Reverse Logistics Market Overview

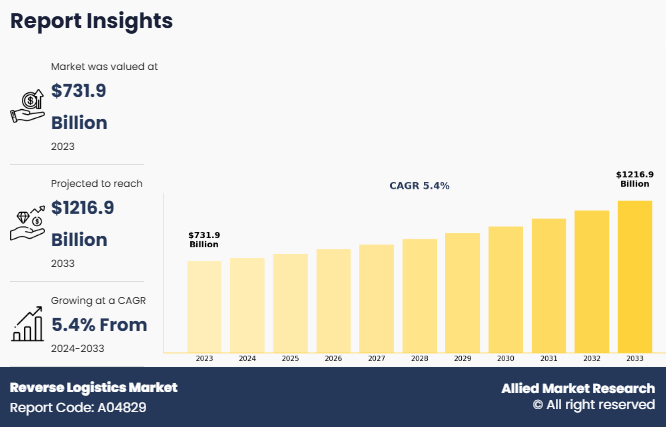

The global reverse logistics market size was valued at USD 731.9 billion in 2023, and is projected to reach USD 1.2 trillion by 2033, growing at a CAGR of 5.4% from 2024 to 2033. The growth of the global reverse logistics market is fueled by the rapid expansion of e-commerce, stricter product recall regulations in the automotive sector, and the rise of tech-enabled logistics services. Advancements in AI, machine learning, RFID, and IoT-connected devices are further accelerating market development.

Key Market Trends

End-of-life returns are expected to witness substantial growth by return type, driven by rising sustainability and recycling initiatives.

The e-commerce sector is projected to be a major contributor to market growth among end users, due to increasing online retail and product return volumes.

Asia-Pacific is anticipated to record the highest CAGR during the forecast period, fueled by rapid industrialization and expanding e-commerce infrastructure.

Market Size & Forecast

2033 Projected Market Size: USD 1.2 trillion

2023 Market Size: USD 731.9 Billion

Compound Annual Growth Rate (CAGR) (2024-2033): 5.4%

What is Reverse Logistics

Reverse Logistics is the process of managing the return of goods from the end user back to the seller or manufacturer. It is the management of return of goods due to disposal, refurbishment, or replacement of the original product. It typically involves the movement of goods in reverse order from consumer to manufacturer or seller.

Market Dynamics

Reverse logistics solutions are effective, allowing customers to return products to manufacturers for a variety of reasons, such as wrong product ordered, damaged products delivered, product quality not as per the description, and non-requirement of products at the customer end. These services are implemented by pharmaceutical, automotive, FMCG, and other manufacturers to improve customer satisfaction and reduce adverse environmental impact.

The automotive industry in recent years has witnessed an increase in decentralized production due to surge in demand for high-quality automotive aftermarket parts. Inadequate quality car parts result in fatal accidents, leading the government to implement strengthening regulations to avoid such incidents. The government's engagement in quality control of vehicle deployment by agencies to look after the production of automobiles has accelerated the reverse logistics business.

For instance, on January 20, 2024, Toyota Motor Corporation announced that 50,000 of the U.S. vehicles are unsafe to drive due to defective airbags. The company announced its customers to halt driving vehicles called for immediate recall due to the risk of a faulty airbag inflator that has the potential to explode and seriously injure or kill the driver or passengers. Vehicles manufactured by 19 different automakers, such as Subaru, Tesla, BMW, Volkswagen, Audi, Daimler Vans, Mercedes-Benz, and Ferrari, have been asked to replace these airbags. The airbags were made by Takata Corporation and were installed in most of the car models launched in between the year 2002 and 2015. Since then, 67 million airbags have been recalled, and at the end of 2022, 11 million were still being replaced.

Similarly, in May 2021, MG Motor India and Attero announced a partnership for recycling electric vehicle batteries. Under the partnership, Attero is expected to provide reverse logistics, refurbishing, and recycling solutions to MG Motor India. Automotive manufacturers have adopted reverse logistics services to reduce e-waste, ensure passenger safety, and safely disposal of automotive components. Thus, the rise in the adoption of reverse logistics by leading automotive manufacturers owing to the government regulations for passenger safety and minimizing e-waste is anticipated to fuel the growth of the reverse logistics market during the forecast period.

What are the Top Impacting Factors

The global reverse logistics market growth is driven by expansion of e-commerce industry, increased product recall due to stringent government rules for product quality in the automotive industry, rise of tech-driven reverse logistics services, and surge in adoption of IoT-enabled connected devices. However, factors such as lack of control of manufacturers on reverse logistics service and uncertainty in the reverse logistics process hinder market growth. Furthermore, introduction of blockchain technology and reduction in losses owing to adoption of a multi-modal system are anticipated to provide lucrative market growth opportunity.

Technological advancement in FMCG and pharmaceutical have revolutionized the reverse logistics market globally. The increase in penetration of Internet of things (IoT) solutions in reverse logistics operations enables direct access to the company network and aids in live tracking of shipments for the customers and freight companies. In addition, the evolution of state-of-the-art technologies such as artificial intelligence (AI), machine learning, radio-frequency identification (RFID), and Bluetooth, benefitted the reverse logistics industry show remarkable growth.

For instance, in February 2021, Sensitech launched IoT supply chain monitoring devices. These multi-modal, real-time IoT solutions devices are projected to be utilized for real-time tracking of shipments traveling by aircraft. Moreover, the digital transformation of supply chains across the globe reduces inefficiency and waste, which promotes the use of IoT-enabled devices in reverse logistics. For instance, the Smart Disposition platform, developed by Optoro, uses machine learning to determine the most profitable channel for re-routing each returned unit. Thus, the rise in such technological advancements and the increase in use of IoT-enabled devices act as a catalyst to the growth of the reverse logistics market.

The manufacturers, retailers, and customers are completely dependent on the reliability, competency, and honesty of logistics service providers. In this scenario, the manufacturing or retailing company is fully reliant on the logistics service provider, which results in a lack of direct control. In addition, the manufacturer is not able to monitor the operations at the warehouse, which is a serious threat to the quality of products and results in product damage or deterioration in product quality.

Moreover, outsourcing to a third-party reverse logistics (3PL) company could potentially lead to a breach of confidentiality, resulting in the exposure of customer personal data or the sharing of commercially sensitive information. Thus, the lack of control of manufacturers on reverse logistics service is anticipated to hinder the growth of the reverse logistics market during the forecast period.

Technological advancements such as Block-chain enable enhanced tracking and transparency of the overall lifecycle of the product beginning from sourcing of component materials by the manufacturers to the final disposal of the product. The leading market players of the logistics industry have begun testing and deploying blockchain technology for augmenting their reverse logistics operations. For instance, Walmart Canada utilizes a blockchain for automated invoice generation, which removes the time-consuming freight bill audits. The supply chain leaders have implemented a combination of block-chain and reverse logistics strategies for managing product lifecycles such as reclamation, recycling, and disposal. Blockchain technology helps to track returns and identify issues related to high return rates. The evolution of advanced blockchain technology for reverse logistics services presents a lucrative opportunity for the v.

Segmental Analysis

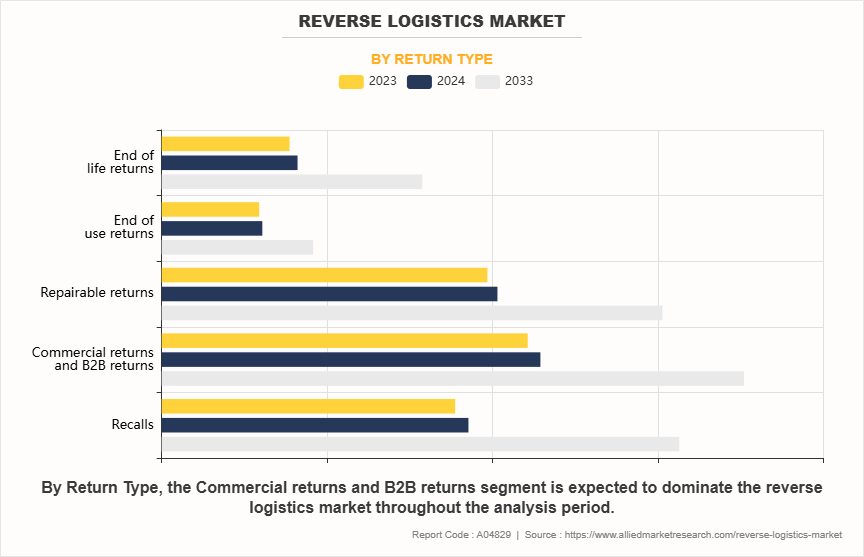

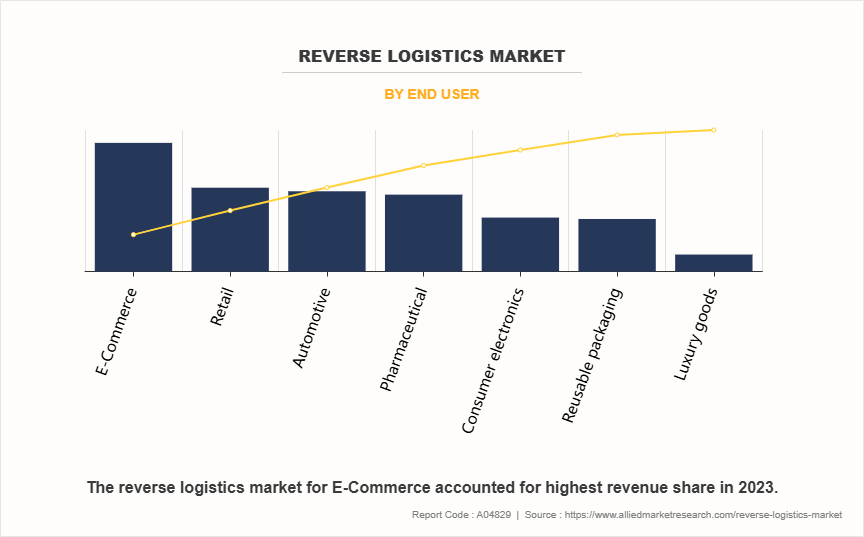

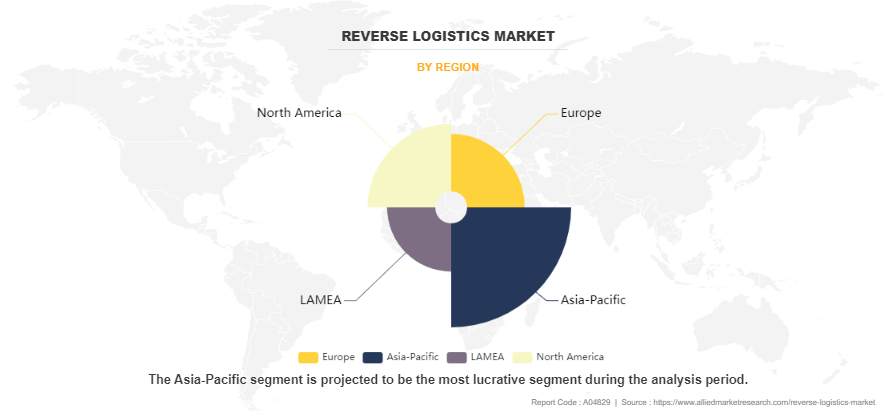

The reverse logistics market is segmented into return type, end user, and region. On the basis of the return type, the market is divided into recalls, commercial returns & B2B returns, repairable returns, end-of-use returns, and end-of-life returns. By end user, the market is segregated into e-commerce, automotive, pharmaceutical, consumer electronics, retail, luxury goods, and reusable packaging. By region, the market analyzed across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

By Return Type

On the basis of return type, the global reverse logistics market is segmented into recalls, commercial returns & B2B returns, repairable returns, end-of-use returns, and end-of-life returns. The commercial returns and B2B returns accounted for the largest Reverse Logistics Market Size &share in 2022, owing to the expansion of the e-commerce industry, change in customer expectations, and rise in environmental concerns. However, the end-of-life returns segment is anticipated to witness the strongest growth rate due to an upsurge in environmental concerns among manufacturers as there is the presence of hazardous materials in the end-of-life products. The demand for reverse logistics services in end-of-life products, primarily waste electrical and electronic equipment, has increased in recent years. Moreover, government agencies across the globe have implemented strict regulations for reverse logistics services for end-of-life products.

By End User

Based on end user, the global reverse logistics market is segregated into e-commerce, automotive, pharmaceutical, consumer electronics, retail, luxury goods, and reusable packaging. The e-commerce segment accounted for the largest Reverse Logistics Market Share in 2022 and is anticipated to witness the strongest CAGR growth rate during the Reverse Logistics Market Forecast period owing to rise in volume of products ordered through e-commerce platforms and increased demand for effective reverse logistics. Product returns add about 7%-11% to the base price of items supplied, and this figure is likely to climb up, necessitating the rapid implementation of an effective reverse logistics solution. Owing to the reduced personal engagement with the products in e-commerce, the amount of goods returned is twice that of goods returned from brick-and-mortar stores.

By Region

Based on region, the reverse logistics market is analyzed across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa. The Asia-Pacific region accounted for the largest market share in 2022 and is expected to witness the highest growth rate during the forecast period owing to the growing lReverse Logistics Industry due to expansion of the manufacturing sector in the region. Moreover, strong government assistance for the development of regional logistics infrastructure aids in the growth of reverse logistics market. Furthermore, the expanding e-commerce business in emerging economies such as India, Indonesia, Vietnam, and others is helping drive the reverse logistics market's expansion.

Which are the Top Reverse Logistics companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the reverse logistics industry.

C.H. Robinson Worldwide, Inc.

Core Logistic Private Limited

DB SCHENKER

RLG

DHL Group

FedEx

Kintetsu World Express, Inc.

SAFEXPRESS

United Parcel Service of America, Inc.

YUSEN LOGISTICS CO., LTD.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the reverse logistics market analysis from 2023 to 2033 to identify the prevailing reverse logistics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the reverse logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global reverse logistics market trends, key players, market segments, application areas, and market growth strategies.

Reverse Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.2 trillion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Return Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | RLG, Core Logistic Private Limited, DB SCHENKER, FedEx, Kintetsu World Express, Inc, DHL Group, YUSEN LOGISTICS CO., LTD., C.H. Robinson Worldwide, Inc., United Parcel Service of America, Inc., SAFEXPRESS |

Analyst Review

The reverse logistics market is gaining momentum as companies increasingly prioritize sustainability, resource efficiency, and customer satisfaction. At the heart of this transformation is the push toward closed-loop supply chains, where products are returned, refurbished, resold, or recycled. Companies like Patagonia and Adidas have implemented innovative reverse logistics processes, such as collecting and recycling used clothing and shoes, helping reduce waste and extend product lifecycles. In 2021, Patagonia’s “Worn Wear” program saw considerable success in reusing and reselling pre-owned items, illustrating the financial and environmental benefits of a well-structured reverse logistics strategy.

Technological advancements are further enhancing the efficiency of reverse logistics operations. For instance, **DHL** introduced an advanced circular supply chain in 2022 to manage the recovery and reuse of electronic components like processors and touchscreens. By employing artificial intelligence (AI) and blockchain technology, DHL has improved transparency, reduced waste, and streamlined the recycling process. Similarly, Sensitech's IoT-enabled real-time monitoring devices to have been deployed to track returned shipments, ensuring better visibility across the supply chain and reducing inefficiencies.

The rise of e-commerce has also significantly impacted the reverse logistics landscape. Online giants such as Amazon and eBay have built robust systems to manage high return volumes, especially in sectors like fashion and electronics. These companies have partnered with third-party logistics providers to streamline return processing and warehousing, allowing for faster turnaround times. In 2023, UPS acquired Happy Returns, a reverse logistics company, to enhance its digital capabilities and manage the growing volume of product returns.

The global reverse logistics market was valued at $731.9 billion in 2023, and is projected to reach $1,216.9 billion by 2033, registering a CAGR of 5.4% from 2024 to 2033.

The Reverse Logistics market is product type, and region. 2024-2033 would be the forecast period in the market report.

The Commercial returns and B2B returns segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Reverse Logistics market was valued at $738. 9 million in 2023.

The Reverse Logistics market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Reverse Logistics market report.

The top companies that hold the market share C.H. Robinson Worldwide, Inc., Core Logistic Private Limited, DB SCHENKER, RLG, DHL Group, FedEx, Kintetsu World Express, Inc

Loading Table Of Content...

Loading Research Methodology...