RFID Tags Market Research, 2032

The Global RFID Tags Market was valued at $5.9 billion in 2022, and is projected to reach $15 billion by 2032, growing at a CAGR of 9.9% from 2023 to 2032.

RFID (Radio Frequency Identification) tags are mini electronic devices that store data and communicate with other devices via radio waves. They are employed to monitor and recognize items, and their utilization is growing progressively in diverse applications. These tags are essential elements of the RFID system, which also encompasses RFID scanners and antennas, enabling efficient and automated data gathering and identification procedures.

Every RFID tag is composed of a microprocessor and an antenna. The microprocessor stores records which includes identity numbers or records about the object it is linked to. The antenna allows the tag to send and receive radio waves with an RFID reader.

Key Takeaways

The global RFID tags market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious RFID tags market growth objectives.

Key Market Dynamics

The RFID tags market is experiencing significant growth driven by the increasing demand for automation and inventory management solutions across various industries. This growth is particularly pronounced in sectors like retail, healthcare, and logistics, where efficiency and accuracy are paramount. Technological advancements and the integration of IoT are enhancing the functionality and adoption of RFID tags, leading to improved operational efficiencies and data accuracy in tracking assets. Furthermore, growing concerns over supply chain transparency and security are propelling market expansion, as businesses seek to leverage RFID technology to mitigate losses and improve accountability. However, challenges such as high initial costs and interoperability issues may impact adoption rates, requiring companies to weigh the benefits against potential implementation hurdles.

Segment Overview

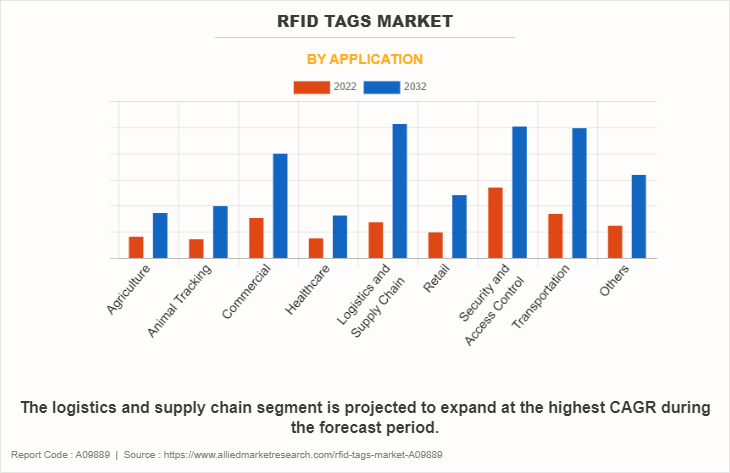

The RFID tags market is segmented into Application, Type, and Frequency.

As per application, the RFID tags industry is fragmented into agriculture, animal tracking, commercial, healthcare, logistic and supply chain, retail, security and control, transportation, and others.

The increase in e-commerce and integrated retailing is a principal factor fueling the market for RFID tags. In this realm, where the fusion of online and physical channels is paramount, RFID technology becomes essential. It takes into consideration proficient observing and control of stock across different stages, guaranteeing that items are available at that point and spot required by customers.

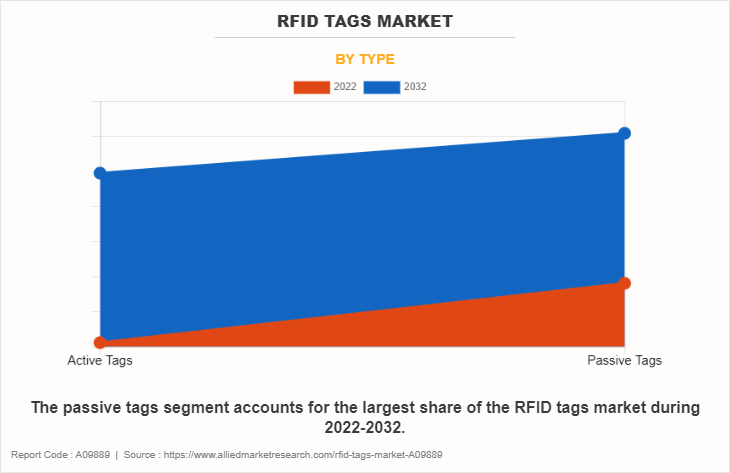

By type, the market is bifurcated into active tags and passive tags.

The use of RFID labels upgrades the exactness of stock levels, decreases the gamble of stock deficiencies, and betters the client experience by guaranteeing the accessibility of items. Moreover, this technology aids in the efficient management of the supply chain, from overseeing warehouses to confirming product presence in stores, accommodating the constantly evolving demands of integrated retailing. Therefore, the growth in e-commerce and the move towards integrated retail approaches significantly increase the requirement for RFID tags in the retail sector.

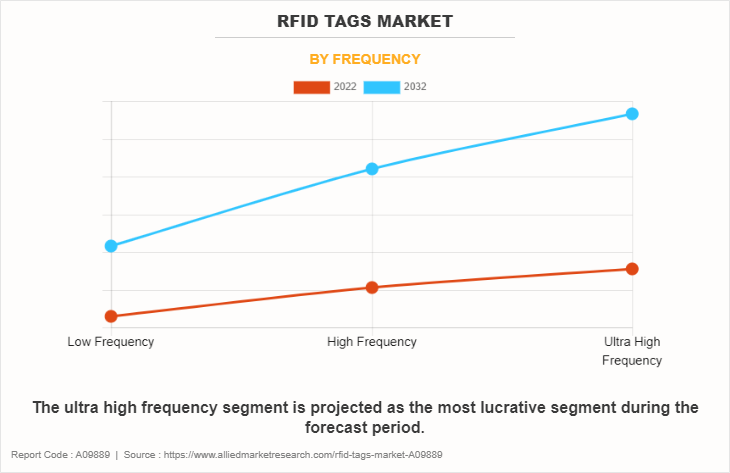

By frequency, the RFID tags market is divided into low frequency, high frequency, and ultra-high frequency.

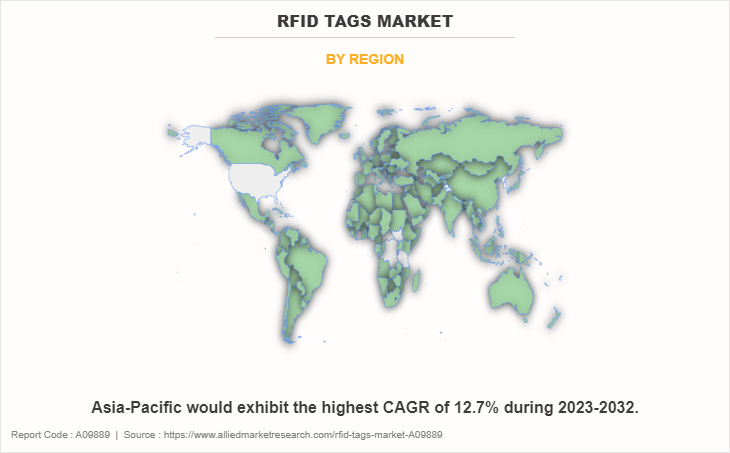

RFID tags market trends indicate that in 2022, the Middle East rose as the leading entity in the LAMEA region's RFID tag sector, securing the highest revenue percentage. This notable expansion is primarily linked to the region's strategic investments aimed at upgrading essential sectors like logistics, transportation, and security. The Middle East's pivotal position as a key node for global trade and transportation, along with concerted efforts to enhance supply chain effectiveness and security measures, has spurred a swift escalation in the utilization of RFID technology in various industries. This progression has further solidified the region's dominant role and influence in the RFID tags marketplace.

Region wise, the RFID tags industry is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific) and LAMEA (Latin America, Middle East, and Africa)

As per the RFID tags market analysis, country-wise, the U.S. has captured a significant portion of the RFID tags market share in North America for the period 2023 to 2032, due to its early implementation and vigorous progression of RFID technology. This leading stance is further increased by the growing demand for RFID-based systems in varied sectors, encompassing retail, healthcare, domestic, and logistics, motivated by investments in futuristic assets and applications such as animal identification.

The UK has consolidated its leading role in the RFID tags market regarding revenue share in 2022, mainly attributable to its sophisticated technological framework and extensive integration of RFID tracking systems across multiple sectors. The nation's dedication to supply chain optimization, inventory oversight, and augmented security protocols has stimulated the demand for RFID solutions, positioning the UK as a key player in the Europe region.

China is projected to evolve into a crucial market for the RFID tag industry in the Asia-Pacific region, primarily driven by its swift economic advancement, comprehensive manufacturing capability, and an escalating focus on incorporating progressive technologies. The nation's burgeoning sectors, including logistics, retail, and production, are increasingly recognizing the merits of RFID asset tags in augmenting efficiency, supply chain administration, and inventory regulation, contributing to the growth of the RFID tags market size in China. However, competition from alternative technologies like barcode scanning and QR codes presents a notable restraint in the RFID tags market. These alternatives often provide simpler and more cost-effective solutions for specific applications. Businesses evaluating RFID technology may consider these alternatives, particularly if their requirements are straightforward or budget constraints are a concern. The challenge for RFID technology is to demonstrate its unique value proposition and advantages in scenarios where more traditional methods may seem sufficient. In this serious situation, it becomes essential for RFID answers for constantly develop and feature their remarkable benefits to remain an appealing choice on the market.

Despite these limitations, the widening scope of RFID tags in various industries offers substantial growth prospects in the RFID tags market. Initially prevalent in retail and supply chain management, RFID technology is now discovering novel and creative applications in fields like agriculture, construction, and hospitality. In agriculture, RFID tags are utilized for monitoring livestock and observing crop conditions, thus improving agricultural management. Within the construction sector, they aid in the tracking of tools and materials, enhancing inventory control and diminishing theft. In the hospitality industry, RFID tags improve guest experiences with efficient access systems for rooms and tailored services. These emerging uses across different sectors not only exhibit the adaptability of RFID technology but also pave the way for new markets, fostering the development and expansion of the RFID tags market.

Top Impacting Factors

The RFID tags market is expected to witness notable growth owing to growing demand for inventory management and visibility, integration with IoT and big data analytics, and an increase in adoption in retail. Moreover, personalization and customization of RFID tags are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high initial investment costs limit the RFID tags market growth.

Regional/Country Market Outlook

North America: The North American RFID tags market is robust, supported by high adoption rates in retail and logistics sectors that are increasingly focused on optimizing their operations. The United States leads in technological advancements and significant investments in automation, making it a key player in the global market. Companies are leveraging RFID technology to streamline their supply chains, improve inventory visibility, and enhance customer experiences, which drives further growth in this region.

Europe: The Europe RFID tags market is growing steadily, driven by stringent regulations promoting traceability and safety in industries like healthcare and transportation. Countries such as Germany and the UK are at the forefront of innovation, implementing RFID solutions to improve patient safety and streamline logistics processes.

Asia-Pacific: The Asia-Pacific region is poised for rapid growth in the RFID tags market, fueled by increasing urbanization and investments in smart infrastructure to support rapid economic development. China and India are significant contributors, particularly in logistics and retail applications, as companies seek to enhance their operational capabilities.

LAMEA: The LAMEA RFID tags market is evolving, with rising investments in technology across sectors such as healthcare, retail, and agriculture. While challenges like limited infrastructure and regulatory hurdles exist, countries like Brazil and South Africa are showing promising growth potential, driven by an increasing focus on modernizing supply chains.

Competitive Analysis

The RFID tags market overview report highlights the highly competitive nature of the RFID tags market, owing to the strong presence of existing vendors. Vendors with widespread technical and financial assets are expected to benefit a competitive benefit over their counterparts by means of efficiently addressing marketplace needs. The aggressive surroundings on this market is expected to growth as product launches, acquisitions, partnerships, investments, geographical enlargement, and product upgrade/development form of techniques followed with the aid of key carriers boom. Competitive evaluation and profiles of the essential RFID tags market players that have been supplied inside the document consist of Alien Technology Corporation, Avery Dennison Corporation, GAO RFID Incorporated, HID Global Corporation (Assa Abloy), Honeywell International Inc., Identiv, Inc., Impinj, Inc., Invengo Information Technology Co. Ltd., NXP Semiconductors N.V., and Zebra Technologies Corp.

Report Coverage & Deliverables

This report delivers in-depth insights into the RFID tags market overview, application, type, frequency, regions, and major players' key strategies. It offers detailed RFID tags market forecasts and emerging trends.

Application Insights

By application, the RFID tags industry is fragmented into agriculture, animal tracking, commercial, healthcare, logistics and supply chain, retail, security and control, transportation, and others. The logistics and supply chain segment accounted for a major share, owing to the growing need for efficient tracking and inventory management solutions that enhance operational performance.

Type Insights

In terms of type, the RFID tags market is segmented into active tags and passive tags. In 2022, the passive tags segment was the dominant revenue generator due to their lower cost, ease of use, and widespread applicability across various industries. Passive tags are particularly favored in high-volume applications such as retail and supply chain management, where cost-effectiveness and scalability are critical factors influencing adoption.

Frequency Insights

Based on frequency, the market is segmented into low frequency, high frequency, and ultra-high frequency. The ultra-high frequency (UHF) segment accounted for a major share of the RFID tags market, owing to its longer read range and faster data transfer capabilities, making it ideal for applications requiring real-time tracking and monitoring.

Regional Insights

Regionally, the RFID Tags Market is examined across North America, Europe, Asia-Pacific, and LAMEA. Notably, the Asia-Pacific region, particularly China, is expected to grow at the highest rate during the forecast period, driven by increasing investments in smart technologies and infrastructure development. The rapid adoption of RFID solutions in various sectors, coupled with government initiatives aimed at boosting technological innovation, positions this region as a key player in the global RFID market.

Key Strategies and Developments

In September 5, 2024 - Kontakt.io Ultra-Thin Bluetooth Low Energy Tag launched for asset tracking applications. This tag is designed to be ultra-thin and lightweight, making it ideal for use in environments where space is limited. It offers real-time location tracking and can be easily integrated into existing systems, providing a seamless solution for asset management.

August 27, 2024 - Avery Dennison AD Minidose U9XM UHF RFID Tags introduced for pharmaceutical and healthcare item identification. These tags are specifically engineered to meet the stringent requirements of the healthcare industry, ensuring accurate tracking and identification of small items like syringes and vials. The high memory capacity of these tags allows for detailed data storage, enhancing inventory management and patient safety.

October 1, 2024 - Vubiq Networks unveiled Chipless RFID Hyperimaging Technology, enhancing data tag bit density and reducing costs. This innovative technology leverages millimeter wave polarization and phase detection to create a chipless RFID system that is both cost-effective and highly efficient. The increased data density allows for more information to be stored on each tag, making it a powerful tool for various industries, including logistics and supply chain management.

Key Benefits For Stakeholders

- To provide an accurate view of future investment pockets, this study provides analytical estimates for RFID tags market size along with current trends and estimations.

- In order to be able to achieve a more prominent position, the overall RFID tags market analysis is based on an understanding of prevailing profitability trends.

- The report presents information related to key drivers, restraints, and RFID tags market opportunity with a detailed impact analysis.

- In order to measure financial competence, RFID tags market forecasts shall be quantitatively analysed from 2022 until 2032.

- The Porter Five Force analysis shows that buyers and suppliers are more powerful in the RFID market.

- Key vendor shares and RFID tags market trends are included in the report.

RFID Tags Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15 billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 366 |

| By Application |

|

| By Type |

|

| By Frequency |

|

| By Region |

|

| Key Market Players | GAO RFID Incorporated, HID Global Corporation, AVERY DENNISON CORPORATION, Alien Technology Corporation, Invengo Information Technology Co. Ltd., Impinj, Inc., Honeywell International Inc., NXP Semiconductors N.V., Identiv, Inc., Zebra Technologies Corp. |

Analyst Review

The RFID tags market is undergoing a significant growth phase. This growth is attributed to several vital factors. ?First and major, the increasing programs of RFID era across numerous industries are predominant drivers of this demand. Industries like retail, logistics, and healthcare is increasingly adopting RFID for more efficient tracking and stock management, showcasing the technology's extensive applicability and effectiveness.

The development of more secure, durable and adaptable tags was also stimulated by advances in RFID technology. These improvements have broadened the range of RFID applications and allow tags with various uses to be used. Such technical developments are vital to respond to the needs of different sectors.

The growing emphasis on improving customer experience, particularly in the retailing sector, is one of the most important contributing factors. RFID tags are transforming the shopping experience with personalization, faster checkouts and a better control of inventory at these settings. In addition, market growth is being fueled by these advances that directly and positively affect customer satisfaction and loyalty.

In addition, RFID technology is also benefiting from the worldwide shift in business practices to digitalisation and automation. RFID technology is increasingly recognized as a vital tool for achieving these operational objectives, in view of companies' search for more efficient and streamlined processes.

Some of the key players profiled in the study include Alien Technology Corporation, Avery Dennison Corporation, GAO RFID Incorporated, HID Global Corporation (Assa Abloy), Honeywell International Inc., Identiv, Inc., Impinj, Inc., Invengo Information Technology Co. Ltd., NXP Semiconductors N.V., and Zebra Technologies Corp. These players have adopted various strategies such as product launches, acquisitions, partnerships, investments, geographical expansion, and product upgrade/development to increase their market penetration and strengthen their position in the ambient light sensor industry.

The RFID Tags Market is expected to grow at a CAGR of 9.94% during the period of 2023 to 2032.

The industry size of RFID Tags is estimated to be $5,893.9 million in 2022.

North America is the largest regional market for RFID Tags.

The leading application of the RFID Tags Market is in the field of supply chain management and logistics.

The top companies holding significant market share in the RFID Tags industry include Avery Dennison Corporation, HID Global Corporation (Assa Abloy), NXP Semiconductors N.V., Zebra Technologies Corp., and Honeywell International Inc.

Loading Table Of Content...

Loading Research Methodology...