Restaurant Point Of Sale (POS) Terminal Market Research, 2031

The global restaurant point of sale (pos) terminal market was valued at $16.5 billion in 2021, and is projected to reach $44.6 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Restaurant POS systems assist restaurant owners in streamlining sales, cash flow, food inventory, and bookkeeping processes as well as improving the customer experience. Payment gateways, order management, and table bookings are further functionalities of restaurant POS terminals. In addition, some restaurant POS systems include more sophisticated capabilities, such as food costing and a built-in marketing suite, to assist restaurant managers with budgeting as well as planning and carrying out outreach initiatives. Moreover, most point-of-sale (POS) software and systems for restaurants can be utilized by restaurants that provide food & beverages, such cafés, food trucks, and bars.

Restaurants are increasingly using point of sale systems to function more quickly, cut down on billing time, keep track of order fulfillment times, and prevent order mistakes during busy times. In addition, to make sure the business runs smoothly, they entail payroll administration, inventory control, keeping track of sales data, and billing. Online ordering, E-wallets, table reservations, loyalty programs, and many more features are integrated with POS terminal systems. This factor notably drives the growth of restaurant point of sale terminal market. However, high acquisition costs and security risks of the POS terminals hinder the growth of restaurant POS terminal market. On the contrary, technological advancements in the POS terminals such as inclusion of machine learning (ML) and automations is expected to fuel the growth of restaurant point of scale terminal market in upcoming years. Moreover, increasing adoption of POS terminals by restaurants for streamlining the operations is expected to provide lucrative opportunities for the market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the restaurant POS terminal market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the restaurant point of sale terminal market outlook.

The restaurant point of sale (pos) terminal market is segmented into Component, Deployment Mode, Type, Application and End User.

Segment Review

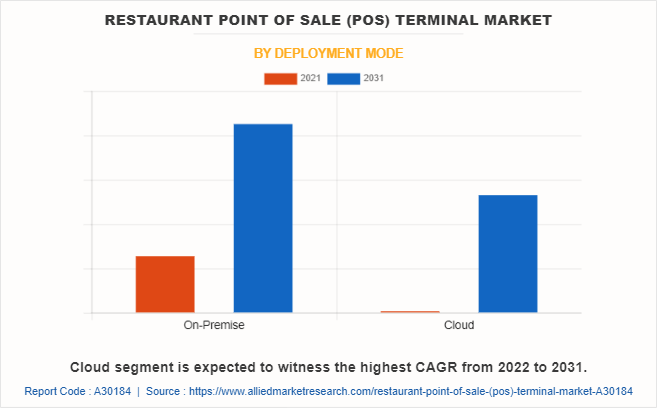

The restaurant point of sale terminal market is segmented into component, deployment mode, type, application, end user, and region. By component, the market is differentiated into hardware, software and services the hardware is further segmented into swipe card machine, touchscreen/desktop and others. The services is further segmented into professional services and managed services. The professional services is further segregated into system implementation & integration, support & maintenance and training & consulting. Depending on deployment mode, it is fragmented into on-premise and cloud. By type, it is segmented into fixed POS and mobile POS. The fixed POS is further segmented into self-serve kiosks, cash counters terminal and others. The application segment is segregated front end and back end. By end user, it is segmented into full-service restaurant (FSR), quick service restaurant, intuitional FSR, and others. The full-service restaurant (FSR) is further segmented into fine dine and casual dine. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By deployment mode, on-premise segment accounted for the highest restaurant point of sale terminal market size. This is attributed to the fact that on-premise implementation provides several advantages, such as the fact that on-premise POS systems do not rely on the internet, without the internet, one might still navigate the system and information via the installed device.

By region, Asia-Pacific acquired the largest restaurant point of sale terminal market share in 2021. This is attributed to the rapidly expanding and evolving foodservice industry in countries, such as India and China, as a result of favorable demographic conditions and increased disposable income levels.

The key players in restaurant point of sale terminal market analysis includes Aures Group, Diebold Nixdorf, Incorporated, Hewlett Packard Enterprise Development LP, INGENICO, Lightspeed Management Company, LLC, NCR Corporation, Oracle, Panasonic Corporation, PAX Technology Limited, Posist Technologies Pvt. Ltd., Posiflex Technology, Revel Systems, Shift4, Squirrel System, Touch Dynamic, Cake, and Toast. These players have adopted various strategies to increase their market penetration and strengthen their position in the restaurant POS terminal industry.

COVID-19 Impact Analysis

The COVID-19 outbreak had a moderate effect on the restaurant point of sale terminal industry. The restaurants were increasingly adopting POS terminals for streamlining the restaurant operations and follow the social distancing norms. Moreover, increasingly reliance on digital menu in the restaurant industry has fueled the growth of restaurant POS terminal market. Furthermore, growth of digital payment industry during the pandemic has propelled the growth of restaurant point of sale terminal industry.

Top Impacting Factors

POS Terminal at Restaurants Aids in Smoother Transactions

The restaurant POS terminal captures data to personalize customer’s experience while shopping. In addition, using contact information such as phone number, e-mail id, and others, businesses can send order updates, create targeted email campaigns based on the past purchases and other behaviors or demographics. Moreover, loyalty programs are effective tools to promote repeat orders and attract potential customers, aligning rewards with their interests. If a restaurant does not have an enough space for a large cashier, mobiles POS systems can help, converting smart phone or tablet into a POS for accepting card payments. It promotes the connection of card reader to the smart device keeping the POS open and when prompted the customers can swipe, dip, and tap their card for making the transaction. This results in smoother payment transactions of the restaurant bills. Thus, this factor promotes the restaurant point of sale terminal market growth.

Increasing Preference for Cashless Transactions

As the transactions are increasingly becoming cashless, customers do not tend to have cash-on-hand, and they prefer to use debit or credit card for shopping. Additionally, restaurant POS terminals enable transactions and provide a convenient and hassle-free payment experience for the customers. In addition, restaurant POS vendors are enhancing security of customer data and chargeback protection to reduce losses and avoid fraudulent purchases. A major and growing trend in the restaurant point of sale terminal market is the development of QuickBooks which helps restaurants to monitor total sales, inventory management, payment, payroll, and customer relationship management (CRM) information. This factor is expected to drive the growth of the global market over the coming years. Furthermore, the prominence of cashless payments in emerging countries creates various opportunities for the restaurant point of sale terminal market. Thus, increasing preference for cashless transactions is fueling the growth of restaurant point of sale terminal market.

Increasing Adoption of POS Terminal by Restaurants for Smoother Business Operations

The restaurant POS terminal functions involve billing, recording sales figures, payroll management, and inventory control to ensure smooth business functions. In addition, everyday sales and inventory data recorded in the POS system are analyzed to track the sales pattern and help restaurants to manage sales tax reporting as well as track their monthly and annual sales. Hence, the installation of fixed or mobile POS systems can reduce everyday tedious and manual tasks recording sales and preparing tax reports. Additionally, integration of customer relationship management (CRM) software in the POS system automatically fetches customer information to create regular updates and prepare sales reports. Thereby, the added advantage of installing a POS system to extract insights related to customer preference, and sales trends are expected to augment the market growth. Thus, the increasing adoption of POS terminal by restaurants for smoother business operations is propelling the growth of restaurant point of sale terminal market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the restaurant point of sale terminal market forecast from 2021 to 2031 to identify prevailing restaurant point of sale terminal market opportunity.

- In addition to the market research, important drivers, restraints, and opportunities are covered as well.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the restaurant point of sale terminal market segmentation assists in determining the prevailing market opportunities.

- According to their contribution to global market revenue, the major countries in each region are mapped.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global restaurant point of sale terminal market trends, key players, market segments, application areas, and market growth strategies.

Restaurant Point of Sale (POS) Terminal Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 44.6 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 534 |

| By Component |

|

| By Deployment Mode |

|

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Revel Systems, Aures Group, Hewlett Packard Enterprise Development LP, Panasonic Corporation, Toast, NCR Corporation, Shift4, Diebold Nixdorf, Incorporated, Lightspeed Management Company, LLC, Posist Technologies Pvt. Ltd., Cake, PAX Technology Limited, Oracle, Squirrel System, Touch Dynamic, Posiflex Technology, INGENICO |

Analyst Review

The need for restaurant POS terminals is expected to increase as digital payments become more and more prevalent throughout the world. Smart cards, mobile wallets, and online banking methods are all being used more often by consumers to make purchases, which is helping the industry to expand. Moreover, digital transactions eliminate the inconvenience of carrying cash and guarantees security. Furthermore, mobile wallet acceptance has increased as a result of the increasing use of cellphones in emerging nations. To ensure economic progress, government entities promote the use of electronic payment methods. These elements are expected to encourage the use of POS terminals in restaurants.

The COVID-19 pandemic pushed restaurants to integrate more advanced technologies to effectively meet consumer requirements, with improved safety and economic feasibility. Restaurant POS terminals offer several COVID-friendly features that have helped restaurants serve customers in a socially distanced setting.

The key market players in the restaurant POS terminal market are Aures Group, Diebold Nixdorf, Incorporated, Hewlett Packard Enterprise Development LP, INGENICO, Lightspeed Management Company, LLC, NCR Corporation, Oracle, Panasonic Corporation, PAX Technology Limited, Posist Technologies Pvt. Ltd., Posiflex Technology, Revel Systems, Shift4, Squirrel System, Touch Dynamic, Cake, and Toast. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnerships to reduce supply and demand gaps. With rise in awareness & demand for restaurant POS terminal across the globe, major players have collaborated on their product portfolio to provide differentiated and innovative products.

The restaurant POS terminal market is estimated to grow at a CAGR of 10.8% from 2022 to 2031.

The restaurant POS terminal market is projected to reach $44.56 billion by 2031.

POS terminal at restaurants aids in smoother transactions, increasing preference for cashless transactions and increasing adoption of POS terminal by restaurants for smoother business operations majorly contribute toward the growth of the market.

The key players profiled in the report include Aures Group, Diebold Nixdorf, Incorporated, Hewlett Packard Enterprise Development LP, INGENICO, Lightspeed Management Company, LLC, NCR Corporation, Oracle, Panasonic Corporation, PAX Technology Limited, Posist Technologies Pvt. Ltd., Posiflex Technology, Revel Systems, Shift4, Squirrel System, Touch Dynamic, Cake, and Toast.

The key growth strategies of restaurant POS terminal market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...