a remarkable 22% spike in sales of ready-to-eat meals and snacks, reflecting heightened consumer demand during this period.

Furthermore, Latin America and the Middle East & Africa relatively held smaller shares of the global market, each ranging between 5-10%, but they witnessed steady growth as emerging markets among the regions. In Latin America, food and beverages sales grew by 8% despite economic pressures, driven by demand for affordable and local products. Sales of traditional foods increased by 14% due to a rising interest in modern, healthy alternatives. Additionally, 55% of consumers expressed a preference for sustainably sourced products, reflecting a growing awareness of environmental issues in the region.

Similarly, in the Africa region, e-commerce sales of food and beverages increased by 10% due to improved digital infrastructure. Consumption of locally produced items rose by 9%, strengthening regional economies. Additionally, functional beverages designed for providing hydration and energy alternatives experienced a 7% growth, highlighting evolving consumer preferences toward health-focused options.

Strategies redefining food and beverages supply chains in Q4 2024

In Q4 2024, supply chain disruptions significantly impacted the food and beverages industry, with 45% of companies reporting challenges primarily due to logistical delays and rising transportation costs. In response, 35% of firms increased their reliance on local suppliers, up from 25% in the previous year, which contributed to a 10% reduction in overall supply chain costs. In addition, 50% of companies adopted advanced inventory management systems to enhance efficiency and minimize stockouts, resulting in a 12% improvement in order fulfillment rates.

Further, 30% of firms integrated AI and blockchain technology into their supply chains for better traceability and real-time monitoring, leading to a 15% decrease in food waste. Sustainability efforts taken by prominent companies fostered a 20% increase in consumer trust and brand loyalty. Almost 40% of companies committed to reducing their carbon footprint through optimized logistics and eco-friendly practices in the quarter. To further mitigate vulnerabilities, 25% of companies diversified their supplier base to reduce dependency on specific regions. However, rising input costs for raw materials increased by an average of 8%, prompting companies to seek cost-effective alternatives and renegotiate supplier contracts. Moreover, 15% of firms increased their stockpiling of essential ingredients to avoid uncertainty, ensuring continuous production during peak demand periods.

Final words

The food and beverages industry in Q4 2024 showcased perseverance amidst evolving consumer trends, supply chain challenges, and rising costs. The transition toward health-conscious, sustainable products and the growth of e-commerce highlighted changing preferences. Strategic focus leading companies on local sourcing and technological advancements helped reduce disruptions, ensuring continued growth and adaptation in a dynamic market environment.

To get more insights into the emerging trends in the food and beverages industry, talk to our esteemed analysts here!