Table Of Contents

- Global Semiconductor Billings: Steady Recovery and Growth Forecast

- Geographical Insights

- Regional insights

- Product category trends

- Supply Chain Updates

- Raw Materials

- Logistics

- Workforce

- Challenges and Solutions

- Raw material shortages

- Geopolitical tensions

- Talent shortages

- Addressing raw material shortages

- Mitigating Geopolitical Tensions

- Managing Talent Shortages

- Forecast and Expectations for 2025

Sonia Mutreja

Koyel Ghosh

Semiconductor Industry Review 2024: Innovations and Future Prospects

In 2024, the semiconductor industry showed resilience and innovation in a fast-changing global landscape. The market reached a value of around $611 billion, driven by advancements in artificial intelligence, automotive electronics, and 5G technologies. For example, AI-powered chips from companies like NVIDIA and AMD experienced high demand. Meanwhile, automotive electronics gained traction as carmakers like Tesla and Toyota expanded their focus on electric vehicles and autonomous driving systems.

However, the industry faced significant challenges. Supply chain issues caused delays, especially for critical components like silicon wafers. Geopolitical tensions between countries, particularly the U.S. and China, added uncertainty, while the prices of raw materials like rare earth metals increased due to tight supply.

Global Semiconductor Billings: Steady Recovery and Growth Forecast

The above graph shows the Global Semiconductor Billings trend (in billion US$) based on WSTS (World Semiconductor Trade Statistics) data, shown as a 12-month moving average (12MMA). It indicates actual billing data up to 2023 and forecasts (FC) for 2024 and 2025.

Historical Trend (2016-2023): Semiconductor billings show a gradual upward trend with fluctuations. Significant peaks occurred around 2021, reflecting strong demand for chips driven by industries such as consumer electronics, automotive, and AI. A dip is visible in 2023, likely due to supply chain issues and market adjustments.

Forecast Period (2024-2025): The shaded area indicates a strong recovery and sustained growth in semiconductor billings, aligning with the WSTS forecast. The market is projected to surpass $700 billion in annual billings by 2025, driven by Memory, Integrated Circuits, and rising regional demand, particularly in the Asia-Pacific and Americas markets.

This visual highlights the resilience and strong outlook for the semiconductor industry despite short-term challenges, as demand accelerates across key technological markets.

Geographical Insights

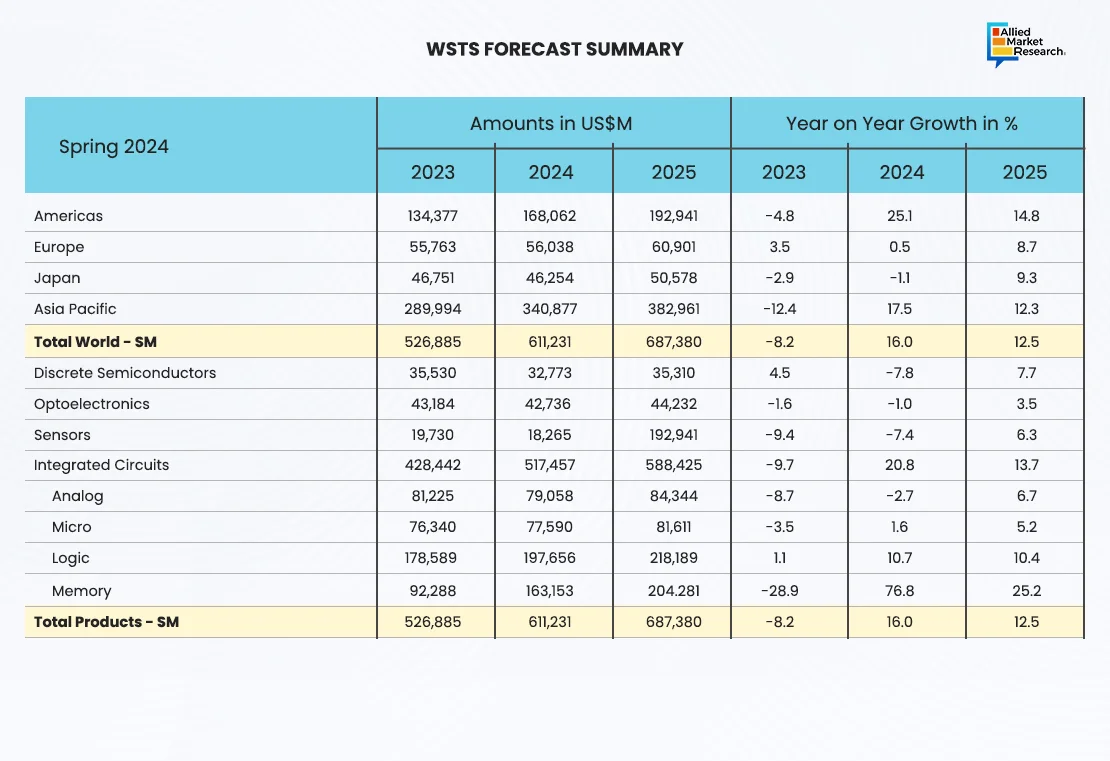

The World Semiconductor Trade Statistics (WSTS), a non-profit organization established in 1986 and the industry's sole provider of monthly shipment statistics, projects a positive outlook for the semiconductor industry in 2024 and 2025, with healthy growth anticipated across regions and product categories. Total worldwide semiconductor sales are expected to grow from $526.9 billion in 2023 to $611.2 billion in 2024, a 16% year-on-year increase. In 2025, sales are projected to reach $687.4 billion, reflecting a 12.5% growth rate.

This forecast highlights a strong recovery for the semiconductor market, primarily driven by Memory and Integrated Circuit segments, alongside robust demand from the Asia-Pacific and Americas regions.

Regional insights

- Asia-Pacific remains the largest market with sales rising from $289.9 billion in 2023 to $340.9 billion in 2024 (+17.5% growth).

- The Americas are expected to see significant recovery, growing by 25.1% in 2024, reaching $168.1 billion.

- Europe and Japan are expected to witness moderate growth at 0.5% and 1.1%, respectively.

Product category trends

- The memory segment drives the recovery with an impressive 76.8% growth in 2024, followed by an additional 25% increase in 2025.

- The integrated circuits segment, including Logic and Micro categories, are forecasted to grow by 20.8% in 2024.

- The discrete semiconductors and sensors segment also show steady improvement with growth rates of 7.8% and 7.4%, respectively.

Supply Chain Updates

Raw Materials

In early 2024, silicon wafer prices increased by 10%, driven by increasing demand from the automotive, AI, and 5G sectors combined with restricted supply. However, expanded production facilities in Southeast Asia particularly in Malaysia and Vietnam have helped to settle prices by Q3 2024, improving concerns over long-term shortages. Additionally, industry leaders like GlobalWafers and SUMCO announced plans to ramp up capacity, which could moderate price pressures in 2025.

Rare earth materials, essential for chip production (e.g., neodymium and yttrium), witnessed a 7% price hike during 2024, primarily fueled by geopolitical tensions between the U.S. and China. Restrictions on rare earth exports from China worsened the situation, prompting countries like the U.S., Japan, and the EU to diversify supply chains. Efforts included investments in alternative mining operations in Australia and recycling technologies for rare earth recovery. The U.S. CHIPS Act and similar initiatives accelerated domestic sourcing to reduce dependency on single regions.

Logistics

The adoption of AI-driven logistics systems transformed the semiconductor supply chain in 2024. These systems significantly improved operational efficiency, cutting lead times by 20% across North America and Europe. Companies like ASML and Qualcomm integrated predictive analytics and real-time tracking to anticipate demand, optimize shipments, and minimize delays caused by supply chain disruptions.

Furthermore, blockchain technology was increasingly adopted to enhance supply chain transparency and reduce the risk of counterfeit components. Major semiconductor hubs, such as those in Taiwan and South Korea, deployed automated warehousing systems and robotics to streamline operations, ensuring faster order fulfilment and inventory management.

Despite these advancements, transport delays remained a concern, particularly in regions affected by geopolitical events, such as tensions in the Red Sea and South China Sea. To address these challenges, logistics firms established alternative trade routes and expanded reliance on multi-modal transportation, including rail networks and air freight.

Workforce

The semiconductor industry faced an ongoing shortage of skilled workers, especially in engineering, R&D, and advanced manufacturing. This problem was most severe in North America and Europe, where the need for highly skilled professionals was greater than the available supply.

To address this, countries like South Korea and India introduced training and upskilling programs. In South Korea, the government partnered with companies like Samsung Electronics and SK Hynix to train 15,000 professionals each year.

India’s “Skill India” initiative also made strong progress in 2024 by training 10,000 workers in semiconductor manufacturing and assembly. Partnerships between the Indian government and private companies, such as Tata Electronics and Vedanta-Foxconn, helped grow India’s semiconductor workforce, turning it into a key hub for talent.

Globally, universities and technical schools partnered with industries to create specialized courses for future engineers. For example, the Semiconductor Education Alliance in the U.S. offered training programs focused on AI, semiconductor physics, and wafer fabrication to build a steady pipeline of skilled workers.

At the same time, semiconductor companies used remote working and AI-based tools to reduce the skills gap. Virtual platforms, on the other hand, enhanced productivity and provided training opportunities for new engineers, especially in design and software roles.

Flourishing Markets

AI semiconductors

The AI semiconductor market flourished in 2024, driven by breakthroughs in deep learning and edge computing. Nvidia and AMD secured major contracts for AI-enabled chips, contributing to a 15% rise in the sector’s revenue.

Automotive electronics

Automotive semiconductors experienced a 14% growth due to the increasing penetration of EVs and ADAS. Companies like NXP Semiconductors and Infineon Technologies led advancements in power management and sensor technologies.

Challenges and Solutions

Raw material shortages

Raw material shortages, particularly in silicon and rare earth elements, were a significant challenge. To address this, companies diversified their supply chains. For example, Intel partnered with Australian suppliers to secure rare earth materials, reducing dependency on China by 25%.

Geopolitical tensions

Geopolitical issues, including U.S.-China trade restrictions, disrupted global supply chains. To counter this, several firms increased local production capabilities. TSMC’s new facility in Arizona began operations in late 2024, providing a buffer against export limitations.

Talent shortages

The industry-wide talent shortage prompted investments in education and training. Germany’s apprenticeship programs added 5,000 skilled workers, while U.S. initiatives like “Chipmakers of Tomorrow” attracted new talent to the sector.

Addressing raw material shortages

To overcome raw material shortages, semiconductor companies took strategic steps to diversify their supply chains and reduce dependency on single-source suppliers. For instance, ventureLAB's partnership with TSMC aimed to expand Canada's hardware and silicon ecosystem, enhancing access to essential semiconductor resources.

Similarly, companies expanded sourcing from regions like Africa and Southeast Asia, which possess untapped reserves of important materials. Investments in recycling technologies also played a key role, with firms like Umicore leading efforts to reclaim valuable elements from electronic waste, ensuring a more sustainable and reliable supply.

Mitigating Geopolitical Tensions

In response to geopolitical disruptions, companies focused on strengthening local production. For example, TSMC’s new Arizona facility, which started operations in late 2024, boosted regional chip production and minimized risks associated with international trade restrictions. Similarly, Samsung expanded its manufacturing base in Texas, ensuring a steady supply of advanced chips for North American markets. Governments also stepped in with incentives; the U.S. CHIPS Act provided subsidies to encourage domestic manufacturing, reducing reliance on imports and stabilizing supply chains.

Managing Talent Shortages

To tackle the persistent talent shortage in the semiconductor industry, governments and companies implemented targeted initiatives to upskill workers and attract fresh talent. For instance, Germany expanded its dual-education apprenticeship programs in 2024, adding 5,000 skilled workers to the semiconductor sector. This model, which combines academic training with practical on-the-job experience, has been essential in building a reliable workforce for high-tech industries.

Forecast and Expectations for 2025

2024 was a year of both growth and learning for the semiconductor industry. Despite challenges such as material shortages and geopolitical tensions, the sector demonstrated resilience through innovation and strategic diversification. Looking ahead, 2025 is expected to bring further advancements in AI, quantum computing, and automotive electronics. Continued investments in localized production and workforce development are expected to be key to sustaining growth and overcoming global uncertainties.

For detailed insights on these trends, refer to our below trending topics related to the semiconductor industry:

Contact our analysts today for deeper insights into the industry!