From Taiwan to the World: The Global Rise of Bubble Tea

In the 1980s, bubble tea also referred to as boba tea or pearl milk tea was developed in Taiwan and has since become popular worldwide. Bubble tea, which is distinguished by its distinct combination of tea, milk, sweeteners, and chewy tapioca pearls (boba), provides a customized beverage experience that has captured the attention of consumers across the globe. The beverage's popularity has risen rapidly, surpassing its Asian origins and becoming essential in tea shops and cafes throughout Europe, North America, and other continents. This expansion is fueled by its uniqueness, the growing global influence of Asian pop culture, and the increasing demand for customized beverages.

The bubble tea market has experienced substantial growth, with new varieties, flavors, and ingredients appearing to satisfy a wide range of consumer preferences. The range of alternatives, which includes fruit-flavored teas with bursting boba or jelly and the traditional milk tea with black tapioca pearls, has helped bubble tea continue to be popular among all age groups and cultural backgrounds. This article explores the major dynamics influencing the bubble tea market, the potential growth barriers, and the industry's overall outlook.

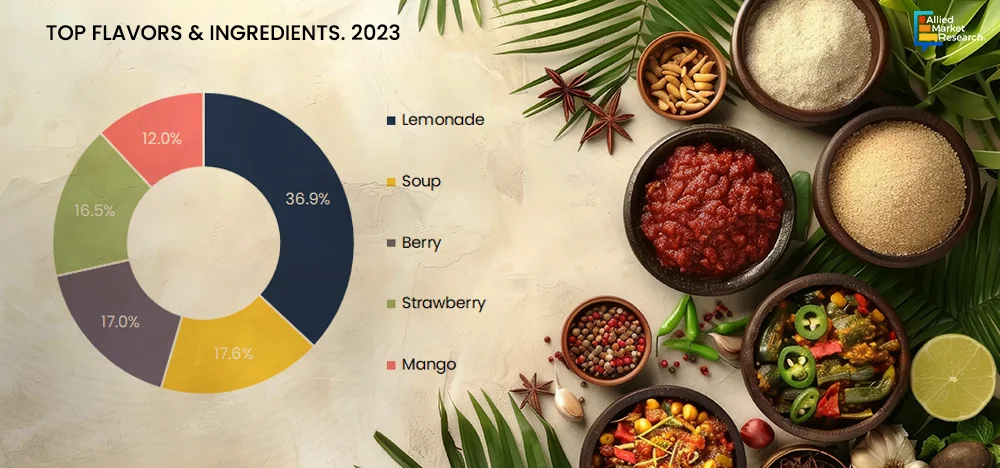

Innovation in Flavors and Ingredients

The constant innovation of tastes and ingredients is one of the most prominent developments in the bubble tea market. Traditionally, tapioca pearls, milk, sweeteners, and black or green tea are served with bubble tea. However, bubble tea sellers have responded to changing consumer tastes by offering a broad variety of flavors, such as matcha, taro, fruit infusions, and herbal teas. Furthermore, products like fruit-flavored bursting boba, aloe vera, chia seeds, and grass jelly now enhance or even replace the traditional tapioca pearls that were once the defining feature of bubble tea. For example, well-known American companies like Kung Fu Tea and Gong Cha have catered to regional tastes while preserving the unique charm of bubble tea by introducing seasonal flavors like gingerbread and pumpkin spice during the holiday season. Local ingredients like pandan and durian have been added to bubble tea throughout Southeast Asia, creating a taste that combines both traditional and modern flavors. According to the study conducted by Tastewise, lemonade was the top flavor preferred by consumers in 2023.

Health-Conscious Variants

The bubble tea market has responded to consumer’s health consciousness by providing healthier options. Since traditional bubble tea can contain a lot of sugar and calories, some health-conscious consumers have raised concerns. As a result, manufacturers are coming up with products that have less sugar, organic components, and non-dairy milk substitutes such as oats, soy, or almond milk. Furthermore, several companies emphasize the use of stevia or honey as natural sweeteners rather than high-fructose corn syrup. The rise of the "better-for-you" trend has led to the growing use of white or green tea in bubble tea, replacing the more common black tea, due to their higher antioxidant content. A variety of "Lite" bubble tea choices, which use less sugar and calories and cater to health-conscious consumers without sacrificing taste, have been introduced by companies like Tealive in Malaysia.

Sustainability and Eco-Friendly Practices

Sustainability is becoming one of the important factors in the landscape of bubble tea as consumers place a higher value on making environmentally friendly choices. Single-use plastic straws, lids, and cups are frequently used in the classic bubble tea experience, which adds to environmental waste. As a result, many bubble tea companies are implementing environmentally responsible strategies, like providing recyclable straws and cups, utilizing packaging that decomposes naturally, and ethically procuring ingredients. For instance, to encourage consumers to use less plastic packaging, the well-known bubble tea brand The Alley has started offering its beverages in reusable glass bottles. In the same way, certain cafés offer discounts to customers who bring their own reusable cups. In addition to benefiting the environment, this shift toward sustainability improves the reputation of bubble tea vendors and attracts environmentally conscious consumers.

Global Expansion and Localization

Bubble tea has been growing rapidly worldwide, with new shops opening in the Middle East, Europe, and North America. Localization, on the other hand, is the process by which brands modify their products to accommodate regional tastes and preferences in conjunction with their expansion. For example, to accommodate local tastes, bubble tea chains in Europe have developed flavors like Earl Grey and English breakfast tea. In the Middle East, on the other hand, flavors like rose and saffron are becoming more popular. Leading international brands like Chatime and Gong Cha are driving this expansion by setting up shop in significant global locations. These companies can engage with local consumers while preserving the unique appeal of bubble tea by localizing its flavors and ingredients. The strategy has helped the bubble tea market expand into new regions.

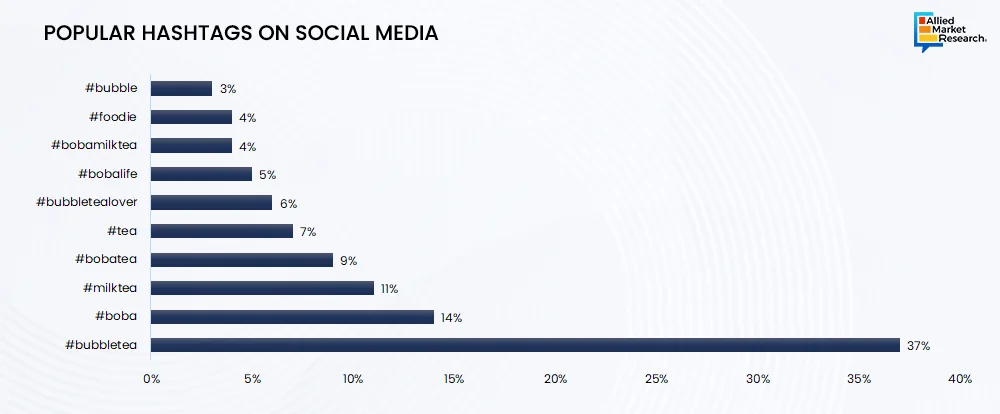

Technological Integration and Digital Marketing

Several bubble tea companies have adopted social media marketing, online delivery platforms, and mobile ordering apps to reach a wider audience. With quick purchasing, customization options, and benefits for making regular purchases, the usage of apps and loyalty programs has improved the consumer experience. Appealing images and videos of the drinks on social media sites like Instagram and TikTok have attracted a younger audience, which has made a significant contribution to the promotion of bubble tea. With hashtags like #bubbletea and #bobatea getting millions of views, the viral nature of social media trends has contributed to the global popularity of bubble tea. As per best-hashtags.com, some of the popular hashtags used by people on Instagram, Twitter, Facebook, and TikTok are #bubbletea, #boba, #milktea, and many more.

Barriers to Growth

The market for bubble tea is expanding significantly, but certain factors could limit its future growth. The health risks associated with bubble tea, especially with its high sugar content, are a major concern. Between 30 and 50 grams of sugar can be found in a typical serving of bubble tea, which is significantly more than the daily recommended amount. Both public health officials and people who are concerned about their health are alarmed by this. In Singapore, for example, the government has imposed strict regulations to reduce sugar intake, especially in beverages. Due to popularity, vendors of bubble tea have reformulated their products, adding options with less sugar or letting consumers adjust the sweetness of their drinks. In markets focused on health and fitness, bubble tea's reputation as a sweet treat can discourage potential consumers despite these efforts.

The bubble tea market faces intense competition, with both small shops and big international chains expanding rapidly, especially in Taiwan, Hong Kong, and major North American cities. This makes it hard for brands to stand out and keep customers loyal. In Taiwan, where bubble tea started, the competition is quite high, with brands relying on price cuts and constant innovation to attract and retain consumers. The rise of DIY bubble tea kits, especially during the COVID-19 pandemic, allowed people to make bubble tea at home, creating more competition that could hurt traditional bubble tea shops' profits.

Simultaneously, the drink is largely dependent on certain components, such as tapioca pearls, which are mainly imported from Asia, especially Taiwan and Thailand. Due to its reliance on imported materials, the market is vulnerable to interruptions in the supply chain. For example, due to delays in shipments from Taiwan, several bubble tea restaurants in North America experienced shortages of tapioca pearls during the COVID-19 pandemic. Due to these shortages, several stores were forced to temporarily close or provide substitute toppings, which had an adverse impact on consumer satisfaction and sales. Furthermore, changes in raw material prices, caused by factors like climate change or political instability in key sourcing areas, can increase production costs, which may lead to higher prices for consumers.

Summing Up

Despite challenges, the bubble tea market is doing well due to ongoing innovation and global expansion. The appeal is increased by using eco-friendly practices and new technology. To keep growing, bubble tea companies need to balance traditional tastes with modern preferences. In short, the market is projected to grow because of its ability to adapt and innovate. However, long-term success is reliant on addressing health and sustainability issues.

Allied Market Research equips suppliers with essential insights and trends, enabling them to make informed decisions through comprehensive and detailed analyses of the bubble tea market. Vendors can obtain an advanced understanding of consumer inclinations, new trends, and competitive dynamics in the bubble tea industry by utilizing AMR's market research. They can find lucrative opportunities and anticipate shifts in the market by using the analysis, which covers a wide range of topics like market size, growth forecasts, and significant market drivers. Businesses can also customize their marketing plans, maximize product offers, and improve customer interaction with the help of AMR's strategic recommendations. To remain ahead of the competition and take advantage of evolving bubble tea market trends, contact our experts today!