RFID Market Research, 2031

The global RFID market was valued at $11.8 billion in 2021 and is projected to reach $31.5 billion by 2031, growing at a CAGR of 10.2% from 2022 to 2031

The report offers a thorough analysis of the global RFID market with a detailed study of various aspects of the market such as market dynamics, vital segments, major geographies, key players, and competitive landscape. The report provides a clear picture of the current market situation and future trends of the global RFID market based on the impact of various market dynamics and vital forces influencing the market. The drivers and opportunities in the market contributing to the market growth are acknowledged in the market dynamics. Besides, challenges and restraints that hold the potential to hamper the market growth are also premeditated in the global RFID market. Porter's five forces analysis is delivered through the report which precisely highlights the effects of key forces on the global RFID market. The report offers market size and estimations analyzing the global RFID market through various segments.

In addition, the report includes a geographical market analysis of these segments. Each segment entailed in the report is studied at regional and country levels as well to provide complete coverage of the global RFID market. The report categorizes the global RFID market into four major geographies including North America, Europe, Asia-Pacific, and LAMEA.

Radio Frequency Identification (RFID) is an enhanced wireless recognition and data-capturing solution designed to recognize, trace, and recognize people, things, and animals using radio wave devices. Moreover, the RFID tags have an integrated circuit and an antenna for transmitting data to the RFID reader. An RFID tag received a signal from an RFID reader, and the tag responded with a signal holding information. Additionally, using a communications interface, the data gathered by readers from the RFID tags is forwarded to a host computer system where it can be kept in a database and analyzed later. RFID tags can also hold a variety of data, from a single serial number to many pages of information.

The global RFID market is expected to witness notable growth during the forecast period, owing to a surge in government initiatives to boost RFID-based solutions across various industries. Moreover, the rise in demand for RFID solutions in the banking and healthcare sectors majorly drives the RFID market outlook. Furthermore, the growing demand for RFID products in retail sectors is projected to shape the future of the RFID market.

However, the high rise associated with data security and privacy is one of the prime factors that restrain the RFID market growth. Further, the surge in the adoption of RFID tags for Industry 4.0, the Internet of Things, and smart manufacturing is projected to provide a lucrative opportunity to expand the RFID market during the forecast period.

The RFID market size is segmented into Product Type, Frequency, End Use, and Region.

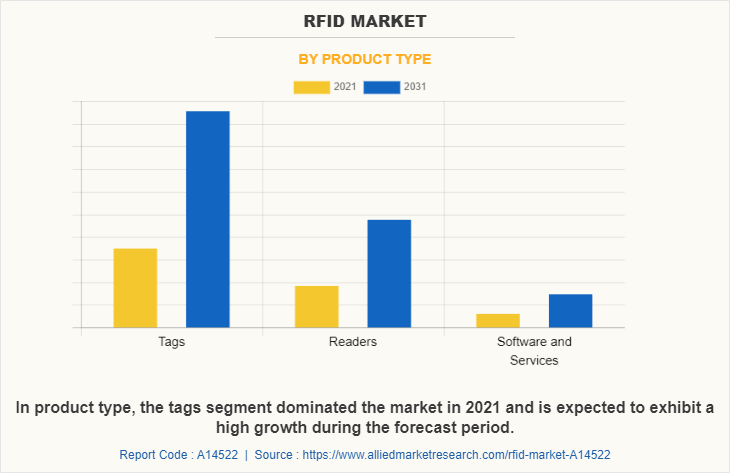

By type, the RFID market is segmented into tags, readers, and software & services. In 2021, the tags segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period 2022-2031.

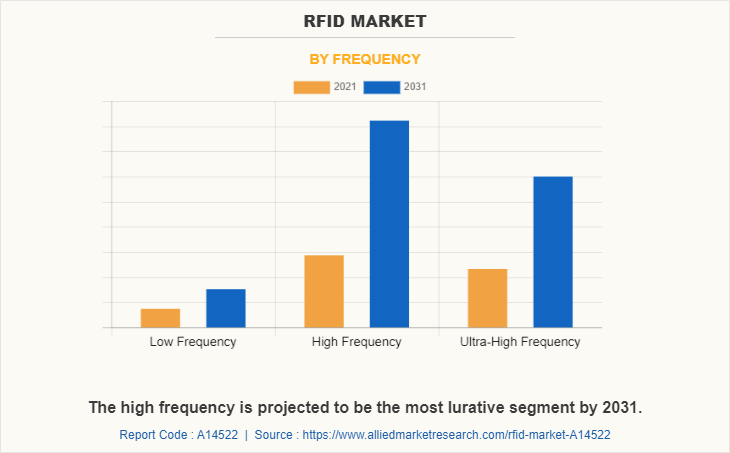

Based on frequency, the market is segmented into low frequency, high frequency, and ultra-high frequency. The high-frequency segment acquired a major share of the market in 2021 and is expected to grow at a high CAGR from 2022 to 2031.

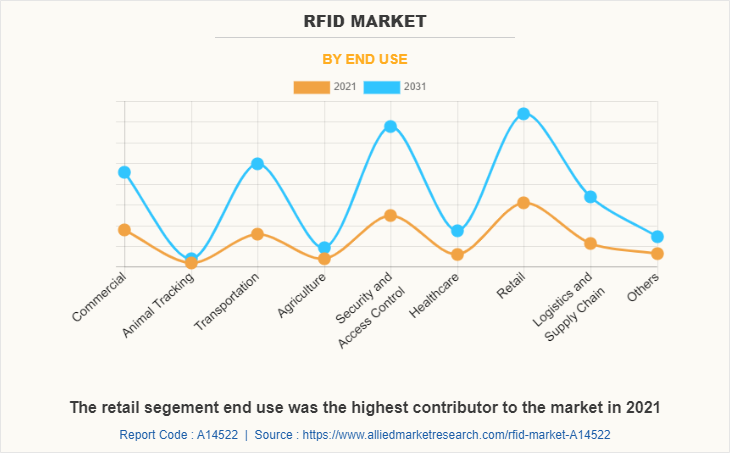

By end use, the market is classified into commercial, animal tracking, agriculture, security and access control, healthcare, retail, logistics and supply chain, and others. The retail segment dominated the market in 2021 in terms of revenue and is expected to dominate the market during the forecast period. However, the transportation segment is expected to grow at a high CAGR during the forecast period.

Region-wise, the RFID market forecast is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Russia, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific, Specifically China, remains a significant participant in the RFID market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced portable devices is driving the growth of the RFID industry in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major global RFID market players that have been provided in the report include Alien Technology, LLC, Avery Dennison Corporation, Bar Code India Limited, and Bartech Data Systems PVT. LTD., Bartronics India Limited, Honeywell International. Inc., IDENTIV, Inc., Infotek Software & Systems Ltd. (I-TEK), NXP Semiconductor N.V., and Zebra Technologies Corporation.

Country Analysis

North America-wise, the U.S. acquired a prime share in the RFID market in the North American region and is expected to grow at a high CAGR of 7.3% during the forecast period of 2022-2031. The U.S. holds a dominant position in the RFID market, owing to the presence of prime players such as Apple Inc. and Intel Corporation has significantly investment in next-generation portable devices solutions to develop next-generation digital display devices.

In Europe, the UK dominated the Europe RFID market share in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, Germany is expected to emerge as the fastest-growing country in Europe's RFID industry with a CAGR, owing to a significant development in the Internet of Things and consumer electronics solutions.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to a significant rise in investment by prime players in next-generation system-on-chip solutions to boost the RFID market. However, South Korea is expected to emerge as a dominant country in the RFID market in the Asia-Pacific region.

In LAMEA, the Middle East garnered significant RFID market opportunity in 2021 owing to the presence of portable electronics vendors in this region is significantly investing in AC-DC power supply adapters in Latin America. Moreover, the Africa region is expected to grow at a high CAGR of 13.2% from 2022 to 2031, owing to a rise in demand for portable devices.

Historical Data & Information

The RFID market is highly competitive, owing to the strong presence of existing vendors. Vendors of RFID Chips and RFID tags-based machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Bartech Data Systems Pvt. Ltd., Bartronics India Ltd., Honeywell International Inc., Assa Abloy, and AVERY DENNISON CORPORATION are the top 5 companies holding a prime RFID market share. Top market players have adopted various strategies, such as product launches, partnerships, acquisitions, product upgrades, and product development, to expand their foothold in the RFID market.

- In June 2022, Avery Dennison Corporation launched a dual-frequency (DF) range of RFID inlays, which provides combined NFC (HF) and RAIN RFID (UHF) functionality for cost-effective item-level tagging in a slimmed-down form factor. The new AD Slim DF EM4425 tag is designed for logistics, medical, and industrial use cases while also offering customer engagement features.

- In October 2022, Avery Dennison Smartrac launched an AD Minidose U9 RAIN RFID inlay for pharmaceutical applications, unlocking critical RFID value for healthcare, pharmacies, and laboratory asset management. AD Minidose U9 is one of the smallest products on the market to receive ARC certification (Spec S) from Auburn University’s RFID Lab, and to be approved for use by the DoseID industry consortium.

- In February 2021, ASSA ABLOY acquired Technology Solutions (TSL) in the UK, a global provider of radio frequency identification (RFID) handheld readers. TSL designs, develops, and manufactures ruggedized mobile RFID readers and other multi-technology, mobile device peripherals that are used to identify and track products and assets.

- In December 2022, ASSA ABLOY acquired Janam, a leading provider of handheld mobile computers and readers, based in the U.S. This acquisition enhances HID’s event access portfolio to now also include handheld readers for scanning tickets using barcode and RFID technology, including NFC.

- In February 2022, Identiv, Inc. comprises a portfolio of near field communication (NFC)-enabled status detection tags for advanced IoT security. Identiv’s range of NFC tags is among the first available with NXP NTAG Semiconductors 22x DNA chip devices that add unique capabilities for advanced anti-counterfeiting, new-to-market tamper detection, and batteryless condition sensing.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the RFID market analysis from 2021 to 2031 to identify the prevailing RFID market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the RFID market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global RFID market trends, key players, market segments, application areas, and market growth strategies.

RFID Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 31.5 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 249 |

| By Product Type |

|

| By Frequency |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Data logics S.P.A., Impinj, Inc., bar code india ltd., Infotek Software & Systems Ltd., Honeywell International Inc., Bartronics India Ltd, Invengo Information Technology Co. Ltd., Zebra Technologies Corporation, Alien Technology, LLC, Identiv, Inc., Assa Abloy, AVERY DENNISON CORPORATION, NXP Semiconductors, GAO RFID Inc., Bartech Data Systems Pvt. Ltd. |

Analyst Review

The RFID market in India has witnessed a significant growth in past few years, owing to high investment by government agencies and private players. However, the rise in cases of security and privacy breach is one of the biggest factors that restrains the market growth in India. In contrast, the rise in investment in RFID products by prime players in this market to offer cost-effective high frequency tracking solutions is expected to drive the market in the coming years.

The India RFID market is highly competitive, owing to the strong presence of existing vendors. RFID vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors. Further, the rise in demand for low-cost asset tracking solution across, healthcare, industrial, and commercial sector is driving the need for next generation to enhance AC-DC power supply adapter solutions.

North America is the largest regional market for RFID,

Significant factors that impact the growth of the India RFID industry include the growing demand for RFID products in retail sectors paired with the surge in government initiatives to boost RFID-based solutions across various industries.

The RFID market was valued $11.8 billion in 2021 and is expected to grow $31.4 billion during the forecast period of 2022-2031.

Retail segment is the leading application of RFID market.

Bar Code India Limited, Bartech Data Systems PVT. LTD., Bartronics India Limited, Honeywell International. Inc.,, and IDENTIV, Inc are the top companies to hold the market share in RFID.

Loading Table Of Content...