Optimizing Energy Conversion and Management with Power Electronics

Power electronics are semiconductor devices used for power rectification, regulation, and static electrical power conversion, particularly in uninterruptible power systems (UPS). They are also used in charging industrial batteries. Power electronics enable efficient power conversion, such as transforming AC to DC in wind power systems and regulating voltage in electric vehicles. They also control motor speed in automation, robotics, and power generation, enhancing efficiency. Additionally, power electronics optimize lighting systems, improving energy use in LEDs and fluorescent lamps.

Power electronics enhance energy efficiency by converting AC to DC with minimal losses, regulating voltage, and improving system reliability. They offer precise power control, prevent electrical hazards, reduce energy consumption, and lower maintenance costs. Their compactness, versatility, and efficiency enable faster switching and support various applications, from renewable energy to electronics.

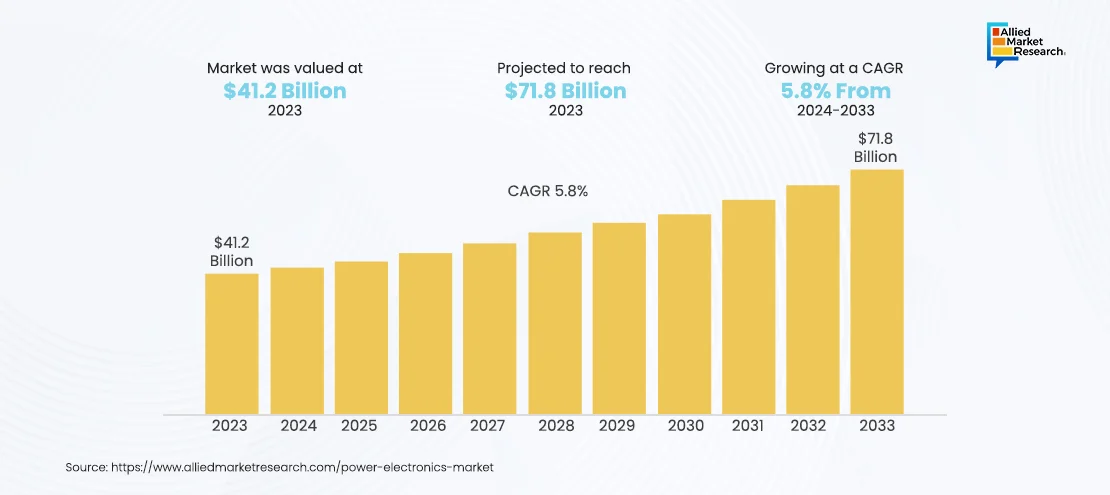

A report published by Allied Market Research states that the Global Power Electronics Market was worth $41.2 billion in 2023 and is expected to grow to $71.8 billion by 2033, registering a CAGR of 5.8% from 2024 to 2033. The key factors driving the growth of the power electronics market include advancements in automotive electronics, a rise in the adoption of renewable energy, and increased use of power electronics components in electric vehicles. Additionally, the surging need for SiC-based photovoltaic cells in developing countries such as Brazil, India, and China further fuels the market's expansion. Key components like power resistors, capacitors, and portable phone batteries are essential in power electronics, helping store, manage, and convert energy efficiently in different devices and systems.

Supply-side analysis

The power electronics market is gaining momentum due to advancements in automotive electronics, the growing adoption of renewable energy, and the increasing use of power electronics components in electric vehicles. Retail sales of power electronics have risen significantly, fueled by the rising demand for EVs and the expanding use of renewable energy sources. Additionally, the shift toward bundling installation services and providing all-in-one solutions has contributed to greater customer satisfaction.

Top entities like Schneider Electric reported an 11.5% organic revenue growth in 2024, reaching $33.3 billion, exceeding market expectations. The company's growth was driven by higher demand in energy management, especially from data centers. Its net profit rose to $4.57 billion from $4.28 billion last year.

At the distribution level, suppliers have increased the manufacturing capacity by starting new production facilities to meet the heightened demand. On August 19, 2024, RIR Power Electronics Limited, a leading company in power electronics and semiconductors, revealed its strategic expansion into high-growth market segments through advanced products and solutions. Despite these advancements, challenges like rising raw material costs and longer lead times for components have pushed manufacturers to diversify their suppliers and implement just-in-time inventory strategies to strengthen supply chain resilience.

Value chain analysis

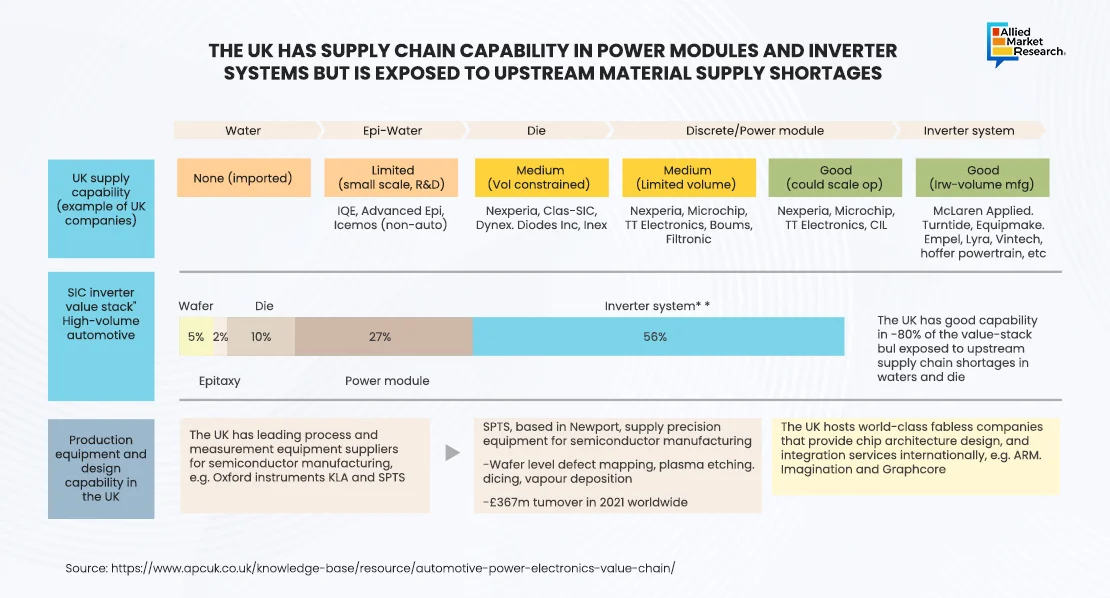

The power electronics market covers everything from sourcing raw materials to delivering final products to users. Power electronics are primarily based on raw materials like silicon carbide (SiC) and gallium nitride (GaN), which are essential for producing semiconductors in power devices. The supply chain for these materials is global, with key contributions from regions such as the Indo-Pacific.

The next phase of the power electronics value chain is manufacturing. It involves the creation of semiconductor wafers, which are then processed into chips. It includes designing, fabricating, and testing semiconductor devices. Leading companies in this field, such as Infineon Technologies and Wolfspeed, have vertically integrated their operations to improve control over the supply chain.

The distribution and retail sector encompasses specialized distributors, online platforms, and direct sales from manufacturers. Distributors like Arrow Electronics and Digi-Key Electronics provide a diverse selection of power electronic components, ranging from standard items to custom solutions. These channels make power electronics available to a wide range of customers, from small businesses to large corporations.

The assembly and integration stage involves software integration to ensure the controllers work seamlessly with various types of machinery. When selecting power electronic components, factors such as energy efficiency, reliability, and cost-effectiveness are essential. For example, in 2023, the growing use of power electronics in electric vehicles has gained momentum, due to their ability to improve battery performance and increase driving range. Any issues, such as inefficiencies, inaccuracies, or malfunctions during this phase, can result in poor CNC performance, which causes production delays and machine downtime. To deliver a high-quality product, it's important to assemble, integrate software, calibrate, and test it properly.

Technological advancements in power electronics

In the field of power electronics, ongoing advancements are integral for improving the efficiency, reliability, and overall performance of electronic systems. Two key technological innovations that have gained significant attention are Silicon Carbide Metal-Oxide-Semiconductor Field-Effect Transistors (SiC MOSFETs) and Power Integrated Modules (PIMs).

Moreover, manufacturers are developing innovative models to strengthen their portfolios. For instance, STMicroelectronics introduced its fourth-generation STPower silicon carbide MOSFET technology, in September 2024. While the MOSFET is designed to meet the demands of both the automotive and industrial sectors, it is optimized for traction inverters, which are a key component of EV powertrains. The new generation of SiC technology is also ideal for a range of high-power industrial applications, such as solar inverters, energy storage systems, and data centers.

Case studies

SolarTech Innovations

SolarTech Innovations implemented advanced power electronics in their SolarVillage project in Phoenix, Arizona, completed in March 2024. The project featured state-of-the-art solar inverters and microinverters designed to maximize energy conversion efficiency from solar panels. The integration of these power electronics increased the overall energy output of the solar panels by 22%, resulting in annual savings of $1,200 per household. Additionally, the project achieved a 17% reduction in grid dependency, promoting energy independence. SolarVillage experienced a 20% decrease in greenhouse gas emissions per home, contributing to the city's clean energy goals. The environmentally friendly design attracted eco-conscious buyers, boosting the project's market appeal.

EcoEnergy Developments

In 2023, EcoEnergy Developments integrated cutting-edge power converters and energy storage systems into its EcoSmart Apartments project in San Francisco, California. These systems enabled efficient energy management and storage, enhancing the overall sustainability of the apartments. The use of power converters and energy storage systems reduced energy consumption by 18%, leading to annual savings of $900 per household. The apartments also benefited from a 25% improvement in energy efficiency ratings. The advanced energy management systems contributed to a 20% increase in property value, making the apartments more attractive to tech-savvy and environmentally conscious buyers. The project also experienced a 25% faster sale rate compared to similar developments.

ElectricVehicle Hub

In 2023, UrbanTech Developments incorporated GaN (gallium nitride) power transistors into its ElectricVehicle Hub project in San Francisco, California. These transistors, renowned for their high-power density and efficiency, enhanced both the charging speed and overall performance of EV charging stations. As a result, the project witnessed a 25% increase in charging station throughput, making the hub more attractive to EV owners. Additionally, the project experienced a 15% faster adoption rate compared to similar EV charging initiatives, highlighting strong demand for high-performance charging solutions.

The integration of GaN power transistors improved charging station efficiency and resulted in a 12% boost in user satisfaction, with EV owners praising the stations for their reliability and reduced charging times. UrbanTech Developments strengthened its reputation by using advanced components to build high-quality, sustainable EV infrastructure.

Developments in silicon carbide manufacturing and power conversion technologies

In September 2024, Bhubaneswar hosted the ceremony for Silicon Carbide manufacturing facility, a major boost to the semiconductor industry in India. The facility was set up by RIR Power Electronics Ltd at the EMC Park in Infovalley. RIR's products are sold globally, across Europe, Asia, and North America, and are used in industries such as defense, railway, power, aerospace, sustainable energy, and transportation.

On the other hand, ABB signed an agreement to acquire the power electronics business of Gamesa Electric in Spain from Siemens Gamesa, in December 2024. This acquisition strengthened ABB’s position in the expanding market for high-powered renewable power conversion technology. It significantly enhanced the company’s existing power conversion products and services for renewable OEMs and end users, adding new portfolio and engineering assets that supported the profitable growth strategy of ABB’s Motion business area.

Also, in May 2023, ABB Power Conversion launched the compact and efficient 1/16th-brick DC/DC converters, the KBVS008 and KBVW010 modules, specifically designed to meet the power requirements of 5G equipment. These converters feature adjustable output voltage ranges, high power density, and strong protection capabilities, making them ideal for applications such as 5G radios.

Final words

Power electronics is key to making energy use more efficient and reliable in many industries. It helps improve renewable energy systems, electric vehicles, and power grids. New technologies like silicon carbide (SiC) and gallium nitride (GaN) semiconductors, along with smart control systems, are making power management even better. With these innovations on board, industries can save more energy, reduce waste, and move toward a greener future.

Allied Market Research partners with power electronics vendors to offer insights to enhance products across sectors like automotive, industrial, and energy. AMR helps identify trends, understand market demand, and drive innovation. This support enables companies to improve product design, increase energy efficiency, and stay competitive in a market focused on sustainability and advanced technology.

For more detailed insights into the landscape, contact our specialists today!