The global retail logistics market size was valued at $238.5 billion in 2022, and is projected to reach $809.7 billion by 2032, growing at a CAGR of 13.5% from 2023 to 2032.

Retail logistics refers to the process of managing and coordinating the movement of goods, materials, and products from suppliers to the final consumers in the retail industry. It involves various activities such as procurement, transportation, inventory management, warehousing, order fulfillment, and distribution, all aimed at ensuring that the right products are available in the right quantities at the right locations and at the right time to meet customer demands. This involves the planning and coordination of activities across the entire supply chain, from raw material suppliers to manufacturers to distributors to retailers and ultimately to consumers.

The widespread adoption of online shopping and the continuous growth of e-commerce platforms have led to a surge in demand for retail logistics services. As consumers increasingly prefer shopping online due to its convenience and broader product selection, the pressure on logistics providers to handle these orders efficiently and swiftly has intensified. Retailers and logistics companies need to meet these expectations to retain customer loyalty. This has resulted in the need for logistics solutions that can ensure timely deliveries and often pushing companies to optimize their supply chain and distribution networks. E-commerce businesses need to manage their inventory efficiently to avoid stockouts and overstock situations.

Real-time tracking or demand forecasting and inventory optimization technologies have become vital tools for retailers to ensure they have the right products in stock and ready for shipping. E-commerce allows businesses to reach a global customer base. As companies expand their operations internationally, logistics becomes even more complex due to cross-border shipping, varying regulations, and different customer expectations. This has prompted the development of international logistics solutions and strategies. Moreover, in the highly competitive e-commerce landscape, efficient logistics can serve as a significant differentiator for companies.

Insufficient transportation infrastructure, such as poorly maintained roads, limited ports, and congested highways, can lead to delays in the delivery of goods. Delays can result in increased holding costs, stockouts, and potentially dissatisfied customers. Moreover, outdated or inadequate storage infrastructure, including warehouses and distribution centers can lead to disruptions in the supply chain. These disruptions can stem from capacity constraints, lack of modern inventory management systems and difficulties in coordinating the flow of goods.

Furthermore, inefficient storage infrastructure can force retailers to maintain higher levels of inventory to compensate for potential delays or disruptions in the supply chain. A lack of efficient transportation and storage infrastructure can make it challenging for retailers to quickly respond to changes in demand. This can lead to missed sales opportunities or excess inventory that becomes obsolete.

A unified omni-channel strategy allows customers to have a consistent and convenient shopping experience. They can browse products online, make purchases in-store, and even return or exchange items through any channel. This level of flexibility enhances customer satisfaction and loyalty. Moreover, an omni-channel approach enables retailers to gather data from various touchpoints. This data can be used to understand customer preferences and behaviors, allowing for tailored marketing efforts and product recommendations. Effective omni-channel logistics require real-time visibility into inventory levels across all channels. This visibility helps retailers avoid stockouts and overstock situations, leading to better inventory management and reduced costs.

Furthermore, retailers can offer various fulfillment options, such as buy online and pick up in-store (BOPIS), curbside pickup, same-day delivery, and traditional shipping. This flexibility meets customers' varied preferences and urgent needs. Moreover, managing returns is a critical aspect of omni-channel retail. An integrated logistics strategy streamlines the returns process, making it easier for customers to return items through any channel. Omni-channel logistics might involve partnerships with third-party logistics providers, technology companies, and other industry players. These partnerships can open doors to innovative solutions and shared expertise.

The key players profiled of retail logistics companies XPO Logistics, Inc., DSV, Kuehne + Nagel International, C.H. Robinson Worldwide, Inc., Nippon Express, FedEx, Schneider, United Parcel Service, APL Logistics Ltd, and DHL International GmbH.

Investment and agreement are common strategies followed by major market players. For instance, in October 2022, Aramex PJSC declared that it had successfully acquired Access USA Shipping, LLC (MyUS), a technology-focused worldwide platform facilitating cross-border e-commerce. Aramex obtained all required regulatory authorizations and finalized the acquisition, paying a total cash amount of approximately $265 million.

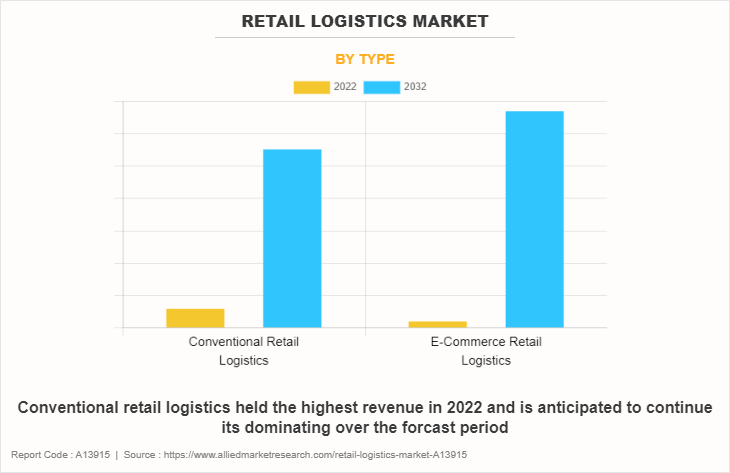

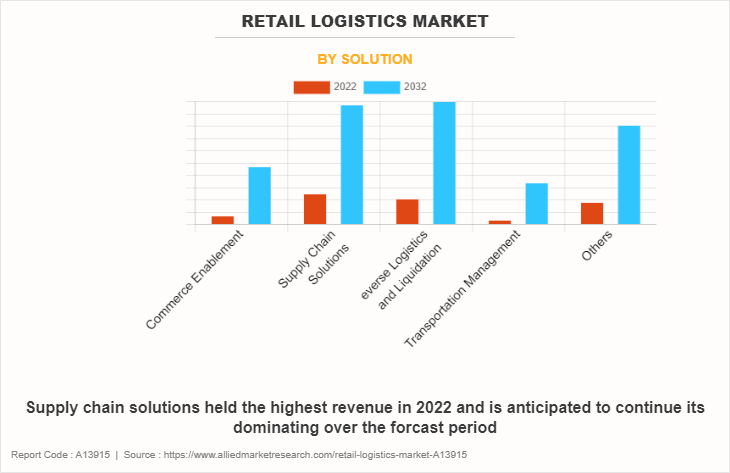

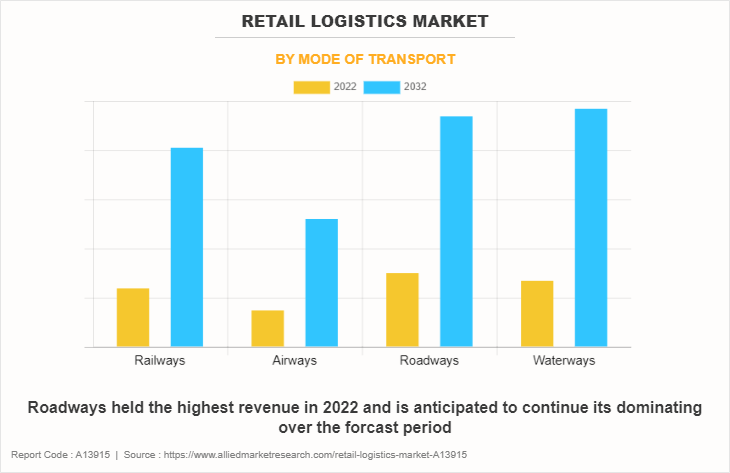

The retail logistics market is segmented on the basis of type, solution, mode of transport, and region. By type, the market is divided into conventional retail logistics and e-commerce retail logistics. By solution, the market is classified into commerce enablement, supply chain solutions, reverse logistics & liquidation, transportation management, and others. By mode of transport, the market is classified into railways, airways, roadways, and waterways. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The retail logistics market is segmented into Type, Solution and Mode of Transport.

By type, the conventional retail logistics sub-segment dominated the market in 2022. Consumer preferences and behaviors drive the demand for retail products which in turn impacts logistics operations. As consumer expectations for faster delivery, reliable supply chains, and convenient returns increase, retail logistics providers need to adapt to meet these demands. The rise of e-commerce has significantly impacted the retail logistics landscape. Conventional retailers are increasingly incorporating online sales channels, leading to the need for efficient order fulfillment, inventory management, and last-mile delivery.

Moreover, conventional retail logistics heavily relies on efficient supply chain management. Effective coordination of suppliers, distribution centers, warehouses, and transportation networks is crucial to ensure timely delivery and minimize operational costs. Furthermore, as urban populations grow, retail logistics providers face challenges related to congestion, limited storage space, and regulatory constraints in densely populated areas. This drives the need for innovative solutions like micro-fulfillment centers and urban delivery hubs. These are predicted to be the major factors affecting the retail logistics market size during the forecast period.

By solution, the supply chain solutions sub-segment dominated the global retail logistics market share in 2022. The rapid expansion of e-commerce has transformed retail logistics. As more consumers shop online, retailers are under pressure to provide efficient and timely delivery services. This drives the demand for advanced supply chain solutions that optimize inventory management, order fulfillment, and last-mile delivery. Consumers increasingly expect faster delivery options, such as same-day or next-day delivery. This demand for speed requires retailers to implement sophisticated supply chain solutions to streamline processes and reduce delivery times.

Retailers are looking for ways to reduce excess inventory and associated holding costs while maintaining product availability. Supply chain solutions that offer demand forecasting, real-time inventory tracking, and data analytics help optimize inventory levels and reduce stockouts. Effective supply chain solutions are needed to synchronize inventory across these channels and enable efficient order routing.

By mode of transport, the roadways sub-segment dominated the global retail logistics market share in 2022. Road transportation offers a high level of accessibility, enabling goods to reach both urban and rural areas where other modes of transportation might be less feasible. This extensive reach is especially important for retail businesses aiming to serve diverse markets. Road transport allows for flexible routes and schedules, making it easier for retailers to adapt to changing customer demands and market trends.

Retailers can quickly adjust delivery routes and times based on real-time information. This is essential for e-commerce and online retail, where quick and efficient last-mile delivery is a competitive advantage. Road transportation is generally faster over short to medium distances compared to other modes such as maritime or rail. This speed is advantageous for perishable goods, time-sensitive products, and quick replenishment of stock. Road transport is often more cost-effective for shorter distances, making it an attractive option for retailers operating within a certain geographic range. It eliminates the need for transshipment and intermediate handling, reducing overall logistics costs.

By region, Asia-Pacific dominated the global market in 2022. Asia-Pacific is experiencing significant urbanization, leading to the concentration of populations in cities. This trend increases the demand for effective logistics networks to supply goods to densely populated areas. Moreover, investments in transportation and logistics infrastructure, such as roads, ports, and warehouses, are crucial for efficient movement of goods within and between countries. Improvements in infrastructure positively impact the regional retail logistics market expansion.

Furthermore, retailers are striving to optimize their supply chains to reduce costs and enhance customer service. This involves streamlining inventory management, order processing, warehousing, and transportation. Moreover, international trade and cross-border e-commerce are growing rapidly in the region. Effective cross-border logistics solutions are essential for retailers to reach global markets and customers. Regulatory changes, including trade agreements and customs regulations, can significantly influence the flow of goods in the region. These changes may impact the efficiency and cost-effectiveness of retail logistics operations.

Impact of COVID-19 on the Global Retail Logistics Industry

- The COVID-19 pandemic had a significant impact on the retail logistics market. Many countries implemented lockdowns and travel restrictions to curb the spread of the virus. These measures led to disruptions in supply chains, including factory closures, transportation restrictions, and reduced labor availability. This caused delays in the movement of goods, affecting retailers' ability to restock shelves and fulfill customer orders.

- With physical retail stores closing or operating with limited capacity, there was a significant shift towards online shopping. This sudden increase in e-commerce placed additional pressure on logistics and fulfillment operations, as retailers had to adapt to higher demand for home deliveries and manage returns efficiently.

- Fluctuating demand patterns and supply chain disruptions made inventory management more challenging. Retailers had to navigate through unpredictable demand surges and shortages, leading to potential stockouts of popular items and overstocking of less-demanded products.

- Last-mile delivery, the final step in the delivery process from a distribution center to the end consumer, faced challenges due to increase in demand. Retailers had to find ways to ensure timely and safe deliveries while dealing with potential labor shortages and the need for contactless delivery options.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the retail logistics market analysis from 2022 to 2032 to identify the prevailing retail logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the retail logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global retail logistics market trends, key players, market segments, application areas, and market growth strategies.

Retail Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 809.7 billion |

| Growth Rate | CAGR of 13.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 310 |

| By Solution |

|

| By Type |

|

| By Mode of Transport |

|

| By Region |

|

| Key Market Players | DHL International GmbH, APL Logistics Ltd, FedEx Corporation, XPO Logistics, Inc., United Parcel Service, Inc., Schneider, C.H. Robinson Worldwide, Inc., Nippon Express Co., Ltd., Kuehne + Nagel International AG, DSV |

The rapid expansion of e-commerce has led to an increase in demand for efficient logistics solutions to handle the movement of goods from warehouses to customers' doorsteps. The rise of online shopping has significantly impacted traditional retail supply chains, driving the need for more advanced and flexible logistics networks, which is estimated to generate excellent opportunities in the retail logistics market.

The major growth strategies adopted by retail logistics market players are investment and agreement.

North America is projected to provide more business opportunities for the global retail logistics market in the future.

XPO Logistics, Inc., DSV, Kuehne + Nagel International, C.H. Robinson Worldwide, Inc., Nippon Express, FedEx, Schneider, United Parcel Service, APL Logistics Ltd, and DHL International GmbH are the major players in the retail logistics market.

Conventional retail logistics sub-segment of the type acquired the maximum share of the global retail logistics market in 2022.

E-commerce companies and third-party logistics (3PL) providers are the major customers in the global retail logistics market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global retail logistics market from 2022 to 2032 to determine the prevailing opportunities.

Retailers often source products from around the world to offer a diverse range of goods at competitive prices. This has led to an increase in emphasis on international logistics, including customs clearance, cross-border transportation, and compliance with varying regulations, which is anticipated to boost the retail logistics market in the upcoming years.

Loading Table Of Content...

Loading Research Methodology...