Revenue-Based Financing Market Research, 2033

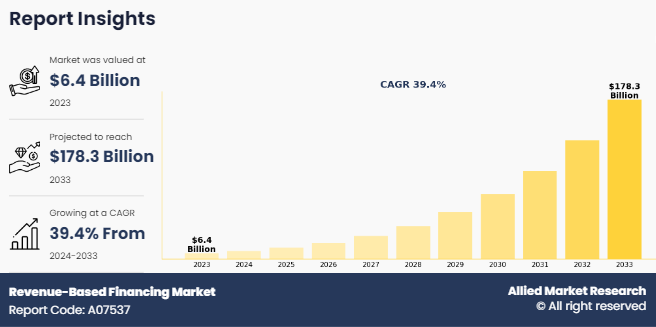

The global revenue-based financing market size was valued at $6.4 billion in 2023, and is projected to reach $178.3 billion by 2033, growing at a CAGR of 39.4% from 2024 to 2033.

Revenue-based financing (RBF) or revenue-based investing (RBI) is a financing frequently used by entrepreneurs in conjunction with angel financing. RBF is largely used among growing companies such as business-to-business (B2B), SaaS companies, and technology service firms with high recurring revenue. Moreover, this category of firms with subscription-based agreements & long-term contracts largely benefits from RBF, as it requires low collateral and has consistent future revenue to borrow against.

Key Takeaways

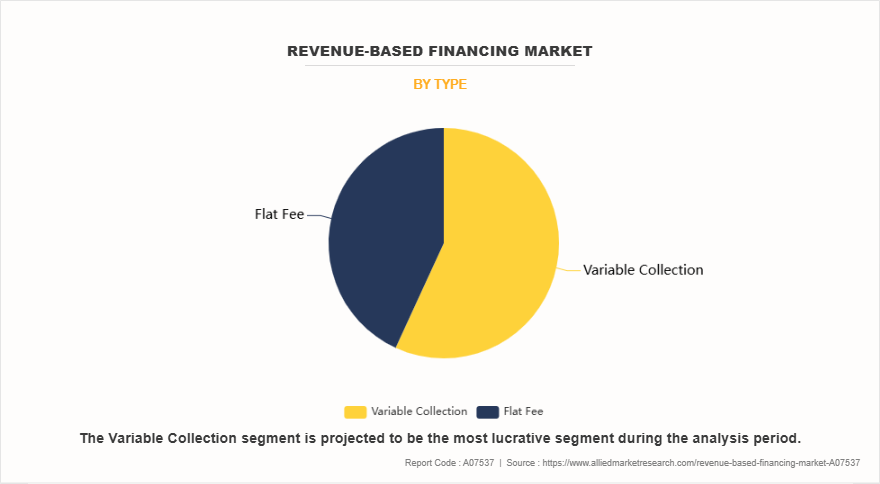

By type, the variable collection segment accounted for the largest revenue-based financing market in 2023.

By enterprise size, the small and medium-sized enterprises segment accounted for the largest revenue-based financing market in 2023.

By industry vertical, the IT and telecom segment accounted for the largest revenue-based financing market in 2023.

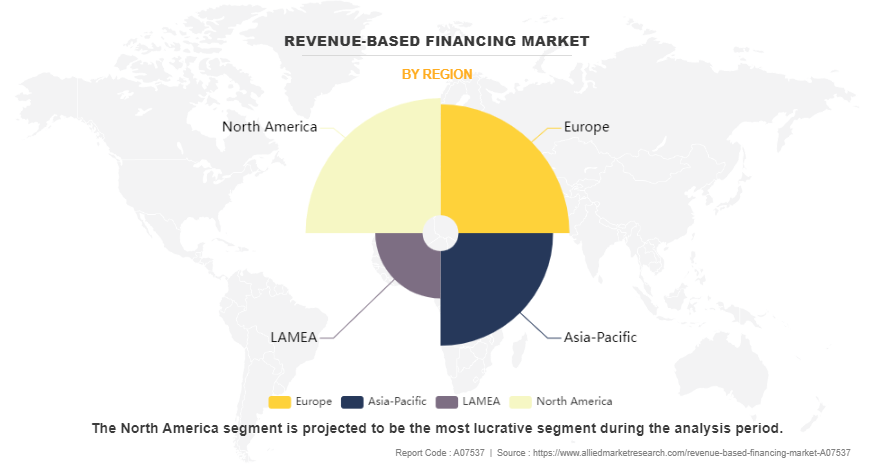

Region wise, North America generated the highest revenue in 2023.

Surge in demand among investors to earn more profits from RBF and increase in need for faster & quicker fund raising than conventional banks boost the market growth. In addition, rise in adoption of revenue-based financing by a large number of start-ups & small businesses is a major factor that drives the market growth. However, absence of standardization across the globe and lack of awareness & understanding toward revenue-based financing are some of the factors that hamper the market growth. On the contrary, rise in adoption & implementation of digital platforms among start-ups and small businesses is expected to boost the market growth in the coming years.

Segment Review

The revenue-based financing market outlook is segmented into type, enterprise size, industry vertical, and region. By type, it is classified into variable collection and flat fee. By enterprise size, it is divided into large enterprise and small & medium enterprise. By industry vertical, it is segregated into BFSI, IT & telecom, healthcare, media & entertainment, consumer goods, energy & utilities, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the revenue-based financing market share was dominated by the variable collection segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to its flexible repayment structure, where businesses repay based on their revenue, allowing better cash flow management. This model is attractive to small and medium enterprises (SMEs), reducing the financial burden during low-revenue periods, and is expected to drive the segment growth in the market. However, the flat fee segment is expected to grow at the highest rate during the forecast period, owing to its appealing structure for startups and small businesses, offering predictable costs without diluting equity.

Region wise, the revenue-based financing market was dominated by North America in 2023 and is expected to retain its position during the forecast period, owing to a robust startup ecosystem, increasing investor interest, and the growing adoption of alternative financing solutions. The region's diverse business lines, including technology, e-commerce, and healthcare, significantly contribute to the region's growth in the market. However, Asia Pacific is expected to witness significant growth during the revenue-based financing market forecast period, owing to the increasing demand for flexible financing solutions among startups and small to medium-sized enterprises (SMEs). The region's robust entrepreneurial ecosystem, coupled with a rise in digital platforms offering revenue-based financing, is driving region expansion in the revenue-based financing market

Competition Analysis

The report analyzes the profiles of key players operating in the revenue-based financing market such as Capchase, Lighter Capital, Clear Finance Technology Corporation, Karmen SAS, Wayflyer, Re:cap Technologies GmbH, Liberis, Outfund, Viceversa, Flow Capital Corp. and Kapitus Servicing, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the revenue-based financing market.

Recent Product Launch in the Revenue-based Financing Industry

In October 2023, Uncapped, formerly known as a revenue-based finance provider, secured a $216.32 million debt facility aimed at expanding its offer to the U.S. and European entrepreneurs and businesses. The new debt financing was provided by New York-based private equity firm Fortress Investment Group.

In January 2022, the London/Berlin-based Vitt announced a $15 million (equity and debt) pre-seed funding round, adding another participant to the revenue-based, non-dilutive financing game. A more appealing alternative to conventional methods of either constrictive loan or dilutive equity funding rounds, the platform gives SaaS enterprises the option of raising expansion capital based on annual recurring revenue streams.

In June 2021, global embedded business finance platform Liberis was selected by Klarna, the leading global payments and shopping service, for a strategic collaboration to provide additional financial services to Klarna merchants. Through this partnership, Liberis provides revenue-based financing to Klarna merchants.

Top Impacting Factors

Drivers

Rise in adoption of revenue-based financing by large number of start-ups & small businesses

The rise in adoption of revenue-based financing (RBF) by numerous startups and small businesses significantly propels the growth of the revenue-based financing market. This revenue-based financing model offers an appealing alternative to traditional loans, allowing businesses to secure funding without giving up equity or facing rigid repayment schedules. In addition, the startups and small enterprises often grapple with cash flow challenges and the need for flexible capital to fuel growth. The revenue-based financing addresses these needs by linking repayments to the revenue generated, making it more manageable for businesses, especially during fluctuating income periods, which drives the market growth.

Furthermore, increase in acceptance of revenue-based financing is driven by its ability to support diverse industries, including technology, e-commerce, and consumer goods. The more businesses seek scalable funding options, revenue-based financing providers are expanding their offerings, creating a competitive landscape that enhances market accessibility, which fuels the revenue-based financing market growth.

Increased Focus on Cash Flow Management

The revenue-based financing (RBF) market is experiencing growth, driven by an increased focus on cash flow management among businesses. The revenue-based financing model allows companies to secure capital in exchange for a percentage of future revenues, aligning repayment schedules with actual earnings. This flexibility is particularly appealing to startups and small enterprises that face unpredictable cash flows, as it mitigates the financial strain associated with fixed repayments typical of traditional loans, which is expected to drive the market growth. In addition, the businesses increasingly adopt subscription-based models, which generate consistent revenue streams, revenue-based financing becomes an attractive option for investors, providing them with a more predictable return on investment tied directly to the company's performance and cash flow, which propels the growth of revenue-based financing industry.

Restraint

Lack of awareness & understanding towards revenue-based financing

The revenue-based financing (RBF) market faces significant restraints due to a prevalent lack of awareness and understanding among potential investors and entrepreneurs. Many businesses, particularly startups, remain unfamiliar with RBF as an alternative to traditional financing methods, such as equity investment or bank loans. This unfamiliarity hinders the market growth.

In addition, the absence of comprehensive educational resources and clear guidelines about how RBF operates can deter stakeholders from engaging with it. Many entrepreneurs may not fully hold the implications of sharing a percentage of future revenues, viewing it as a loss of control over their cash flow, which can create hesitation in pursuing revenue-based financing. Furthermore, investors may struggle to evaluate RBF opportunities without a solid understanding of the associated risks and returns, further limiting the growth of the market.

Opportunity

Rise in adoption of digital platforms

The rise in the adoption of digital platforms presents a significant opportunity for the revenue-based financing (RBF) market, owing to innovation and access to funding for a diverse range of businesses. As digital technologies become increasingly integrated into everyday business operations, entrepreneurs are leveraging the digital platforms to enhance their visibility, streamline operations, and foster customer engagement. This leveraging of digital platforms not only allows businesses to generate and analyze revenue data more efficiently but also enables them to showcase their performance metrics to potential investors, which is expected to drive the revenue-based financing market.

In addition, the digital platforms facilitate a more transparent and accessible funding environment, breaking down traditional barriers that often hinder startups and small enterprises from securing financing, which is ultimately empowering startups and small enterprises to leverage innovative funding solutions, thereby driving their growth in a market. With the increasing availability of data-driven insights, revenue-based financing (RBF) providers assess the revenue potential of businesses more accurately. This minimizes risk and allows for informed funding decisions. Moreover, the data-centric approach led to tailored financing solutions that align with a business's growth trajectory, fostering long-term partnerships between funders and entrepreneurs.

Furthermore, the proliferation of e-commerce and online services has created a new wave of revenue-generating opportunities, especially for businesses that may be missed by regular financing methods. The ability to track and analyze revenue in real-time enhances the credibility of businesses seeking RBF, making it easier for them to present their case for funding, which further propels the market growth.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the revenue-based financing market analysis from 2023 to 2033 to identify the prevailing revenue-based financing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the revenue-based financing market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global revenue-based financing market trends, key players, market segments, application areas, and market growth strategies.

Revenue-Based Financing Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 354 |

| By Type |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Outfund, Capchase, Flow Capital Corp, Kapitus Servicing, Inc, Wayflyer, Viceversa, Lighter Capital, Inc., Karmen SAS, Liberis, Re:cap Technologies GmbH, Clear Finance Technology Corporation |

Revenue-Based Financing is a funding model where businesses repay a loan based on a fixed percentage of their future revenue, instead of offering equity or collateral.

The base year is 2023 in the revenue-based financing market.

The forecast period for the revenue-based financing market is 2024 to 2033.

The total market value of the revenue-based financing market was $6.4 billion in 2023.

The market value of the revenue-based financing market is projected to reach $178.3 billion by 2033.

Loading Table Of Content...

Loading Research Methodology...