Restaurant Management Software Market Insights, 2031

The global restaurant management software market size was valued at USD 4.2 billion in 2021, and is projected to reach USD 17.1 billion by 2031, growing at a CAGR of 15.3% from 2022 to 2031.

The restaurant management software market share is expected to witness notable growth during the forecast period, owing to increasing adoption of advanced restaurant service technologies and rising acceptance of quick service restaurant (QSR) services. Furthermore, rise in application of seamless payment gateway drives the growth of the market.

Furthermore, the upsurge in the online food ordering and delivery services has led to a need for robust restaurant operations software that can handle these additional operations, accelerating market growth. In addition, the increase in the consumer demand for healthier and customizable options by utilizing restaurant technology solutions, allows restaurants to offer personalized menu options and promote healthier alternatives. These factors are expected to fuel the growth of the global restaurant management software market.

However, lack of advanced all-in-one restaurant management software impedes the growth of the market. On the contrary, lucrative potential for the restaurant management software market is projected to flourish owing to expanding entry of subscription-based solutions offered by new companies.

On the contrary, the restaurant management software market is expected to offer several growth opportunities for new players in the market. Rise in demand for automation in the restaurant industry has led to the increase in the adoption of restaurant management software, which streamlines operations, manages customer data, tracks inventory, handles point-of-sale (POS) systems, and processes orders, thereby enhancing efficiency and reducing human error. This trend presents significant growth opportunities for developers of automated software solutions, as they can save restaurant owners both time and money.

In addition, the increase in the restaurant management software market demand, driven by the surge in the restaurant industry's dependency on data to make decisions, has led to the surge in the need for software that can track important factors like sales, customer preferences, and inventory, offering advanced analytics and real-time reporting. Furthermore, the integration of customer relationship management (CRM) tools with restaurant management software provides enhanced customer experience, offering features such as loyalty programs, personalized promotions, and convenient mobile ordering. These factors are expected to offer remunerative opportunities for the growth of the market.

For instance, on May 18, 2024, MenuSifu partnered with Happy Cashier and Hestia, celebrating its 10-year anniversary by launching new products. The partnerships aimed at transforming restaurant automation. Happy Cashier offers virtual cashiers to reduce costs and boost productivity, while Hestia provides automated cooking machines that save resources and reduce labor costs. MenuSifu also introduced new products, including POS devices, E-Menu, Loyalty and Marketing software, and Waitlist & Reservation systems, all integrated with Happy Cashier and Hestia technologies.

Moreover, the rise in consumer expectations for seamless services has led restaurants to adopt solutions that offer easy-to-use platforms for reservations, payments, and customer interactions, ensuring a smooth and efficient dining experiences. In addition, the surge of independent and small restaurant chains is driving the adoption of restaurant management software, enabling these establishments to compete with larger chains. By leveraging powerful tools, enabled restaurants can streamline operations efficiently without the need for large IT teams or high overhead costs. This trend creates significant growth opportunities for affordable, easy-to-implement software solutions tailored to the needs of smaller businesses.

Furthermore, the upsurge in the growth of the restaurant industry in emerging markets such as Asia-Pacific, Latin America, and the Middle East is driving a significant demand for modern restaurant operations software, offering localized, cost-effective solutions are well-positioned to capture market share in these regions. In addition, the integration of data analytics with advanced restaurant management software enables restaurants to make data-driven decisions, optimize operations, and enhance customer experiences. By analyzing key metrics like sales trends, customer preferences, and inventory levels, restaurants can improve efficiency, reduce waste, and offer more personalized services, ultimately driving growth and profitability.

Moreover, Artificial intelligence (AI) is transforming restaurant management by automating tasks like inventory management, demand forecasting, and customer service. AI-driven systems can predict ingredient shortages, recommend menu adjustments based on customer preferences, and assist with dynamic pricing strategies, making operations more efficient and responsive to customer needs. These factors are expected to offer lucrative restaurant management software market opportunities for the growth of the market.

For instance, on April 11, 2024, Toast launched its new Restaurant Management Suite, powered by insights from over 100,000 restaurant locations, including multi-unit brands like Caribou Coffee and Papa Gino’s. The suite provides enterprise brands with essential data, control, support, and integrations to better manage their businesses. Steve Fredette, President and Co-Founder of Toast, highlighted that the suite's innovations, such as Benchmarking and Multi-Location Management, are designed to help restaurants perform optimally and grow.

A system that manages payment processing, order administration, daily accounting, and streamlines operations and advertising is known as a restaurant management software. A restaurant management system aids businesses in streamlining operations so they may focus on enhancing the restaurant's reputation.

A modern restaurant management software includes data protection measures to preserve sensitive company data, simplifies internal processes, connects all the stakeholders in the restaurant's performance, and easily manages sales, labour, and inventory data management. As a consequence, this raises sales, profits, and client satisfaction while reducing staff retention, order processing mistakes, wait times, and stress levels, and striving towards enhanced restaurant management.

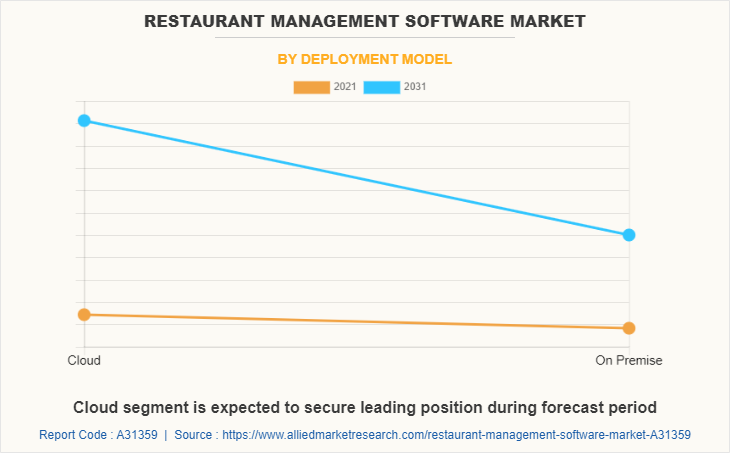

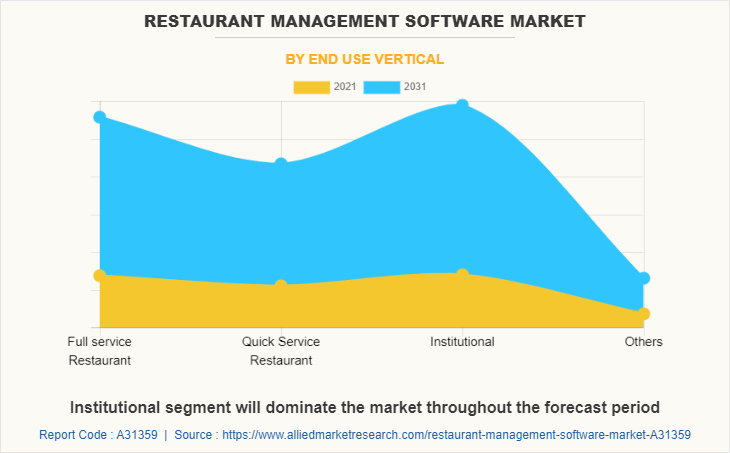

The restaurant management software market is segmented into solution, deployment model and end use vertical. On the basis of solution, the market is segmented into front end solution, accounting and cash flow solution, purchasing and inventory management, table and delivery management, employee payroll and scheduling, and others. By deployment model, the market is divided into cloud and on premise. By end use vertical, the market is fragmented into full service restaurant, quick service restaurant, institutional, and others. The full service restaurant is further sub-segmented into fine dine and casual dine.

By Solution

Purchasing & Inventory Management segment is projected as one of the most lucrative segments

Purchasing & inventory management solutions are utilized to minimize food waste and raw material tracking. The main objective of this solution is to guarantee that all supplies are accessible whenever the production department requires them, preventing production from being interrupted owing to a shortage of supplies. Therefore, assisting in retaining buffer supply of all essential items to ensure uninterrupted production chain. Restaurant supervisors are able to utilize perishable goods and purchase the necessary inventory while also cutting costs by incorporating purchasing & inventory management solution.

Cloud-based restaurant management software solutions are delivered via cloud, which is an online server. Several features are offered by cloud-based restaurant management software including inventory tracking, employee timesheets, CRM integration, and point-of-sale (POS) system, easy menu setup, managing loyalty programs, technical support, and detailed reporting.

Hospitality institutions have been exhibiting a strong presence around the world as it is driven by the positive international relations between countries. These locations offer a variety of amenities in addition to lodging, such as security, conference and event space, restaurants, and bars, all of which help boost occupancy levels.

Market Trends Insights:

The restaurant management software market trends are expected to be impacted by several noteworthy trends in the market. One of the significant trends is the rise in the adoption of cloud technology which provides scalable, flexible, and cost-effective solutions. Cloud-based systems enable restaurant owners to access and manage operations from any location and on any device, a flexibility that has become crucial as many restaurants adopt remote work and multi-location management.

In addition, there is growing trend toward the surge in the use of food delivery apps such as Uber Eats, DoorDash, and Grubhub which has led to the demand for restaurant management software that seamlessly integrates with these platforms. Mobile ordering and delivery management features have become essential, allowing restaurants to efficiently handle both online ordering and in-house orders from a unified platform. Furthermore, the shift in preference towards contactless and self-service technology in restaurants, enabling contactless ordering, payment, and check-in. Self-service kiosks and tableside ordering via mobile apps or QR codes are becoming popular as they reduce physical interaction and enhance customer safety. These factors are expected to accelerate the growth of the market in the upcoming years.

For instance, on April 12, 2024, Posist rebranded as Restroworks, reflecting its evolution from a POS provider to a unified technology platform for global restaurant chains. The new identity symbolizes its comprehensive suite of products, including cloud-native POS software, inventory management, kitchen automation, analytics, digital ordering solutions, and integrations with over 400 third-party solutions. This rebranding, which includes a new name, logo, website, and identity, underscores Restroworks' mission to make restaurants prosperous.

Another notable trend the market is expected to witness is the increase in the demand for restaurant management software that aids in scheduling, payroll management, and labor cost optimization. Key features such as real-time schedule adjustments and compliance with labor laws provide substantial benefits for restaurant operators. In addition, there is growing trend towards the adoption of effective CRM tools in the restaurant management software market. These tools enable restaurants to create loyalty programs, track customer preferences, and implement personalized marketing campaigns. Furthermore, the adoption of the subscription-based pricing models is another trend in the market, helping restaurants to avoid substantial upfront costs. This trend makes software solutions more accessible to smaller establishments and independent restaurant owners.

In addition, the integration of advanced security features like encryption, two-factor authentication, and compliance with standards such as PCI DSS (Payment Card Industry Data Security Standard) helps to safeguard sensitive information. Moreover, the shift in preference toward sustainability has led restaurants to look for software solutions that aid in reducing waste and improving resource management. Modern restaurant management software now includes features such as waste tracking, menu optimization to minimize food waste, and energy consumption monitoring. These factors are expected to drive the growth of the market in the upcoming years.

For instance, on September 10, 2024, Zomato announced its POS (point of sale) developer platform to help restaurants optimize operations. The platform offers easy-to-read documentation, real-time API testing, and a toolkit for POS partners to introduce features at scale. Developers can quickly onboard and integrate using step-by-step guides, and test APIs and webhooks in real time for immediate troubleshooting. This new platform builds on Zomato’s partnerships with various POS players, providing scalable systems for inventory, payroll, and real-time analytics. Recently, Zomato has launched several initiatives to improve margins across its business verticals.

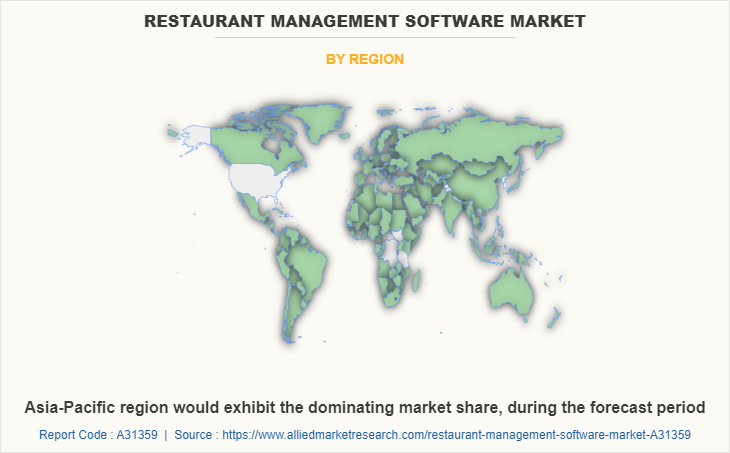

Region-wise, the restaurant management software market trends are analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America, specifically the U.S., remains a significant participant in the global restaurant management software industry. This region's rise is attributed to a number of factors, including swift urbanization, increased disposable income, the foodservice industry's well-organized architecture, and a high degree of vendor market penetration.

North America covers U.S. and Canada. North America is projected to obtain significant share in the restaurant management software market share. Rapid urbanization, rise in disposable income, well-organized architecture of the foodservice sector, and high level of vendor market penetration contribute to the growth of the market in North America.

For instance, on November 8, 2024, Toronto-Dominion Bank Group (TD) partnered with TouchBistro to offer Canadian restaurant owners an all-in-one payment and management platform. This collaboration allowed TD customers to integrate payment processes seamlessly with their restaurant operations. By combining TD’s payment solutions with TouchBistro’s comprehensive management system, restaurant owners could manage orders, reservations, staffing, floor plans, and billing from a single interface. TouchBistro simplified operations by merging front-of-house, back-of-house, and guest engagement tools into one platform, boosting efficiency, sales, and guest satisfaction. This collaboration is expected to drive the restaurant management software market size by simplifying operations and improving restaurant technology solutions.

Top Impacting Factors:

Significant factors significantly impact the expansion of the restaurant management software market. One major factor is the rise in focus on safeguarding metadata. As the need for data security intensifies, restaurants are seeking sophisticated software solutions to protect sensitive data related to customers and their operations. Furthermore, the increase in digital transformation and the surge in reliance on artificial intelligence (AI) within the restaurant sector are crucial. Features powered by AI, including predictive analytics, tailored recommendations, and automated customer support, are improving both operational efficiency and customer satisfaction, resulting in a growing demand for such software.

However, the substantial initial investment for installation and ongoing upkeep can pose a challenge for adoption, particularly for smaller enterprises. This upfront cost often deters certain restaurants from upgrading or implementing new software systems, hindering the overall growth of the market.

On the other hand, the upsurge in the integration of restaurant management software across different end-use sectors creates a significant opportunity for the market growth. As more dining establishments, from fast-food to upscale venues, adopt technology to enhance their operations and improve customer experiences, the demand for these software solutions is projected to rise. This trend is anticipated to drive market growth, providing software providers with opportunities to innovate and reach a broader customer base in the years ahead.

For instance, on January 21, 2025, McDonald’s extended its partnership with Cognizant to enhance labor and operational efficiencies using AI technology. This includes support for global finance systems, human capital management, payroll processing, franchisee management, data management, and legal applications. McDonald’s will utilize Cognizant’s Skygrade and Neuro IT platforms to transition to cloud-native systems and automate IT functions. This partnership aligns with McDonald’s “Digitizing the Arches” initiative to modernize and streamline operations.

Growth of Online Ordering and Delivery in the Food Industry:

The integration of online ordering and delivery systems through restaurant management software (RMS) has become essential in the food industry, offering various benefits to both diners and establishments. A primary advantage is the potential for increased revenue. By providing online ordering options, restaurants can access a broader clientele, including those who are unable to visit in person due to location, time limitations, or personal choice. Furthermore, integrating delivery services into RMS enables restaurants to capitalize on the growing demand for convenience, thereby extending their customer reach beyond the physical location.

Another significant advantage is the increased convenience for customers. Online ordering platforms enable customers to place orders at any time and from any location, allowing them to enjoy their favorite meals without having to leave their homes. The option to browse menus, personalize orders, and monitor delivery progress contributes to the simplicity of the experience, enhancing overall customer satisfaction and loyalty. For restaurants, efficient operations are a significant advantage. Integrated online ordering systems with RMS handle orders automatically, minimizing human error and removing the necessity for phone calls or manual order entry. This results in faster service, decreased wait times, and allows kitchen staff to concentrate on food preparation instead of handling orders. Additionally, online ordering platforms offer insightful data, including customer preferences and order history, which enables restaurants to customize their offerings, enhance menu design, and develop targeted marketing strategies.

Furthermore, automating the order-taking process helps restaurants cut down on labor expenses related to taking orders via phone or face-to-face. Moreover, certain restaurant management system (RMS) solutions connect directly with third-party delivery services, facilitating smoother order management and improved collaboration between restaurants and delivery drivers, ultimately lowering operational costs.

Moreover, online ordering and delivery services, enabling restaurants to remain competitive in a rapidly digitalizing environment. With an increasing number of consumers seeking the ease of online food ordering, implementing a strong system allows restaurants to fulfill customer demands and uphold their standing in the market. In addition, incorporating online ordering and delivery features into restaurant management software equips restaurants with opportunities for increased revenue, operational efficiency, customer satisfaction, and long-term business growth.

For instance, on January 22, 2025, NCR Voyix Corporation (NYSE: VYX) was recognized as a Leader in the IDC MarketScape reports for Worldwide Point-of-Sale Software in both the Quick Service/Fast Casual and Full-Service Restaurant sectors. These reports highlighted NCR Voyix's innovative approach, focusing on multi-channel ordering, payment capabilities, and uninterrupted operations. Dorothy Creamer from IDC noted the importance of evolving POS software to meet the complex needs of modern restaurant operators. NCR Voyix's cloud platform offers strong omni-channel support, reporting, analytics, marketing/loyalty, and operational management.

Report Coverage & Deliverables:

Restaurant management software market report provides comprehensive analysis, including global and regional market size estimates, growth projections, and key trends. It covers market drivers, challenges, and opportunities, providing insights into the adoption of technology, shifting consumer expectations, and evolving business needs. The report also examines strategic partnerships, innovations, and technological advancements in restaurant management software. Deliverables include comprehensive restaurant management software market forecasts, highlighting growth opportunities and market dynamics. The report also features competitive strategies from leading market players, offering valuable insights into their market positioning, product offerings, and future developments. With a focus on market segmentation, the report provides an overview of the software solutions catering to various types of restaurants, from quick-service to fine dining, along with trends in customer engagement and operational efficiency.

Competition Analysis:

Competitive analysis and profiles of the major restaurant management software market players, such as Clover Network, LLC, HotSchedules (Fourth Enterprises LLC.), Jolt, NCR Corporation, OpenTable, Inc., Oracle Corporation, Personica (Fishbowl Inc.), Revel Systems, Inc., Square Capital, LLC (Block, Inc.) and TouchBistro are provided in this report. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the restaurant management software market.

Recent Product Launches in the Market:

- On March 04, 2025, Ladle™ officially launched as the new parent company uniting top software solutions for the foodservice, restaurant, and grocery industries. Combining ComplianceMate™, MeazureUp™, and Storewise™, Ladle aims to drive efficiency, compliance, and profitability for over 18,000 locations worldwide. It provides an integrated platform for food safety, operations, and profitability, streamlining workflows and enhancing team collaboration. Gebski emphasized that the integration of these industry leaders strengthens their offerings and positions Ladle to deliver effective, efficient solutions to customers.

- On February 2, 2025, Yum! Brands launched Byte by Yum!, a new AI-driven SaaS platform to enhance operational efficiency for its global chains like KFC, Taco Bell, Pizza Hut, and Habit Burger & Grill. This platform consolidates essential restaurant systems into a cohesive, easy-to-manage digital ecosystem, improving service speed, order accuracy, and guest satisfaction while reducing inefficiencies. Joe Park, Chief Digital & Technology Officer, emphasized the platform's strategic importance, highlighting its AI capabilities for better demand anticipation, inventory management, and team productivity. Byte by Yum! includes online and mobile ordering, POS systems, kitchen and delivery optimization, menu management, and labor management functions, offering predictive analytics for data-driven decisions.

Key Benefits for Stakeholders:

- This study comprises analytical depiction of the restaurant management software market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall restaurant management software market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current restaurant management software market forecast is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porters five forces restaurant management software market analysis illustrates the potency of the buyers and suppliers in the smart display.

- The report includes the restaurant management software market share of key vendors and restaurant management software market trends.

Restaurant Management Software Market Report Highlights

| Aspects | Details |

| By Solution |

|

| By Deployment Model |

|

| By End Use Vertical |

|

| By Region |

|

| Key Market Players | NCR Corporation, Clover Network, LLC, Jolt, Personica (Fishbowl Inc.), Oracle Corporation, TouchBistro, HotSchedules (Fourth Enterprises LLC.), Square Capital, LLC (Block, Inc.), OpenTable, Inc., Revel Systems, Inc. |

Analyst Review

Restaurant management software is a system that includes every operational and marketing element required to operate a restaurant. The purpose of a restaurant management software is to streamline marketing and operations while handling order administration, payment processing, and day-to-day problem resolution. By tracking raw materials & equipment’s, sales, and staffing data, restaurant management software also link every employee and other resources to enhance restaurant owner’s growth.

The global restaurant management software market is highly competitive, owing to the strong presence of existing vendors. Restaurant management software market vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

As more modern restaurant service technologies are adopted and quick service restaurant (QSR) offerings are increasingly embraced, the market share for restaurant management software is anticipated to expand significantly during the forecast period. The market has grown due to the expanding usage integrated payment channels. The market's expansion has been hampered by an absence of sophisticated all-in-one restaurant management software. The rising entry of subscription-based solutions provided by new firms, on the other hand, creates attractive opportunities for the restaurant management software industry to flourish.

Among the analyzed regions, North America exhibits the highest adoption rate of restaurant management software market and has been experiencing massive expansion of the market. On the other hand, Europe is expected to grow at a faster pace, predicting lucrative growth due to emerging countries, such as Germany, France and Italy, investing in these technologies. Regions, such as the Asia-Pacific & LAMEA, are also expected to offer new opportunities in the restaurant management software market, during the forecast period.

Globally, various key players and software service providers are investing in restaurant management software market to make them compatible with various industrial platforms. For instance, Oracle Corporation had launched flagship kitchen display system (KDS) restaurant management software. This solution is optimize kitchen workflows, food quality, and speed of service to enhance restaurant management software market’s growth. This completely integrated kitchen production system, which combines high levels of usability with a unified technological approach, improves the efficiency and speed of order fulfilment for restaurants showcasing lucrative growth opportunities for the market growth.

The key players profiled in the report include Clover Network, LLC, HotSchedules (Fourth Enterprises LLC.), Jolt, NCR Corporation, OpenTable, Inc., Oracle Corporation, Personica (Fishbowl Inc.), Revel Systems, Inc., Square Capital, LLC (Block, Inc.) and TouchBistro.

The global restaurant management software market was valued at $4.2 billion in 2021, and is projected to reach $17.1 billion by 2031,

The restaurant management software market is projected to grow at a compound annual growth rate of 15.3% from 2022 to 2031.

The key players operating in the market include AlClover Network, LLC, HotSchedules (Fourth Enterprises LLC.), Jolt, NCR Corporation, OpenTable, Inc., Oracle Corporation, Personica (Fishbowl Inc.), Revel Systems, Inc., Square Capital, LLC (Block, Inc.) and TouchBistro.

Europe is expected to witness significant growth in restaurant management software market forecast.

The restaurant management software market share is expected to witness notable growth during the forecast period, increasing adoption of advanced restaurant service technologies and rising acceptance of quick service restaurant (QSR) services. Furthermore, growing application of seamless payment gateway has driven the growth of the market. On the contrary, lucrative potential for the restaurant management software market to flourish as a result of the expanding entry of subscription-based solutions offered by new companies.

Loading Table Of Content...