Retinal Biologics Market Research, 2032

The global retinal biologics market was valued at $14.9 billion in 2022, and is projected to reach $24.7 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032. Retinal biologics are specialized therapeutic agents that are used in the treatment of various retinal disorders such as macular degeneration, and diabetic retinopathy. These biologics are derived from living organisms, such as proteins or antibodies, and are designed to target specific molecules or processes involved in retinal diseases. They offer targeted therapies that address the underlying mechanisms of retinal disorders, providing more effective treatment options compared to traditional approaches. Retinal biologics are typically administered through intravitreal injections, which involve delivering the medication directly into the eye.

Market Dynamics

The retinal biologics market growth has been driven by factors such as an increase in the number of people suffering from retinal diseases such as age-related macular degeneration (AMD), diabetic retinopathy, and retinal vein occlusion. Rise in geriatric population associated with retinal diseases, and advancements in biotechnology propel the market growth. In addition, older individuals are more susceptible to retinal diseases. Thus, rise in geriatric population has increased the demand for retinal biologic drugs and boost the market growth.

Furthermore, the rise in incidence and prevalence of retinal diseases such as age-related macular degeneration, diabetic retinopathy, drive the demand for effective treatment options and propel the market growth. For instance, according to the National Center for Biotechnology and Information (NCBI), dry AMD accounts for 85% to 90% of AMD cases in 2021. Moreover, advances in biotechnology, genetic engineering, and molecular biology have opened new possibilities for developing retinal biologics drugs. Techniques such as gene therapy, cell-based therapies, and RNA interference have shown promise in preclinical and clinical studies, driving research and development activities in retinal biologics and propel the market growth.

The increase in awareness about retinal diseases, their diagnosis, and available treatments has played a crucial role in driving market growth in the field of retinal biologics. For instance, organizations such as the Foundation Fighting Blindness, and the American Macular Degeneration Foundation (AMDF) play a crucial role in promoting awareness, supporting research, and providing resources to patients and their families. The efforts of these groups contribute to increased public awareness and, consequently, market growth.

The retinal biologics industry growth is expected to be driven by high potential in untapped, emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, and rise in prevalence of chronic diseases such as diabetes. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure.

The demand for retinal biologics is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of VEGF-A antagonist and increase in awareness early diagnosis and treatment, further drive the growth of the market. However, retinal biologics often come with a high price tag, which may limit their accessibility and affordability in developing countries and hinder market growth. In addition, development and commercialization of biologic drugs involve rigorous regulatory processes and compliance requirements that may restrain the market growth.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global retinal biologics market experienced a decline in 2020 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain across various end-user industries like pharmaceuticals, healthcare, and industrial.

Many routine eye exams and elective procedures were postponed or canceled due to lockdowns, social distancing measures, and the focus on managing COVID-19 patients during the pandemic were delayed or halted during the pandemic due to restrictions on non-essential research activities and the reprioritization of resources. This impacted the introduction of new therapies into the market and restrained market growth. However, the market has recovered after the pandemic, and shows stable growth for the retinal biologics market. This is attributed to the increase in adoption of VEGF inhibitors, surge in prevalence of retinal diseases and increase in number of pipeline drugs for the treatment of retinal diseases.

Global Retinal Biologics Market Segmental Overview

The retinal biologics market analysis is segmented into drug class, indication, distribution channel, and region. On the basis of drug class, the market is bifurcated into VEGF-A antagonist and others. The VEGF-A antagonist segment is further categorized into Aflibercept, Ranibizumab, and others. On the basis of indication, the market is categorized into macular degeneration, diabetic retinopathy, and others. On the basis of distribution channel, the market is categorized into hospital pharmacies, drug stores and retail pharmacies, and online providers. On the basis of, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America and Middle East and Africa).

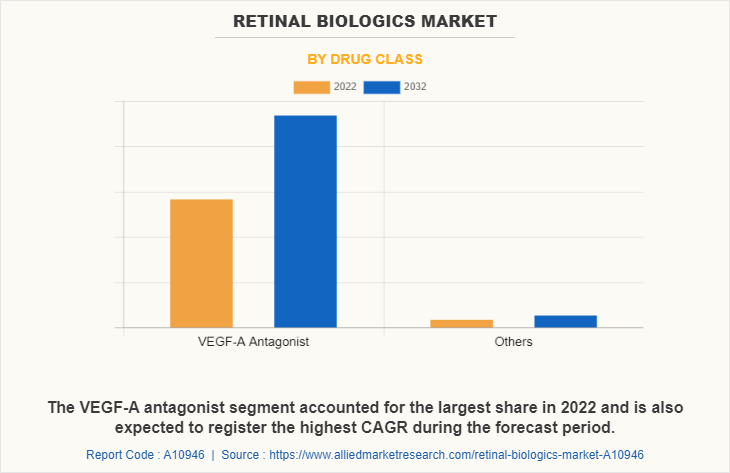

By Drug Class

The VEGF-A antagonist segment dominated the retinal biologics market share in 2022 and is also expected to register the highest CAGR during the forecast period, owing to their high effectiveness, wide adoption, ongoing advancements, and the growing prevalence of retinal diseases. These factors contribute to the segment growth rate.

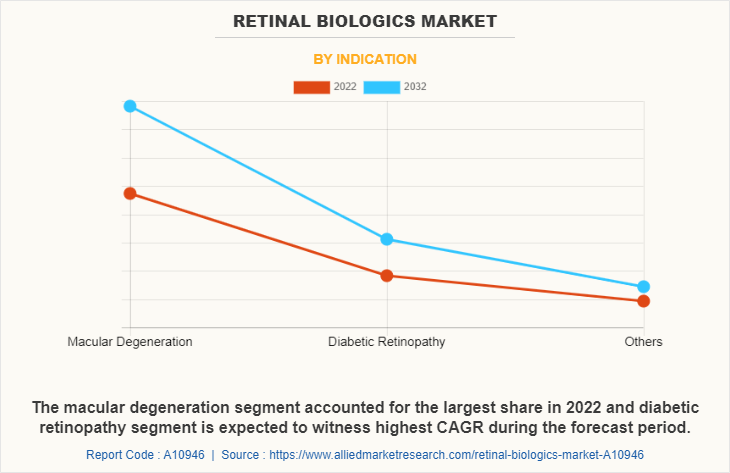

By Indication

The macular degeneration segment dominated the retinal biologics market size in 2022 and is anticipated to continue this trend during the forecast period. This was attributed to rise in the number of people suffering from macular degeneration, particularly age related macular degermation.

However, diabetic retinopathy segment is anticipated to witness highest growth during the retinal biologics market forecast period, owing to increase in prevalence of diabetes retinopathy, the significant burden of diabetic retinopathy, and increased awareness about early diagnosis and treatment.

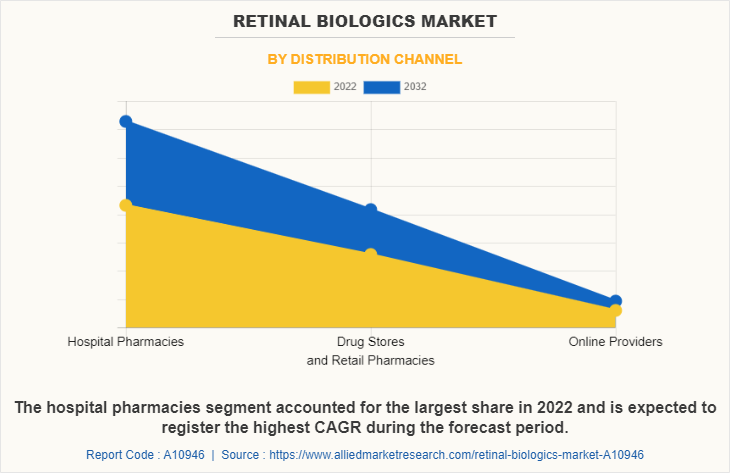

By Distribution Channel

The hospital pharmacies segment held the largest retinal biologics market size in 2022 and is expected to remain dominant throughout the forecast period, owing hospital pharmacies have access to a wide range of specialized medications, including retinal biologics. In addition, these medications are often prescribed and administered within the hospital setting, ensuring that patients receive the necessary treatments for their retinal diseases which supports the segment growth.

By Region

The retinal biologics industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the retinal biologics market share in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Bayer AG, Novartis AG, Regeneron Pharmaceuticals, and advancements in manufacturing retinal biologics drive the growth of the market.

In addition, easy availability of retinal biologics drugs, higher health awareness about early diagnosis and treatment drives the market growth in this region. Furthermore, a well-developed healthcare infrastructure, including a robust network of hospitals, clinics, and research institutions. This infrastructure supports the research, development, and adoption of retinal biologics propel the market growth.

Moreover, product launch, product approval, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market. For instance, in August 2022, Novartis AG received the Philippine Food and Drug Administration (FDA) approval of brolucizumab for the treatment of neovascular (wet) age-related macular degeneration (AMD).

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. The Asia-Pacific region has a large population and rise in prevalence of retinal diseases such as age-related macular degeneration (AMD), diabetic retinopathy, and retinal vein occlusion. This high disease burden creates a substantial market opportunity for retinal biologics in this region. In addition, increased awareness about retinal diseases, their impact on vision, and the availability of advanced treatments has contributed to a growing demand for retinal biologics.

Asia-Pacific offers profitable retinal biologics market opportunity for key players operating in the retinal biologics market, thereby registering the fastest growth rate during the forecast period, owing to the growth in infrastructure of industries, and-established presence of domestic companies in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the retinal biologics, such as AbbVie Inc., Amgen Inc., Bayer AG, Biocon, Biogen, Coherus BioSciences, Inc., F. Hoffmann-La Roche Ltd., Novartis AG, Outlook Therapeutics, Inc., and Regeneron Pharmaceuticals, Inc. are provided in this report. Major players have adopted product launch, product approval, and collaboration as key developmental strategies to improve the product portfolio of the retinal biologics market.

Recent Product Launches in the Retinal Biologics Market

- In October 2022, Coherus BioSciences, Inc. announced the commercial availability of CIMERLI (ranibizumab-eqrn), a biosimilar product interchangeable with Lucentis (ranibizumab injection) for all approved indications.

- In June 2022, Biogen and Samsung Bioepis Co., Ltd. announced that BYOOVIZ (ranibizumab-nuna), a biosimilar referencing LUCENTIS (ranibizumab) has been launched in the U.S.

Recent Product Approvals in the Retinal Biologics Market

- In August 2022, Novartis AG received the Philippine Food and Drug Administration (FDA) approval of brolucizumab for the treatment of neovascular (wet) age-related macular degeneration (AMD).

- In March 2022, Novartis AG announced that the European Commission (EC) has approved Beovu (brolucizumab) 6mg for the treatment of visual impairment due to diabetic macular edema (DME).

- In June 2020, Novartis AG announced today that the U.S. Food and Drug Administration (FDA) approved a label update for Beovu (brolucizumab) to include additional safety information regarding retinal vasculitis and retinal vascular occlusion.

- In September 2021, Samsung Bioepis Co., Ltd., and Biogen announced that the U.S. Food and Drug Administration (FDA) has approved BYOOVIZ (ranibizumab-nuna), a biosimilar referencing LUCENTIS (ranibizumab) for the treatment of neovascular (wet) age-related macular degeneration (AMD), macular edema, retinal vein occlusion (RVO), and myopic choroidal neovascularization (mCNV).

- In September 2022, Bayer AG announced that the Ministry of Health, Labour, and Welfare (MHLW) in Japan has approved Eylea (aflibercept) intravitreal injection 40mg/mL for the treatment of preterm infants with retinopathy of prematurity (ROP).

Recent Collaboration in the Retinal Biologics Market

- In September 2021, AbbVie has announced a collaboration with RegenxBio to develop and market a potential one-time gene therapy, RGX-314, for treating wet age-related macular degeneration (wet AMD), diabetic retinopathy (DR) and other chronic retinal diseases.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the retinal biologics market analysis from 2022 to 2032 to identify the prevailing retinal biologics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the retinal biologics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global retinal biologics market trends, key players, market segments, application areas, and market growth strategies.

Retinal Biologics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.7 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Distribution Channel |

|

| By Drug Class |

|

| By Indication |

|

| By Region |

|

| Key Market Players | Biogen, Bayer AG, Coherus BioSciences, Inc., Novartis AG, AbbVie Inc., Outlook Therapeutics, Inc., Amgen Inc., Biocon, Regeneron Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd. |

| Other Players | Pfizer Inc |

Analyst Review

This section provides various opinions in the retinal biologics market. The increase in demand for retinal biologics and rise in awareness about importance of early diagnosis and treatment is expected to offer profitable opportunities for the expansion of the market. However, high cost of retinal biologic drugs for the treatment of retinal diseases hinders the market growth.?

In addition, surge in the prevalence of retinal diseases and a rise in awareness regarding the potential benefits of retinal biologics drugs. This led to an increase in demand for retinal biologic drugs across the globe which is expected to fuel market growth during the forecast period. In addition, the surge in geriatric population that are susceptible to age-related macular degeneration market (AMD) further drives the growth of the market.?

Furthermore, North America is expected to witness largest growth, in terms of revenue, owing to the increase in prevalence of retinal diseases along with rise in geriatric population and presence of major key players in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in healthcare awareness, and growth in geriatric population that are suffering from retinal diseases.???

The retinal biologics market was valued at $14.9 billion in 2022 and is projected to reach $24.7 billion by 2032, registering a CAGR of 5.1% from 2023 to 2032.??

The forecast period for retinal biologics market is 2023 to 2032.

The base year is 2022 in retinal biologics market.

Top companies such as F. Hoffmann-La Roche Ltd., Regeneron Pharmaceuticals, Inc., Novartis AG, and Bayer AG held high market share in 2022.

Rise in prevalence of retinal diseases such as macular degeneration and diabetic retinopathy, increase in strategic initiatives by various organizations, and increase in geriatric population are the major factors responsible for the market growth.

North America is the largest regional market for retinal biologics owing to rise in prevalence of retinal diseases, and high awareness about early diagnosis and treatment has increased the adoption of retinal biologics in this region.

The VEGF-A antagonist segment is the most influencing segment owing to high adoption of VEGF-A antagonist to treat the retinal diseases such as age-related macular degeneration (AMD), diabetic retinopathy, retinal vein occlusion, and its extensive clinical evidence along with high effectiveness.

Retinal biologics refers to a class of therapeutic agents used in the treatment of retinal diseases.

Loading Table Of Content...

Loading Research Methodology...