Revenue Operations Software Market Research, 2033

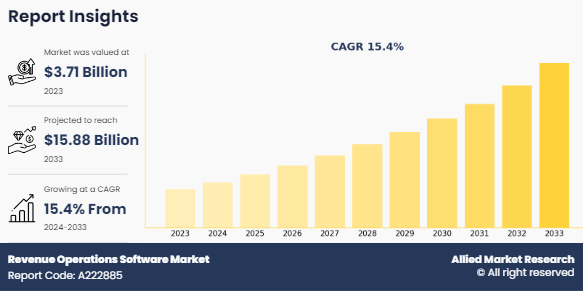

The global revenue operations software market was valued at $3.7 billion in 2023, and is projected to reach $15.9 billion by 2033, growing at a CAGR of 15.4% from 2024 to 2033. Revenue operations software (RevOps software) is a comprehensive suite of tools that help businesses manage the entire revenue lifecycle. It centralizes sales, marketing, and customer success initiatives from lead generation to customer retention to hold every department accountable for its revenue contribution. In addition, automation is another aspect of revenue operations software, in which AI-powered solutions streamline procedures, improve business processes, and allow for autonomous decisions throughout the IoT ecosystem. Furthermore, the integration of advanced technologies has the potential to create several benefits for businesses and consumers alike. Revenue operations software solutions may help to improve efficiency and productivity for businesses, as well as reduce costs. Moreover, it can provide enhanced convenience and a better user experience for consumers. In addition, the use of technologies in conjunction with the IoT can help to improve revenue operations management and analytics, as well as provide businesses with a better understanding of their products. Such enhanced factors are expected to provide lucrative opportunities for market growth during the forecast period.

Key Takeaways:

By deployment type, the cloud segment accounted for the largest revenue operations software market share in 2023.

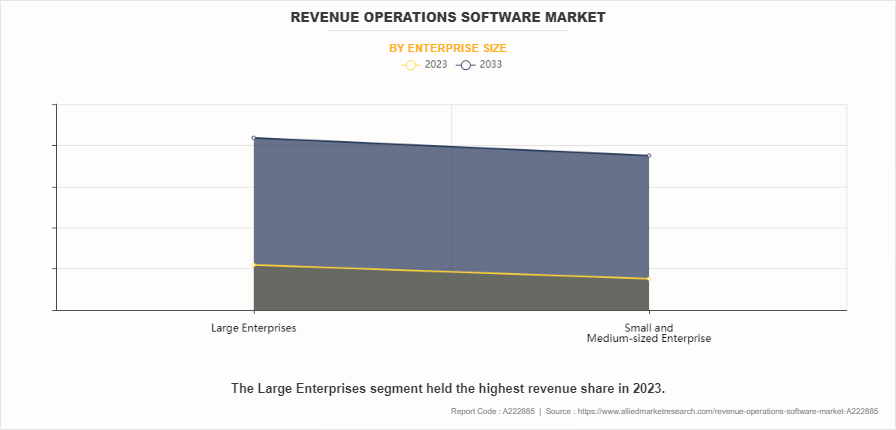

By enterprise size, the large enterprise segment accounted for the largest revenue operations software market share in 2023.

By application, sales forecasting segment accounted for the largest revenue operations software market share in 2023.

By end user, the manufacturing segment accounted for the largest revenue operations software market share in 2023.

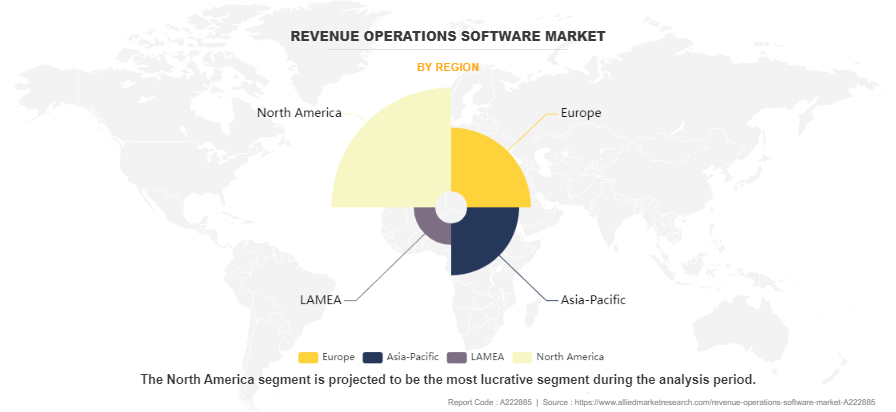

Region-wise, North America generated the highest revenue in 2023.

The report focuses on growth prospects, restraints, and trends of revenue operations software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the revenue operations software market.

Segment review

The revenue operations software market is segmented into deployment type, enterprise size, application, end-user, and region. By deployment type, it is bifurcated into cloud-based and on-premises. By enterprise size, it is divided into large enterprises and small and medium-sized enterprises. By application, the market is classified into sales forecasting, customer relationship management (CRM) integration, marketing, finance, and others. By end-user, it is divided into, manufacturing, BFSI, retail, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on the enterprise size, the large enterprise segment dominated the market share in 2023 and, is expected to maintain its dominance during the revenue operations software market forecast period, owing to their more complex operations and larger budgets, allowing them to invest in comprehensive software solutions. These organizations often require advanced features to manage their extensive data, sales processes, and customer relationships effectively, making them more inclined to adopt robust revenue operations software, which is further expected to propel the overall market growth. However, the software segment is expected to exhibit the highest growth during the forecast period, owing to the increasing availability of affordable and user-friendly software solutions tailored for SMEs. As these businesses recognize the importance of optimizing their revenue processes to remain competitive, they are more likely to adopt revenue operations software and further boost the growth of revenue operations software market size.

Region-wise, North America attained the highest growth in 2023. This is attributed to Businesses in this region are quick to adopt new technologies to enhance their revenue management processes, driven by a competitive market environment and a strong focus on innovation is anticipated to propel the growth of the market in this region. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period, owing as companies in this region seek to improve their operational efficiency and customer engagement, they are increasingly adopting revenue operations software. The combination of a growing middle class and heightened competition is prompting these businesses to invest in technology solutions that help optimize their revenue processes, which further contribute to the growth of the global revenue operations software market size.

Competition Analysis

The market players operating in the revenue operations software industry are Gong.io Inc., Clari, BoostUp, Salesforce, Inc., HubSpot, Inc., Outreach, Aviso, Revenuegrid.com, Xactly, Ambit Software, PandaDoc Inc., Kluster, Gainsight, Recapped, Bigtincan, fullcast.io, and Cross Commerce Media, Inc. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships among others, which help drive the growth of the revenue operations software market globally.

Recent Developments in the Revenue Operations Software Industry

In April 2024, Clari partnered with Deloitte Digital. The partnership will see Deloitte Digital offer AI revenue transformation to customers using the Clari Revenue Platform and its Revenue Cadence framework. Clari and Deloitte already have several joint customers, which seem to have been the catalyst for formalizing this partnership.

In November, BoostUp.ai launched its RevOps MasterClass, a comprehensive set of courses designed for sales, marketing, and customer success operations professionals to master the art of revenue operations.

In June 2022, Gong partnered with Apollo, Clearbit, and Cognism. Gong integrates with the partners’ robust contact enrichment capabilities to provide sales professionals with powerful insights and autonomous actions to close more deals faster and with less effort. The new features are expected to be available this fall.

Top Impacting Factors

Increasing demand for data-driven decision-making

The rise in the trend of data-driven decision-making in almost every industry sector to improve process optimization is directly influencing the growth of the global revenue operations software market. Radical advancements in the technological environment, enabled through communication technologies, require revising present business models and strategies. Consequently, revenue operations software solutions are gaining significant adoption to increase the use of IT and control systems among revenue operators, particularly IoT and other digital technologies such as AI. In addition, as organizations strive to optimize their revenue streams and improve operational efficiency, the ability to harness and analyze vast amounts of data has become crucial. These factors are expected to contribute to the increased installation of the revenue operations software market, globally. Furthermore, RevOps software provides a unified platform that consolidates data from sales, marketing, and customer success teams, enabling businesses to make informed decisions based on real-time insights. In addition, the integration of automated systems in organizations has reduced the rate of errors, such as network traffic congestion, as well as operating costs. Hence, these multiple benefits offered by revenue operations software use in business operations and maintenance services are expected to boost the demand for the revenue operations software market. For instance, in October 2023, SYSPRO partnered with SugarCRM, to provide mid-market manufacturers and distributors with a tightly integrated ERP and CRM solution. As a result, customers can align the front and back offices to optimize inventory, streamline supply chain and manufacturing operations, and drive additional revenue. Such investment pooling in the digitalizing of the infrastructure is projected to fuel the demand for revenue operations software, which in turn, augments the market growth on a global scale.

The increase in the adoption of advanced technologies

The growth in demand for advanced technologies and efficient operations is a significant driver of the revenue operations software market. Technologies include using IoT devices and AI technology to automate processes and operations in businesses such as manufacturing, logistics, and agriculture. Hence, by automating processes and operations, businesses can improve efficiency, reduce costs, and enhance productivity. Moreover, these advanced technologies enable more accurate data analysis, predictive modeling, and process automation, allowing organizations to streamline revenue-generating activities and improve efficiency across sales, marketing, and customer success teams. Such factors are further expected to significantly contribute to the huge potential for the growth of the revenue operations software market. In addition,the data-driven approach helps companies identify trends, forecast revenue more accurately, and respond quickly to market changes. Organizations are increasingly developing and investing in revenue operations software technologies, with more companies using advanced technologies and systems to improve operations and gain efficiency. For instance, in April 2021, HubSpot launched Operations Hub, a new product designed to transform the role of operations professionals across the business world and empower them to take center stage in helping their companies scale. Therefore, such initiatives are expected to further accelerate the use of technologies, which play a significant role in the continued growth of the revenue operations software market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the revenue operations software market analysis from 2023 to 2033 to identify the prevailing revenue operations software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the revenue operations software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global revenue operations software market trends, key players, market segments, application areas, and revenue operations software market growth strategies.

Revenue Operations Software Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 15.9 billion |

| Growth Rate | CAGR of 15.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 368 |

| By Application |

|

| By End-User |

|

| By Deployment Type |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Fullcast, Inc., BoostUp, Xactly, HubSpot, Inc., Revenuegrid.com, Aviso, Inc., Bigtincan Holdings Limited, Outreach, Gainsight, Inc., Gong.io Inc., Ambit Software Private Ltd., PandaDoc Inc., Recapped, Inc., Kluster, Clari, Inc., Salesforce, Inc., Cross Commerce Media, Inc. |

Analyst Review

The revenue operations software industry has grown rapidly in response to the massive amounts of data generated by Internet of Things (IoT) devices, and the need for AIpowered analytics and decision-making. CXOs are considering the benefits that revenue operations software can offer, such as the ability to provide a unified and scalable solution for managing and processing revenues from a vast array of IoT devices, enabling real-time insights and decision-making. In addition, revenue operations software may help organizations optimize their operations, reduce costs, and improve customer experience by automating routine tasks and providing personalized services. Such factors are expected to provide lucrative opportunities for market growth during the forecast period. However, CXOs also recognize the challenges associated with revenue operations software. One significant challenge is the industry's fragmentation, with multiple vendors offering different solutions and technologies, which can make it challenging for organizations to select the right platform for their needs. In addition, revenue operations software requires significant investment in infrastructure, data analytics capabilities, and talent, which can be a barrier to entry for small and medium-sized enterprises (SMEs).

Furthermore, ethical, and regulatory concerns related to data privacy and security must be addressed, as well as the need for a strong ecosystem of partners and developers to build and integrate applications and services. CXOs must evaluate the services based on their industry-specific needs and requirements, including factors such as real-time monitoring and process optimization in almost every sector. By addressing these challenges, CXOs can unlock the full potential of revenue operations software to transform their operations, create value, and gain a competitive advantage in their industry. For instance, in June 2024, Salesforce launched new capabilities for Revenue Lifecycle Management that allow businesses to scale and automate the entire quote-to-cash sales process from quoting and contracting to fulfilling an order on a unified platform for sales, finance, and legal teams.

The revenue operations software market was valued at $3.7 billion in 2023 and is estimated to reach $15.9 billion by 2033, exhibiting a CAGR of 15.4% from 2024 to 2033.

Increasing demand for data-driven decision-making and the increase in the adoption of advanced technologies are the upcoming trends of Revenue Operations Software Market in the globe.

The development of cloud computing technology is the leading application of the Revenue Operations Software Market.

North America is the largest regional market for Revenue Operations Software.

Gong.io Inc., Clari, BoostUp, Salesforce, Inc., HubSpot, Inc., Outreach, Aviso, Revenuegrid.com, Xactly, Ambit Software, PandaDoc Inc., Kluster, Gainsight, Recapped, Bigtincan, fullcast.io, and Cross Commerce Media, Inc are the top companies to hold the market share in Revenue Operations Software.

Loading Table Of Content...

Loading Research Methodology...